TSLACL trade ideas

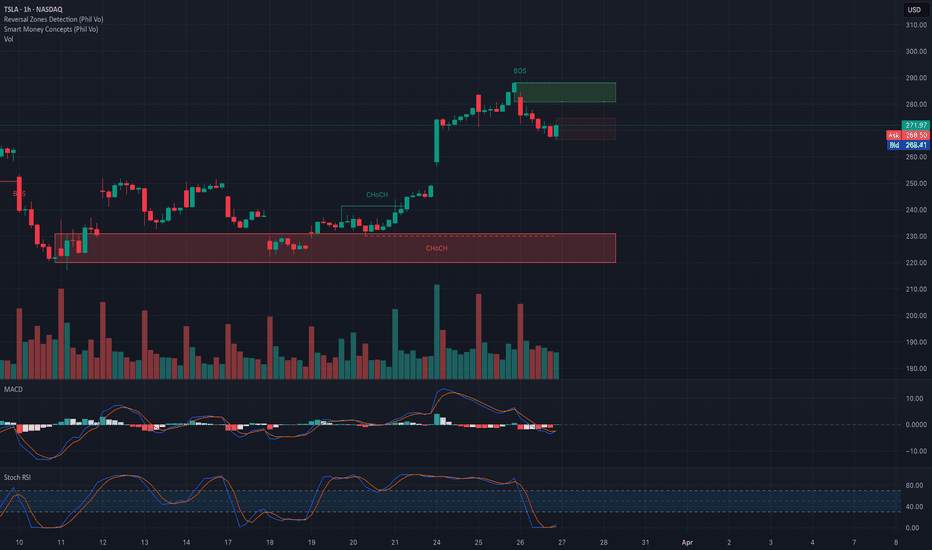

TSLA Reversal or Continuation? Gamma Magnet at Work – Watch This ⚠️ Technical Analysis (TA) – Intraday Setup

Current Price Zone: ~$268.41

* TSLA recently broke structure to the upside (BOS) after a strong rally from the previous CHoCH zone near $230–240.

* After tapping into the supply zone at $282–288, price has pulled back toward $267–268.

* Still trading above all major recent swing lows and inside a potential retracement zone.

Indicators:

* MACD: Bearish cross, momentum slowing after breakout.

* Stoch RSI: Oversold, suggesting a possible bounce opportunity.

🔐 Key Zones

Support Levels:

* 267.50–268.00 → HVL + consolidation zone; key intraday pivot.

* 255 → Strong demand / GEX support zone.

* 250 → PUT wall and prior consolidation base.

Resistance Levels:

* 282.5–288 → Supply zone + 2nd CALL Wall.

* 300 → Gamma Wall and highest positive GEX — strong resistance unless momentum breakout.

🧠 GEX & Options Flow (TanukiTrade Sentiment)

* GEX Sentiment: 🟢🟢🟢 — Fully Bullish

* IVR: 62.7 → High implied volatility, tradable swings.

* IVx avg: 81.2

* CALL$%: 32.4% → Bullish call flow dominates.

* Support Walls:

* 255 (PUT Wall 1)

* 250 (Put Support)

* Resistance Walls:

* 282.5 (CALL Wall 2)

* 300 (Gamma Wall)

📌 With strong bullish options flow and GEX positioning, market makers are likely to support pullbacks and encourage reversion higher unless 255 breaks.

🛠️ Trade Scenarios

📈 Bullish Setup – Rebound from 267–268 Zone

* Price respects current HVL zone and shows reversal signs.

* Entry: Break above 270 or reclaim with volume.

* Target 1: 275

* Target 2: 282.5

* Target 3: 288–300 (extended breakout)

* Stop-Loss: Below 265

* Options Play:

* Long Apr 12 $275 Calls

* Aggressive: $280/$290 Call Spread targeting breakout to Gamma Wall

📉 Bearish Setup – Breakdown Below 267

* If 267 fails and price breaks into lower zone.

* Entry: Break below 265 with strong volume

* Target 1: 255

* Target 2: 250

* Stop-Loss: Above 270

* Options Play:

* Long Apr 12 $260 Puts

* Debit Spread: Buy $265 / Sell $255 Puts

🧭 Final Thoughts & Bias

* Bias: Bullish unless 267 fails.

* Key Level: 267.5 (gamma pivot) – price staying above suggests bullish continuation.

