From Fast Charging to Fast Swapping: The Innovation Driving NioSince the last time I wrote about Nio, on July 17, exactly 40 days have passed, and the stock has risen by 55% (yesterday's close).

The results are impressive, with the cars increasingly spreading across Northern Europe.

But the real innovative concept is not the car itself, but the battery and the Battery Swap.

Why is the Battery Swap innovative?

The Battery Swap is innovative because it addresses one of the main limitations of electric vehicles: charging time and battery lifespan.

In fact, it introduces a new market concept that solves several problems:

1. Drastic reduction in “charging” time

Swapping the battery takes only a few minutes, comparable to a traditional fuel refill.

It avoids the long waits of standard or fast charging.

2. Extended vehicle lifespan

Batteries can be replaced with more advanced models without changing the vehicle.

This eliminates the problem of battery degradation over time, one of the main concerns for customers.

3. Flexible business model

Possibility of a battery subscription, reducing the initial cost of the vehicle.

Creation of a network of swap stations that can generate recurring revenue.

4. Sustainability and recycling

Used batteries can be replaced and sent for regeneration or recycling.

This reduces environmental impact compared to full vehicle replacements.

5. Competitive advantage

This technology differentiates Nio from other electric vehicle manufacturers and can drive mass adoption in markets where fast charging is still limited.

And now I leave you with a question:

Do you think the know-how behind Battery Swap applies only to the automotive market?

