3M Breaks a Major Resistance — Cup & Handle Pattern Activation1. Technical Analysis

MMM has formed a textbook Cup & Handle structure on the 1h timeframe:

• Well-rounded cup

• Shallow handle correction

• Multiple touches of the 172.8–173.2 resistance

• A strong breakout candle

• A clean retest of the breakout zone

The 50-period SMA provides dynamic supp

Key facts today

3M is experiencing growth and margin expansion, attributed to operational discipline and cultural transformation, while making progress toward its ambitious growth, margin, and cash return targets.

Barclays has maintained its 'Overweight' rating for 3M (MMM) and raised the price target for the company's shares from $180.00 to $190.00.

0.50 USD

3.71 B USD

21.83 B USD

About 3M Company

Sector

Industry

CEO

William M. Brown

Website

Headquarters

St. Paul

Founded

1902

ISIN

ARDEUT110293

FIGI

BBG000DDG3P5

3M Co. is a technology company, which manufactures industrial, safety, and consumer products. It operates through the following segments: Safety and Industrial, Transportation and Electronics, Health Care, Consumer, and Corporate and Unallocated. The Safety and Industrial segment consists of personal safety, industrial adhesives and tapes, abrasives, closure and masking systems, electrical markets, automotive aftermarket, and roofing granules. The Transportation and Electronics segment includes electronics, automotive and aerospace, commercial solutions, advanced materials, and transportation safety. The Health Care segment offers medical and surgical supplies, skin health and infection prevention products, oral care solutions, separation and purification sciences, health information systems, inhalation and transdermal drug delivery systems, and food safety products. The Consumer segment covers consumer healthcare, home care, home improvement, and stationery and office products, such as consumer bandages, braces, supports, respirators, cleaning products, retail abrasives, picture hanging, and consumer air quality solutions. The Corporate and Unallocated segment refers to special items and other corporate expense-net. The company was founded by Henry S. Bryan, Hermon W. Cable, John Dwan, William A. McGonagle, and J. Danley Budd in 1902 and is headquartered in St. Paul, MN.

Related stocks

MMM US🌎The company is showing some progress. In the third quarter of 2025, revenue grew 3.5%, the fastest pace in four years , and operating margin increased 1.7 percentage points to 24.7%.

Sales of products launched in the past five years grew 30% in the quarter.

The appointment of new CEO William Bro

3M: Approaching the Target Zone3M stock has recently traced a zigzag pattern on the chart. In the short term, we anticipate further upside, with shares moving into our Target Zone between $184.42 and $202.51. Within this range, we expect to see the peak of the magenta impulse wave (1). Once this level is reached, a corrective wav

MMM eyes on $167-169: Major Resistance may give a Dip-to-Fib BuyMMM got a nice surge from its Earnings Report.

Just hit major resistance zone $167.61-169.15

Look for Dip-to-Fib like $163.85 or 160.xx zone

.

See "Related Publications" for previous plots such as this BOTTOM entry:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

==================

3M (NYSE: $MMM) Delivers Strong Third-Quarter Results3M (NYSE: NYSE:MMM ) Delivers Strong Third-Quarter Results; Increases Full-Year Margin and EPS Guidance.

GAAP sales of $6.5 billion , up 3.5%; operating margin 22.2%, up 130 bps; EPS of $1.55, down 38%, all YoY

Adjusted sales of $6.3 billion with organic growth of 3.2% YoY

Adjusted operating margi

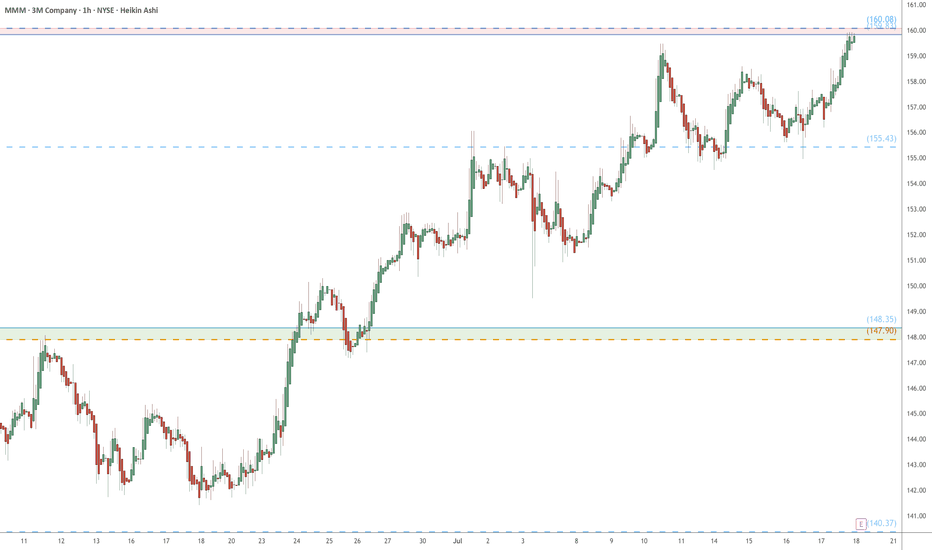

MMM eyes on $160: Resistance Zone waiting for Earnings reportMMM has been crawling off a decade long bottom.

Testing a significant resistance at $159.83-160.08

Earnings report tomorrow, so a key 24 hours here.

.

Previous analysis that caught the BREAK OUT:

Hit the BOOST and FOLLOW for more PRECISE and TIMELY charts.

=======================================

3M - LTF Successful RetestWe have seen a liquidity zone form for the past year and finally we are looking at a successful retest. Given this holds as a new buying zone then our next target would be $170-$174 followed by the ATH around $216.

If price fails to hold this liquidity zone as new support and price closes back belo

Double Calendar Option Spread on MMMUsing a double calendar spread to profit from price movement in either direction after earnings announcement in 3 days time (18 July) for MMM.

These trades can be extremely profitable if one expects movement after earnings.

Selling both a Put and Call at high (pre-earnings IV) makes this option tr

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US88579YBK6

3M Company 3.25% 26-AUG-2049Yield to maturity

5.61%

Maturity date

Aug 26, 2049

MMM4404250

3M Company 3.125% 19-SEP-2046Yield to maturity

5.60%

Maturity date

Sep 19, 2046

MMM4971226

3M Company 3.7% 15-APR-2050Yield to maturity

5.55%

Maturity date

Apr 15, 2050

MMMH

3M Company 3.625% 15-OCT-2047Yield to maturity

5.55%

Maturity date

Oct 15, 2047

US88579YBD2

3M Company 4.0% 14-SEP-2048Yield to maturity

5.53%

Maturity date

Sep 14, 2048

MMM4131137

3M Company 3.875% 15-JUN-2044Yield to maturity

5.38%

Maturity date

Jun 15, 2044

MMM.GP

3M Company 5.7% 15-MAR-2037Yield to maturity

4.90%

Maturity date

Mar 15, 2037

MMM6021412

3M Company 5.15% 15-MAR-2035Yield to maturity

4.75%

Maturity date

Mar 15, 2035

MMM4404424

3M Company 2.25% 19-SEP-2026Yield to maturity

4.53%

Maturity date

Sep 19, 2026

US604059AE5

3M Company 6.375% 15-FEB-2028Yield to maturity

4.22%

Maturity date

Feb 15, 2028

MMM6021411

3M Company 4.8% 15-MAR-2030Yield to maturity

4.16%

Maturity date

Mar 15, 2030

See all MMMD bonds

Curated watchlists where MMMD is featured.