eBay: Set for Further DeclineseBay has recently made another move higher, briefly reclaiming the $86.36 level. However, the stock has since resumed its downward trajectory as anticipated and is expected to continue selling off soon as part of magenta wave . Overall, this magenta downward impulse should push price closer to support at $55.96, completing turquoise wave 1.

Trade ideas

eBay’s Hidden Cycle | Correction Now, Explosion Next🔍 eBay (EBAY) – Full Spectrum Analysis

(Fundamentals + Elliott Waves + SMC + Market Structure + Fibonacci Confluence + Market Cycle)

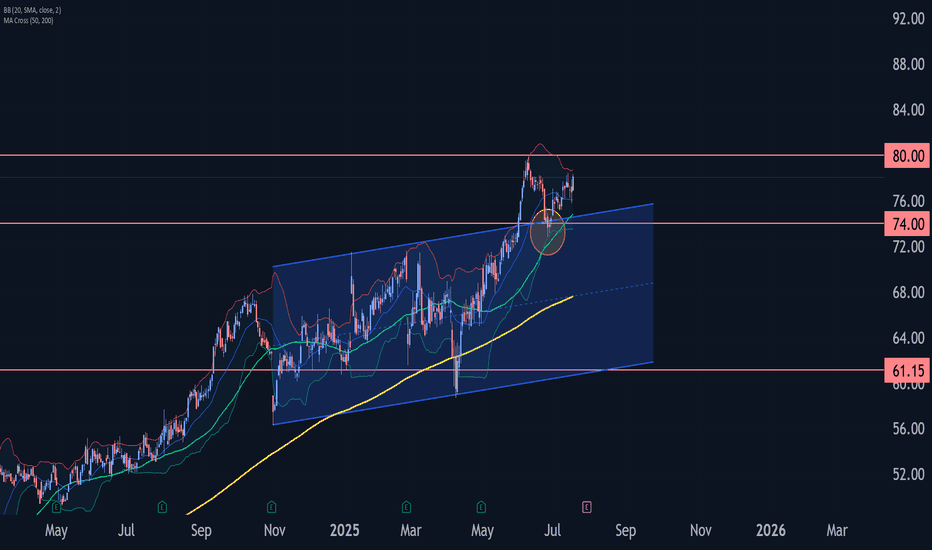

eBay may be completing a major Wave 3 and entering a large corrective structure (W–X–Y) before a massive long-term Wave 5 rally toward the 2.618 extension (~$450) . This aligns surprisingly well with fundamentals and market behavior.

Let’s break this down clearly. 👇

📌 1. Fundamental Overview – “Stable but Slow” 💼

eBay is fundamentally a mature, cash-flow rich, low-growth digital marketplace . It’s not a hyper-growth tech stock anymore—more like a cash generator with strategic share buybacks.

⭐ Strengths

Strong free cash flow 🚰

Aggressive share repurchases (shrinking share count = upward EPS pressure)

Stable margins due to marketplace model, not inventory-heavy

Healthy balance sheet compared to most e-commerce peers

⚠️ Weaknesses

Sluggish revenue growth

Marketplace competition (Amazon, Walmart Marketplace, niche platforms)

Limited innovation compared to its early-2000s era

Sensitive to consumer spending cycles

🧭 Interpretation

Fundamentals support a long consolidation / corrective phase rather than a trend collapse. eBay isn’t dying—it’s simply slow and stable , perfect for a long drawn-out Elliott correction before a major cycle expansion (Wave 5).

🌊 2. Elliott Wave Theory

It demonstrates:

Wave 1 – early 2000 breakout

Wave 2 – deep correction following dot-com bust

Wave 3 – huge multiyear advance 2008–2025 (strongest wave ✔️)

Now entering Wave 4 – a complex W–X–Y correction

Projection: Wave 5 at 2.618 ext (~$450) – extremely reasonable for a long-term cycle top

Why this fits Elliott Wave perfectly:

Wave 3 is extended (very normal for tech).

Wave 4 is usually complex , time-consuming, messy.

Wave 5 often reaches 2.618 Fib extension when Wave 3 is extended.

