The Exhaustion Gap: BIIB's Momentum Failure at Resistance## Risk Management Framework

Entry: 144.86 (Point 4)

Stop Loss: 152.92 (8.92% risk) - Above Point 2 highs

Target: 91.99 (35.88% reward) - Major Chaos Theory support zone

Risk/Reward Ratio: 1:4.02

Position Advantages:

• Price at mathematical resistance (VWAP 2-sigma)

• Momentum exhausti

975 ARS

1.49 T ARS

8.49 T ARS

About Biogen Inc.

Sector

Industry

CEO

Christopher A. Viehbacher

Website

Headquarters

Cambridge

Founded

1978

ISIN

ARBCOM4601A8

FIGI

BBG00PCCBPX0

Biogen, Inc. is a biopharmaceutical company, which engages in discovering, developing, and delivering therapies for neurological and neurodegenerative diseases. Its products include TECFIDERA, VUMERITY, AVONEX, PLEGRIDY, TYSABRI and FAMPYRA for the treatment of MS, SPINRAZA for the treatment of SMA, ADUHELM for the treatment of Alzheimer's disease, and FUMADERM for the treatment of severe plaque psoriasis. The company was founded by Charles Weissmann, Heinz Schaller, Kenneth Murray, Walter Gilbert, and Phillip Allen Sharp in 1978 and is headquartered in Cambridge, MA.

Related stocks

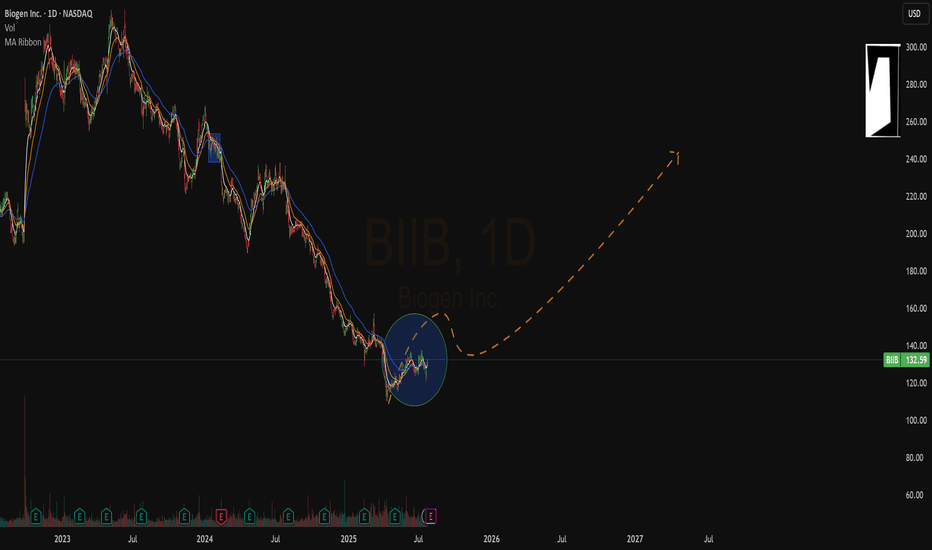

Biogen Stock Chart Fibonacci Analysis 081325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 134/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