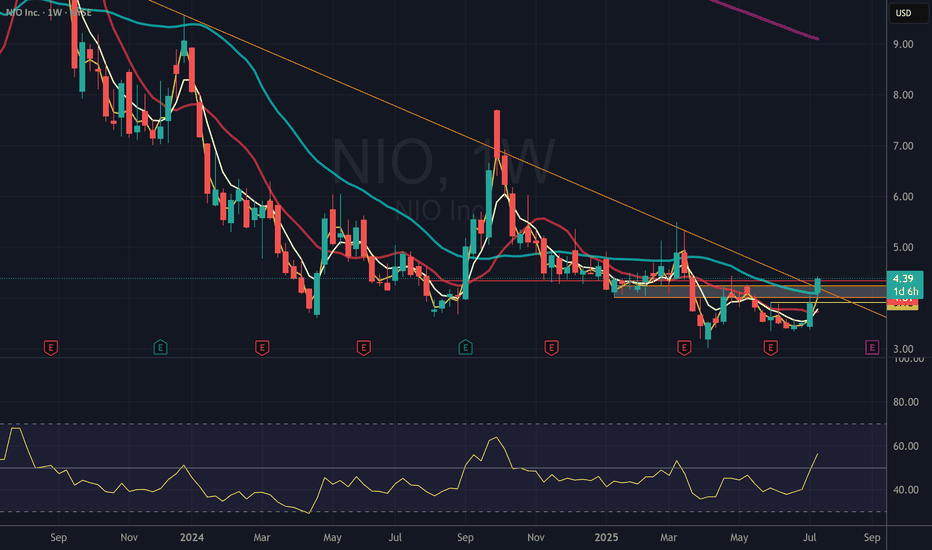

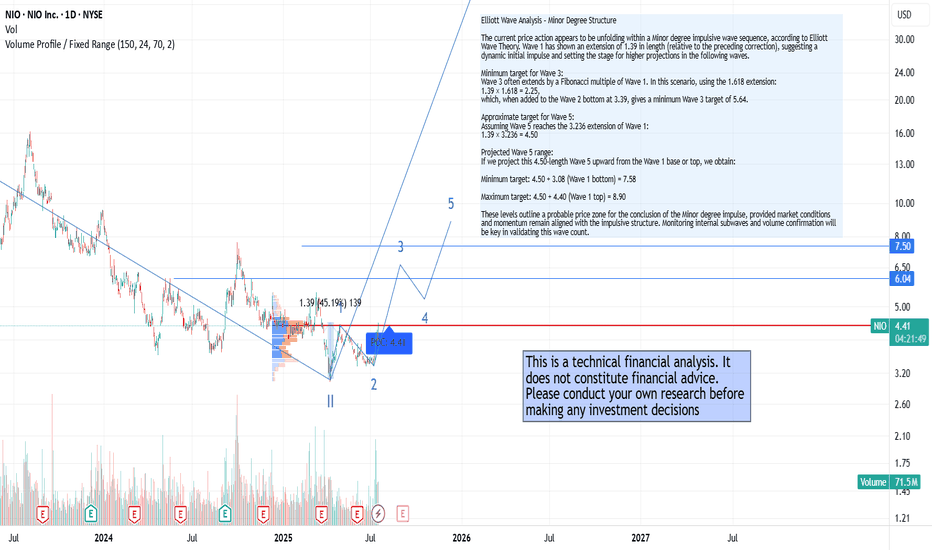

It seems we are in a 3rd Elliot's Wave in a Primary Cicle. It could reach 7.50$. This is not a financial advice.

Trade ideas

NioNYSE:NIO – NIO Inc. | Daily Chart Technical Analysis

NIO ( NYSE:NIO ) just broke out of a critical resistance zone with a +14.44% move on strong volume, signaling a potential bullish continuation.

🔹 Key Technical Highlights:

Breakout: Price has surged above the key supply zone around $5.90–$6.15, confirming a breakout from the descending channel (dotted white line).

Volume Spike: Significant volume confirms institutional interest and adds credibility to the breakout.

Moving Averages: Price is now trading well above both the 50-day and 200-day MAs, a shift in trend structure.

Support Levels: Strong base formed between $4.17 and $4.83 — could act as demand on any retest.

Next Target: $7.03 resistance is the next major level to watch. Above that, the chart opens up toward the $9.50–$11 range (highlighted zone).

📊 Current Price: $6.34

NIO is attempting a trend reversal after prolonged bearish pressure. Continuation depends on holding above the breakout zone with sustained volume.

#NIO #Stocks #EV #TechnicalAnalysis #Breakout #Trading #Charting #NIOstock

NIO overboughthi traders

NIO has seen a strong breakout recently, moving sharply higher and now testing the $6.35 resistance level. This rally has been accompanied by a spike in volume, which shows strong momentum behind the move.

However, if you feel like you missed out on this run, don’t FOMO into buying here. The RSI is overbought across multiple timeframes (4h, daily, and weekly), which suggests the stock is due for a cooldown.

The best strategy in these setups is to wait for a healthy pullback. The highlighted buy zone around the $5.20–$5.50 range could offer a better risk/reward entry if price retraces. A bounce from that zone could then lead to another leg higher, with a potential target near $7.58.

In summary:

✅ Strong breakout on high volume.

⚠️ RSI overbought across 4h, daily, and weekly.

🕰 Best to wait for a pullback into the buy zone rather than chase.

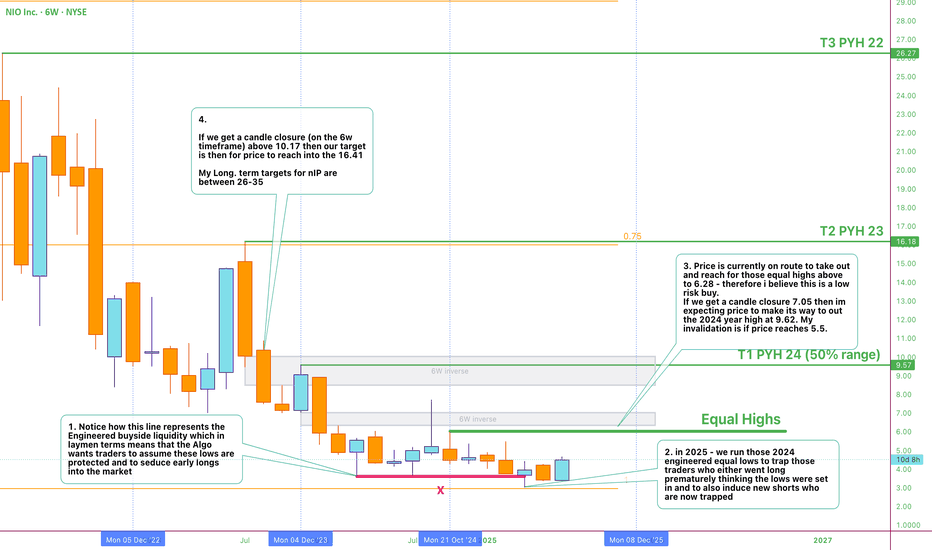

NIO Trendline Break PossibleGood evening traders,

After NIO's rapid growth Pre-Covid, the company has failed to make a comeback. In my opinion this was due to its rapid growth and impulse move back in 2020. My rule with impulse moves is the market will tend to retrace 100% of its initial move.

Following the fall of NIO for the past several years, it has clearly been bouncing from a descending trendline and so far it has touched 4 times. I expect NIO to continue to drop, the $3.00'ish price seems to be a good price to enter with a possibility of it reach the $1.00 area. I'm expecting a breakout soon followed by a retracement back to the trendline and bounce up until is reaches the $27 dollar area. This is just the technical aspect of this analysis. Hope this helps some of you with your investments.

Don't forget to like and follow for more trading ideas & trading opportunities. Happy Trading!

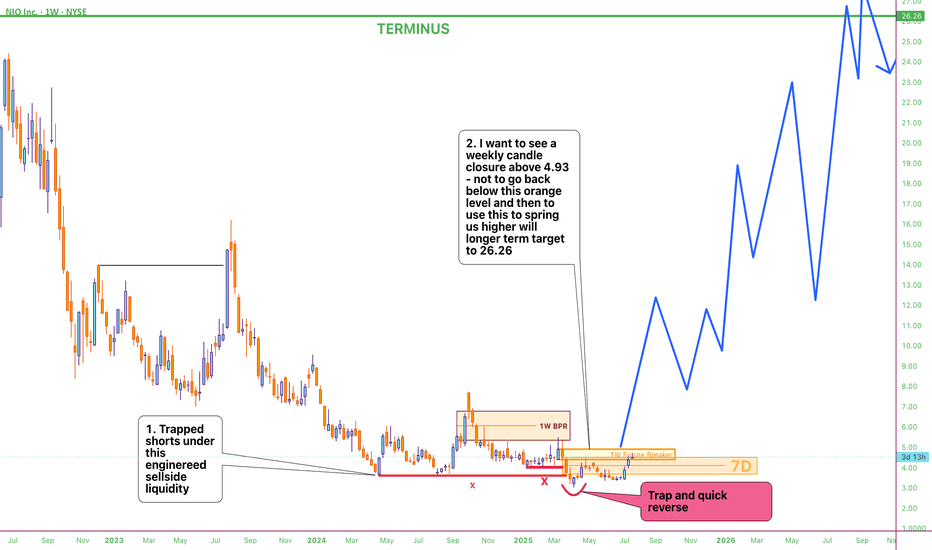

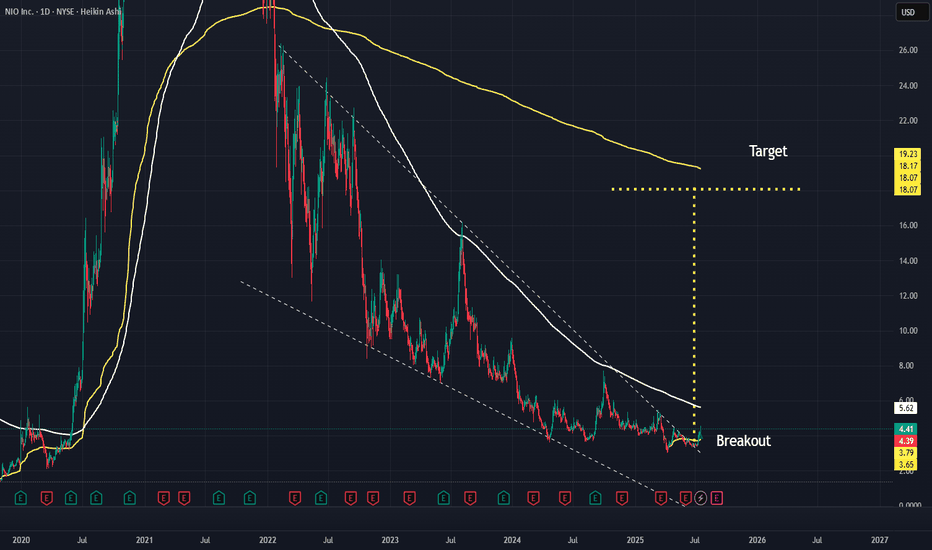

On the Edge of BreakoutDear NIO investors,

It looks like we’ve finally broken out of the long downtrend that’s held since the peak (check the massive channel on the log scale). The breakout may have happened this morning, eyeing a flag pattern continuation toward 6.5–6.7.

This is not financial advice, trade at your own risk.

NYSE:NIO

NIO Setting Up for a Big Move!🚨 NIO ALERT 🚨

Looks like a buy & fly setup is loading! 📈💥

📊 Technicals aligning beautifully with macro cycle support.

🔥 Volume picking up. The structure looks explosive.

📍 A clean breakout could send this EV beast soaring!

I'm watching closely for confirmation...

This could get FAST. ⚡

Nio - Best caseHere my best term scenario on Nio

We may have bottomed out as we have started to see bullish price action but tread with caution. once we have candle closure on weekly above that weekly breaker block i am looking ath this level to be our launchpad higher with the best case; is that we reach our long term target between 25-37

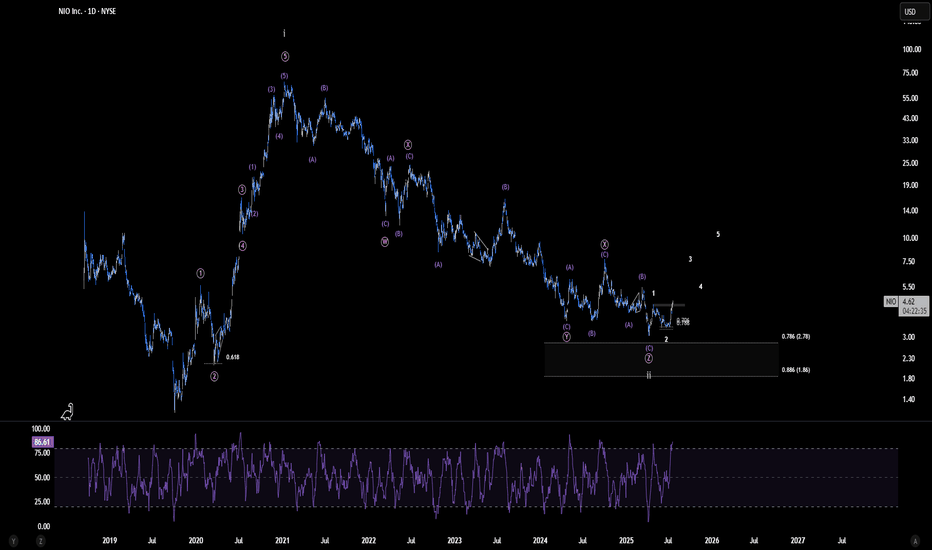

NIO - Start of a major Breakout? | Ew analysisPersonally, I see only two realistic scenarios for NIO: either the major correction has already concluded, or we are very close to its completion. The scenario presented here appears the most compelling, as it allows for the possibility of a significant bullish impulse beginning to unfold toward the end of Q4 2025—potentially fueled by improved profitability prospects and the company's continued push toward long-term operational efficiency.

NIO BREAKOUTChinese auto manufacturers are under tremendous pressure—only a few will survive this squeeze. Among them, NIO is making a bold move into Europe. The stock’s price chart is showing a breakout from a classic falling wedge formation—a bullish reversal pattern typically signaling a strong move upward.

Technically:

The breakout from the wedge aligns with increasing trading volume and several technical indicators pointing upward, including RSI and MACD.

Multiple analysts confirm that NIO is positioned “right at the apex of a narrowing wedge,” suggesting an imminent breakout.

Additional charting from Reddit confirms this view, noting that pre-market action in Hong Kong and Singapore showed a breakout above the wedge boundary, targeting the $5.05–$5.20 range.

Fundamental context:

NIO is expanding aggressively into Europe (Norway, Germany and more), a move that strengthens its long-term growth narrative.

While domestic pressure in China remains elevated—due to fierce competition from players like BYD—this European strategy adds a meaningful growth lever.

My price target of $18 reflects a confluence of factors:

It corresponds roughly to the VWAP near NIO’s all-time low—a logical area for institutional interest.

It also represents the measured rally from a falling wedge breakout, assuming a full-range thrust.

New Highs Ahead?In recent sessions, Nio Inc. has shown a price acceleration consistent with a Minor degree impulsive wave, as outlined by Elliott Wave Theory. Wave 1 has extended by a factor of 1.39, and the current price structure suggests a possible completion of Wave 3 and an early development of Wave 5, with clear technical targets already in place.

This technical scenario aligns with recent positive developments on the fundamental side:

🔹 Stronger delivery numbers – The latest quarterly results reveal robust year-over-year growth in vehicle deliveries, highlighting the company’s ability to scale production and meet rising demand. This performance is further enhanced by an improved product mix, with a shift toward higher-end or newer models, which contributes to stronger revenue per unit and improved brand positioning.

🔹 Battery swap network expansion – The company is steadily expanding its battery swap infrastructure. This innovative model, which allows EV drivers to swap a depleted battery for a fully charged one in just a few minutes, differentiates the company from traditional EV players. It also reduces charging time anxiety, increases convenience, and aligns with long-term goals for energy and fleet efficiency—particularly in dense urban areas and high-mileage use cases like ride-hailing or logistics.

🔹 New market entries – The company is actively pursuing international expansion, with strategic launches in Europe, including growing presence in countries like Germany, the Netherlands, and Norway. At the same time, it's establishing key partnerships in the Middle East to prepare for future entry into high-potential markets such as the UAE and Saudi Arabia. This geographic diversification not only broadens the customer base but also strengthens global brand positioning in the premium EV segment.

🔍 Key Highlights – NIO Mid-2025 Update

📈 Vehicle Deliveries

June 2025: 24,925 vehicles delivered (+17.5% YoY)

Q2 2025: 72,056 vehicles (+25.6% YoY)

1H 2025 total: 114,150 units (+30% YoY)

Cumulative deliveries: 785,714 units as of June 30, 2025

🔋 Battery Swap Network

Global footprint: Over 2,700 stations (2,400+ in China, ~60 in Europe)

China: ~2,651 stations, with 159 in Shanghai

Europe: ~60 stations, notably in Germany and Norway

Utilization: Peak stations in Shanghai exceed 100 swaps/day; global average ~30–40

💡 Takeaway

These strong operational metrics confirm accelerating growth and strategic infrastructure expansion, reinforcing NIO’s unique value proposition in the EV sector. The fundamental momentum aligns with bullish technical signals, including an unfolding Elliott Wave pattern projecting higher targets.

Based on the current Elliott Wave projection:

Minimum target for Wave 3: 5.64

Projected Wave 5 range: between 7.58 and 8.90

In summary, we’re observing a technically and fundamentally aligned scenario where price action is increasingly supported by improving financials and strategic execution on the ground.

This is not a financial advise, please do your own research.

NIO – Breakout Approaching from Apexhi Traders

How are you today? Do you like NIO stock today?

The price of NIO is currently sitting right at the apex of a narrowing wedge, indicating that a decisive breakout is likely imminent. This technical formation has been building for months, and the price has now tightened into a point where volatility and direction are expected to return soon.

The RSI (Relative Strength Index) is showing bullish signs, with an upsloping structure despite the sideways price action, which suggests growing bullish momentum under the surface. This hidden strength adds confidence to a potential bullish breakout.

We’ve identified two key upside targets for the bulls:

🎯 Target 1: $5.24 — a 45% move from current levels

🎯 Target 2: $7.70 — previous resistance and a major psychological level

However, on the flip side, if the price breaks down from this pattern instead of up, we could see NIO revisit levels as low as $2.20, which would delay the bullish scenario significantly and potentially extend the consolidation phase.

Summary:

🔺 At apex of wedge pattern — breakout expected soon

📈 RSI is bullish and rising, indicating potential strength

🎯 Bullish targets: $5.24 and $7.70

⚠️ Bearish breakdown risk: Downside to $2.20

Traders should watch for a confirmed breakout or breakdown before entering, as momentum can accelerate quickly once direction is established.

Safe Entry Zone NIOGreen Zone Is Safe Entry and Retest before exploding higher.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

NIO - The Bullish RoadThere is a long road to go to see any bullishness in NIO. This diagram is a simple annotation of the steps for higher prices and bullishness on NIO. Right now we might be seeing the beginning of a shift to bullishness if we star displacing higher and price signatures such as bullish fair value gaps left open would help strengthen the bullish bias.