Trade ideas

Morgan Stanley (NYSE: $MS) Stock Rises Despite €101M FineMorgan Stanley (NYSE: NYSE:MS ) is gaining momentum in the market despite facing a €101 million fine from the Dutch Public Prosecutor’s Office over historical tax practices. The penalty involves dividend tax evasion tied to structured transactions executed between 2007 and 2012. Authorities stated that the bank filed incorrect returns as part of share acquisition strategies around dividend dates. Morgan Stanley accepted responsibility, repaid withheld taxes and interest by the end of 2024, and agreed to the settlement, closing the long-running case.

Despite regulatory scrutiny, Morgan Stanley continues expanding its presence in digital assets as major financial institutions deepen their crypto offerings. JPMorgan is preparing to accept Bitcoin and Ether as collateral for institutional loans by year-end, marking a significant shift toward wider blockchain integration in traditional finance. The bank already allows collateralization using crypto-linked ETFs, signaling rising comfort with token-backed financial products.

Broad adoption is accelerating as more banks commit to serving the growing digital asset market. Morgan Stanley plans to enable E*Trade clients to access cryptocurrencies next year, strengthening its strategic position as demand increases. Other major institutions—including State Street, BNY Mellon, Fidelity, and BlackRock—remain active through custody services, tokenization initiatives, and ETF support. Increasing regulatory clarity in the U.S. has encouraged firms to expand beyond basic crypto custody and move toward trading, advisory, and collateral services.

While the sector continues facing compliance challenges, investor appetite for blockchain-linked products is rising. Morgan Stanley’s stock has maintained positive momentum as investors look beyond penalties and focus on its growing role in digital finance.

Technical Outlook

The stock maintains an overall bullish structure, having broken above a key horizontal resistance at $141, which now acts as support. If price retraces, $141 remains the critical level to watch.

Morgan Stanley (MS) Simple Market Breakdown!MS is sitting at an important level right now; it’s getting ready to make its next big move 📊

Here’s what I’m watching:

📈 If we can close above 164.26, the next push could take us up toward 169–171 before hitting any major resistance.

📉 But if we drop below 161, then a move down toward 157.80 makes sense as the next target zone.

💡 In short: it’s all about which side breaks first; above 164.26 = bullish move 🔼, below 161 = bearish pressure 🔽.

Want to see how I’m planning around these levels and what confirmations I’m looking for before entering a position?

💬 DM me “MS” and I’ll share my full chart setup directly.

Mindbloome Exchange

Trade Smarter Live Better

Earnings Season Kicks Off with Strong Bank ResultsEarnings Season Kicks Off with Strong Bank Results

On 3 October, we noted growing optimism in equity markets ahead of the corporate earnings season. That sentiment was validated yesterday as several major banks reported results that exceeded analysts’ expectations, helping the S&P 500 index (US SPX 500 mini on FXOpen) rebound from last Friday’s sell-off.

Morgan Stanley (MS) led the rally, with its shares hitting a new all-time high above $166 following a robust quarterly report:

→ Revenue surged to a record $18.2 billion, up 18% year-on-year.

→ Earnings per share (EPS): actual $2.80, vs forecast $2.10.

Technical Analysis of Morgan Stanley (MS)

Price action in MS shares allows for the construction of an upward channel (shown in blue) that has been forming since the summer.

→ Yesterday, a wide bullish gap appeared on the chart.

→ The price advanced into the upper half of the channel, breaking above the $160 psychological level.

From a bullish perspective:

→ The breakout from a bullish flag pattern supports the scenario of a resumed uptrend within the channel.

→ The channel median, reinforced by the $160 support, could serve as a key level going forward.

However, there are several bearish signals to note:

→ Intraday price swings formed a wide up-and-down movement, resembling a bearish engulfing pattern that could develop further in today’s session.

→ The brief and shallow breakout above the previous high suggests a bull trap.

The RSI indicator also shows signs of bearish divergence, implying that:

→ The recent surge in MS shares may have prompted some long holders to lock in profits near record highs.

