I Think GE Aerospace is BrilliantThis is one of my favorite companies on the market. I really have a deep fascination for aviation and all things, planes. Naturally it makes sense for me to have exposure to the sector. I do not have many companies in my portfolio but I'm going to share my reasons for why I have been buying GE stock

0.80 USD

5.81 B USD

34.38 B USD

About GE Aerospace

Sector

Industry

CEO

H. Lawrence Culp

Website

Headquarters

Evendale

Founded

1878

ISIN

ARDEUT110160

FIGI

BBG000FSTYL2

GE Aerospace is an American aircraft company, which engages in the provision of jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft. The firm's portfolio of brands includes Avio Aero, Unison, GE Additive, and Dowty Propellers. It operates through the Commercial Engines & Services and Defense & Propulsion Technologies segments. The Commercial Engines & Services segment is involved in the design, development, manufacturing, and servicing of jet engines for commercial airframes, as well as business aviation and aeroderivative applications. The Defense & Propulsion Technologies segment offers defense engines and critical aircraft systems. The company was founded by Thomas Alva Edison in 1878 and is headquartered in Evendale, OH.

Related stocks

GE heads up at $305.12: Golden Genesis fib may give DIP to reBuyGE flew through all of our mapped targets (see idea below)

Now at a possible top by Golden Genesis fib at $305.12

Look for a Dip-to-Fib (likely) or a Break-n-Retest next.

.

Previous Analysis that nailed a PERFECT BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=============

GE watch $260-261: Key support to maintain strong UptrendGE has been in a strong uptrend for a couple of years now.

Earnings report dropped it to support zone at $260.00-261.05

This zone is now clearly visible to everyon, so Do-or-Die here.

Long entry here with tight stop loss just below zone.

======================================================

.

Crazy claims #GEWe’re up about 6% since I recently shared this idea. I won’t go through the full methodology, just my price target. Short- to mid-term trade, and it looks like we’re breaking over 208 any day now. I’m in with a very small size, but after 208, I’m full size. Looking forward to next quarter to see if

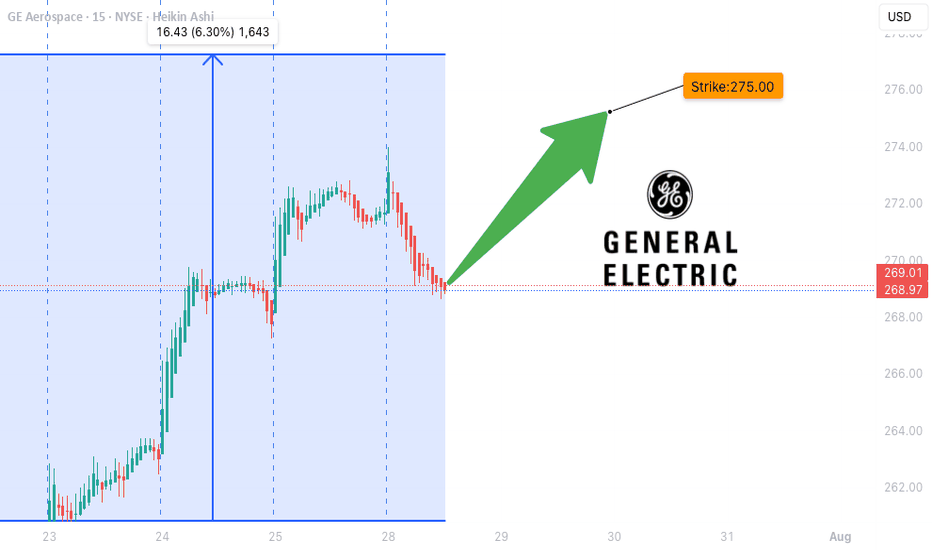

GE Targeting the Highs — Ready to Breakout?⚡ GE Weekly Options Alert (Aug 12, 2025)**

**Bias:** 🟡 **MODERATE BULLISH** — RSI strong but volume light

📊 **Key Stats:**

* **Call/Put Ratio:** 0.84 — neutral sentiment

* **Daily RSI:** 71.0 ↗ strong momentum

* **Weekly RSI:** 83.9 ↗ very bullish

* **Volume:** 0.8× last week — low institutional c

GE WEEKLY OPTIONS SETUP (2025-07-28)

### ⚙️ GE WEEKLY OPTIONS SETUP (2025-07-28)

**Mixed Signals, Bullish Flow – Can Calls Win This Tug-of-War?**

---

📊 **Momentum Breakdown:**

* **RSI:** Falling across models → ⚠️ *Momentum Weak*

* **Volume:** Weak 📉 = Low conviction from big players

* **Options Flow:** Call/Put ratio favors bull

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture an

GE Weekly Options Trade Setup – 07/14/2025 $290C | Exp. July 18

📈 GE Weekly Options Trade Setup – 07/14/2025

$290C | Exp. July 18 | Bullish Catalyst In Play

⸻

🔥 BULLISH MOMENTUM CONFIRMED

✅ All 5 major AI models (Grok, Claude, Gemini, Llama, DeepSeek) agree:

GE just broke out — strong momentum, price above MAs, MACD bullish.

📰 Catalyst: Citigroup Upgrade 💥

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GE.HQH

General Electric Capital Corporation 4.5% 15-NOV-2025Yield to maturity

15.25%

Maturity date

Nov 15, 2025

G

GE4373214

GE Capital International Funding Co. ULC 3.373% 15-NOV-2025Yield to maturity

10.75%

Maturity date

Nov 15, 2025

GE.HQF

General Electric Capital Corporation 4.5% 15-NOV-2025Yield to maturity

7.61%

Maturity date

Nov 15, 2025

XS0182703743

General Electric Company 5.375% 18-DEC-2040Yield to maturity

6.08%

Maturity date

Dec 18, 2040

G

75VG

GE Capital UK Funding Unlimited Co. 8.0% 14-JAN-2039Yield to maturity

6.05%

Maturity date

Jan 14, 2039

G

US1236.USD

General Electric Capital Corporation 6.0% 02-FEB-2046Yield to maturity

5.86%

Maturity date

Feb 2, 2046

65LH

General Electric Capital Corporation 4.875% 18-SEP-2037Yield to maturity

5.79%

Maturity date

Sep 18, 2037

US369604BF9

General Electric Capital Corporation 4.125% 09-OCT-2042Yield to maturity

5.42%

Maturity date

Oct 9, 2042

US369604BX0

General Electric Capital Corporation 4.25% 01-MAY-2040Yield to maturity

5.36%

Maturity date

May 1, 2040

GE4976362

General Electric Capital Corporation 4.35% 01-MAY-2050Yield to maturity

5.29%

Maturity date

May 1, 2050

US369604BH58

General Electric Capital Corporation 4.5% 11-MAR-2044Yield to maturity

5.27%

Maturity date

Mar 11, 2044

See all GED bonds

Curated watchlists where GED is featured.