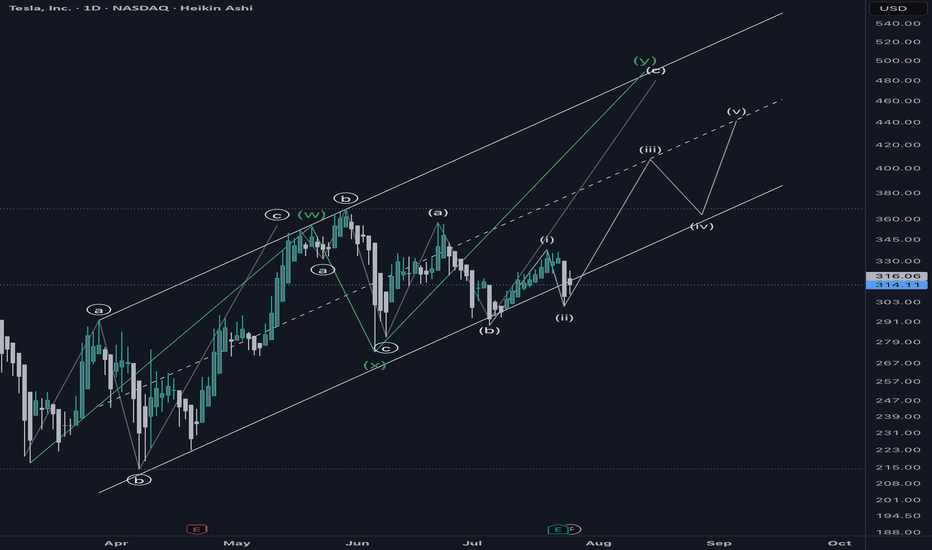

WXY structure with a double topTesla has been in a uptrend with a corrective structure WXY. I am not sure if the WXY is a part of wave 5 terminal structure or a B wave. However expecting a double top or 78.6 retrace to 425-430 range as a minimum. For this scenario, an impulsive upside move is expected within the next few weeks. However the price needs to move back into the channel next week as a first step.

TSLACL trade ideas

Geopolitical Tensions & Trade Wars1. Understanding Geopolitical Tensions

Definition

Geopolitical tensions refer to conflicts or rivalries between nations that arise from differences in political systems, territorial claims, military strategies, or economic interests. These tensions often extend beyond diplomacy into military confrontations, sanctions, cyber warfare, and trade restrictions.

Key Drivers of Geopolitical Tensions

Territorial disputes – e.g., South China Sea, India-China border, Israel-Palestine conflict.

Resource competition – oil, natural gas, rare earth minerals, and even water supplies.

Ideological differences – democracy vs. authoritarianism, capitalism vs. socialism.

Technological dominance – battles over 5G, semiconductors, and artificial intelligence.

Strategic influence – the U.S. vs. China in Asia-Pacific, Russia vs. NATO in Eastern Europe.

Geopolitical tensions may not always escalate into war, but they often manifest as economic weapons, including tariffs, sanctions, and restrictions on trade.

2. What Are Trade Wars?

Definition

A trade war is an economic conflict between nations where countries impose tariffs, quotas, or other trade barriers against each other, often in retaliation. Instead of cooperating in the free exchange of goods and services, they use trade as a weapon to gain leverage.

Mechanisms of Trade Wars

Tariffs – taxes on imported goods (e.g., U.S. tariffs on Chinese steel).

Quotas – limits on the number of goods imported (e.g., Japan’s rice import restrictions).

Subsidies – financial aid to domestic industries, making exports cheaper.

Export controls – restricting key goods, like semiconductors or defense equipment.

Sanctions – blocking trade altogether with specific countries or entities.

Difference Between Trade Dispute and Trade War

A trade dispute is usually limited and negotiable (resolved via WTO).

A trade war escalates into repeated rounds of retaliatory measures, often causing collateral damage to global supply chains.

3. Historical Background of Trade Wars

Mercantilism in the 16th–18th centuries – European powers imposed heavy tariffs and colonized territories to control resources.

Smoot-Hawley Tariff Act (1930, USA) – raised tariffs on over 20,000 goods, worsening the Great Depression.

Cold War Trade Restrictions (1947–1991) – U.S. and Soviet blocs limited economic interaction, fueling technological and arms races.

Japan-U.S. Trade Tensions (1980s) – disputes over Japanese car and electronics exports to the U.S. led to tariffs and voluntary export restraints.

U.S.-China Trade War (2018–present) – the most significant modern trade war, involving hundreds of billions in tariffs, sanctions, and tech restrictions.

