CVX at a Critical Level | Breakdown or Breakout Ahead?🔥 Hello TradingView traders, hope you’re all doing great!

Wishing you green trades and strong risk management 🌱

Today, we’re going to analyze one of the main stocks in the Dow Jones index:

📌 Chevron Corporation (CVX)

🛢️ Company Overview

Chevron is one of the world’s largest energy giants and a cor

Key facts today

Chevron is now the top foreign investor in Venezuela, maintaining operations amid U.S. sanctions and military pressure linked to President Maduro's regime.

On December 19, 2025, an explosion at a Petroboscan oil-gas station in Venezuela, where Chevron owns 40%, cut production by 3,100 barrels daily, damaging equipment but causing no injuries.

Chevron's stock saw a slight increase, aligning with a broader rise in the S&P 500 energy index, which rose by 0.4% due to increasing crude prices.

500 ARS

16.17 T ARS

177.16 T ARS

About Chevron Corporation

Sector

Industry

CEO

Michael K. Wirth

Website

Headquarters

Houston

Founded

1879

ISIN

ARDEUT110087

Chevron Corp. engages in the provision of administrative, financial management, and technology support for energy and chemical operations. It operates through the Upstream and Downstream segments. The Upstream segment consists of the exploration, development, and production of crude oil and natural gas, the liquefaction, transportation, and regasification associated with liquefied natural gas, the transporting of crude oil by major international oil export pipelines, the processing, transporting, storage, and marketing of natural gas, and a gas-to-liquids plant. The Downstream segment consists of the refining of crude oil into petroleum products, the marketing of crude oil and refined products, the transporting of crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car, and the manufacturing and marketing of commodity petrochemicals and plastics for industrial uses and fuel & lubricant additives. The company was founded on September 10, 1879 and is headquartered in Houston, TX.

Related stocks

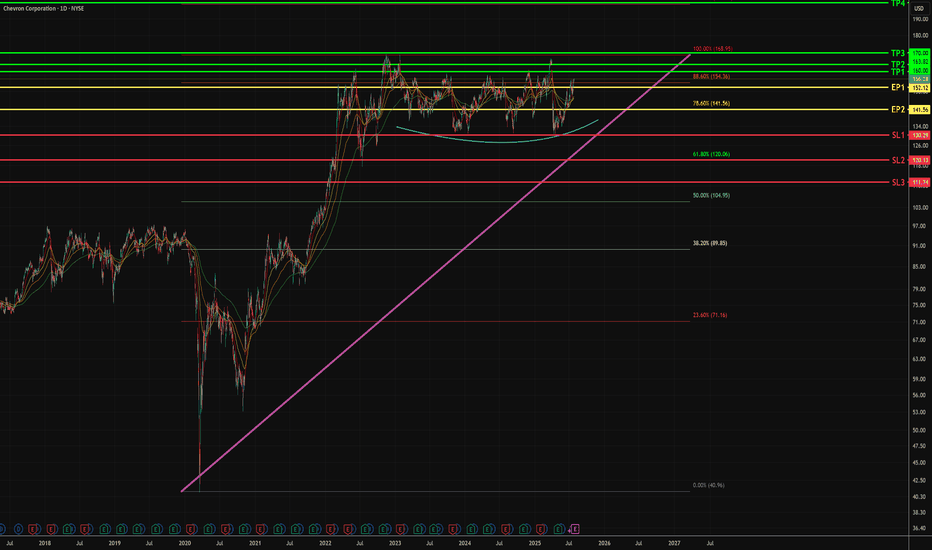

CHEVRON 3-year Channel Down started new Bearish Leg to $132.Chevron (CVX) has been trading within a Channel Down since the November 14 2022 market High. Having currently broken below both its 1W MA50 (blue trend-line) and 1W MA200 (orange trend-line), with the two having formed a 1W Death Cross, the pattern has already started its new Bearish Leg.

There is

CVX - Potential Swing Upside - Mid TermTimeline - now to 3 months

1. Bullish flag pattern sustained, form during Oct 2021.

2. Rounding bottom above 1D resistance at $130

- Last close is above Fib 88.6% - $154.36

- In the 2 days, weak selling pressure is noticed.

3. More attempts to break 88.6% Fib level opposed to $130 support line

Update for CVX: Looking for an up move/wave.

As discussed before in our previous post, NYSE:CVX looks like it will go up, it did go up so if you are in manage your trades. We can see pushing higher and lets see how far will it go.

For reference, this is our previews chart:

Always remember WTW 4 Golder Rules:

1) Do not jump in

2) Do not

Remember that 4hour chart because it's your Entry Have you ever thought one day it will happen?

You look straight into your blind spot.And you say one day I will see.

You look straight into your life,

Knowing tomorrow won't change and say "it will change"

This is where you find comedy.

Its not trying to be funny it's funny when you see yourself

$CVX: The calm before the storm. We're watching a beautiful consolidation on the daily chart. Price is coiled between $152.00 and $154.50.

This is not a time for guesswork. This is an IMMINENT BREAKOUT. This is how I’m viewing the setup for today.

• BULLISH Trigger: A 2-Up candle break above the recent high of $154.50. Target the

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CVX.B is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks