peeking at ADBE to prepare for its earningAdobe faces a dynamic competitive landscape across its diverse product portfolio, with rivals ranging from large enterprise software companies to specialized creative tools and emerging startups. The company's primary areas of competition are concentrated within its three main business segments: Digital Media, Digital Experience, and Document Cloud.

For design and photography, Canva has emerged as a significant threat, particularly for non-professional users and small businesses, with its user-friendly interface and vast library of templates. In the professional sphere, companies like Affinity (offering Serif's Designer, Photo, and Publisher) provide powerful, non-subscription-based alternatives that appeal to budget-conscious professionals and freelancers. Other notable competitors include Sketch and Figma for user interface and user experience (UI/UX) design, and CorelDRAW as a long-standing alternative for graphic design.

In the video and motion graphics space, Blackmagic Design's DaVinci Resolve has gained considerable market share from Adobe's Premiere Pro and After Effects. Its free version offers robust professional capabilities, attracting a large user base, while the paid Studio version remains competitively priced. Apple's Final Cut Pro is a strong contender in the macOS ecosystem.

Salesforce stands out as a primary competitor, offering a comprehensive suite of marketing and sales tools that directly rival Adobe's offerings. Oracle and SAP also provide competing marketing cloud solutions. In the content management system (CMS) and web analytics space, companies like Sitecore, Acquia, and Google Analytics present significant competition. The rise of integrated marketing platforms has intensified the battle for enterprise customers seeking a unified solution for their marketing technology stack.

For PDF editing and creation, companies like Foxit and Nitro PDF provide feature-rich, cost-effective solutions for both individuals and businesses. In the realm of electronic signatures, DocuSign has established itself as a dominant force, directly competing with Adobe Sign. Furthermore, cloud storage and collaboration platforms like Dropbox, Google Drive, and Microsoft OneDrive offer basic PDF viewing and annotation capabilities, chipping away at some of Adobe's core functionalities. The increasing demand for digital document workflows has fueled a vibrant ecosystem of specialized tools that challenge Adobe's all-encompassing approach.

ADBECL trade ideas

Adobe faces earnings test and signs of financial pressureShares of Adobe Inc. (symbol ‘ADBE’) have incurred losses in the last quarter of around 17%. The company’s earnings report for the fiscal quarter ending August 2025 is due for release on Thursday, 11th September, after the market closes. The consensus EPS is $4.21, against $3.81 in the same quarter last year.

As of 31/05/2024, the company had a current ratio of 99%, meaning that it does not have the ability to repay any short-term obligations with the current assets at hand and, therefore, is not safe from any minor financial turbulence. Also, total assets outweigh total liabilities at a ratio of just shy of 2:1, while long-term debt increased by 49.41% year over year. All these indications show that Adobe is facing some financial pressure, which is displayed on the daily chart.

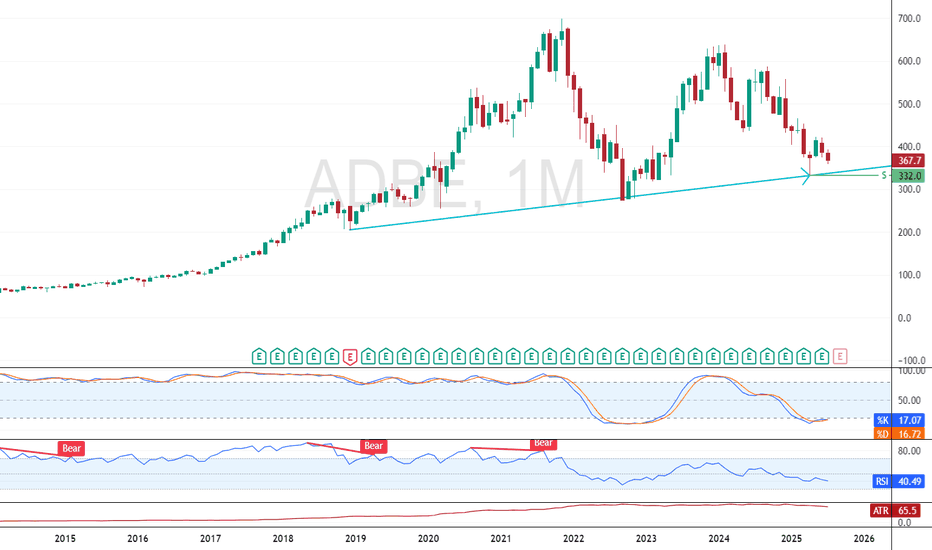

From the technical analysis perspective, the price seems to be forming a double bottom with the lower band of the Bollinger bands currently acting as a support. The 50-day simple moving average is trading below the 100-day validating the overall bearish trend in the market while the Stochastic oscillator is near the extreme oversold levels. The Bollinger bands are still quite expanded hinting that there is momentum to support any short term sharp moves to either direction. Approaching the earnings release date the volatility is probably going to increase especially if the actual figure of the EPS beats the expectations.

Disclaimer: The opinions in this article are personal to the writer and do not reflect those of Exness

Adobe double bottomAdobe appears to have put in a double bottom. Double or triple bottoms are usually near macro lows. Adobe has solid fundamentals with strong earnings and books. They maintain revenue growth, and are trading at a forward PE of 16 which is laughable. If the company buys back a decent amount of shares they will easily have over 30 EPS in 2030, leading to over a 700$ stock price if the multiple is around 25. The average PE for this stock is in the 50s.

Technically, we note a potentially double bottom, a rise here, with a momentum shift in the stochastic RSI. Volume has been on a slow and steady rise. BBWP is in the middle of the range.

The setup:

Shares, or calls at least 4 months out, seem reasonable here. I have about 40k cash freed up from last week's pump and am debating entering this setup as a lot of the market seems overvalued.

ADOBE ( ADBE ) Here’s a concise overview of **Adobe Inc. (ADBE)** stock, including the latest data, performance drivers, business strengths, and key risks:

## Stock market information for Adobe Inc. (ADBE)

* Adobe Inc. is a equity in the USA market.

* The price is 362.09 USD currently with a change of 8.68 USD (0.02%) from the previous close.

* The latest open price was 355.8 USD and the intraday volume is 3058636.

* The intraday high is 363.45 USD and the intraday low is 353.16 USD.

* The latest trade time is Saturday, August 23, 04:15:00 +0400.

---

## 1. Stock Snapshot (as of August 23, 2025)

* **Current Price**: \~\$362.09.

* **Intraday Range**: \~\$353 to \~\$363.

* **Trading Volume**: About 3.0 million shares, notably below its \~4.1 million 50-day average.

* **52-Week Performance**: Still about 38–39% below its high of \~\$587 reached in September 2024. ( , )

---

## 2. Recent Financial and Strategic Highlights

* **Q2 FY2025 Results**:

* Revenue: **\$5.87 billion**, up **11% year-over-year**.

* Adjusted EPS: **\$5.06**, up **13% YoY**.

* Strong cash flow of **\$2.19 billion** and robust Remaining Performance Obligations (RPO) of **\$19.7 billion**, up \~10% YoY. ( , )

* **Raised Full-Year Outlook**:

* Revenue guidance lifted to **\$23.50–23.60 billion**.

* Adjusted EPS guidance increased to **\$20.50–20.70**.

* These upgrades reflect growing demand fueled by AI-enhanced tools like Firefly and Acrobat AI. ( )

* **AI Momentum**:

* Growth in Acrobat and Express subscriptions, strong uptake of AI tools like Firefly (24 billion generations), and accelerating monetization of AI offerings. ( )

---

## 3. Analyst Sentiment: Mixed Optimism

* **Bullish Outlooks**:

* RBC Capital reaffirms **Outperform** rating with a **\$480 target**. ( )

* Some analysts (e.g., at Mizuho) have high targets (e.g., \$575), citing AI-driven monetization potential. ( )

* Jefferies and Morgan Stanley are positive with targets around **\$590** and **\$510**, respectively. ( )

* **Cautious Perspectives**:

* Others lowered targets amid concerns over intensifying AI competition and unclear value capture—some even downgraded to Sell with lower target forecasts (e.g., \$280–\$310). ( , )

---

## 4. Strengths and Challenges at a Glance

**Strengths**

* Leadership in creative software with strong digital media and experience segments.

* Solid financial execution, with steady ARR growth and cash generation.

* Strategic AI rollouts are enhancing product engagement and potential monetization.

**Challenges**

* Stock remains significantly below its 52-week high—investor sentiment remains subdued. ( , )

* Investor caution due to mixed responses post-earnings—even strong results sometimes triggered a stock drop. ( , , )

* AI competition is rising fast (e.g., from OpenAI, Canva, Alphabet), raising concerns about Adobe's long-term competitiveness. ( )

* Market expects performance execution to live up to premium valuation—multiple concerns remain about future growth momentum.