4. Causes of Trade Wars in the Modern Era

Economic Protectionism – shielding domestic industries from foreign competition.

National Security Concerns – restricting sensitive technologies like 5G, AI, and semiconductors.

Geopolitical Rivalry – economic weapons as part of larger power struggles (e.g., U.S. vs. China, Russia vs. NATO).

Unfair Trade Practices Allegations – accusations of currency manipulation, IP theft, or dumping.

Populism & Domestic Politics – leaders use trade wars to appeal to local voters by promising to "bring jobs back home."

5. Case Study: The U.S.-China Trade War

The U.S.-China trade war (2018–present) is the most important example of how geopolitical rivalry shapes global trade.

Phase 1 (2018): U.S. imposed tariffs on $50 billion worth of Chinese goods, citing unfair trade practices and intellectual property theft.

Retaliation: China imposed tariffs on U.S. agricultural products, especially soybeans, targeting American farmers.

Escalation: Tariffs expanded to cover $360+ billion worth of goods.

Technology Restrictions: U.S. banned Huawei and restricted semiconductor exports.

Phase 1 Agreement (2020): China promised to increase U.S. imports, but tensions remain unresolved.

Impact:

Global supply chains disrupted.

Rising inflation due to higher import costs.

Shift of manufacturing from China to Vietnam, India, and Mexico.

U.S. farmers and Chinese exporters both suffered losses.

6. Geopolitical Hotspots Affecting Trade

1. Russia-Ukraine War

Western sanctions cut Russia off from global finance (SWIFT ban, oil & gas restrictions).

Europe shifted away from Russian energy, sparking energy crises.

Global wheat and fertilizer exports disrupted, raising food inflation worldwide.

2. Middle East Conflicts

Oil is a geopolitical weapon—any conflict in the Persian Gulf impacts global crude prices.

OPEC+ decisions are often politically influenced, affecting both producers and consumers.

3. South China Sea

A vital shipping lane ($3.5 trillion in trade passes annually).

Territorial disputes between China and Southeast Asian nations raise risks of blockades.

4. Taiwan & Semiconductors

Taiwan produces over 60% of global semiconductors (TSMC).

Any conflict over Taiwan could paralyze global tech supply chains.

5. India-China Border & Indo-Pacific Rivalries

India bans Chinese apps and tightens investment rules.

Strengthening of Quad alliance (US, India, Japan, Australia) reshapes Asian trade.

7. Impact of Geopolitical Tensions & Trade Wars

1. On Global Economy

Slower global growth due to reduced trade flows.

Inflationary pressures from higher tariffs and supply disruptions.

Increased uncertainty reduces foreign direct investment (FDI).

2. On Businesses

Supply chain realignments (China+1 strategy).

Rising costs of raw materials and logistics.

Technology companies face export bans and restrictions.

3. On Consumers

Higher prices for imported goods (electronics, fuel, food).

Limited choices in the market.

4. On Financial Markets

Stock market volatility increases.

Commodity prices (oil, gold, wheat) spike during conflicts.

Currency fluctuations as investors seek safe havens (USD, gold, yen).

5. On Developing Nations

Export-dependent economies suffer as global demand falls.

Some benefit by replacing disrupted supply chains (e.g., Vietnam, India, Mexico).

8. The Role of International Institutions

World Trade Organization (WTO)

Provides a platform to resolve disputes.

However, its influence has declined due to U.S.-China disputes and non-compliance.

International Monetary Fund (IMF) & World Bank

Provide financial stability during crises.

Encourage open trade but have limited enforcement power.

Regional Trade Agreements

CPTPP, RCEP, EU, USMCA act as counterbalances to global tensions.

Countries diversify trade partnerships to reduce dependence on rivals.

9. Strategies to Manage Geopolitical Risks

Diversification of Supply Chains – "China+1" strategy by multinationals.

Hedging Against Commodity Risks – futures contracts for oil, wheat, etc.

Regionalization of Trade – building self-sufficient trade blocs.

Technology Independence – countries investing in local semiconductor and AI industries.

Diplomacy & Dialogue – ongoing talks via G20, BRICS, ASEAN, and other forums.

10. The Future of Geopolitical Tensions & Trade Wars

Rise of Economic Nationalism: Countries prioritizing local industries over globalization.

Technology Wars Intensify: AI, semiconductors, and green energy will be new battlegrounds.

Fragmentation of Global Trade: Shift from globalization to "regionalization" or "friend-shoring."

Energy Transition Risks: Conflicts over rare earth metals, lithium, and cobalt needed for batteries.

New Alliances: BRICS expansion, Belt & Road Initiative, and Indo-Pacific strategies will reshape global economic influence.

