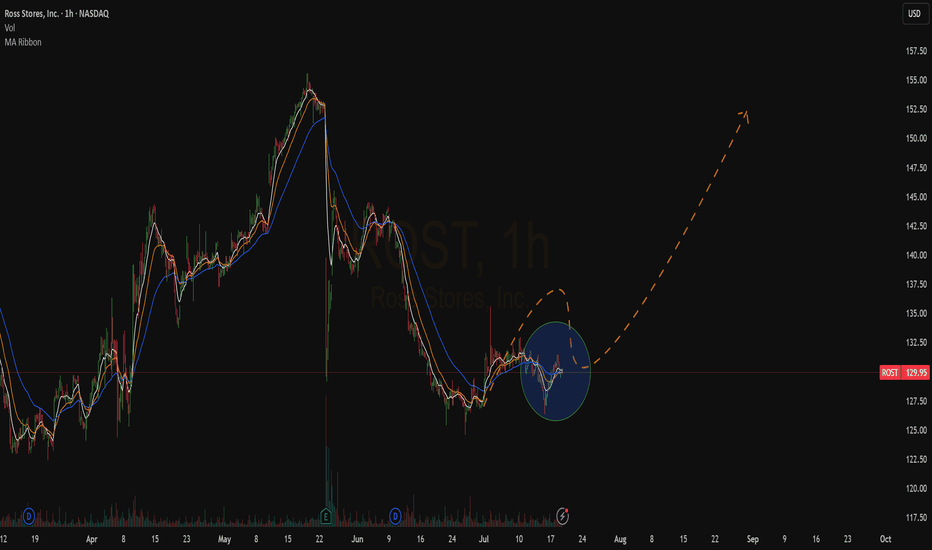

ROST - Ross Stores - Broke previous High and back for Re-testHello Everyone, Followers,

Second one and probably last one from me for today is ROST - Ross Stores Inc.

What they do

Ross Stores is a major U.S. off-price retailer. They operate the flagship “Ross Dress for Less®” chain—the largest off-price apparel & home fashion chain in the U.S.—plus the dd’

1.25 USD

1.86 B USD

18.78 B USD

About Ross Stores, Inc.

Sector

Industry

CEO

James Grant Conroy

Website

Headquarters

Dublin

Founded

1957

ISIN

ARBCOM4600Z7

Ross Stores, Inc. engages in the operation of off-price retail apparel and home accessories stores. Its products include branded and designer apparel, accessories, footwear, and home fashions through the Dress for Less and dd's DISCOUNTS brands. The company was founded by Stuart G. Moldaw in 1957 and is headquartered in Dublin, CA.

Related stocks

Ross Stores, Inc. (ROST) Grows With Consumer Value FocusRoss Stores, Inc. (ROST) is a leading off-price retailer offering name-brand apparel, footwear, and home fashions at discounted prices. With over 2,000 stores across the U.S. under the Ross Dress for Less and dd’s DISCOUNTS banners, the company attracts value-conscious shoppers in all markets. Ross’

ROST - Strong Fundamental + Technical Breakout Setup**Title: ROST - Strong Fundamental + Technical Breakout Setup | Long Entry $150.9**

---

**📈 Ticker:** ROST (Ross Stores Inc.)

**📍 Recommendation:** LONG

**⏰ Timeframe:** Swing to Position Trade (1-4 weeks)

---

### **🎯 Trade Idea Summary**

- **Entry:** $150.90 (on pullback or breakout confi

ROST Earnings Play: Big Call Setup Ahead of BMO! 🚀 ROST Earnings Play: Big Call Setup Ahead of BMO! (Aug 21, 2025) 🚀

### 🏦 Earnings Outlook

* 📊 **Revenue Growth:** +2.6% TTM – stable retail performance

* ⚖️ **Margins:** Profit 9.8%, Operating 12.2%, Gross 32.8% → strong operational efficiency

* 📈 **Historical Beat Rate:** 100% over last 8 quarte

Ross Stores Faces Crucial $150 Resistance TestTrend:

The stock has remained inside a descending channel since Aug 2024. Price is currently testing the upper trendline resistance at $150–151, a level where it has been repeatedly rejected.

Momentum Indicators:

RSI (60.3): Slightly bullish but shows bearish divergence vs price → signals weake

ROST is correcting and that's OK - Long at 141.28People get panicky during corrections. Understandably, it can be nerve-wracking watching that stock you were sure was going up, going down. With the short term nature of the trading I'm doing, I don't worry that much, and especially when the corrections are garden variety ones.

ROST is down alm

Second $ROST entry on bullish confirmation!Key Stats:

Market Cap: $51.9B

P/E Ratio: 24.65 (sector average ~22.5)

Free Cash Flow: $1.6B TTM

Next Earnings Date: March 4, 2025

Technical Reasons Supporting an Increase:

Ascending Channel Formation: ROST continues to trend upward within a well-defined ascending channel, target

You need $ROST to spell PROFITSKey Stats

Current Price: $154.87

52-Week Range: $113.77 - $159.16

P/E Ratio: 24.38 (moderate valuation for retail)

Market Cap: $51.38B

Revenue Growth: +5.8% forecasted YoY for FY 2025

Next Earnings Date: March 4 2025

Top 3 Technical Reasons ROST Will Increase:

Breakout Setup: The s

See all ideas

ROST4973627

Ross Stores, Inc. 5.45% 15-APR-2050Yield to maturity

5.86%

Maturity date

Apr 15, 2050

US778296AD5

Ross Stores, Inc. 4.8% 15-APR-2030Yield to maturity

4.66%

Maturity date

Apr 15, 2030

ROST5064464

Ross Stores, Inc. 1.875% 15-APR-2031Yield to maturity

4.51%

Maturity date

Apr 15, 2031

ROST4973625

Ross Stores, Inc. 4.7% 15-APR-2027Yield to maturity

4.10%

Maturity date

Apr 15, 2027

ROST5064463

Ross Stores, Inc. 0.875% 15-APR-2026Yield to maturity

4.07%

Maturity date

Apr 15, 2026

See all ROSTD bonds

Curated watchlists where ROSTD is featured.

Female-led stocks: Who rules the world?

34 No. of Symbols

See all sparks