---

## 5. Final Thoughts

Adobe (ADBE) is a powerhouse in creative and digital solutions. Its Q2 results demonstrate healthy growth and increasing AI integration, and the company has responded by raising full-year outlooks—indicating confidence in its strategy. However, persistent investor reservations, competitive pressures in AI, and inconsistent stock reactions suggest that while long-term potential is bright, navigating near-term expectations remains a challenge.

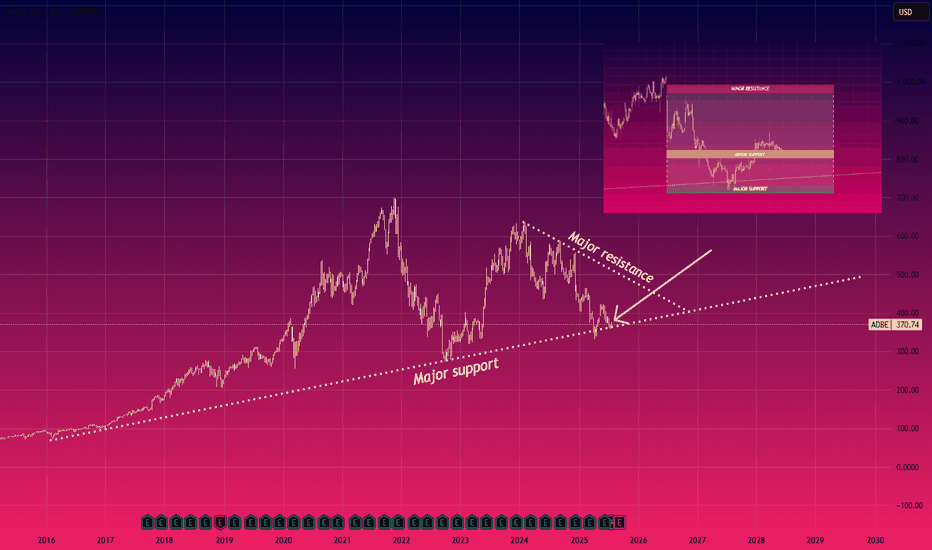

Adobe (ADBE) Weekly Chart – Support HoldADBE continues to trade within a broad descending channel while maintaining contact with its long-term ascending support trendline.

Price recently retested the major horizontal support near $330 — a level that has acted as a critical demand zone multiple times in the past — and responded with a notable bounce, reflecting renewed buying pressure and potential accumulation.

If this recovery holds, price action could gravitate toward the descending resistance trendline, with a primary upside target around $639, which aligns with prior swing highs and the upper boundary of the channel.

The RSI is recovering from mid-range levels, suggesting there is still upside momentum potential before entering overbought territory. Sustained strength above $350–$360 would further validate the bullish bias and may attract additional momentum buyers.

Conversely, a decisive breakdown below $330 and the ascending trendline would invalidate the current structure and expose the stock to deeper downside risk toward the $280 region.ear.

500$ +40% DB RALLYA close above 372$ area to look for the move up on the weekly, likely catalyst earnings coming up on 9/11 analysts project revenue around $5.35 billion up 12% YoY and non-GAAP EPS of ~$4.50-$4.60 driven by Creative Cloud and Firefly AI adoption. Chart looks amazing to back it up, software is not dead and they're implementing a lot of AI to further their growth not to be put out of business by it. Daily has some trend resistance around 360 and 50 100 MA above that the neckline for double bottom at last local top of 420 will also need to be smashed, pretty much in the clear after that besides a back test, this will take a while to play out but there's a decent shot with all these software companies bottoming at the same time. NYSE:CRM NYSE:NOW NYSE:HUBS

ADBE has also bought back a record 12B in stock this year while it looks like there's a mix of hedge funds open/closing q1. Profitable, growing and lowest valuation in a decade, Firefly might be 29.99/ month but it's safe and makes money compared to some of its free competition, the earnings hopefully show a LARGE increase over expected for subscriptions or a major acquisition.

Thanks me later - ADBE Rejection Strong Support!

NASDAQ:ADBE

ADBE has been confirmed of rejection strong support at 332.84 through price reversal at 343.30.

ADBE must break level 376.0 to create higher high as a confirmation of bullish trend reversal.

Set up invalidation at 329.0 for the longterm target at 632.45.

$ADBE is an IA sleeping giantHi there, I bring you Adobe today.