Conclusion

Geopolitical tensions and trade wars are not temporary disruptions but structural features of the modern global economy. While globalization created interdependence, it also exposed vulnerabilities. Trade wars, sanctions, and economic blockades have become powerful tools of foreign policy, often with far-reaching economic consequences.

For businesses and investors, the challenge lies in navigating uncertainty through diversification, resilience, and adaptation. For policymakers, the task is to strike a balance between protecting national interests and sustaining global cooperation.

Ultimately, the world may not return to the hyper-globalization era of the early 2000s. Instead, we are moving toward a multipolar trade system shaped by regional blocs, strategic rivalries, and technological competition. How nations manage these tensions will determine the stability and prosperity of the 21st-century global economy.

TSLA 1H + GEX Game Plan for Tue, Sep 16TSLA Cooling After a Monster Run — Will 410 Hold or Is 430 Next? ⚡️

Market Structure (1-Hour View)

* Sharp run-up: TSLA ripped from mid-300s to a peak around 430 and is now consolidating in a broad rising channel.

* Trend support: Current pullback is testing a rising channel floor near 405–410.

* Momentum: MACD still in a bearish cross with fading histogram; Stoch RSI is climbing out of oversold — early sign of a potential rebound.

Key Levels to Watch

* Resistance: 410.8 (current pivot), 420.0–422.0, and 430.4 (recent high / gamma wall).

* Support: 402.2, 395.9, then deeper supports near 346.1 and 340.0 if momentum collapses.

GEX Read (Sep 16)

* Highest positive NETGEX / Call resistance: 430.4

* 2nd Call Wall: ~420–422 area.

* HVL / gamma pivot: 356–357.

* Put walls: 320 and 305.

* Options sentiment: Calls >100% (very call-heavy), IVR ~20, IVx ~65.9 — big bullish skew but with elevated implied volatility.

Implication:

* Dealers may keep TSLA pinned around 400–420 for balance.

* A strong reclaim of >420 with volume invites a retest of 430.4 and possibly higher.

* Lose 402 and a slide to 395–390 is possible.

Trade Scenarios

1) Bullish Continuation

* Trigger: 1H close >412–415 with uptick in volume.

* Entry: 414–415 on retest.

* Targets: 420 → 430.4.

* Stop: Below 408.

* Options: 420/430 call debit spread expiring this week.

2) Range Fade

* Trigger: Failure to clear 415 with repeated rejection wicks.

* Entry: 413–414 short.

* Targets: 402 → 395.9.

* Stop: Above 417.

* Options: 410P or 415/402 put spread for quick fade.

3) Deeper Pullback

* Trigger: Clear 1H break <402 with retest fail.

* Entry: 401–402 short.

* Targets: 395 → 390, with a stretch toward 356–357 (HVL) if heavy selling accelerates.

* Stop: Back above 406.

Options: 400/390 put spread for a measured pullback.

Scalping & Swing Notes

* First test of 410–412 will set the early tone; quick rejections there can produce a 5–10 point scalp.

* If we gap near 400, watch for a sweep into 395 then bounce back toward 410.

Risk & Management

* Keep sizing conservative: TSLA’s elevated IV means sharp intraday swings.

* Scale out partials at first target and tighten stops if momentum accelerates in your favor.

This analysis is for educational purposes only and does not constitute financial advice. Always trade with a plan and manage risk carefully.

TSLA eyes on $409.56: Golden Genesis fib to hold "High Ground"TSLA has been surging based on various news.

Now retracing towards a Genesis fib at $409.56

Clean bounce would indicate very strong trend.

Golden Genesis fibs are important milestones.

High gravity fibs can capture price into orbit.

Expect consolidation around it then sling shot.

.

Previous analysis that caught a PERFECT BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

========================================================

.

You will ask yourself, "how did he know Tesla would do that"?I wrote this on my July 29th chart description (below):

"Price action really has less to do with the news making Elon a hero, then a villain and then back and forth...but moreso to do with price action patterns that just keep repeating". Since then, the pattern has played out exactly as anticipated, and my 1st take profit target just hit (+22%).

July 29th chart:

Now the question remains, will Telsa hit my next target range (T2). Although it is a much larger range than my T1, I will monitor price action closely and use TA to get out near the top before the next major retracement.

Let me know if you're into Tesla and if you are interested in me charting the top of this run.

May the trends be with you.

Tesla Short: Stop above $368, TP at $298In this video, I re-initiated the short idea for Tesla. Reason being that I observed that around $367-ish is an important price point (although I have no idea why). Also, the move up has been more corrective in nature (since I drew ABCDE). The move also resembles a rising wedge.