This is a textbook count. 📘🔥

🔐 3. Smart Money Concepts – “Distribution → Accumulation → Expansion”

Looking at price behavior leading into 2024–2025:

🔴 Distribution Signs (near Wave 3 top)

Choppy, wick-heavy candles

Liquidity hunts above equal highs

Failure to sustain breakout levels

Bearish divergence on volume

This shows institutions unloading at premium prices.

🟡 Expected: Accumulation Phase (your W–X–Y)

Wave 4 = the zone where smart money loads up quietly before a big cycle advance.

Expect:

Sweeps of lows

Long wicks down

Tight ranges after capitulation

Volume spikes at bottoms

🟢 Expansion (Wave 5)

Once the long correction completes, smart money typically drives a massive markup—the Wave 5.

📉 4. Price Action & Market Structure

🔻 Structure Turning Bearish Temporarily

It shows:

Loss of trendline support

Lower highs forming

Price failing at the 1.618 extension → classic Wave 3 exhaustion

So yes, Wave 4 correction is structurally valid.

🔻 Support Levels of Interest

These align beautifully with W and Y targets:

0.382 retracement → mid-correction support

0.5 retracement → perfect W–Y completion zone

These fibs are exactly where long-cycle Wave 4 structures tend to land.

📐 5. Fibonacci Confluence

All fib levels match long-term cycle behavior:

✨ Key Confluences

1.618 = Wave 3 termination (hit)

0.382 and 0.5 retracements = Wave 4 corrective basins

2.618 extension = Wave 5 terminal projection (~$450)

The 2.618 target has high probability if Wave 4 remains orderly .

🔄 6. Market Cycle Psychology

Right now eBay is in the late-complacency → early anxiety phase.

We can map it like this: [/b

Euphoria (Wave 3) → everyone bullish

Complacency → “the dip will be bought”

Anxiety → price begins trending down

Fear → W wave leg

Doubt / Despair → Y wave completion

Hope / Belief / Thrill → early Wave 5

Euphoria → Wave 5 top

This fits our projected cycle perfectly.

🎯 7. Final Take – Summary

This eBay chart i s one of the cleanest long-term Elliott counts we’ve seen. The scenario we’re mapping is not only technically sound, but supported by fundamentals, smart money behavior, fib confluence, market structure, and economic cycles .

eBay is not a rocket ship right now. It’s a maturing, slow-growth platform entering a long correction (Wave 4). But that correction is setting the stage for a massive, multi-year Wave 5 that could take the stock to its all-time highest valuations.

In other words:

👉 Wave 3 is done.

👉 Wave 4 is coming — slow, corrective, messy, multi-year.

👉 Wave 5 will be explosive once correction completes.

This is a very natural long-term market rhythm for a mature tech company like eBay.

Save this post before the move happens!

Drop a comment: Bullish or Bearish on eBay?👇

Disclaimer: This idea is for educational purposes only and reflects our personal opinion, not financial advice. Always do your own analysis before taking any trade. We are not responsible for any profits or losses. Trade safe and manage your risk. 📉📈

