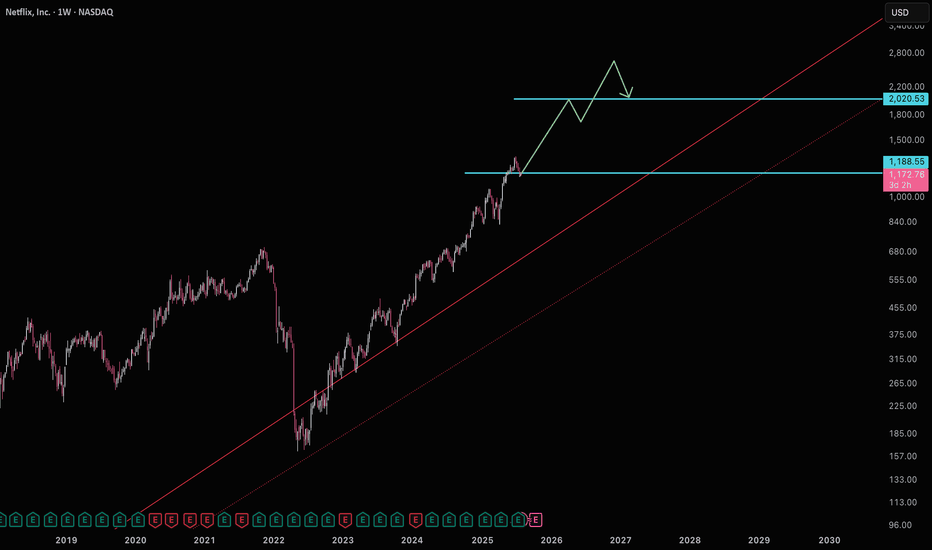

Netflix (NFLX) - Elliott Wave Map to $25K📘 Netflix (NFLX) – The Final Act of Supercycle Wave III, Setting the Stage for Wave V to $25,000+

Symbol: NASDAQ:NFLX

Timeframe: Monthly

Published: October 2025

Current Price: ~$1,120

Framework: Elliott Wave | Fibonacci Extensions | Price Action | Smart Money Concepts (SMC) | Fundamenta

Key facts today

Netflix's Q3 2025 earnings faced a negative market response due to an unexpected Brazilian tax expense impacting operating income, according to Co-CEO Gregory Peters.

580 ARS

7.98 T ARS

35.60 T ARS

About Netflix, Inc.

Sector

Industry

Website

Headquarters

Los Gatos

Founded

1997

ISIN

ARBCOM4601D2

Netflix, Inc. engages in providing entertainment services. It also offers activities for leisure time, entertainment video, video gaming, and other sources of entertainment. It operates through the United States and International geographic segments. The company was founded by Marc Randolph and Wilmot Reed Hastings on August 29, 1997 and is headquartered in Los Gatos, CA.

Related stocks

Netflix Down After Earning, But Its Hunting SupportNetflix is coming down after earnings and is currently trading more than 10% lower. Whenever we see such a sharp reversal, it’s important to zoom out and look at the broader trend. From the 2023 lows, there is still a very strong and impulsive recovery, so this could be just a temporary deeper corre

Netflix (NFLX) Shares See a Sharp DeclineNetflix (NFLX) Shares See a Sharp Decline

According to recent charts, Netflix (NFLX) shares have traded below $1,100 this week — for the first time since late May. The stock has fallen more than 17% from its July peak, while the S&P 500 index remains close to record highs.

Why Has Netflix (NFLX)

Netflix: A Correction Within a Strong UptrendNetflix: A Correction Within a Strong Uptrend

NASDAQ:NFLX has gone through a lot over the past few years, from huge growth to deep corrections, and lately we’ve seen a (healthy?) 20% pullback that brought the price right to the lower boundary of its long-term ascending channel.

At first glanc

Netflix: Key Support Zone in sightNetflix shares have continued to decline since our last update. We have now provided additional detail on the ongoing turquoise wave 4, which is subdivided into a magenta three-part structure. Within this structure, wave is expected to push price further down into the turquoise Target Zone, betwee

Netflix Earnings Market OverreactionAt this point we all know that Netflix is a common part of an average American's life. However, we came to terms with reality that the global field has a larger effect on the NASDAQ:NFLX than we might think. As we saw in the Q3 '25 earnings report, Brazil levied a one time tax bill on Netflix that

Netflix (NFLX) | FVG + OTE Entry Loading | Multi-Confluence ICT Netflix (NASDAQ: NFLX) is currently retracing into a high-probability multi-timeframe setup, aligning several ICT confluences that suggest a potential re-entry opportunity within a bullish continuation narrative.

Market Structure:

Price remains bullish overall, with clear higher highs (HH) and high

Netflix Buying OpportunityNetflix shares have dropped sharply — losing around 10% of their value in just one day, wiping billions from its market cap. The decline followed disappointing earnings results and a one-off $619 million tax charge in Brazil, overshadowing strong revenue growth.

On the chart, price has tapped into

Popcorn Ready? Netflix Layering Setup for Bold Traders🎬 Netflix Stock | Thief Trader’s Profit Realization Blueprint 🍿💰

🧭 Market Outlook

Netflix (NFLX) is lining up for a bullish playbook — and here’s how the Thief Strategy goes down. This setup is purely educational and shares how I personally view price behavior with a layering approach.

🎯 Trading P

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

NFLX5862368

Netflix, Inc. 5.4% 15-AUG-2054Yield to maturity

5.25%

Maturity date

Aug 15, 2054

NFLX5862367

Netflix, Inc. 4.9% 15-AUG-2034Yield to maturity

4.34%

Maturity date

Aug 15, 2034

NFLX4901374

Netflix, Inc. 4.875% 15-JUN-2030Yield to maturity

4.13%

Maturity date

Jun 15, 2030

USU74079AN1

Netflix, Inc. 5.375% 15-NOV-2029Yield to maturity

4.06%

Maturity date

Nov 15, 2029

NFLX4908613

Netflix, Inc. 6.375% 15-MAY-2029Yield to maturity

3.94%

Maturity date

May 15, 2029

NFLX4826528

Netflix, Inc. 5.875% 15-NOV-2028Yield to maturity

3.91%

Maturity date

Nov 15, 2028

NFLX4764899

Netflix, Inc. 4.875% 15-APR-2028Yield to maturity

3.86%

Maturity date

Apr 15, 2028

US64110LAN64

Netflix, Inc. 4.375% 15-NOV-2026Yield to maturity

3.80%

Maturity date

Nov 15, 2026

XS198938050

Netflix, Inc. 3.875% 15-NOV-2029Yield to maturity

3.34%

Maturity date

Nov 15, 2029

XS207282979

Netflix, Inc. 3.625% 15-JUN-2030Yield to maturity

2.79%

Maturity date

Jun 15, 2030

XS198938017

Netflix, Inc. 3.875% 15-NOV-2029Yield to maturity

2.71%

Maturity date

Nov 15, 2029

See all NFLXB bonds

Curated watchlists where NFLXB is featured.