In any case, the most important point in this idea is the stop loss which should be set above $368. The ultimate Take Profit Target for me is $298 with a short-term target of $344.

Good Luck!

TSLA SELL AT $426! Retracement to $372 imminent TSLA was a perfect ascending bullish triangle, yes, I drew the Elliott Wave wrong but got the calls right at $300 ($339 first target) and bounce off support at $324.80 ish (separate post). Remember the $7500 EV credit expires soon so there will likely be a pull forward of purchases this quarter which could temporarily juice the stock. We could see all time highs but first we must retrace once target of $426 is reached.

#TSLA Analysis, Elon breaks the Key level ^.^^Elon pours Big Money $$$ into TSLA stock recently causing Rally!

Price has gone up significantly, I don't think it will drop below $400 any time soon.

Strong Greenbar breaks out from the wedge with large volume increases.

Short sellers are getting squeeze out.

More investors are coming to catch smokey train.

Price Target next $480.

Come and join the Rally.

TSLA breaking out a rangeI think TSLA is moving up

The 1D timeframe show us how it was on a range and a few days ago started to go up

Next lvl should be 450, but also can go to 480

What do you think?

Bullish or bearish?

Do you see the bull flag?

Also the size and shape of candles remember me to a bullish movement.

When you see candlesticks all the day, everyday, you can see a pattern!

Lol

TSLA Technical Outlook – Symmetrical Triangle Breakout Watch🚗 TSLA Technical Outlook – Symmetrical Triangle Breakout Watch

Ticker: TSLA (Tesla, Inc.)

Timeframe: 30-minute candles

🔍 Current Setup

TSLA has been consolidating for months inside a large symmetrical triangle, marked by:

Descending resistance: from ~380 down to ~347.

Ascending support: from April lows near ~240, now rising toward ~320.

Current price: ~348, testing the upper boundary of the triangle.

This structure signals compression after a major downtrend, and the breakout direction will likely define TSLA’s next big move.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 350–355.

Intermediate Targets:

370–380 → First resistance zone.

400–420 → Extension levels.

Measured Move Target: ~450+ (based on the triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Failure at resistance and break below 320, confirmation under 310.

Intermediate Supports:

300 → Psychological level.

280–260 → Stronger support zone.

Measured Move Target: ~250 (triangle projection downward).

📈 Volume Analysis

Volume has been contracting steadily during the triangle’s formation.

A major volume spike will be key to confirming whichever direction TSLA chooses.

⚖️ Probability Bias

TSLA is at the make-or-break resistance zone (~350).

A breakout above 355 would strongly favor bulls, targeting 380 → 400+.

But a rejection here and break below 320 would shift momentum bearish, sending TSLA back toward 280–260.

✅ Takeaway

TSLA is at a critical inflection point inside a long-term triangle:

Bullish Break > 355: Targets 370 → 400 → 450+

Bearish Break < 320: Targets 300 → 280 → 250

Watch for volume-backed confirmation, as this move could define Tesla’s next multi-week trend.

Tesla - consolidation patternUsually, whenever the price gives a breakout, we will think the price will reverse or have a pullback. Sometimes the same trend will continue after a small consolidation. I am seeing similar type of consolidation here.

Buy above 390 with the stop loss of 387 for the targets 383, 396, and 399. We can expect resistance or some profit booking around 400.

Always do your analysis before taking any trade.

$TSLA: Let The Rally Speak For Itself - 9/16/2025Based on the analysis, it’s confirmed that NASDAQ:TSLA has initiated a new rally following the completion of a lengthy and complex corrective structure at $288.

The stock bounced twice off the 50-week moving average, signaling strong support as the correction neared its end.

Due to the depth and complexity of the structure, Wave 3 is expected to unfold with high momentum, potentially delivering an explosive rally. Key upside targets are displayed in the chart — we’ll be watching closely to see how price reacts at those levels.

📚 Note: The internal structure and labeling were intentionally left visible in the chart for educational purposes. This is especially useful for traders interested in Modern Trading Algorithms and their structural variations.

Happy Trading, and let the rally speak for itself. 🚀

Tesla: breakout mode, Elon’s rocket fuel for the chartTechnically , Tesla broke out of a symmetrical triangle while holding above EMA/MA supports, which confirms bullish control. The breakout unlocks targets at 368.46 (Fibo 1), followed by 411.38, 432.03, and the 1.618 extension at 464.30. Volume profile confirms strong accumulation below, leaving the upside path less crowded.