Between 2020 and 2024, Adobe delivered sustained growth, moving from $12.87 B in 2020 to $21.51 B in 2024, an impressive 67% cumulative increase. Operating income grew from $4.24 B to $6.74 B over the same period. Net income peaked at $5.26 B in 2020, dropped in 2021–2022, and recovered to $5.56 B in 2024 , with a 14.1% rebound in 2023 and a modest 2.4% gain in 2024, today sits at 6.87B.

Also shows great margins. NASDAQ:ADBE operates with industry-leading profitability. Gross margin in 2024 was 89% , reflecting low COGS for subscription-based products. Operating margin was 36% , down slightly from its 2021 peak due to higher R&D and sales investments. Net margin stood at 26% in 2024.

Return metrics are also strong. ROE exceeded 37% in 2024 (boosted by large buybacks reducing equity) and ROA was 17%. This is far ahead of peers like Salesforce (ROE 10%, ROA 6.4% ) and even in line with Microsoft numbers.

Adobe consistently generates robust FCF, moving from $6.88 B in 2021 to $7.87 B in 2024. The dip in 2023 (–6.1%) was due to higher tax payments, but 2024 saw a 13.4% rebound. FCF margins have hovered around 37–40%, providing ample capital for reinvestment and buybacks.

Long-term debt rose from ~$10.7 B in 2020 to $15.2 B in 2024 , while equity declined due to repurchases, pushing the debt-to-equity ratio from 0.84 in 2021 to 1.14 in late 2024. Leverage is still manageable given Adobe’s EBITDA and cash flows.

Adobe does not pay dividends, instead returning capital via buybacks. Over the last decade, it repurchased $39.7 B worth of stock, including $3.4 B in the most recent quarter. In March 2024, it authorized a new $25 B buyback program through 2028. (Bullish Bullish Bull)

Versus Salesforce, Adobe has smaller revenue but much higher margins and ROE. Microsoft surpasses Adobe in scale but not in gross margins (Adobe 89% vs Microsoft 70%). Adobe’s valuation (around 19x forward EPS ) is below its historical average, giving it a slight relative discount despite strong fundamentals.

Post Q2 2025, Adobe raised its FY guidance to 23.60 B revenue and $20.70 adjusted EPS , above prior consensus. Last quarter: $5.87 B revenue (+11% YoY) and $5.06 EPS (vs $4.97 expected) . Growth is expected to be driven by AI-powered Creative Cloud and Document Cloud, with analysts forecasting 10% annual revenue growth and sustained high margins.

Cheers!

Pablin

ADBE - Bullish Breakout from Channel Support | Targeting 359.75Price recently bounced from the lower boundary of a well-defined descending channel, finding support at a key demand area.

The breakout above local resistance suggests bullish momentum building up, with two target zones mapped at 351.41 and 359.75.

Watching for a potential continuation towards the upper trendline of the channel.

Adobe Wave Analysis – 6 August 2025- Adobe reversed from strong support level of 335.00

- Likely to rise to resistance level 360.00

Adobe recently reversed up from the support zone between the strong support level of 335.00 (which stopped the sharp daily downtrend in April) and the lower daily Bollinger Band.

This support zone was further strengthened by the support trendline of the daily down channel from the start of June.

Given the strength of the support level of 335.00 and the oversold daily Stochastic Adobe can be expected to rise to the next resistance level 360.00.

Adobe Wave Analysis – 1 August 2025- Adobe broke the key support level 360.00

- Likely to fall to support level 335.00

Adobe recently broke below the key support level 360.00 (which stopped the previous minor impulse wave i at the start of July).

The breakout of the support level 360.00 accelerated the active impulse wave C of the medium-term ABC correction (2) from the end of May.

Given the strong daily downtrend, Adobe can be expected to fall further to the next support level at 335.00 (the double bottom from April and the target for the completion of the active impulse wave C).

Bottom Feeding - Opportunity?Adobe is sitting on two areas of support - an 11 year old trendline and the 0.786 Fibonacci. It looks like it's coiling up in a giant triangle. This is a steadily growing business with a very sticky product suite. Whilst everyone is falling over themselves to buy Figma at $110, I think it's time to start paying attention to Adobe here.

I believe the AI fear is overdone, if you look at the continued growth in Adobe, their cash flow and continued growth, this is definitely the more compelling buy out of the two. If we lost the trendline support and Fibonacci support, things could indeed get worse.

Not financial advice.