#ebay #stocks #elliottwave #waveanalysis #smartmoney #stockmarket

#tradingview #technicalanalysis #investing #fibonacci #marketstructure

#tradercommunity #chartanalysis

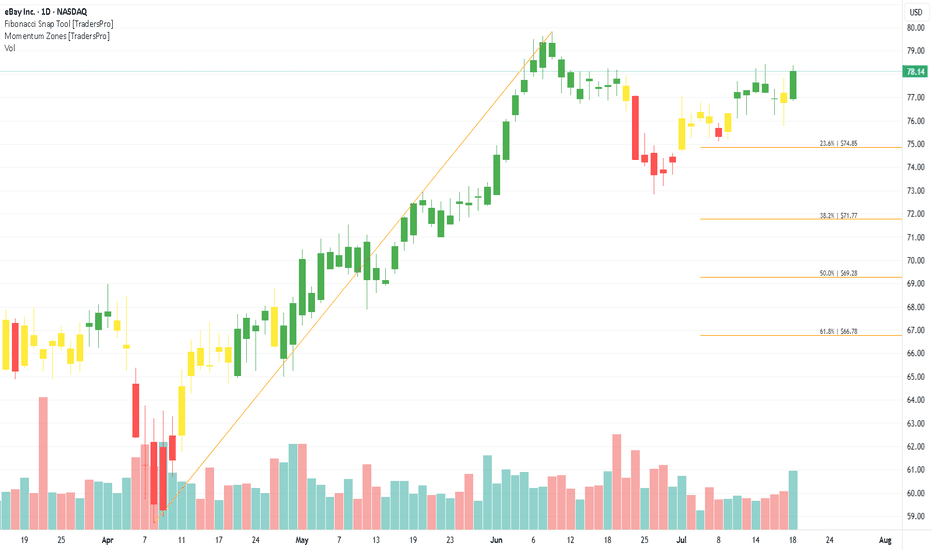

EBAY eyes on $80-81: Major Fib zone could mark a BOTTOMEBAY dropped hard from its last earnings report.

Now basing on a major support szone at $80.21-81.67

Look for a clean launch from here, stop loss just below.

.

See "Related Publications" for previous plots such as this PERFECT BOTTOM call:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

========================================================

.

EBAY QuantSignals V3 Swing 2025-11-05EBAY QuantSignals V3 Swing 2025-11-05

EBAY Swing Signal | 2025-11-05

• Direction: BUY PUTS | Confidence: 60%

• Horizon: 16 days to 2025-11-21

• Strike Focus: $80.00

• Entry Range: $1.81

• Target 1: $2.70

• Stop Loss: $1.30

• 1W Move: -0.71%

• 2W Move: -10.78%

• Volume vs Prior Swing: 1.6×

• Swing Range: $79.11 - $91.91

• ⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

⚖️ Compliance: Educational swing commentary for QS Premium. Not financial advice.

🎯 TRADE RECOMMENDATION

Direction: BUY PUTS

Confidence: 60%

Conviction Level: MEDIUM

🧠 ANALYSIS SUMMARY

Katy AI Signal: NEUTRAL with 50% confidence, but provides specific bearish targets ($86.32 target vs $79.46 stop loss) - directional bias suggests potential downside with weak technical positioning

Technical Analysis: Strong bearish momentum with -11.75% daily decline, price at 12.2% of swing range near support at $79.11, all EMAs aligned bearish, MACD bearish, weak trend strength

News Sentiment: Mixed with recent downgrades (UBS lowers target to $95) but some positive analyst coverage (Truist raises to $92, Benchmark maintains $110), overall moderate bearish impact from recent large-cap loser status

Options Flow: Put/Call ratio of 0.68 indicates bullish flow bias, but unusual activity at $84 calls suggests potential resistance level - institutional positioning shows defensive hedging

Risk Level: ELEVATED - extreme daily move may lead to oversold bounce, neutral Katy signal limits conviction

💰 TRADE SETUP

Expiry Date: 2025-11-21 (16 days)

Recommended Strike: $80.00

Entry Price: $1.74 - $1.87

Target 1: $2.70 (50% gain from entry)

Target 2: $3.50 (90% gain from entry)

Stop Loss: $1.30 (25% loss from entry)

Position Size: 2% of portfolio

⚡ COMPETITIVE EDGE

Why This Trade: Combines extreme oversold conditions with clear technical breakdown below key levels, offering favor

Image

QS Analyst

APP

— 11:16 AM

able risk/reward despite Katy's neutral stance

Timing Advantage: Entry after -11.75% daily decline reduces immediate downside risk while capturing potential continuation of bearish momentum

Risk Mitigation: Tight stop loss protects against oversold bounce, strike selection at current price level provides balanced delta exposure

🚨 IMPORTANT NOTES

Katy AI shows NEUTRAL confidence (50%) - trade qualifies but requires caution

Extreme daily move increases volatility risk - position size should be conservative

Monitor $79.11 swing low as critical support level - break below would confirm bearish continuation