* GEX Implication: Dealers are long calls and may hedge by buying dips → supportive near 255–267.

📍 Ideal play today: Watch for early reversal near 267, and scale into calls on confirmation.

📛 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

TSLA the companyReviewing my charts out loud. I like the month and week view best. Watch the zones. Above 250 TSLA is above water. Will take a look at how week and month close to see if anything pops out at me. Tootles!

*I watch for setups

*BYD is gaining market share in China

*Europe may not want to affiliate right now

*Dubai for funding?... I happened to read years ago that Dubai investors put their money behind Lucid (LCID). Their earnings Q1 2025 was stellar.

*Currently, TSLA sales are in a slump

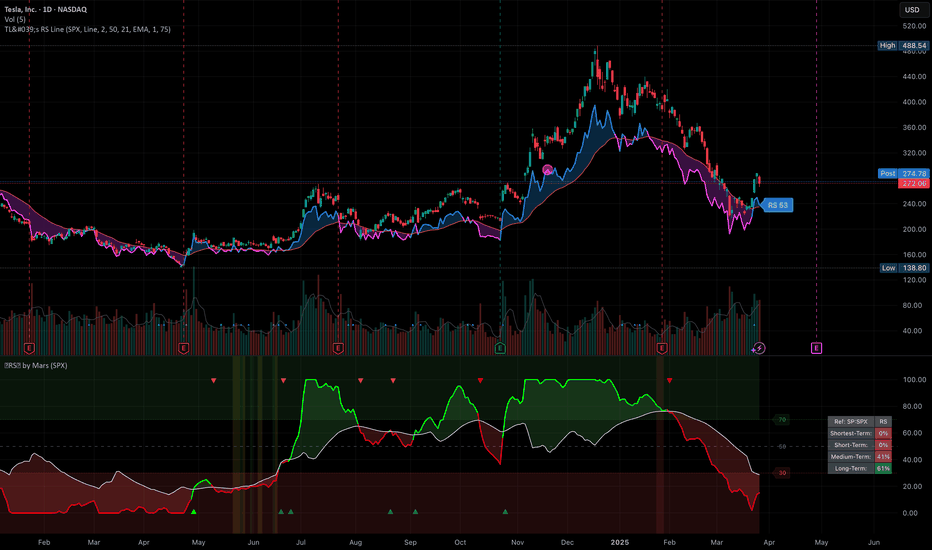

TESLA formed the new bottom and is going for $600.Tesla / TSLA is on the 2nd straight green 1week candle, crossing above the 1week MA50.

With the 1week RSI bouncing on the 2 year Rising Support, the Channel Up has technically formed its new bottom.

Both the current and the previous one were formed on the 0.618 Fibonacci retracement level after a -55% decline.

If the bullish wave is also as similar as the bearish waves have been, the price should reach as high as the -0.382 Fib extension.

Buy and target the top of the Channel Up at $600.

Follow us, like the idea and leave a comment below!!

TSLA looking for rejection around 200HMASo, I've been bearish on TSLA around that $400 mark and was waiting for more PA to evolve before calling the shots. It broke down. Quite rapidly actually. Currently looking to see what happens when price floats around that 200HMA in red. Also looking at weekly RSI that broke down the centre of the channel. If RSI on weekly cannot reclaim above centra at 50 and price has a hard time returning above 200HMA, I'll be looking for another leg down on HTF. I'm looking at weekly timeframe here so be mindful about that. I'm fluid. For me, price doesn't have to get a clean rejection for me to make up my mind. Although, that would make life easier, I'll also look at how price behaves around a certain price level. What I mean by that is: I don't care whether the price will go higher than that 200HMA in daily candles. I care about weekly closes and formations around that area.

TSLA Shorts, Done in 15 minPDH taken, CISD, H1 IFVG, MMSM forming with draw on PDL but with RB right above profit target needed to be adjusted. The price kept creating bearish pd arrays showing hand that the draw was lower and entry was after H1 BISI was inverted and entered on retracement with partials along the way. I'll try to label my charts post trade.

Tesla stock has completed 5 downward waves.Tesla stock has completed 5 downward waves

Currently, market sentiment is highly negative. A correction to the $296-$326 area, which corresponds to 38.20 and 50% Fibonacci levels, seems likely. They have also covered the gap from below.

After Tesla stock's correction, I expect a global collapse of the SP500, the US stock market, and the cryptocurrency market.