Fundamentally , Tesla keeps investor attention alive. EV sales stabilized, but the focus has shifted to AI and robotaxi — Musk’s latest promises of disruption. With Fed rates peaking and yields easing, growth stocks regain momentum. Risks remain from Chinese competitors, yet Tesla’s margins are still leading the industry.

Tactical plan : entry zone stands at 323–336. As long as price holds above it, buyers target 368.46 → 411.38 → 464.30. A break below 323 would flip the bias back toward 291.

Bottom line: Tesla’s chart looks ready for lift-off. Musk might be dreaming of Mars, but for now, bulls are happy if he just launches the stock a few hundred dollars higher.

The Anatomy of a TSLA Retracement TradeBased on a detailed analysis of Tesla's recent price action, a compelling bearish thesis suggests that the stock is poised for a significant retracement. The current market structure indicates that the recent rally may be unsustainable, necessitating a retest of a critical support level to re-establish a more stable foundation.

The Bearish Hypothesis: Retracement to Trendline Support

The core thesis is that the price is set to retrace and test the integrity of the ascending diagonal support trendline. This is not an indication of a full trend reversal, but rather a high-probability correction. T

This corrective phase will likely see the price descend to the lower boundary of the channel. A retest of this key support trendline is a common and healthy technical pattern.

Trade: A short position could be considered upon a clear rejection at the recent highs or upon a decisive breakdown of a minor support level, with the primary profit target being the ascending diagonal support trendline.

TSLA Eyes $400 Breakout — Key Levels & Trade Plans for Sep.15Market Preview

* Macro backdrop: U.S. index futures are steady after a strong tech rally last week. Rates and the dollar remain stable, leaving room for growth stocks to extend gains.

* Sector tone: EV and AI-related momentum is strong, with Tesla leading on heavy volume and institutional call buying.

Technical Analysis – TSLA

Trend & Structure (1-Hour Chart)

* Price surged to $395–396 and is consolidating near the highs.

* Structure remains firmly bullish with higher highs/lows and a well-defined rising channel.

Key Levels

* Resistance: $396.6 (highest positive NETGEX / CALL Resistance), $405, and $420 as next upside targets.

* Support: $389.9 (near-term pivot), $368.8 (major breakout base), $347.5 (HVL zone).

Momentum & Indicators

* MACD on 1H is bullish and expanding, supporting continuation.

* Stoch RSI is near overbought, signaling possible brief consolidation or a minor pullback before another leg higher.

* Volume remains strong, showing solid institutional demand.

Options/GEX Insight

* Massive call positioning (≈98% call bias) with positive GEX layers up to $420 suggests market makers may support higher prices.

* IVR 17.4 and IVx avg 61.5 indicate elevated but manageable volatility.

Trade Scenarios for Sept 15

* Bullish Plan:

* Entry: Break/hold above $396.6 with volume.

* Targets: $405 → $420.

* Stop: Below $389.9.

* Defensive Plan (if rejection occurs):

* Entry: Loss of $389.9 with momentum shift.

* Targets: $368.8 → $347.5.

* Stop: Above $396.6.

Summary

Tesla heads into Monday with a strong bullish setup. Holding above $389.9 keeps momentum intact, while a breakout over $396.6 could trigger a run toward $405–420.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

Tesla on Track – Golden Zone Respect Leading to $867 TargetAs we discussed in the earlier setup, Tesla retraced beautifully into the golden zone (62–79% retracement area) after sweeping sell-side liquidity. This zone aligned with a higher-timeframe order block, providing strong confluence for a bullish reaction.

The price has since respected that golden zone, confirming buyers stepped in aggressively and validating the bullish bias. From here, the market structure points toward continuation to the upside, with immediate targets at prior buy-side liquidity pools, eventually extending toward the $867 region, a level that aligns with the 100% Fibonacci projection and liquidity resting above previous highs.

This setup illustrates a textbook ICT/SMC play:

Liquidity Sweep ✅

Golden Zone Respect ✅

Strong Bullish Reaction ✅

Clear Buy-side Targets Ahead ✅

If momentum holds, Tesla remains positioned for a multi-month expansion leg toward the $867 target zone.

⚠️ DYOR: Not financial advice. Always confirm setups with your own framework and risk management.

$TSLA: Branching Effect🏛️ Research Notes

Reaching branching effect through cross-cycle interconnection. Alongside I'll test some elements mentioned below.

Local Progressions

Rhyme and levels derived from apparent cycle compression.

Added channels with darkening gradient that cover bullrun from mid 2019, driven by angle of tops.

In the local scope, as price deepens into denser zone the probability of disproportional reaction gets higher. t would probably complete its intermediate and even longer-term cycles before escaping the boundary.