Boeing May Be Taking OffBoeing was stuck below a key level for two years, but now it may be taking off.

The first pattern on today’s chart is the $233.84 level, the high on January 8, 2024. (That was a key session when the aerospace giant gapped lower after a 737 MAX 9 in-flight incident.)

BA probed that level last summe

Boeing Company Shs Cert Deposito Arg Repr 0.041666667 Shs

No trades

0.10 USD

1.92 B USD

76.77 B USD

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

IPO date

Sep 5, 1934

Identifiers

2

ISIN ARDEUT110061

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems. It operates through the following segments: Commercial Airplanes (BCA), Defense, Space and Security (BDS), and Global Services (BGS). The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems, global mobility, including tanker, rotorcraft and tilt-rotor aircraft, and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The company was founded by William Edward Boeing on July 15, 1916, and is headquartered in Arlington, VA.

Related stocks

$BA has the potential to move toward $300–$400 over the next ~12Bought some NYSE:BA last week and shared this with members.

Here’s why I think it has the potential to move toward $300–$400 over the next ~12 months. As a swing trader, I’ll be trading it in and out, targeting smaller moves along the way.

• Production ramp: Boeing is still ramping up production

Boeing – 4H StructureBoeing – 4H Structure

Price is trading within a compression phase between rising support and descending resistance, signaling an approaching expansion move. The 243 level remains the key decision zone.

Technical View

• Stability above 243 → bullish pressure intact

• Upside path opens toward 246.8

BA – Daily Technical AnalysisBoeing is testing a major long-term descending trendline, acting as a strong supply zone.

Price is reacting right at this resistance, making this a critical decision area.

Technical Structure

• Overall structure: Wide range with descending ceiling

• Price at dynamic resistance

• Moving average

BA Holding Gamma Support (242.5) — Upside Rotation In Play?✈️ BA Intraday Trading Playbook

Market Context

BA is attempting to stabilize after sharp volatility.

Structure shows defensive bounce behavior, not trend confirmation yet.

Gamma remains positive & call-dominated, which favors controlled upside if key supports hold.

This is a decision zone trade, not

Boeing - Lowering HeightsWe are analyzing the move since November 2025, identifying two main impulses, which can be viewed as a three -wave structure of a larger five -wave move.

At this stage, it’s not critical whether this impulse is considered wave 5 or wave B of a larger move.

Currently, a downward move is expec

A turnaround at $BA...or just another false dawn?An excerpt from analysis covered on the @ForexTraderPaul Monday Market Update on YouTube.

I've not been the biggest fan of BA over the last few years - but you have to learn to trade what you see as opposed to what you think or your biases are trying to tell you.

Anyway, BA has been on a tear the

Boeing shares ready to capitalize on recovery momentumNYSE:BA stock took a beating when the twin 737 Max disasters rightly sent the stock reeling a few years ago. It's been a long road to recovery since then, and setting aside the story, and fundamental drivers the technicals point to a big upside move getting underway.

Just look at the monthly chart

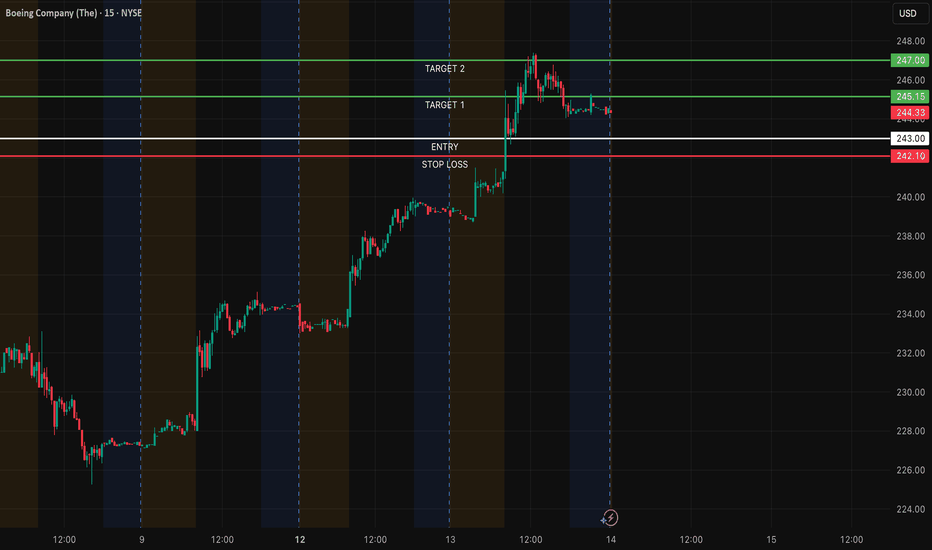

Morning Momentum Trade idea for $BAIf the price of the stock NYSE:BA stays between the entry line and target 1.

It will then quickly hits the entry line in the morning and then go towards the targets upward.

I would suggest to take the majority of the position out in the first target since the overall markets may go lower after

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.73%

Maturity date

May 1, 2064

US097023DM42

Boeing Company 6.858% 01-MAY-2054Yield to maturity

6.59%

Maturity date

May 1, 2054

BA5803370

Boeing Company 6.858% 01-MAY-2054Yield to maturity

6.40%

Maturity date

May 1, 2054

BA5803367

Boeing Company 6.528% 01-MAY-2034Yield to maturity

6.28%

Maturity date

May 1, 2034

BA5803365

Boeing Company 6.388% 01-MAY-2031Yield to maturity

6.15%

Maturity date

May 1, 2031

BA5803162

Boeing Company 6.298% 01-MAY-2029Yield to maturity

6.08%

Maturity date

May 1, 2029

BA5803363

Boeing Company 6.259% 01-MAY-2027Yield to maturity

6.05%

Maturity date

May 1, 2027

US97023BV6

Boeing Company 3.65% 01-MAR-2047Yield to maturity

6.02%

Maturity date

Mar 1, 2047

BA5946120

Boeing Company 7.008% 01-MAY-2064Yield to maturity

5.89%

Maturity date

May 1, 2064

BA4983331

Boeing Company 5.93% 01-MAY-2060Yield to maturity

5.86%

Maturity date

May 1, 2060

BA4602171

Boeing Company 3.625% 01-MAR-2048Yield to maturity

5.86%

Maturity date

Mar 1, 2048

See all BAD bonds