Cisco Set a Record High Ahead of Earnings. What Its Chart SaysCisco Systems NASDAQ:CSCO is set to release fiscal Q2 results this week at a time when the networking-equipment giant just hit an all-time high and has beaten the S&P 500 SP:SPX in every major timeframe from one month to one year. Let's see what its chart and fundamentals say here.

Cisco's Fun

Cisco Systems, Inc. Shs Cert.Deposito Arg.Repr. 0.2 Shs

No trades

Key facts today

Cisco Systems has introduced its Silicon One G300, a 102.4 Tbps switching chip designed to boost performance and security for AI data centers, enhancing network efficiency by 33%.

750 ARS

10.85 T ARS

60.37 T ARS

About Cisco Systems, Inc.

Sector

Industry

CEO

Charles H. Robbins

Website

Headquarters

San Jose

Founded

1984

IPO date

Feb 16, 1990

Identifiers

2

ISIN ARDEUT110095

Cisco Systems, Inc engages in the design, manufacture, and sale of Internet Protocol based networking products and services related to the communications and information technology industry. The firm operates through the following geographical segments: the Americas, EMEA, and APJC. Its product comprises of the following categories: Switches, Routers, Wireless, Network Management Interfaces and Modules, Optical Networking, Access Points, Outdoor and Industrial Access Points, Next-Generation Firewalls, Advanced Malware Protection, VPN Security Clients, Email, and Web Security. The company was founded by Sandra Lerner and Leonard Bosack on December 10, 1984 and is headquartered in San Jose, CA.

Related stocks

Live Trade on Cisco Systems (CSCO)The price has reached the bottom of its channel and has shown a very strong reaction. In addition, based on one of our trading systems, a buy signal has been issued. It appears that the price may move toward the specified levels.

Follow proper risk and money management.

This is just my personal

Cisco Wave Analysis – 3 February 2026

- Cisco broke resistance area

- Likely to rise to resistance level 85.00

Cisco recently broke the resistance area located between the round resistance level 80.00 (which stopped the previous waves iii and 1) and the resistance trendline of the wide daily up channel from September.

The breakout o

CSCO Correction TargetCisco (CSCO) Stock Analysis

As shown on the chart, Cisco is trading near the upper boundary of its 9-month channel. After forming two strong divergences on the 4H chart (Chart A) and the daily chart (Chart B)—confirmed by both MACD and RSI—the stock has entered a corrective phase.

Given the presen

$CSCO — what a beautiful trade I just missed.It was on one of my screens, it was planned… and I still missed it. Painful, but it happens.

So why was it such a good setup? 👇

It came down to confluence:

- Block break (pink)

- Trendline break

- Block sitting right on support (clear buy orders)

- Retracement from the high had three legs (highe

Cisco Systems at $73.88: Support Test Sets Up a Tactical BounceCurrent Price: 73.88 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 55%(Signals are mixed and volume is light, but price is sitting just above a well-defined support zone and I’m defaulting to upside with tight risk control)

Targets

Target 1: 74.80

Target 2: 75.90

S

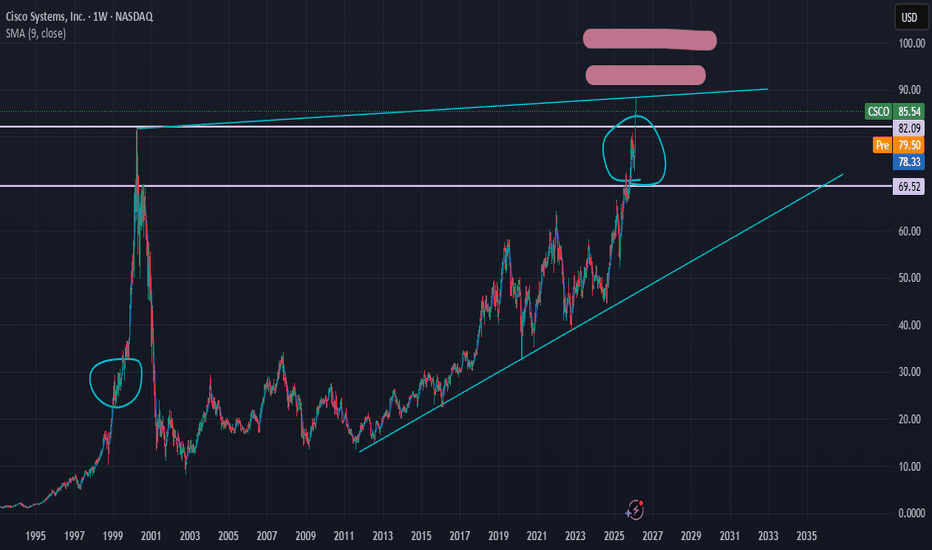

CISCO is perhaps one of the best shorts for 2026.Cisco (CSCO) has been trading within a 15-year Channel Up and just last month (Dec 2025) it hit the Internal Higher Highs trend-line, which is the Resistance level that has priced the last two major market Tops (Dec 2021, July 2019).

At the same time, it almost reached its All Time High (ATH) of $8

CSCO Signals Technical Caution as Price Slips Below Key SupportCSCO is flashing early cautionary signals after breaking below the 50-day EMA, suggesting the potential start of a bearish phase. The stock has also formed a head-and-shoulders pattern, a classic reversal structure that points to a shift from the prior uptrend.

From here, two scenarios may unfold.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US17275RBC5

Cisco Systems, Inc. 2.95% 28-FEB-2026Yield to maturity

8.74%

Maturity date

Feb 28, 2026

CSCO5758123

Cisco Systems, Inc. 4.9% 26-FEB-2026Yield to maturity

8.59%

Maturity date

Feb 26, 2026

CSCO5758319

Cisco Systems, Inc. 5.35% 26-FEB-2064Yield to maturity

5.59%

Maturity date

Feb 26, 2064

CSCO5758318

Cisco Systems, Inc. 5.3% 26-FEB-2054Yield to maturity

5.50%

Maturity date

Feb 26, 2054

CSCO6010620

Cisco Systems, Inc. 5.5% 24-FEB-2055Yield to maturity

5.46%

Maturity date

Feb 24, 2055

CSCO.GD

Cisco Systems, Inc. 5.9% 15-FEB-2039Yield to maturity

4.95%

Maturity date

Feb 15, 2039

CSCO.GG

Cisco Systems, Inc. 5.5% 15-JAN-2040Yield to maturity

4.88%

Maturity date

Jan 15, 2040

US17275RBT8

Cisco Systems, Inc. 5.05% 26-FEB-2034Yield to maturity

4.54%

Maturity date

Feb 26, 2034

CSCO6010283

Cisco Systems, Inc. 5.1% 24-FEB-2035Yield to maturity

4.40%

Maturity date

Feb 24, 2035

CSCO6010614

Cisco Systems, Inc. 4.95% 24-FEB-2032Yield to maturity

4.20%

Maturity date

Feb 24, 2032

CSCO5758317

Cisco Systems, Inc. 4.95% 26-FEB-2031Yield to maturity

4.05%

Maturity date

Feb 26, 2031

See all CSCO bonds