Consider scaling into position given elevated volatility environment

📊 TRADE DETAILS 📊

🎯 Instrument: EBAY

🔀 Direction: BUY 📈

🎯 Strike: 80.00

💵 Entry Price: 1.81

🎯 Profit Target: 2.70

🛑 Stop Loss: 1.30

📅 Expiry: 2025-11-21

📏 Size: 2.0

📈 Confidence: 60%

⏰ Entry Timing: N/A

🕒 Signal Time: 2025-11-05 14:16:11 EST

⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

eBay: Confirming Wave [ii] Top Right on ScheduleeBay rallied once again to test resistance at $101.15, but quickly reversed with sharp sell-offs, confirming the top of magenta wave in a timely manner. Since then, the stock has moved as anticipated below the $86.36 level and now appears poised for further declines as part of wave . The subsequent wave- corrective move higher should remain capped below $86.36, allowing wave to complete turquoise wave 1 at a lower level—though still above $55.96.

EBAY Wave Analysis – 30 October 2025

- EBAY broke support zone

- Likely to fall to support level 80.00

EBAY today opened with the sharp downward gap which broke the support zone between the support level 87.00 (which stopped multiple downward corrections from September) and the 50% Fibonacci correction of the upward impulse from June.

The breakout of this support zone accelerated the active intermediate ABC correction from the key resistance level 101.00.

EBAY can be expected to fall further toward the next support level 80.00 (former resistance from June).

EBAY | This Retail Business Will BOOM | LONGeBay, Inc. is a commerce company, whose platforms include an online marketplace and its localized counterparts, including off-platform businesses in South Korea, Japan, and Turkey, as well as eBay's suite of mobile apps. It offers a platform for various product categories, including parts and accessories, collectibles, fashion, electronics, and home & garden. eBay generates revenue mainly through fees from sales, payment processing, and advertising. The company was founded by Pierre Morad Omidyar in September 1995 and is headquartered in San Jose, CA.

Ebay Wave Analysis – 14 October 2025

- Barclays reversed from key support level 87.00

- Likely to rise to resistance level 94.20

Ebay recently reversed from the support area between the key support level 87.00 (lower boundary of the sideways price range from August), lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from June.

The upward reversal from this support area created daily Japanese candlesticks reversal pattern Hammer.

Given the clear daily uptrend, Ebay can be expected to rise to the next resistance level 94.20 (which stopped earlier waves a and B).

Ebay Wave Analysis – 2 October 2025

- Ebay reversed from support level 87,50

- Likely to rise to resistance level 94.20

Ebay recently reversed up from the support area between the support level 87,50 (low of the previous wave A from the start of September) and the lower daily Bollinger Band.

The support level 87,50 was strengthened by the 50% Fibonacci correction of the previous sharp upward impulse 5 from June and by the support trendline from April.

Given the clear daily uptrend, Ebay can be expected to rise to the next resistance level 94.20 (which stopped earlier waves B and ii).

Ebay Wave Analysis – 19 September 2025- Ebay reversed from support zone

- Likely to rise to resistance level 95.00

Ebay recently reversed up from the support zone between the key support level 88.50 (which stopped the previous wave (A) at the start of September).

The support level 88.50 was further strengthened by the lower daily Bollinger Band, 50% Fibonacci correction of the upward impulse wave (5) from June and the support trendline from April.

Given the clear daily uptrend, Ebay can be expected to rise to the next resistance level 95.00 (which stopped the previous correction (B)).

How To Boost The 3-Step Rocket Booster Strategy Using StochasticAm so tired right now and i feel so sad.

How do you feel?

When it comes to trading your feelings dont matter

what matters is your technical analysis.

These past days i kept reading the book

by Steve on candlestick charting

And comparing

to the technical skills i already know.

It took me about 3 years to learn technical analysis so if you

are starting dont give up.

Finding this stock NASDAQ:EBAY was not easy at all.

I had to refine and digest my trading strategies.

I kept studying and refining

my trading strategies.

Its not easy but its worth it.Thats all i

have been doing these past days

Just studying trading.

By the way that's a spinning black top

And its above the Rocket booster strategy

Also notice the crossover below?

Rocket boost this content to learn more.

