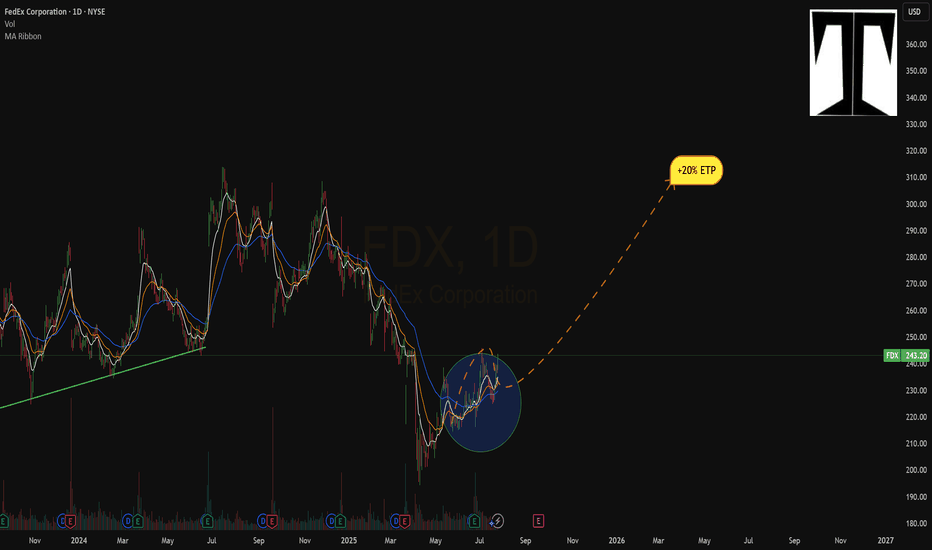

FedEx delivers green amidst a sea of redDespite selling most of my spot crypto, bitcon's bear market has still cost me $ by hammering my poorly-timed crypto-correlated stock picks COIN, CRCL, GLXY, and HOOD. Meanwhile, even Gold and Silver had a dramatic pullback. And on top of that, investors are finally calling bs on big tech *ahem, mic

FedEx Corporation Shs Cert Deposito Arg Repr 0.1 Shs

No trades

Key facts today

FedEx Supply Chain won the 2025 Leadership Award in the Circular Economy category for its e-waste pilot program, aimed at cutting electronic waste through reuse and responsible recycling.

2,150 ARS

4.14 T ARS

89.02 T ARS

About FedEx Corporation

Sector

Industry

CEO

Rajesh Subramaniam

Website

Headquarters

Memphis

Founded

1971

IPO date

Dec 28, 1978

Identifiers

2

ISIN ARDEUT110962

FedEx Corp. is a holding company, which engages in the provision of transportation, e-commerce, business services, and business solutions. It operates through the following segments: FedEx Express, FedEx Freight, Corporate, Other, and Eliminations. The FedEx Express segment offers transportation and delivery services. The FedEx Freight segment refers to freight transportation services to business and residences. The FedEx Services segment includes sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and certain back-office functions that support the company's operating segments. The Corporate, Other, and Eliminations segment is involved in the corporate headquarters costs for executive officers and certain legal and finance functions, as well as certain other costs and credits not attributed to the firm's core business. The company was founded by Frederick Wallace Smith on June 18, 1971, and is headquartered in Memphis, TN.

Related stocks

FedEx ($FDX) – Signs of Short-Term ExhaustionNYSE:FDX is currently trading well above its Keltner Channel, with RSI extended at 82, a level that typically reflects short-term overbought conditions rather than sustainable momentum.

Price is showing early signs of exhaustion after an impulsive move higher. When price stretches this far beyond

Fedex Fake OutSo Fedex just had earnings @ market close.

And as you can see, earnings were good...?

But if you zoom out and look in history. you will see that...

Every time Fedex had earnings, it would pump into resistance

and reject just as sharply.

Is this a coincidence? I cant say... but this is somethin

Fedex Chart Fibonacci Analysis 092425Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 232/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

Fedex Chart Fibonacci Analysis 092025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 233/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

FedEX analysis FDX has found resistance 🚧 at the trendline

From here, price may look to tap into the fair value gap highlighted in purple as the next logical target area.

🎯 Conclusion: Bias is cautiously bullish — I expect FedEx could push into the fair value gap on its next leg higher. This view is based on te

$FDX Bullish CaseFedEx is sitting right on long-term channel support around $220 with RSI neutral, giving a favorable risk/reward setup. On the fundamental side, global trade volumes are recovering, e-commerce tailwinds remain intact, and management’s DRIVE program is cutting billions in costs through automation + A

9/9/25 - $fdx - my canary, but watching only9/9/25 :: VROCKSTAR :: NYSE:FDX

my canary, but watching only

- updated my thinking on NYSE:UPS following such an anti-stellar YTD performance

- the google trends reflect the reality that mgmt (of all these co's) has been saying

- in a lot of ways NYSE:FDX 's mgn profile and non-amzn affected b

FedexThe monthly is looking like it may go failed 2, and the weekly is setting up for a 3-2-2 reversal back to the top. This has a high probability since the 2-down retraced 50% of the last three bars. In a perfect scenario, 229 calls expiring this Friday would work, but to give the move more time to dev

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US31428XBD7

FedEx Corporation 4.5% 01-FEB-2065Yield to maturity

7.26%

Maturity date

Feb 1, 2065

FDX6083334

FedEx Corporation 4.05% 15-FEB-2048Yield to maturity

6.32%

Maturity date

Feb 15, 2048

FDX6237489

FedEx Corporation 4.5% 01-FEB-2065Yield to maturity

6.26%

Maturity date

Feb 1, 2065

FDX.GD

Federal Express Corporation 7.6% 01-JUL-2097Yield to maturity

6.07%

Maturity date

Jul 1, 2097

FDX6042542

FedEx Corporation 4.1% 01-FEB-2045Yield to maturity

6.05%

Maturity date

Feb 1, 2045

FDXD

FedEx Corporation 4.1% 01-FEB-2045Yield to maturity

6.01%

Maturity date

Feb 1, 2045

FDX6085625

FedEx Corporation 5.1% 15-JAN-2044Yield to maturity

5.98%

Maturity date

Jan 15, 2044

FDX3881474

FedEx Corporation 3.875% 01-AUG-2042Yield to maturity

5.98%

Maturity date

Aug 1, 2042

US31428XBN5

FedEx Corporation 4.4% 15-JAN-2047Yield to maturity

5.97%

Maturity date

Jan 15, 2047

FDX4739441

FedEx Corporation 4.95% 17-OCT-2048Yield to maturity

5.95%

Maturity date

Oct 17, 2048

FDX6021907

FedEx Corporation 4.75% 15-NOV-2045Yield to maturity

5.93%

Maturity date

Nov 15, 2045

See all FDX bonds