Philip Morris International Inc. Shs Cert Deposito Arg Repr 0.0555555555 Shs

No trades

Trade ideas

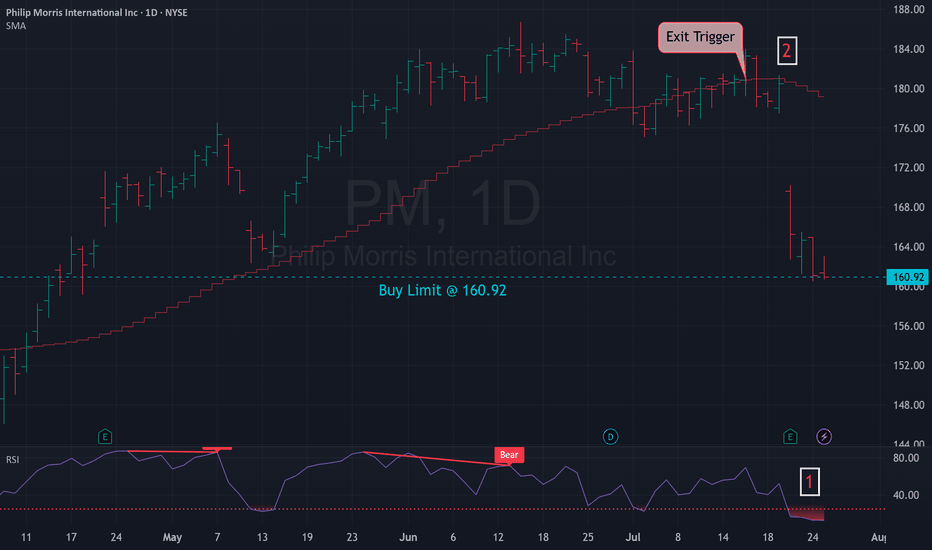

PM has reached important support Price has followed the broader trend structure outlined in prior updates since August and has now reached a key mid-term support zone, where at least a temporary bounce is likely.

Alternatively, a breakdown below 140 would increase the odds of a move toward 130 support.

On the macro time frame, the uptrend structure from the 2020 bottom continues to suggest long-term potential for higher resistance targets, as long as price holds above 127.

Chart:

Macro view (Monthly):

Previously:

• On key support to watch (Oct 3):

Chart:

www.tradingview.com

• On immediate downside potential (Sep 25):

Chart:

www.tradingview.com

• On downside potential (Sep 5):

Chart:

www.tradingview.com

• On resistance (Aug 11):

Chart:

www.tradingview.com

Philip Morris Turning Point: Surge to $200 or Drop to $140?

Technical Analysis

Overall Trend: The stock is in an upward channel, and the ascending trendline (blue) has been validated multiple times, showing strong price reactions.

Moving Average: The price is fluctuating near the 50-day moving average, which acts as short-term support/resistance.

Key Support: The $163–165 range aligns with the ascending trendline.

Key Resistance: $175–177 and then $185–190.

Short-Term Scenario (1–3 weeks)

Bullish Scenario:

If the price holds above the trendline ($163–165) and breaks $168.5, a rise to $175 is expected. If $175 is broken, the next target is $182–185.

Target 1: $175

Target 2: $182–185

Stop Loss: Below $162

Bearish Scenario:

If the trendline is broken and the price consolidates below $162, a drop to $155 is possible, and in the worst case, it could reach $138–140.

Target 1: $155

Target 2: $138–140

Stop Loss: Recovery and consolidation above $168

Long-Term Scenario (3–6 months)

Bullish Scenario:

If the upward trend continues and the $185–190 resistance is broken, the path toward the all-time high near $195–200 opens.

Mid-term Target: $185–190

Long-term Target: $195–200

Stop Loss: Losing support at $155

Bearish Scenario:

If the key support at $155 is broken and selling pressure continues, a corrective target around $137 is likely. This level is considered strong support on a larger timeframe.

Target 1: $155

Target 2: $137

Stop Loss: Recovery and consolidation above $175

Summary:

In the short term, traders should consider the $163–165 range as critical. Holding above it opens a growth opportunity to $175–185, but losing it could trigger a drop to $155 and $140.

In the long term, as long as support at $155 holds, the bullish trend remains dominant, and the $190–200 target remains active.

$PM Maintains a Strong Uptrend: Long at $147.17!Philip Morris International Inc. ( NYSE:PM ) is showing a “Strong Uptrend” on a 1-week chart. 📈 We bought at $109.86 and sold at $142.88 previously. Now at $169.17, we’re in a long position at $147.17. With a Trend Score of 8/8 and 100% signal alignment, the short-term projected price is $196.2 ( +15.1% ), supported by bullish RSI/MACD.

How to Trade This Setup:

• Ride the Trend: The uptrend is robust with high volume and bullish signals—hold the long position from $147.17.

• Set Targets: Aim for Resistance 1 at $189.55; Support 1 at $133.02 is a key level if a pullback occurs.

• Manage Risk: Consider trailing stops to lock in gains as the price nears $196.2, given the strong trend.

What’s your next move on NYSE:PM ? Let’s discuss in the comments! 💡 #Trading #PM #Analysis

130 isn't a decider, it's a finder based in all on significanceWith the right angle poised to coincide with oscillators and indicators pointed in the direction of stabilizing at some point, it could be messy and start an entirely new direction in the public's sentiment. However, it could extend further to newer levels when things are in the cool-down phase.

Philip Morris Hit The Ceiling. PMOur last game take on PM centering on a bullish butterfly gave us profits on that very healthy looking impulse up. Now, it is time to come back to reality for this stock. RSX wise - out of OBOS territory, while crossing the MIDAS line. vWAP/US show gradient of trend and are resistant and in alignment. The technicals below have been divergent for a very long time, an indication that a correction has been long overdue.

PM - LONG - "Abysmal courage buy " Abysmal Courage Strategy - Having the courage to buy a winning stock showing strength on a day when market overall seems abysmal or extremely bleak the pundits are cautious the feeling is dire .

Stock Chosen - PM

This is not a model stock but I bought it more so to be courageous on a red day , I had a rough week and took many losses . By the end of Friday I was mostly out of everything with exception of several stronger names .

I , in the past , would never buy on days like Friday , I would sometimes short and sometimes you just go for a walk after to change my focus ect ect. One thing for sure , buying strength on a day like this is really mentally tough for us and our genes its much easier when your PnL is green and you feel smart.

PM , not only did really well on Friday but it has done really well recently. It is lacking 20% week and exceptional eps/sales , so only 4/6 of my requirements. None the less , it is a strong name on an abysmal day. Since it was such a red day I decided to buy it just for that reason . Its very hard to buy strength on red days like that but I have started to see it as a good habit to increase my muscle memory on. It doesn't have to be regular sized position either I think we can micro size....its the act that matters . I am going to personally keep track of the ACB's on a white board , the idea is to take a gloomy day like Friday and while managing risk and taking losses , still force myself to buy one like PM , or add to one that I already have .

"Courage. 💪The more you DO it, the more you DO it!

The most exciting thing about this SUPERPOWER is that you already possess it. 🦸🦸🏽♀️It's available to you NOW. In the very next moment, we can use this mighty force if we merely muster the COURAGE to claim it.

Remember: Our DIRECTION is what leads to a DESTINATION; and the COURAGE to TAKE ACTION consistently will move us in the DIRECTION of the FEW who do 🆚 the MANY who talk."

Tony Robbins~

Philip Morris is Going to SMOKE Earnings on Feb. 6th ($140+)NYSE:PM - ZYN is clearly going nowhere but up, and that's the evil beauty of nicotine/ addiction. Once ya start, ya don't (typically) stop. Philip Morris announces earnings on February 6th, and I think they BLOW analyst expectations out of the water. 😮💨💸🏆

Technically, NYSE:PM is on the verge of breaking above this line of medium term resistance, and once/ if we do, I think we have a clear shot up to $140. Heck, maybe we even see it prior to their report!💥📈🎯

If NYSE:PM really impresses on the 6th, then I wouldn't be surprised if we rallied +12% from pre-reporting levels, in a similar scenario to what occurred following their last report back in November. 🔮🚀🌙

We've got a fun week ahead of us team! 😎🤙🏼

Zynskies and zynachinos can make me 25%?I find this post to be so informative and personal that its funny LOL.

Just like the MRNA post I made, I have been trying to find a store with Zyns and they are all sold out hahaha. This company will see a huge increase of investments as there trying to replace old products with new ones THEY MAKE.