You can review ideas for Bitcoin, Ethereum, Solana, SPY/SP500:

-----

SP500/SPY:

Today:

-----

Bitcoin:

-----

Ethereum:

-----

Solana:

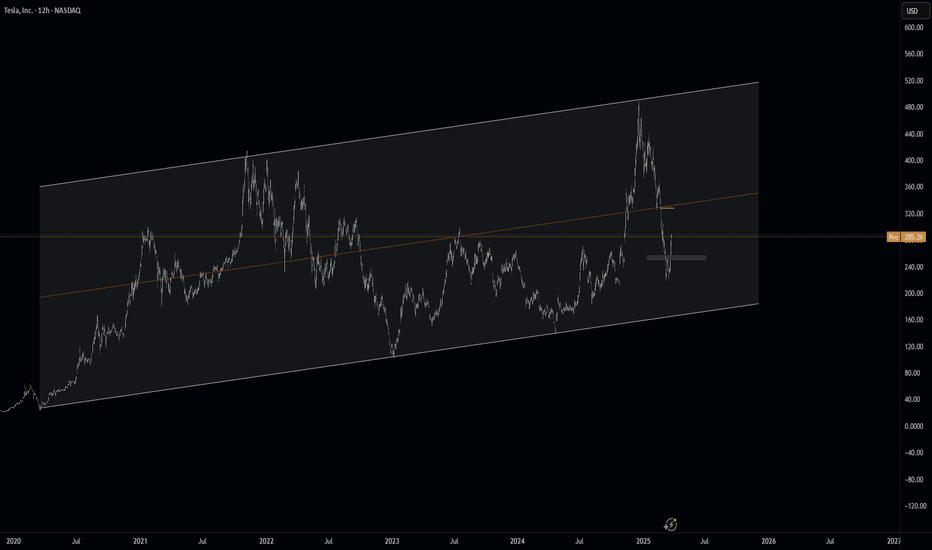

How far will $TSLA go?How far will NASDAQ:TSLA go?

Elon is rolling into the Golden Age with robotaxi’s, A.I. and humanoid robotics.

Some baseline technical analysis. Pitchfork projected from the 2019 impulse waves. Price has touched the median line twice and the bottom of Fibonacci fork thrice. Setting up a possible three drives waves pattern.

Break $600 on this run up and we’ll see $1,000-$1,700 quickly to reach the top of the pitchfork completing the impulse waves. This puts Tesla at a marketcap of $5.47T

MASSIVE $TESLA SHORT:

🚨 NASDAQ:TSLA - MASSIVE SHORT INCOMING? 🚨

Weekly Bearish Divergence Alert 🔻

Tesla is flashing major warning signs on the weekly chart. While price has pushed higher recently, momentum is doing the opposite — bearish divergence on the RSI/MACD is undeniable.

📉 Price Action:

TSLA is struggling to reclaim key resistance near $200–$210. The recent rally looks exhausted, with buyers losing strength.

📊 Technical Breakdown:

RSI Divergence: Price made a higher high, but RSI made a lower high = bearish divergence

MACD Histogram Weakening: Bullish momentum is fading fast

Volume: Declining on green days, heavier on red = distribution underway

⚠️ Macro Headwinds

EV competition is surging

Elon selling shares = supply pressure

Market rotation into value, not growth

🎯 Trade Setup (Not Financial Advice):

Entry: $195–$205 zone

Stop: Close above $215

Targets: $180, $160, then $130 for the brave

This is a textbook swing short opportunity with a favourable risk/reward ratio. Smart money could be unloading here — don’t get caught long at the top.

📅 Watch for confirmation on this week’s close. If the divergence plays out, this could be a multi-week dump.