Disclaimer:Trading is risky learn risk management

and profit taking strategies

also use a simulation trading account

before you trade with real money.

eBay - At this high, the air is thinThis overshoot of the U-MLH is a nice opportunity to stalk ebay for a Short-Trade.

1. wait for a close inside the fork

2. expect a test/retest at the U-MLH

3. on a break of a pivot, I enter short.

Profit Target 1 is the Centerline.

Further downside is possible, but has to be shown below the CL.

Happy new week folks §8-)

Ebay Wave Analysis – 13 August 2025

- Ebay broke the round resistance level 100.00

- Likely to rise to resistance 105.00

Ebay recently broke the round resistance level 100.00, the breakout of which was preceded by the breakout of the resistance trendline of the daily up channel from April.

The breakout of these price levels accelerated the active impulse wave 5, which is part of the intermediate impulse wave (C).

Ebay can be expected to rise to the next resistance, 105.00, which is the target price for the completion of the active impulse wave.

EBAY watch $75.76-76.26: Key Support zone to launch next Leg UP EBAY trying to get back above its ATH from 2021.

Now testing a key support zone at $75.76-76.26.

Good but late long entry with StopLoss just below.

.

See "Related Pubications" for previous charts such as THE BOTTOM call:

Hit the BOOST and FOLLOW for more PRECISE and TIMELY charts.

=========================================================

Ebay Extends The Rally; Pointing To 100 AreaEbay Extends The Rally within an impulse, which can push the price up to 100 area from technical and Elliott wave perspective.

Ebay is extending strongly higher after beating earnings at the end of July, which we see it as a wave 3 of an ongoing five-wave bullish impulse. Currently it can be trading in subwave (5) of 3 that can stop around 100 area, and from where we may see a new corrective pullback in wave 4, as eBay executives sell shares worth over 5.5million. So soon watch out for a new higher degree wave 4 pullback before the bullish trend for wave 5 resumes.

A bullish impulse in Elliott Wave Theory is a five-wave upward movement showing strong trend momentum. Wave 1 starts the advance, Wave 2 corrects part of it, Wave 3 is the longest and most powerful leg, Wave 4 consolidates without overlapping Wave 1, and Wave 5 is the final push before a larger correction. The key rules are: Wave 2 never fully retraces Wave 1, Wave 3 is never the shortest, and Wave 4 doesn’t enter Wave 1’s price zone. This pattern reflects shifting market psychology from early accumulation to final optimism.

EBAY Aggressive Pullback Setup to Deeper SupportsEBAY closed at $95.30 (+2.32%), up 22.33% over 1M, with RSI(14) at 78.55 signaling overbought exhaustion. Stochastic likely >80, ADX >25 trend intact, but price above upper BB after breaking 92 resistance. Recent all-time high near 93.50 (Aug 8) extended to 95+, but post-CPI inflation (core 3.0% YoY) and tariff risks could trigger a deeper correction in e-commerce. Analyses show potential downside to lower pivots.

Chart Analysis:

Strong uptrend from $72 support, but RSI divergence emerging. Bollinger Bands widening on volatility.

Key levels: Resistance at $97 (pivot high), deeper support at $85 (61.8% Fib from recent low, near older Bollinger lower ~$78 adjusted).

Trade Idea: Short

Entry: Below $94 (break of intraday support).

Target: $85 (deeper Fib/pivot support for extended pullback).

Stop Loss: $96 (tighter above today's high for reduced risk).

Risk: ~$2 (94 to 96), Reward: ~$9 (94 to 85), R/R: 1:4.5. Scale out at $88 if momentum fades early.

