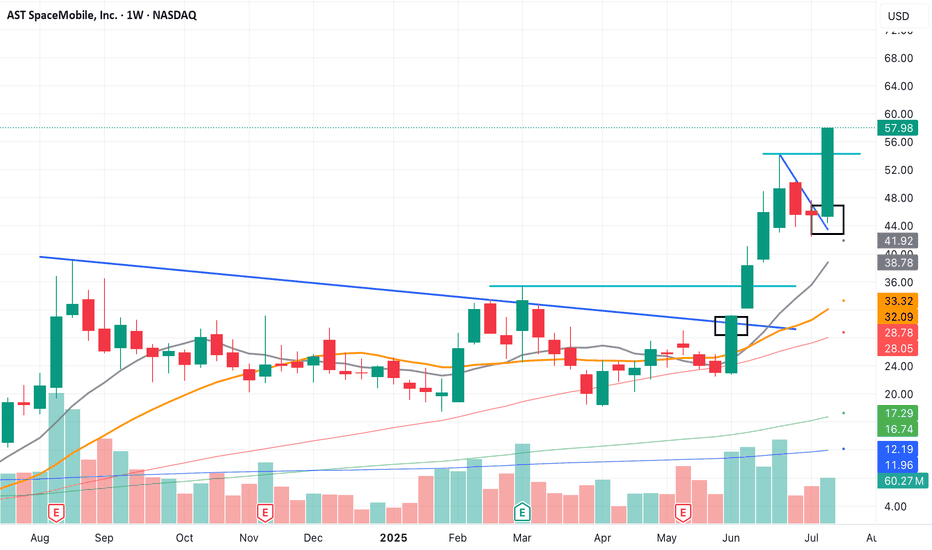

$ASTS bouncing off April low AVWAPAfter testing the AVWAP from the april low, ASTS is seeing a strong bid and holding the AVWAP. I think NASDAQ:ASTS will test the AVWAP from the July high soon at 48-50 level, where I'd take some off. Stock might bounc around between this "AVWAP pinch" after that but I think will eventually break o

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−35.63 MXN

−6.26 B MXN

92.11 M MXN

204.57 M

About AST SpaceMobile, Inc.

Sector

Industry

CEO

Abel Avellan

Website

Headquarters

Midland

Founded

2017

ISIN

US00217D1000

FIGI

BBG01PH10SC7

AST Spacemobile, Inc. engages in building a broadband cellular network in space to operate directly with standard, unmodified mobile devices based on an extensive IP and patent portfolio. It focuses on providing mobile broadband services with global coverage to all end-users, without the need to purchase special equipment. The company was founded by Abel Avellan on May 31, 2017 and is headquartered in Midland, TX.

Related stocks

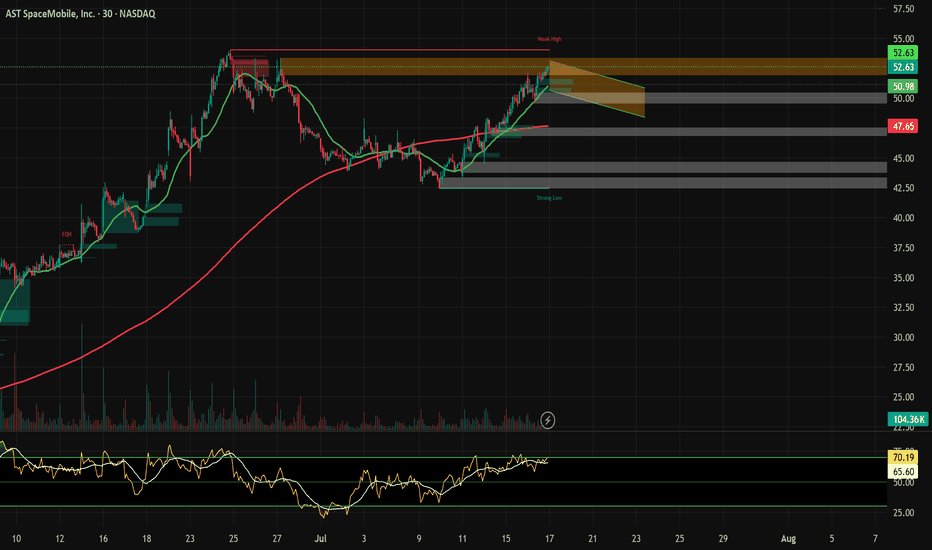

ASTS - Daily - Likely $47 Range RetestCurrently, a head and shoulders pattern has formed around the recent price action, signaling a potential price reversal. However, the price will likely retest the $47 level if the 200-day moving average (MA) continues to hold, as it has during retests in February, April, and June of 2025. Furthermor

