Brent Crude bullish trend breakout ahead?The BRENT crude oil remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 6508 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 6508 would confirm ongoing ups

The Silence Before the $70 Storm in Brent OilThe Silence Before the $70 Storm in Brent Oil

Look at the chart.

The energy market is holding its breath.

We are witnessing a classic standoff in Brent Crude.

A battle between two massive forces. And right now, nobody is winning.

🤔 On one side, we have the bears. Look at the yellow line

Brent Oil M30 HTF Discount Reaction and Bullish Continuation📝 Description

BLACKBULL:BRENT crude oil has completed a corrective pullback after a strong impulsive rally and is now stabilizing above a key short-term demand zone. Price has reacted cleanly from the SSL and lower boundary of the recent range, suggesting buyers are defending this area and prepari

Oil is Boiling! 1/23/2026

After CRYPTOCAP:BTC ’s big run to $126K (now cooling off in corrective mode), Silver and Gold are pushing into new highs and closing in on their projected targets. Meanwhile, Oil popped +2.45% today and the chart is heating up — technically it looks primed for a major upside move.

With rising geo

BRENT Oil → Bullish Breakout | Capital Flow Confirmed🛢️ BRENT CRUDE OIL (UKOIL) - Energy Market Capital Flow Blueprint ⚡

Swing/Day Trade | Bullish Triangular Breakout Strategy

📊 ASSET OVERVIEW

Asset Ticker: BRENT CRUDE / UKOIL (ICE Futures Europe)

Current Price Zone: $64.12 USD/BBL (As of Jan 26, 2026)

Market Status: 📈 Bullish Formation Testing Resis

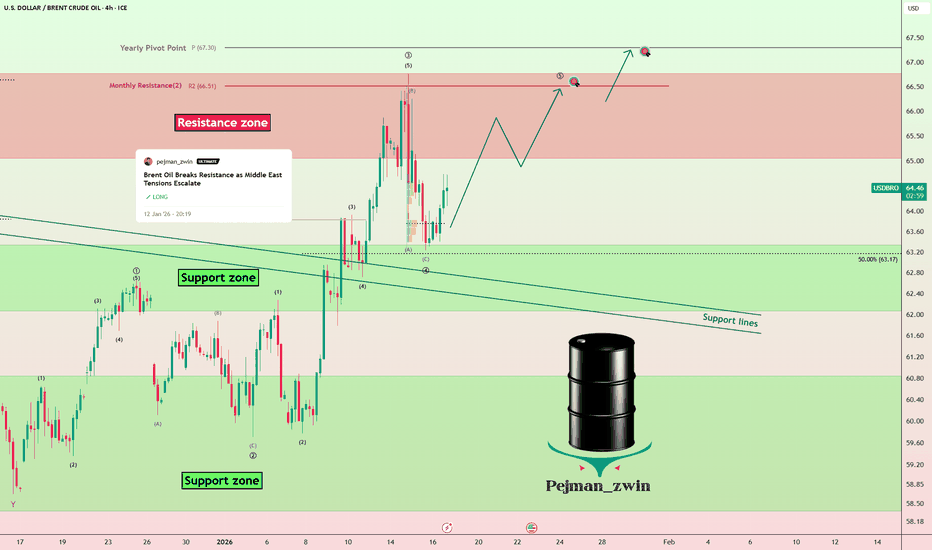

Middle East Risks Keep Brent Oil Bullish — Higher TargetsAs I expected in the previous idea , Brent Crude OIL( BLACKBULL:BRENT ) has risen and reached its targets, with a Risk-To-Reward: 2:01 (full target).

Brent Crude OIL is currently trading near the support zone($63.30-$62.00) and the support lines.

From an Elliott Wave perspective, it appears that

UKOIL/BRENT Chart Shows That OIL Can RallyI am using UKOIL/BRENT chart because there is a direct correlation between this and any other USOIL/WTI chart.

What we have are:

1. It has been falling in a wedge pattern and is coiling. Hence a breakout sooner or later is expected.

2. It has reached an FCO zone which is acting as a good support.

Brent Crude resistance at 6758The BRENT crude oil remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 6508 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 6508 would confirm ongoing ups

Brent Oil — H4 | Bullish Continuation ScenarioBrent Oil — H4 | Bullish Continuation Scenario

Price is holding above key support after a corrective pullback, with structure favoring continuation to the upside.

🧩 Technical Overview

• On the higher timeframe, the market is forming a potential 5th wave, indicating the final impulsive phase of th

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.