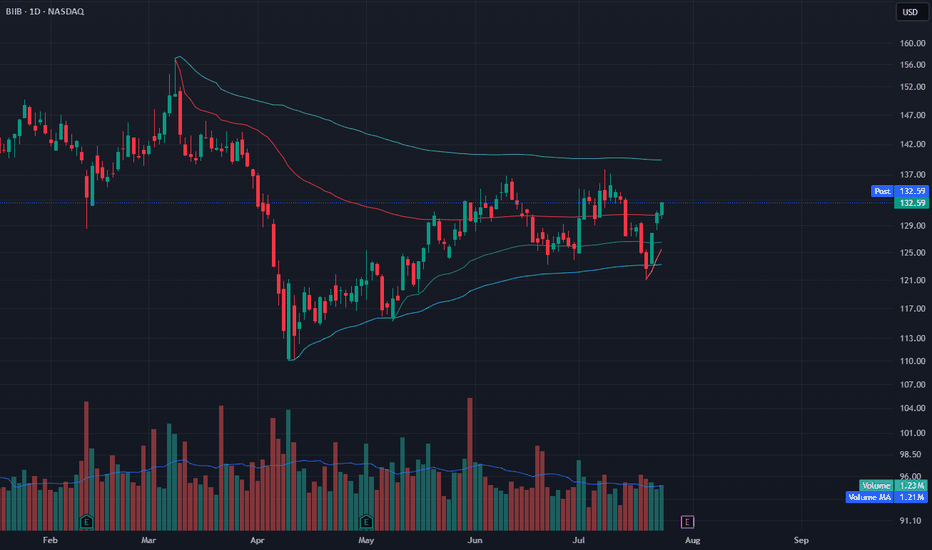

BIIB Bounces from VWAP ClusterBIIB is climbing after bouncing off a VWAP cluster (yellow and green zones) and reclaiming key levels. Price held support near $125 and is now pushing toward the upper range near $134.

Volume is slightly above average (1.23M vs. 1.21M MA), and price structure looks constructive with a clean higher

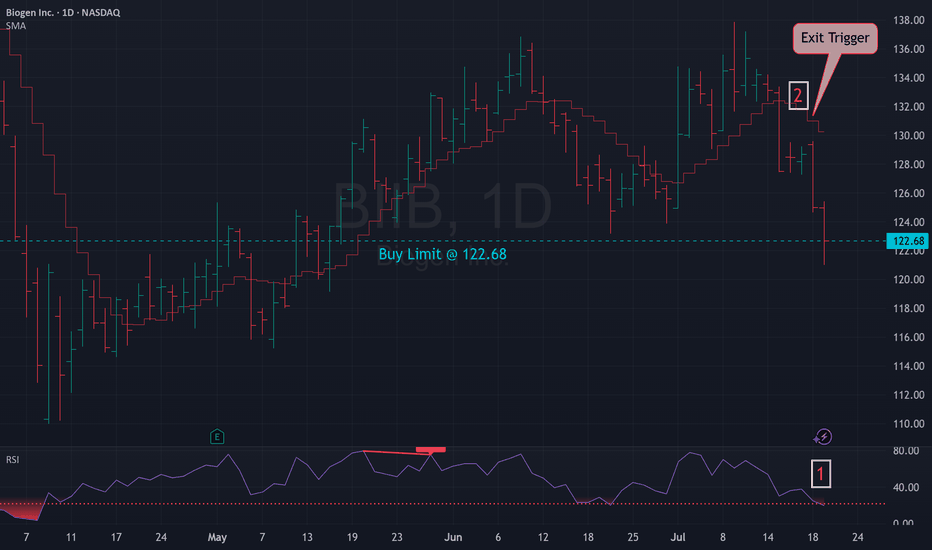

BIIB - Picture Perfect Market Maker ModelQuite Frankly This Is a Piece of Art.

Ai is been helping Bio Tech massively

Using the 3 Month and 1 Month Time frames we have a perfect Market maker model. Consolidation up top with market manipulation straight to distribution (A,M,D)

- 2 main accumulations before it hit's a perfect fair value g

BIIB Long, Coming Soon!The price has sold off from the $207.59 pivot level, dropping to $193.84 as of the Monday, September 30th close. The sharp decline from $200 to $190 over two days last week was largely due to sector-wide weakness, as reflected in the IBB (Biotech ETF). Since then, both the ETF and BIIB have been con

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BIIB6071255

Biogen Inc. 6.45% 15-MAY-2055Yield to maturity

6.03%

Maturity date

May 15, 2055

US9062XAD5

Biogen Inc. 5.2% 15-SEP-2045Yield to maturity

5.92%

Maturity date

Sep 15, 2045

BIIB4981508

Biogen Inc. 3.15% 01-MAY-2050Yield to maturity

5.87%

Maturity date

May 1, 2050

BIIB5133378

Biogen Inc. 3.25% 15-FEB-2051Yield to maturity

5.83%

Maturity date

Feb 15, 2051

BIIB6071069

Biogen Inc. 5.75% 15-MAY-2035Yield to maturity

5.07%

Maturity date

May 15, 2035

BIIB4981506

Biogen Inc. 2.25% 01-MAY-2030Yield to maturity

4.42%

Maturity date

May 1, 2030

BIIB6071254

Biogen Inc. 5.05% 15-JAN-2031Yield to maturity

4.40%

Maturity date

Jan 15, 2031

BIIB5133379

Biogen Inc. 3.25% 15-FEB-2051Yield to maturity

4.30%

Maturity date

Feb 15, 2051

See all BIIB bonds

Curated watchlists where BIIB is featured.