Key facts today

Affirm partners with Ace Hardware to provide 'buy now, pay later' options, expanding its network to over 360,000 partners and allowing in-store purchases starting at $50.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.91 MXN

978.92 M MXN

60.48 B MXN

271.66 M

About Affirm Holdings, Inc.

Sector

Industry

CEO

Max R. Levchin

Website

Headquarters

San Francisco

Founded

2012

ISIN

US00827B1061

FIGI

BBG01018LPV6

Affirm Holdings, Inc. operates a platform for digital and mobile-first commerce. Its platform consists of three core elements: a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The company was founded by Max R. Levchin in 2012 and is headquartered in San Francisco, CA.

Related stocks

Bearish divergence on 1 hourI am bullish on AFRM, targeting $100+. However, watch for bearish divergence on the 1-hour RSI and a bearish rising wedge.

As a long-term investor, I won’t trade it, but a pullback is necessary for growth.

This is not financial advice.

Stop loss: ~$93.21.

Targets: ~$84, ~$82.

Entry IdeaEntry Idea

📈 Entry Price: 77.40

🛑 Stop Loss: 70.00

🎯 Target: 100.00

This is the first entry opportunity at this level. Make sure to apply proper risk management when trading.

⚠️ Disclaimer: This is a technical analysis idea only. The company’s financials or fundamentals have not been analyzed or c

Bear and Bull case for AFRMTwo scenarios are possible:

Bull Case: The price breaks the 79-82 range and rises to $90 or higher.

* Side note: Amazon’s Prime Big Deal Days is around the corner. The two companies have a strategic partnership. It can pave the way for some positive news that may push AFRM higher.

Bear Case: The

AFRM - NEW 52-WEEK HIGHAFRM - CURRENT PRICE :88.46

AFRM made a new 52-week high last Friday with burst in trading activity. The 52-week high resistance level near 82.00 - 83.00 is considered significant resistance level based on the share price history as it had been touched several times. One of the bullish signs for t

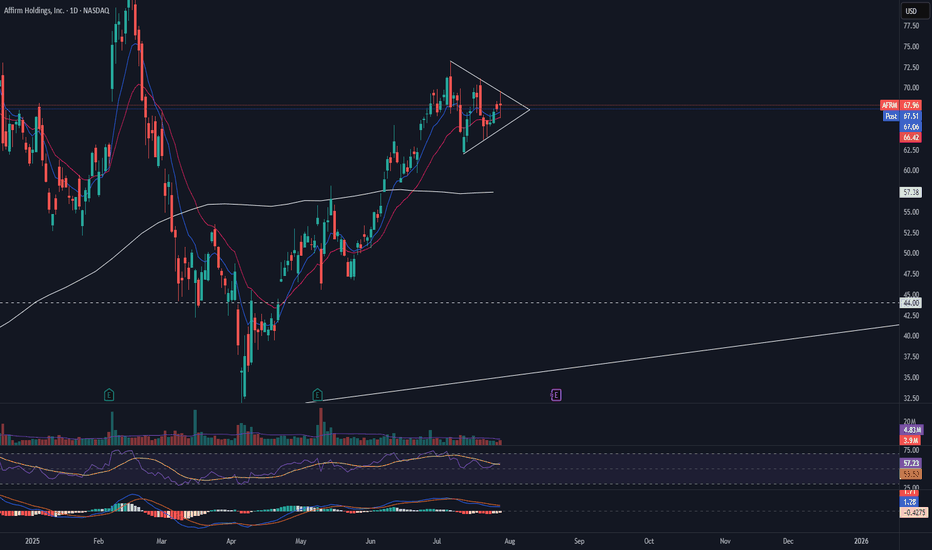

AFRM Pre Earnings Triangle BreakAFRM has broken the symmetrical triangle to the upside. If this holds we could see a strong rally into earnings. I would want to see strong volume added to this equation for the move up to be confirmed.

My STOP on this position would be a daily candle close back under the trendline with confirming

AFRM eyes on $50.66: Semi-Major Genesis fib for High Support AFRM has been showing considerable strength.

Hit a Geneiss fib above and fell back to sister fib.

Strong Bull trend would hold this fib into new highs.

$50.66 is the immediate floor to hold

$49.17 is a minor fib for a speed brake.

$47.60 is Bulls' Last Stand to hold uptrend.

======================

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AFRM is featured.

Frequently Asked Questions

The current price of AFRM is 1,426.27 MXN — it has increased by 4.08% in the past 24 hours. Watch Affirm Holdings, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange Affirm Holdings, Inc. Class A stocks are traded under the ticker AFRM.

AFRM stock has fallen by −9.16% compared to the previous week, the month change is a −5.05% fall, over the last year Affirm Holdings, Inc. Class A has showed a 77.87% increase.

We've gathered analysts' opinions on Affirm Holdings, Inc. Class A future price: according to them, AFRM price has a max estimate of 2,141.13 MXN and a min estimate of 1,191.58 MXN. Watch AFRM chart and read a more detailed Affirm Holdings, Inc. Class A stock forecast: see what analysts think of Affirm Holdings, Inc. Class A and suggest that you do with its stocks.

AFRM stock is 4.45% volatile and has beta coefficient of 2.52. Track Affirm Holdings, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Affirm Holdings, Inc. Class A there?

Today Affirm Holdings, Inc. Class A has the market capitalization of 445.66 B, it has decreased by −10.84% over the last week.

Yes, you can track Affirm Holdings, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Affirm Holdings, Inc. Class A is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

AFRM earnings for the last quarter are 3.75 MXN per share, whereas the estimation was 2.32 MXN resulting in a 61.91% surprise. The estimated earnings for the next quarter are 2.04 MXN per share. See more details about Affirm Holdings, Inc. Class A earnings.

Affirm Holdings, Inc. Class A revenue for the last quarter amounts to 16.44 B MXN, despite the estimated figure of 15.70 B MXN. In the next quarter, revenue is expected to reach 16.17 B MXN.

AFRM net income for the last quarter is 1.30 B MXN, while the quarter before that showed 57.45 M MXN of net income which accounts for 2.16 K% change. Track more Affirm Holdings, Inc. Class A financial stats to get the full picture.

No, AFRM doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Oct 3, 2025, the company has 2.21 K employees. See our rating of the largest employees — is Affirm Holdings, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Affirm Holdings, Inc. Class A EBITDA is 15.11 B MXN, and current EBITDA margin is 24.98%. See more stats in Affirm Holdings, Inc. Class A financial statements.

Like other stocks, AFRM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Affirm Holdings, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Affirm Holdings, Inc. Class A technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Affirm Holdings, Inc. Class A stock shows the strong buy signal. See more of Affirm Holdings, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.