Tariffs hitting eBay harder? #EBAY #Overbought #Pullback #Ecommerce

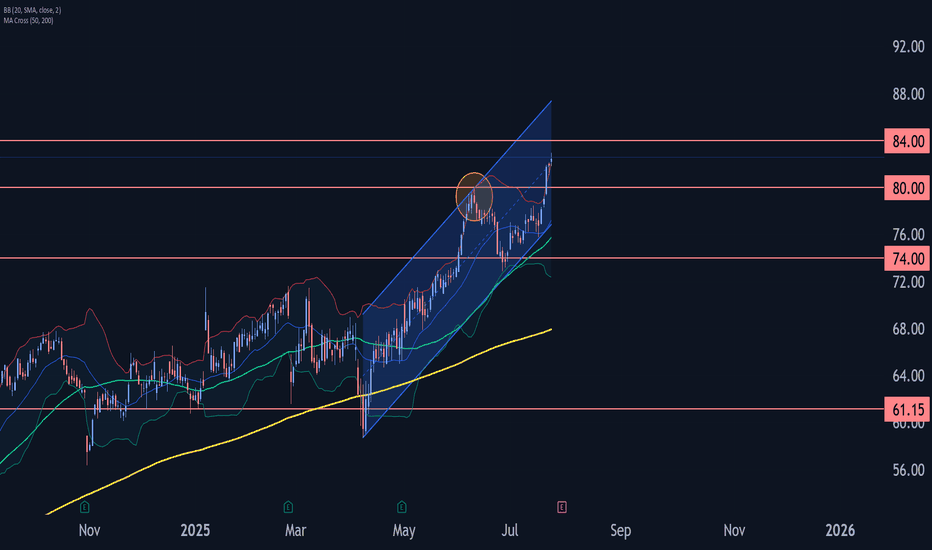

Ebay Wave Analysis – 24 July 2025

- Ebay broke round resistance level 80.00

- Likely to rise to resistance level 84.00

Ebay recently broke the round resistance level 80.00 (which stopped the previous intermediate impulse wave (5) at the start of June, as can be seen below).

The breakout of the resistance level 80.00 accelerated the active minor impulse wave 3 – which belongs to the intermediate impulse wave (3) from the start of July.

Given the clear daily uptrend, Ebay can be expected to rise to the next resistance level 84.00 (target price for the completion of the active minor impulse wave 3).

eBay Inc. (EBAY) Thrives on Niche Buyer DemandeBay Inc. (EBAY) is a global e-commerce marketplace connecting millions of buyers and sellers across a wide range of categories, from collectibles and electronics to fashion and home goods. Known for its auction-style listings and fixed-price options, eBay offers a flexible, user-driven shopping experience. The company’s growth is driven by increasing online retail demand, global expansion, and a strong focus on niche and enthusiast categories.

On the chart, a confirmation bar with rising volume shows renewed buying momentum. The price has entered the momentum zone by breaking above the .236 Fibonacci level. A trailing stop can be placed just below that level using the Fibonacci snap tool to protect gains while giving the trade room to run.

Ebay Wave Analysis – 18 July 2025

- Ebay rising inside impulse wave (3)

- Likely to rise to resistance 80.00

Ebay continues to rise inside the impulse wave (3) of the long-term upward impulse wave 3 from the end of June.

The active long-term impulse wave 3 started earlier from the support zone between the support level 74.00, upper trendline of the recently broken up channel from November and the lower daily Bollinger Band.

Given the clear daily uptrend, Ebay can be expected to rise further to the next resistance 80.00 (monthly high from June and the target for the completion of the active wave (3)).

Ebay Wave Analysis – 24 June 2025

- Ebay reversed from long-term resistance level 80.00

- Likely to fall to support level 71.15

Ebay recently reversed down from the resistance area between the major long-term resistance level 80.00 (which started the weekly downtrend in 2021) and the upper weekly Bollinger Band.

The downward reversal from this resistance area created the weekly Japanese candlesticks reversal pattern Shooting Star.

Given the strength of the resistance level 80.00 and the overbought weekly Stochastic, Ebay can be expected to fall to the next support level 71.15 (former resistance from the start of 2025).

ebay is on sale 🛒Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 EBAY has exhibited an overall bullish trend , trading above the orange and blue trendlines.

At present, EBAY is undergoing a correction phase and it is currently approaching a strong support zone 30 - 34

🏹 Thus, the highlighted red circle is a strong area to look for buy setups as it is the intersection of the green support and lower blue and orange trendlines acting as a non-horizontal support.

📚 As per my trading style:

As #EBAY approaches the lower red circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich