Visa (V) Buy Signal: 3-Step Rocket Booster StrategyVisa (V) Buy Signal – Daily Trigger + Weekly Pullback + Rocket Booster 🚀💳📈

Visa Inc. (V) NYSE:V is flashing a compelling buy signal, supported by daily price action, weekly momentum readings, and long-term trend confirmation via the Rocket Booster Strategy.

Step 1 – Daily Candlestick: Bullish Signal

On the daily chart, Visa is showing bullish candlestick formations, including long lower shadows that confirm buyers are stepping in to defend support. This provides the entry trigger.

Step 2 – Weekly Oscillators: Sell / Strong Sell

The weekly oscillator rating is currently in Sell / Strong Sell territory. This highlights short-term momentum weakness, which in the context of a bigger

uptrend often creates an ideal buy-the-dip scenario. Traders can use this temporary pullback as an opportunity to position before momentum flips back upward.

Step 3 – Monthly Moving Averages: Rocket Booster Strategy (Strong Buy / Buy)

On the monthly timeframe, Visa shows a Strong Buy / Buy rating on moving averages. This is the Rocket Booster Strategy in action: the long-term trend is

powerful and acts like a booster, propelling prices higher once short-term weakness fades.

The Buy Case for Visa

Daily Candlestick → Bullish trigger (buyers defending support)

Weekly Oscillator → Pullback offering better entry levels

Rocket Booster (Monthly MAs) → Long-term trend remains strongly bullish

This multi-timeframe alignment makes Visa a high-probability candidate for further upside.

Trade Idea

Entry Zone: Near current levels or on dips

Stop-Loss: Below recent daily lows

Profit Targets: Previous swing highs and psychological resistance levels

The combination of a daily entry trigger, weekly pullback, and monthly Rocket Booster creates a textbook buy setup.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Trading and investing carry risks. Always practice on a demo account first , and develop solid risk management and profit-taking strategies before committing real capital.

V trade ideas

Visa (V) 3 Buy Signals – Trend, Momentum & Price Action Aligned Visa (V) Buy Signal – Multi-Timeframe Confirmation 🚀📈

Visa Inc. (V) NYSE:V is showing a fresh buy opportunity when viewed through the lens of the 3-step trading system: candlesticks, oscillators, and moving averages across different timeframes.

Step 1 – Daily Candlestick: Bullish Rejection

On the daily chart, Visa has printed bullish candlestick signals — including long lower shadows that show buyers stepping in to defend support. This suggests

demand is strong at lower levels and the path of least resistance remains upward.

Step 2 – Weekly Oscillators: Strong Sell / Sell

Interestingly, the weekly oscillator rating is currently on Sell / Strong Sell, showing momentum weakness in the short term. This isn’t necessarily bearish

for long-term buyers — in fact, it often signals a pullback inside a broader uptrend, giving traders the chance to accumulate at discounted levels.

Step 3 – Monthly Moving Averages: Strong Buy / Buy

The monthly moving average rating is firmly Strong Buy / Buy, confirming that Visa is in a long-term bullish trend. As long as price stays above these key levels,

the primary trend remains intact and pullbacks should be viewed as opportunities, not threats.

The Buy Case for Visa

Daily Candlestick → Bullish rejection signals buyers defending support.

Weekly Oscillators → Short-term weakness creating entry opportunities.

Monthly Moving Averages → Long-term bullish trend remains intact.

This alignment creates a classic buy setup: a strong trend supported by long-term moving averages, a temporary dip in weekly momentum, and a bullish candlestick trigger on the daily chart.

Trade Idea: Traders may consider long entries near current levels or on dips, with protective stops below recent daily lows. Profit targets could be staged at previous swing highs and beyond, in line with the monthly uptrend.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Trading and investing carry risks. Before risking real money, it’s

recommended to practice on a demo account and develop solid risk management and profit-taking strategies.

Bullish Continuation Likely Towards H1 Price Targets Current Price: $344.47

Direction: LONG

Targets:

- T1 = $360.00

- T2 = $375.00

Stop Levels:

- S1 = $340.00

- S2 = $335.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and institutional investors, highlighting a potential bullish continuation in Visa (V), driven by positive macro conditions, resilient demand for financial services, and growing fintech adoption. Traders have noted Visa's robust earnings performance and expanding footprint in digital payments, which serve as key upward catalysts. By leveraging collective intelligence, this analysis underscores the consensus view that Visa is poised to deliver strong returns, minimizing individual biases and drawing on the depth of market expertise amassed for this active trade setup.

**Key Insights:**

Visa is benefiting significantly from the ongoing shift toward cashless payments globally, establishing dominance not only in traditional card networks but increasingly in alternative payment technologies such as mobile wallets, peer-to-peer transfers, and cross-border solutions. Recent quarterly earnings showed double-digit growth in net revenues, driven by increasing consumer spending and resilient transaction volumes across all regions. Traders have pinpointed Visa’s ability to grow margins amid inflationary pressures, leveraging pricing power as payment volumes increase.