→ Despite strong fundamentals supporting long-term growth, the stock could be vulnerable to a short-term correction, potentially towards the bullish gap area.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

MS eyes on $166.13: Genesis fib may give DIP to buy the SURGEMS got a massive bump up from earnings report.

It has just smacked into a Genesis fib at $166.13

Look for a Dip-to-Fib ($162.19) or Break-n-Retest.

.

Previous Trade that caught a PERFECT BREAKOUT

Which gave us a 22% gain:

.

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

Pullback in Morgan StanleyMorgan Stanley recently hit a new high, and now it’s pulled back.

The first pattern on today’s chart is the advance between September 5 and September 23. MS retraced half that move before bouncing, which may confirm its direction remains to the upside.

Second, prices held the rising 21-day exponential moving average (EMA). The 8-day EMA has also stayed above the 21-day EMA. Those signals may be consistent with an uptrend.

Third, Wilder’s Relative Strength Index (RSI) peaked above 76 before dipping toward 50. That may suggest the financial stock worked off an overbought condition and has returned to areas where dip-buyers may feel more comfortable.

Finally, some traders may view the recent pullback as a completed ABC correction, with the potential for the longer-term uptrend to resume.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

A potential break and retest on MS.OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Morgan Stanley: Post-Earnings Reaction & Technical SetupToday, NYSE:MS released strong earnings:

🔹 $2.13 EPS vs. expected $1.98

🔹 Revenue: $16.8B, including:

— +23% in equity trading

— +9% in fixed income

— $59B inflows into Wealth Management

Despite the beat, the stock dropped nearly 4%, signaling possible profit-taking after a 30%+ rally year-to-date.

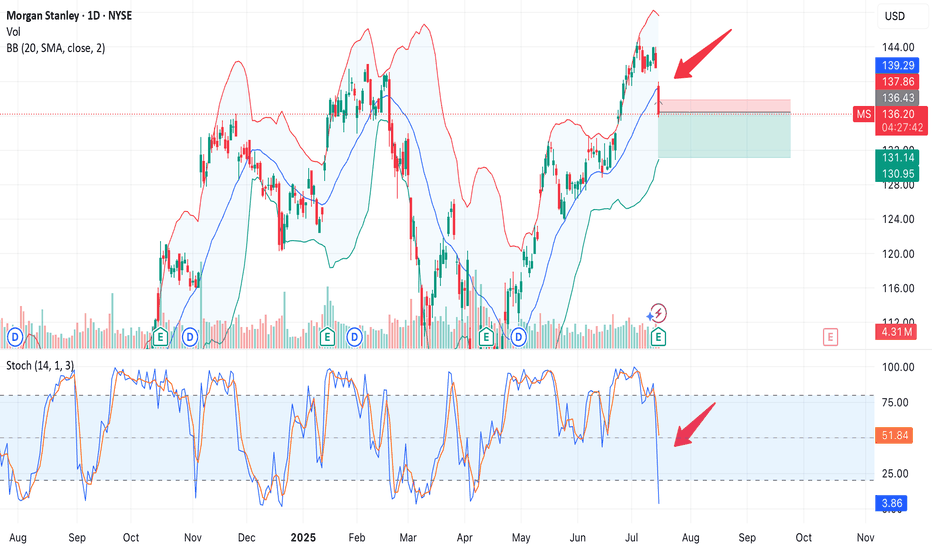

Technical View

The price broke below the middle line of the Bollinger Bands, heading toward the lower band.

The Stochastic RSI turned sharply lower, confirming downside momentum.

Volume on the decline is above average — a bearish sign.

🟦 Key support lies around $130–131, a zone to watch for a potential bounce.

🟥 A breakdown below it could open the way to $127–128.

The market may have priced in the strong results ahead of time, leading to a sell-the-news reaction.

We now see a potential correction toward the $131 area — where buyers might step in.

MS Triple top "SELL" Short opportunityMS has been in a strong uptrend since April 7th 2025. Daily RSI is at 75 and is a great short opportunity near $139. MS has seen a 49% increase in 2.5 months from $94 to $140.