#TSLA #Short #BearishDivergence #SwingTrade #Options #TeslaCrash #TradeView

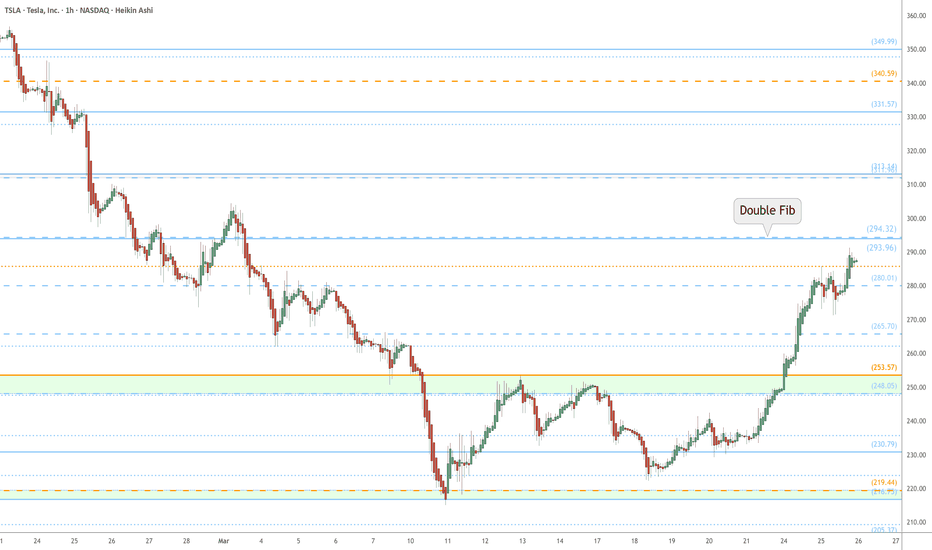

TSLA watch $294: Double Fib hurdle to bounce from Golden GenesisTSLA finally got past our Golden Genesis fib at $253.

Strong bounce cut through several Covid fibs (dashed).

Watch tight confluence of Covid+Genesis around at $294.

$ 293.96 - 294.32 is the exact zone of concern for bulls.

==================================================

.

Tesla (TSLA) – Daily Chart AnalysisTechnical Landscape

Immediate Resistance:

Gap / Low Volume Zone: $288.14 – $338.79

0.236 Fibonacci retracement at ~$338.79

Major Resistance Above:

50% Retracement: ~$356.15

0.618 Fibonacci: ~$418.66

Key Support Levels:

$246.45 (recent structural low)

$220.48

$196.51

$180.80

Momentum Indicators

RSI

Currently rising and reclaiming the 50.00 level, a significant threshold.

Momentum profile closely mirrors the November 2024 recovery (highlighted with circle).

Prior surges from similar RSI+ structures led to multi-week uptrends.

Trend

Bullish crossover confirmed with expanding green histogram.

Momentum is accelerating out of a deeply oversold condition—similar to the late 2024 rally initiation.

Signal line separation is clear, suggesting short-term strength remains intact.

On Balance Volume

Just printed its first strong upturn in over two months.

The curve has transitioned from flat to rising, forming a mirror image of the reversal seen in November 2024.

While early, the formation suggests underlying accumulation and rotation back into strength.

Scenarios Based on Current Structure

Scenario 1: Bullish Continuation Through Gap Zone

Trigger: Break and hold above ~$288.14 (gap entry) with increasing volume and confirmation from RSI+ and WaveTrend.

Structure: Price accelerates into low-volume gap region, seeking fill up to ~$338.79.

Target 1: $338.79 (0.236 Fib)

Target 2: $356.15 (50% retracement)

Target 3: $418.66 (0.618 retracement)

Momentum Bias: All three indicators currently favor bullish continuation.

Scenario 2: Short-Term Rejection at Gap Resistance

Trigger: Price rejects within $288–$300 and fails to sustain above the low-volume node.

Price Response: Retests structural support near $246.45 or deeper at $220.48.

Setup: Look for RSI+ to lose the 50 level and WaveTrend to flatten or recross down.

Bias: Short-term corrective move, but still within a broader base-building structure.

Scenario 3: Breakdown Back Into Range

Trigger: A sharp reversal with high-volume rejection from the current rally leg, especially without full gap fill.

Confirmation: Indicators roll over—WaveTrend flips negative, Volume Buoyancy breaks down.

Target: $220.48 initially, then $196.51 and potentially $180.80 if broader market weakens.

Implication: Reclassifies price action as a failed relief rally, resuming prior downtrend.

Summary

Tesla is in the early stages of a potential trend reversal. The alignment of RSI+, WaveTrend 3D, and Volume Buoyancy with prior bottoming conditions suggests further upside is likely if the stock clears the low-volume region starting at ~$288. That said, this is a structurally thin area, and rejection within the gap could send price back to major support zones.

Volume will be key in validating breakout attempts. Should momentum fade and structural levels fail, the broader downtrend may reassert itself.