Ford (F) — Trend Channel Still in ControlHello Everyone, followers,

Ford is the last one from my side for this week.

Let's drill down:

📊 Technical Overview

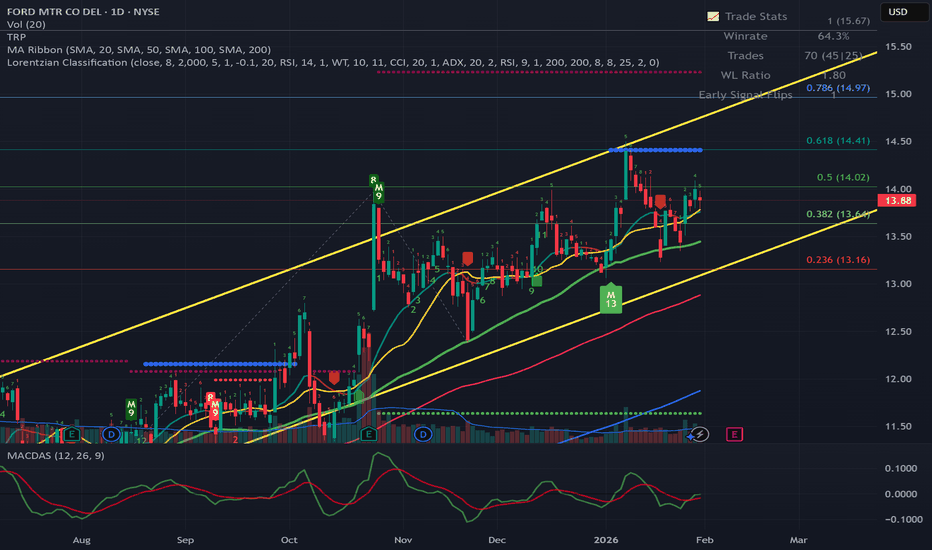

Ford continues to trade inside a well-defined ascending channel.

Price is holding above key moving averages, showing stability despite recent consolidation.

Earnings are schedule

Ford Motor Company Shs Cert Deposito Arg Repr 1 Sh

No trades

Key facts today

Ford Motor is shifting from traditional car making to becoming a key player in robotics, utilizing its manufacturing and supply-chain skills.

1.00 USD

5.22 B USD

164.31 B USD

About FORD MTR CO DEL

Sector

Industry

CEO

James Duncan Farley

Website

Headquarters

Dearborn

Founded

1903

IPO date

Mar 7, 1956

ISIN

ARCAVA460149

Ford Motor Co. engages in the manufacture, distribution, and sale of automobiles. It operates through the following segments: Ford Blue, Ford Model E, Ford Pro, Ford Next, Ford Credit, and Corporate Other. The Ford Blue, Ford Model E, and Ford Pro segment includes the sale of Ford and Lincoln vehicles, service parts, and accessories, together with the associated costs to develop, manufacture, distribute, and service the vehicles, parts, and accessories. The Ford Next segment is involved in the expenses and investments for emerging business initiatives aimed at creating value for Ford in vehicle-adjacent market segments. The Ford Credit segment consists of the Ford Credit business on a consolidated basis, which is primarily vehicle-related financing and leasing activities. The Corporate Other segment refers to corporate governance expenses, past service pension and OPEB income and expense, interest income and gains and losses from cash, cash equivalents, and marketable securities, and foreign exchange derivatives gains, and losses associated with intercompany lending. The company was founded by Henry Ford on June 16, 1903 and is headquartered in Dearborn, MI.

Related stocks

Going for a drive with F -- long at 13.81Ford has been in a strong uptrend really since the beginning of 2025. Until it proves me wrong, I have to respect that. Add in 5 consecutive down days and my signals screaming BUY at me for the last 2 days, and I just can't resist.

Ford has paid me much better than you'd expect from a cyclical st

$F - Ford Motor Company's (NYSE: F) Based on a confluence of recent bullish catalysts, including a significant analyst upgrade and strong fundamental performance, Ford Motor Company's (NYSE: F) stock has broken out to a new 52-week high. This move signals a potential shift in market sentiment and establishes clear technical and fundam

TIME to sell fordbearish divergence

stop buying

nvestors typically sell a stock instead of buying when they anticipate its value will decrease, often due to technical signals (like breaking a support level on a chart), fundamental reasons (company performance decline), or to manage risk and protect capital

F | Possible 3 Year Long Consolidation Over | LONGFord Motor Co. engages in the manufacture, distribution, and sale of automobiles. It operates through the following segments: Ford Blue, Ford Model E, Ford Pro, Ford Next, Ford Credit, and Corporate Other. The Ford Blue, Ford Model E, and Ford Pro segment includes the sale of Ford and Lincoln vehicl

Ford Motor($F) Teams With Renault for Low-Cost European EV Push Ford Motor Company (NYSE:$F) is accelerating its European EV strategy through a newly announced partnership with Renault aimed at producing smaller, more affordable electric vehicles and jointly developing commercial vans. The companies are responding to intensifying pressure from Chinese automakers

Ford Motors Stock Supply and Demand AnalysisFord Motors is currently offering one of the cleanest supply and demand structures in the stock market. The bigger timeframes — monthly and weekly — are in full control, and as price reacts to these higher-timeframe imbalances, new daily demand levels are forming with exceptional strength.

This is

$F At Multi-Year Downtrend Resistance - Bulls Target More UpsideFord Motor Company (NYSE: F) is showing a strong technical breakout after several years of trading inside a broad falling wedge structure. The chart reveals a clear downward-sloping resistance line dating back to 2022, but Ford is trying now to push above it for the first time in almost 3 years. Thi

Ford’s 50% RetracementFord Motor jumped last week, and some traders may think there’s still gas in the tank.

The first pattern on today’s chart is the rally after third-quarter results beat estimates. The surge overcame a resistance level from earlier in the month and established a new 15-month high for the Dearborn aut

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

F

F5633195

Ford Motor Credit Company LLC 6.65% 20-AUG-2030Yield to maturity

6.76%

Maturity date

Aug 20, 2030

F

F5629298

Ford Motor Credit Company LLC 6.75% 20-AUG-2033Yield to maturity

6.74%

Maturity date

Aug 20, 2033

F

F6112840

Ford Motor Credit Company LLC 6.5% 20-JUL-2035Yield to maturity

6.62%

Maturity date

Jul 20, 2035

F

F5477060

Ford Motor Credit Company LLC 6.65% 20-SEP-2032Yield to maturity

6.47%

Maturity date

Sep 20, 2032

See all FC bonds