L: Quick Analysis on $NASDAQ:ADBE Support and ResistanceQuick Analysis on NASDAQ:ADBE Support and Resistance

The chart shows NASDAQ:ADBE nearing a major support level around $370, Which has held since 2016, the downward resistance line suggests continued pressure, but a breakout above $400 levels could signal a bullish reversal

Please note this is not financial advice

Adobe - A gigantic triangle breakout! 🔋Adobe ( NASDAQ:ADBE ) will break the triangle:

🔎Analysis summary:

Yes, for the past five years Adobe has been overall consolidating. But this consolidation was governed by a strong symmetrical triangle pattern. Thus following the underlying uptrend, there is already a higher chance that we will see a bullish breakout, followed by a strong rally.

📝Levels to watch:

$400, $700

🙏🏻#LONGTERMVISION

Philip - Swing Trader

ADOBE MONEY SNATCH! High-Reward Long Setup (Police Trap Alert!)🚨 ADOBE HEIST ALERT: Bullish Bank Robbery Plan! (High-Risk, High-Reward Loot) 🚨

🌟 ATTENTION, MARKET PIRATES & MONEY SNATCHERS! 🌟

(Hola! Bonjour! Marhaba! Hallo!)

🔥 THIEF TRADING STRATEGY 🔥 – ADOBE INC. (ADBE) is primed for a bullish heist! Time to steal profits like a pro!

🔓 ENTRY POINT: "BREAK THE VAULT!"

"The loot is unguarded!" – Go LONG at any price, but for smarter robbers:

Set Buy Limit orders (15m/30m recent swing levels).

ALERT UP! Don’t miss the heist signal!

🛑 STOP-LOSS: "ESCAPE ROUTE!"

Thief SL: Nearest 2H nearest Swing Low (Adjust based on your risk tolerance & lot size).

Police (Bears) are lurking – Don’t get caught!

🎯 TARGET: 440.00 (OR BAIL BEFORE THE COPS ARRIVE!)

Scalpers: Stick to LONG side only!

Big Bankroll? Charge in! Small stack? Join the swing robbers!

Trailing SL = Your Getaway Car!

📢 WHY ADOBE Inc?

🐂 Bullish momentum + Overbought but greedy!

🚨 High-risk Red Zone – Trend reversal? Police trap? Bears are strong here!

💸 "Take profits & TREAT YOURSELF – You earned this loot!"

📡 STAY SHARP, THIEF!

Fundamentals, News, COT Reports, Geopolitics – CHECK THEM! (Linkkss ☝👉👆👉).

Market shifts FAST! Adapt or get caught holding bags!

⚠️ WARNING: NEWS = VOLATILITY TRAP!

Avoid new trades during news!

Trailing stops = Your bulletproof vest!

💥 BOOST THIS HEIST! 💥

"Like & Boost = Stronger Robbery Crew!"

💰 More boosts = More profit heists! 🚀

Stay tuned… Next heist coming soon! 🏴☠️🤑

The only way is down (Otis Clay, inverted)!NASDAQ:ADBE has been in a steady decline since Sept 24. It jumped prior to earnings in Dec 24, only to get hammered back down immediately after release. Since, it has been a sad show. The trend is down. Price has declined over time, MACD is negative, RSI has crossed negative, price is below 100 and 50 EMA. Technical indicators summary is saying Strong Sell, MA is saying Strong Sell. Upside? Investing.com has a fair value of 492.05 which is an upside of 29%. This is only of academic interest. Some might say there is support around $336, but there is not. It is too fragmented. The only "real" support is around $320, but that is also fragmented and not in any way strong. Infact, ADBE does not have any strong support at all, over the last 7-8 years.

Adobe Wave Analysis – 18 June 2025- Adobe broke support zone

- Likely to fall to support level 364.90

Adobe recently broke through the support zone located between the support level 392.85 (which stopped wave A at the end of May) and the 61.8% Fibonacci correction of the upward impulse (1) from April.

The breakout of this support zone continues the active impulse wave C of the intermediate ABC correction (2) from last month.

Given the clear daily downtrend, Adobe can be expected to fall to the next support level at 364.90 (target for the completion of the active impulse wave C).

firefly app is trash; Try it yourself on IOS/Android- NASDAQ:ADBE is bloated company with poor execution and talent density. It is floating around because of legacy tools like pdf, image editing capability.

- With advancement in AI, Adobe has consistently disappointed investors.

- Firefly buzz is overhyped, Tried the app and quality of generated content is the worst. Go and try it yourself.