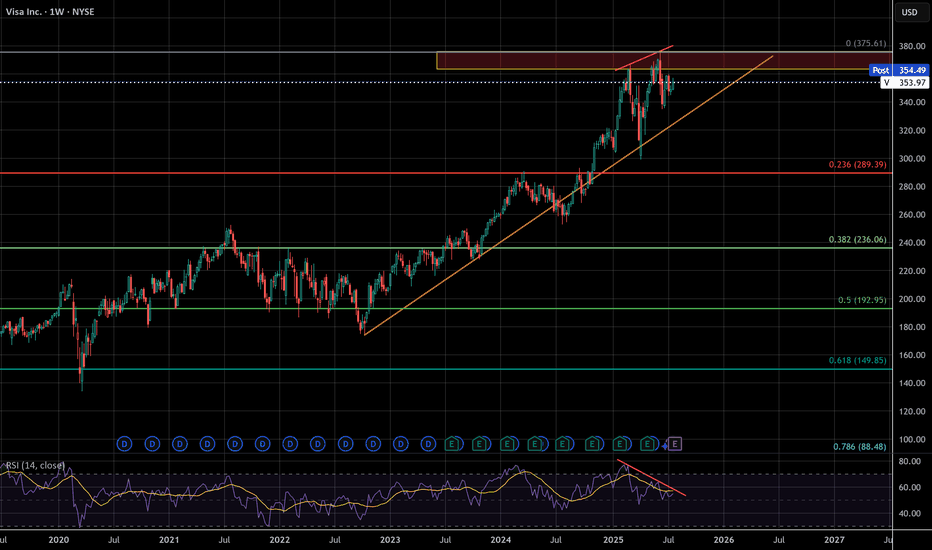

VISA BACK TO 370 BY 2026 Why Visa (V) Could Hit $370 by 2026: Payments Powerhouse Bull Case Visa’s trading at ~$344 today (Sep 23, 2025), up 15% YTD on digital payments surge, but with EPS climbing 12%+ and global transaction volumes booming, $370 (8% upside) by EOY 2026 is a low-bar target for this steady climber. Here’s t

Key facts today

Malaysia Aviation Group has established a digital partnership with Visa to improve its online travel booking services, collaborating with Adobe, Google, and Skyscanner.

600 ARS

15.10 T ARS

27.88 T ARS

About Visa Inc.

Sector

Industry

CEO

Ryan McInerney

Website

Headquarters

San Francisco

Founded

1958

ISIN

ARBCOM460127

Visa, Inc. engages in the provision of digital payment services. It also facilitates global commerce through the transfer of value and information among a global network of consumers, merchants, financial institutions, businesses, strategic partners, and government entities. It offers debit cards, credit cards, prepaid products, commercial payment solutions, and global automated teller machines. The company was founded by Dee Hock in 1958 and is headquartered in San Francisco, CA.

Related stocks

Visa stock analysisVisa stock is showing signs of weakness as price approaches a possible death cross.

the uptrend line that has supported the advance for months. The structure suggests this trendline may be vulnerable to a break, which would mark a potential shift in momentum.

Based on the structure, I think Visa c

Visa: Corrective Upward MoveIn our primary scenario, we place Visa in the corrective upward move of blue wave (x). After the top, we expect the broader downward trend of turquoise wave 4 to take hold, which should push the stock into our turquoise Target Zone between $308.09 and $292.19. At that level, we anticipate a sustaine

Aggressively bullish on $V with 360c exp on November 21# Visa Inc. (V) – Daily Chart Deep Dive

## 1. Price Structure & Trend Pattern

- The daily candles from April through mid-September trace a classic descending triangle: a series of lower highs feeding off the upper trendline, while horizontal support around 351.13 holds repeatedly.

- A descendi

Visa Wave Analysis – 17 September 2025- Visa reversed from key support level 333.00

- Likely to rise to resistance level 351.20

Visa recently reversed down from the support area between the key support level 333.00 (which has been reversing the price from June), lower daily Bollinger Band and the 50% Fibonacci correction of the upward

VISA - The missing puzzle piece - Suffering from successI've seen a lot of negative sentiment online lately about the impending bubble, but even with social media, crude AI, and the US dollar being the peak of that negativity this whale has been dying slowly and few have taken notice.

VISA has begun to censor what can be bought, overcharge merchants, an

Visa - Potential drop from descending triangleV - Potential Bear Swing

Timeframe - 1 weeks to 3 months

Volume

- Maintained volume

Price Action + Trend

- bullish trend broken

- Price broken out of downtrend line

Ichimoku

- Lagging, base and conversion line below kumo

- Kumo cloud thinning and red cloud forming

Patterns

- Descending trian

$V is oscillating in a nice range!Emerging Competitors and Niche Players

• UnionPay & JCB

While headquartered in Asia, these networks are expanding cross-border acceptance and carving out market share among Chinese and Japanese tourists globally.

• Fintech Disruptors

Companies like Stripe, Adyen, Square (Block), Affirm, and

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

3V69

Visa Inc. 3.65% 15-SEP-2047Yield to maturity

5.29%

Maturity date

Sep 15, 2047

3V68

Visa Inc. 4.3% 14-DEC-2045Yield to maturity

5.28%

Maturity date

Dec 14, 2045

US92826CAQ5

Visa Inc. 2.0% 15-AUG-2050Yield to maturity

5.22%

Maturity date

Aug 15, 2050

V4972835

Visa Inc. 2.7% 15-APR-2040Yield to maturity

5.00%

Maturity date

Apr 15, 2040

US92826CAE2

Visa Inc. 4.15% 14-DEC-2035Yield to maturity

4.58%

Maturity date

Dec 14, 2035

3V67

Visa Inc. 3.15% 14-DEC-2025Yield to maturity

4.23%

Maturity date

Dec 14, 2025

V4972836

Visa Inc. 2.05% 15-APR-2030Yield to maturity

4.01%

Maturity date

Apr 15, 2030

V5028512

Visa Inc. 1.1% 15-FEB-2031Yield to maturity

4.00%

Maturity date

Feb 15, 2031

XS306372505

Visa Inc. 3.875% 15-MAY-2044Yield to maturity

3.90%

Maturity date

May 15, 2044

V4972834

Visa Inc. 1.9% 15-APR-2027Yield to maturity

3.83%

Maturity date

Apr 15, 2027

3V6A

Visa Inc. 2.75% 15-SEP-2027Yield to maturity

3.80%

Maturity date

Sep 15, 2027

See all VB bonds