Target 1 on short would be a retest of previous high of $134 / stop would be anything over $141.50

Morgan Stanley (NYSE: MS) Reports Strong Q125 ResultsMorgan Stanley (NYSE: NYSE:MS ) Beats Q1 estimates with record Equity Trading Revenue. The bank posted earnings per share (EPS) of $2.60, beating analyst expectations of $2.18. Revenue reached a record $17.74 billion, topping forecasts of $16.44 billion.

The bank's equity trading revenue soared 45% year-over-year. It reached a new high of $4.13 billion as growth came across business lines and regions. Asia showed particularly strong performance. Prime brokerage and derivatives led gains, fueled by high client activity in volatile markets.

Morgan Stanley shares dropped 1% after the earnings release. However, the stock remains up over 20% in the past year. Volatility in global markets helped trading desks outperform.

Technical Analysis

Morgan Stanley bounced sharply from the $95 support zone. Buyers stepped in near the previous breakout level. Volume increased and confirmed renewed interest. This was seen as Trump paused tariffs for the next 90 days as well. Current price action suggests a recovery trend. The RSI stands at 39, hinting at oversold conditions. A potential path points to $142.03, which acts as the immediate resistance level.

If the price breaks $113 cleanly, momentum could carry it to $130 and beyond. If it fails, it is most likely to retest $95 support level. A strong break above recent highs would confirm bullish continuation. For now, Watch out the $113 and $142 levels closely.

Playing off the potential false breakout?Morgan Stanley's chart is at a critical juncture. After a slide in a descending channel, it briefly poked its head above, but that breakout looks shaky! Now it's dancing around the $115 support zone. A solid hold here, and we might see a bounce. But if that support caves? Watch out for further downside. Is MS about to regain its footing, or is this just a pit stop on the way down? What's your call? Share your predictions!

Morgan Stanley Correction. MSOur last take on MS was dead on and quite profitable. The idea will be linked to this one. ABC zigzag, now impulsing down in C wave. Indicator below are bearish but quite choppy, making meaningful interpretation difficult. Price action, MIDAS cross and behavior of vWAP/US duo are key factors in this decision making.

The Last Step Of The 3 Step System ExplainedLook at this chart what do you see?

Yesterday I felt happy because for the first

time even if am broke I get to see the

light of a negative situation

to be esteemed is more important

than gold and silver.

Sometimes all you need is to be

Motivated so that no matter what you

are going through in your life

you can learn and understand what you are trying to

achieve

I enjoy taking walks because it gives

me a chance to think about

my shortcomings and strategies even more

Look below this chart NYSE:MS you

will see the cross-over on the Stochastic RSI

this is a sign that this price action is going

to go up

Just like the last step of the rocket booster

strategy to learn more rocket boost this content.

Check out the references below

to learn more about this 3-step system.

Disclaimer: Trading is risky you will lose money

whether you like it or not please learn risk

management and profit-taking strategies.

Also, feel free to use a simulation trading account.