ASTS Earnings & Options Breakdown (2025-08-11) 🚀 ASTS Earnings & Options Breakdown (2025-08-11) 🚀

### AST SpaceMobile \ NASDAQ:ASTS — **Moderate Bearish Bias Ahead**

---

### 🔥 Quick Take:

* **Revenue:** +43.6% TTM growth but insanely high P/S ratio (\~3445) signals overvaluation.

* **Margins:** Operating margin -8769% — huge cash burn. Fre

Buying opportunity, if breakoutUptrend

As the chart indicates, the correction wave has been finished in PRZ between 50-61.8 Fib Ret. Also, it's located at the bottom of a channel.

You need a breakout from the descending trend line and confirming above 54 to get a buying position. Next targets could be about 60 and 74 .

Set up a

ASTS | Starlink ain't the only game in space no mo!This stock NASDAQ:ASTS is only up like 2600% in a year. That's like nothing. Might as well be losing that paypah.

Yes, it will swing more wildly than a chimpanzee from a vine. And yes my chart is probably effed as heck, but I'm looking for beyondosphere type of returns.

Is there room for mo

In spaceA space economy company providing communication services through satellite networks.

The space economy is set to explode over the coming years—it’s a good time to start following a few stocks.

The entire space sector is already experiencing strong growth; companies like Rocket Lab have quadrupled

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ASTS is featured.

Frequently Asked Questions

The current price of ASTS is 878.50 MXN — it has increased by 4.32% in the past 24 hours. Watch AST SpaceMobile, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange AST SpaceMobile, Inc. Class A stocks are traded under the ticker ASTS.

ASTS stock has risen by 17.12% compared to the previous week, the month change is a 4.07% rise, over the last year AST SpaceMobile, Inc. Class A has showed a 51.47% increase.

We've gathered analysts' opinions on AST SpaceMobile, Inc. Class A future price: according to them, ASTS price has a max estimate of 1,157.58 MXN and a min estimate of 560.12 MXN. Watch ASTS chart and read a more detailed AST SpaceMobile, Inc. Class A stock forecast: see what analysts think of AST SpaceMobile, Inc. Class A and suggest that you do with its stocks.

ASTS reached its all-time high on Jul 21, 2025 with the price of 1,135.59 MXN, and its all-time low was 377.50 MXN and was reached on Jan 30, 2025. View more price dynamics on ASTS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ASTS stock is 5.46% volatile and has beta coefficient of 1.06. Track AST SpaceMobile, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is AST SpaceMobile, Inc. Class A there?

Today AST SpaceMobile, Inc. Class A has the market capitalization of 222.63 B, it has increased by 6.52% over the last week.

Yes, you can track AST SpaceMobile, Inc. Class A financials in yearly and quarterly reports right on TradingView.

AST SpaceMobile, Inc. Class A is going to release the next earnings report on Nov 17, 2025. Keep track of upcoming events with our Earnings Calendar.

ASTS earnings for the last quarter are −7.69 MXN per share, whereas the estimation was −3.60 MXN resulting in a −113.91% surprise. The estimated earnings for the next quarter are −3.82 MXN per share. See more details about AST SpaceMobile, Inc. Class A earnings.

AST SpaceMobile, Inc. Class A revenue for the last quarter amounts to 21.68 M MXN, despite the estimated figure of 125.37 M MXN. In the next quarter, revenue is expected to reach 401.08 M MXN.

ASTS net income for the last quarter is −1.86 B MXN, while the quarter before that showed −936.39 M MXN of net income which accounts for −99.11% change. Track more AST SpaceMobile, Inc. Class A financial stats to get the full picture.

No, ASTS doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 22, 2025, the company has 578 employees. See our rating of the largest employees — is AST SpaceMobile, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AST SpaceMobile, Inc. Class A EBITDA is −4.02 B MXN, and current EBITDA margin is −4.06 K%. See more stats in AST SpaceMobile, Inc. Class A financial statements.

Like other stocks, ASTS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AST SpaceMobile, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AST SpaceMobile, Inc. Class A technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AST SpaceMobile, Inc. Class A stock shows the neutral signal. See more of AST SpaceMobile, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.