0.30 USD

1.70 B USD

18.45 B USD

About MercadoLibre, Inc.

Sector

Industry

CEO

Marcos Eduardo Galperin

Website

Headquarters

Montevideo

Founded

1999

ISIN

ARDEUT116175

MercadoLibre, Inc. engages in the development of an online commerce platform with a focus on e-commerce and related services. It operates through the following geographical segments: Brazil, Argentina, Mexico, and Other Countries. The Other Countries segment refers to Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Panama, Peru, Bolivia, Honduras, Nicaragua, El Salvador, Guatemala, Paraguay, Uruguay, and the United States of America. Its products provide a mechanism for buying, selling, and paying as well as collecting, generating leads, and comparing lists through e-commerce transactions. The company was founded by Marcos Eduardo Galperin on October 15, 1999 and is headquartered in Montevideo, Uruguay.

Related stocks

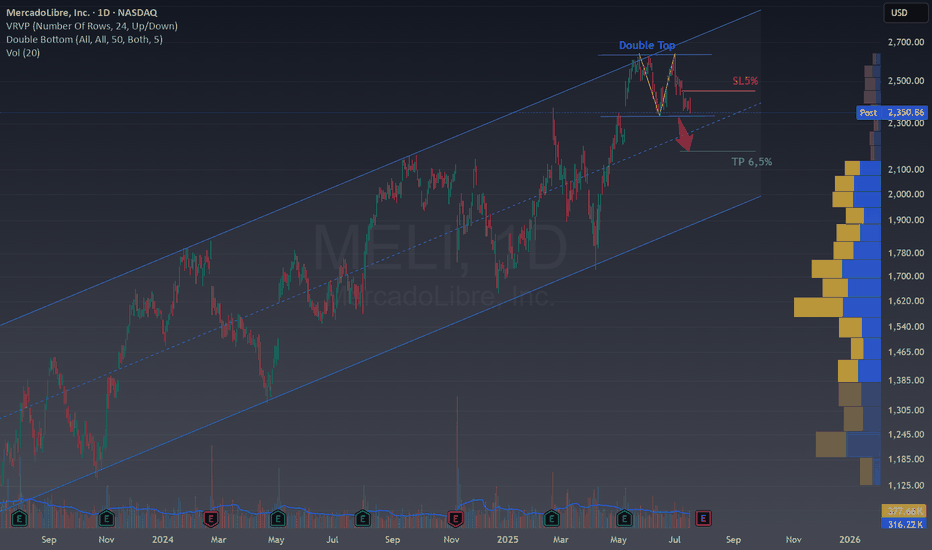

Double Top in MELI – Potential Reversal Inside a Channel🧠 Double Top in MELI – Potential Reversal Inside a Channel

Ticker : MercadoLibre, Inc. (MELI)

Timeframe : 1D (Daily Chart)

Pattern : Double Top

Bias : Bearish Reversal within a Bullish Channel

Technical Breakdown

We're spotting a clean Double Top at the upper boundary of a long-term asc

$MELI: Long term trend activeThe dominant e-commerce and fintech player in Latin America, MercadoLibre, has demonstrated robust growth in the first quarter of 2025.

With a significant increase in gross merchandise volume and total payment volume, the company is capitalizing on the region's digital transformation.

Key metric

MercadoLibre Pulls BackMercadoLibre rallied to new highs last month, and some traders may see an opportunity in its latest pullback.

The first pattern on today’s chart is the $2,374.54 level. MELI first touched that price on February 21 after reporting strong earnings. The stock gapped above the level in May on another s

MercadoLibre setting up for good buy opportunityHello,

MercadoLibre, Inc. engages in the development of an online commerce platform with a focus on e-commerce and related services. It operates through the following geographical segments: Brazil, Argentina, Mexico, and Other Countries.

TECHNICAL ANALYSIS- Checklist

1. Structure drawing (Trend

MELI at Risk from Momentum Shift and High ValuationMELI has gained over 35% since the April dip, but momentum has been fading since September. The slowdown has become increasingly visible, and last week's high may remain the top for some time unless Wednesday’s earnings report surprises the market on the upside.

The consensus estimate for MELI’s re

Technical Analysis of $MELI (MercadoLibre) - For Long TermAfter a thorough analysis of MercadoLibre ( NASDAQ:MELI ) charts on 1M, 1W, and 1D timeframes, here’s a summary covering market context, key levels, trading opportunities, and price phases. Perfect for traders or investors looking for actionable insights.

Market Context

1M/1W: Strong bullish trend

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

M

SXC1O

Mercadopago Servicios de Procesamiento SRL FRN 18-JUL-2026Yield to maturity

—

Maturity date

Jul 18, 2026

See all MELDB bonds