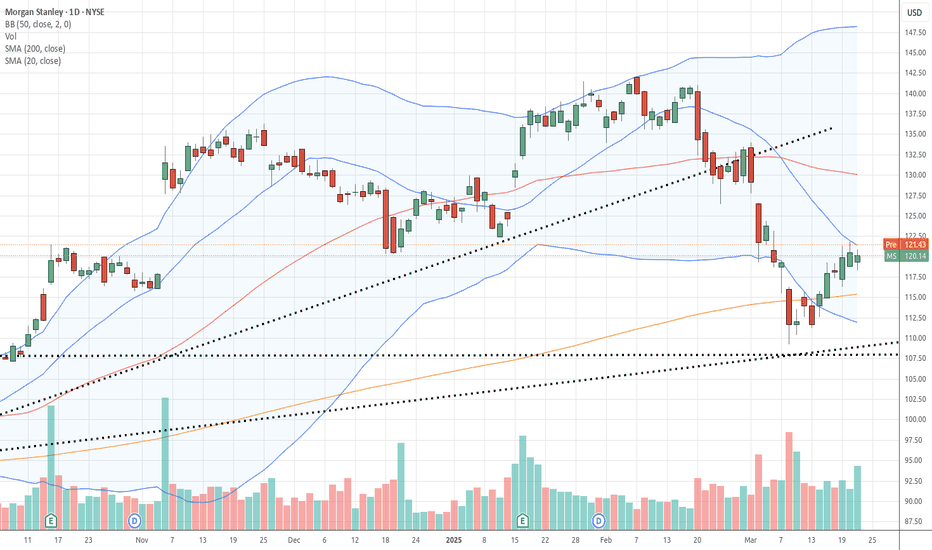

Morgan Stanley, can we follow up on great earnings call?Hi guys, we are next looking into Morgan Stanley. Currently they had a fantastic 2024 , with great growth and great beat over their earnings calls.

Fundamental overview :

Morgan Stanley has adopted a bullish stance on U.S. equities, forecasting the S&P 500 to potentially reach 7,400 by 2025. This optimism is based on anticipated solid earnings growth and accommodative monetary policy, which could enhance the firm's equity trading and investment advisory revenues.

Increased Mergers and Acquisitions (M&A) Activity

The return of Donald Trump to the White House is expected to stimulate a surge in M&A activity, driven by lower borrowing costs and deregulation. Morgan Stanley predicts a 50% increase in M&A deals in 2025 compared to the previous year, which would significantly boost its advisory and underwriting services.

In fixed income, Morgan Stanley identifies securitized credit, particularly U.S. mortgage-backed securities (MBS), as a promising area. The firm believes that moderating monetary policy, coupled with strong consumer and corporate balance sheets, will create favorable conditions for this sector, potentially enhancing its fixed income revenues.

Technical Overview :

Currently we have surpassed a strong resistance line which has been upgraded to a supprot line because of the strong growth at 2024. Currently this Ascending channel should take us to a 2x price level from 83 level to 166 level.

Entry: 127

Target : 166

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my community so you can follow up with me in private!

Morgan Stanley Wave Analysis – 30 January 2025

- Morgan Stanley is rising inside impulse wave iv

- Likely to rise to the resistance level of 145.00

Morgan Stanley continues to rise inside the minor impulse wave iv, which started earlier from the key support level of 135.00 (the former monthly high from November), acting as support after it was broken earlier.

The active impulse wave iv belongs to the higher-order upward impulse sequence (C) from last August.

Given the overriding daily uptrend, Morgan Stanley can be expected to rise further to the next resistance level at 145.00 (the target price for the completion of the active minor impulse wave 3)

Morgan Stanley Breaks Free A Bullish Wedge Reversal in ActionMorgan Stanley (MS) on the 4-hour chart has confirmed a breakout from a descending wedge pattern, signaling a strong bullish reversal. The breakout is accompanied by increased momentum, as indicated by the clean surge above the wedge’s upper boundary. This setup is a classic reversal signal, with bulls reclaiming control.

The entry is placed at 137.87, capitalizing on the breakout momentum. The stop loss is strategically positioned at 123.50, below the wedge’s lower boundary, to safeguard against invalidation of the setup. The take profit is set at 155.35, aligning with the wedge’s projected target based on its height.

The trade exhibits a solid risk-to-reward ratio, and the breakout aligns with the broader bullish market sentiment for the stock. With buyers driving the price upwards, this trade setup offers a high-probability opportunity for trend continuation.

US Market: Stocks Taking Break out and Break Below the CloudThis week following stocks have taken a break out above the cloud (consolidation zone) (1D candle):

1. MS

2. JPM

3. CVX

4. WFC

5. HD

6. BRK.A

7. XOM

8. AXP

9. TMO

10. CSCO

Following stocks have taken a break below the consolidation zone (daily candle):

1. LLY

2. AAPL

3. DIS

4. ABBV

5. MCD

6. MRK

The tool (Zeta Scalper) was fed with 40 stocks (top 40 stocks by market cap) and run at daily candle to find out stocks breaking above and below the consolidation zone.

Use your due diligence before investing or trading.