A notable catalyst is Visa’s drive toward innovation, such as expanding its “Tap to Pay” features and integrating blockchain payment solutions, enabling the company to connect with tech-savvy users. Visa’s aggressive capital deployment strategy—including share buybacks—is seen as providing long-term shareholder value while enhancing liquidity for the stock in public markets. With elevated economic activity and travel continuing globally, Visa remains well-positioned to see continued transactional growth, especially in cross-border transactions that fetch higher margins.

**Recent Performance:**

Visa has gained over 12% in the past three months, showcasing renewed investor confidence following a strong fiscal Q3 earnings report. The market responded positively to Visa’s announcement of higher transaction volumes, particularly fueled by international travel recovery and holiday-spending trends. Moreover, Visa’s stock recently broke above its 50-day moving average line, reinforcing the bullish outlook. The price action displayed resilience, with sharp upward momentum during periods of index volatility, confirming Visa’s status as a defensive yet growth-oriented stock within the fintech space.

**Expert Analysis:**

Technical analysts highlight consistent higher lows in Visa’s chart patterns, signaling sustained demand zones just below $340 levels. Furthermore, Visa’s Relative Strength Index (RSI), currently hovering near 60, indicates room for upward movement without overbought exhaustion. The MACD has crossed into positive territory, reflecting increased buying momentum. Additionally, industry analysts see Visa’s business fundamentals as robust, citing its strong operating cash flow and doubled-down investments into expanding its merchant partnerships globally. The consensus among trading professionals underscores Visa’s long-term competitive moat in capturing higher-margin digital payments worldwide as its primary driver of valuation growth.

**News Impact:**

Recent news about Visa’s collaboration with several fintech startups focusing on cryptocurrency payment integration has heightened optimism among traders. This confirms market leadership ambitions by Visa while capitalizing on new revenue streams in blockchain-based transactions. Moreover, the ongoing rollout of Visa’s expanded partnerships with major global banks ensures upward revisions to payment transaction growth rates. Macroeconomic concerns around inflation appear less impactful, as Visa generates substantial revenue from fee-based structures regardless of economic pressures. Continuing strategic news updates on innovation pipelines adds further merit to traders’ bullish sentiment.

**Trading Recommendation:**

Taking all factors into account, Visa stands out as a powerful growth candidate in the payment solutions sector, showing potential upside as its strong market position aligns with favorable consumer trends and innovative product rollouts. Traders should consider establishing LONG positions at the current price of $344.47, with targets set at $360.00 and $375.00. Employ prudent risk management by placing stop levels at $340.00 and $335.00, ensuring downside protections while capturing significant bullish momentum. Visa’s leadership in both traditional and emerging payment technologies justifies sustained optimism for mid-term price appreciation.

Do you want to save hours every week?

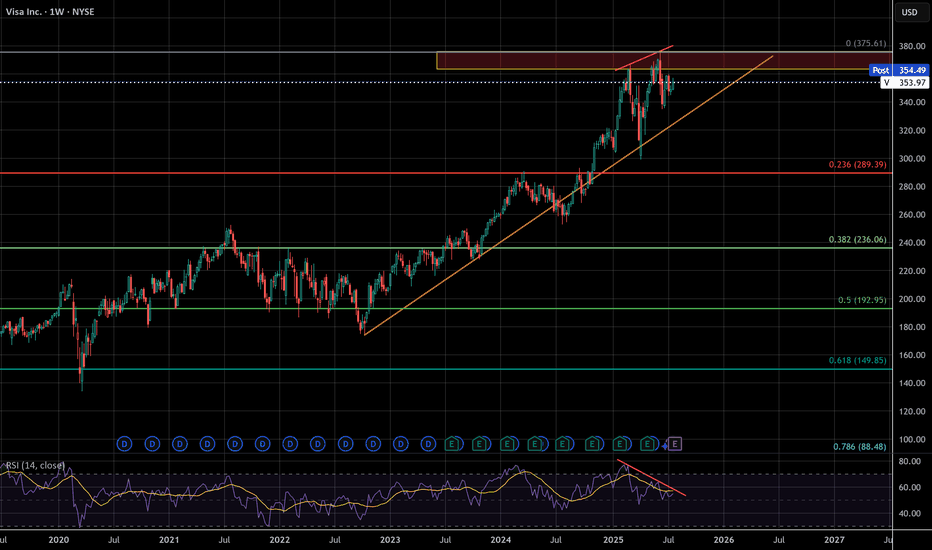

VISA Chart Fibonacci Analysis 080325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point 339/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

VISA - The missing puzzle piece - Suffering from successI've seen a lot of negative sentiment online lately about the impending bubble, but even with social media, crude AI, and the US dollar being the peak of that negativity this whale has been dying slowly and few have taken notice.

VISA has begun to censor what can be bought, overcharge merchants, and short change banks on interchange fees. These are acts of desperation as growth reaches diminishing returns, the beginning decline of a massive company. Think about it, who isn't using visa already? They have to wait for new users to be born. There will only ever be more competition, competition that has superior speed, accuracy, efficiency, and cost.

VISA may not lead this crash, but it's days look to be numbered unless they make radical changes . According to google results, antitrust violations can carry 3 times the monetary penalty gained from illegal activity. I don't think this will happen, but it's a TON of leverage for a massive settlement. The cracks are just beginning, but this company is made of glass

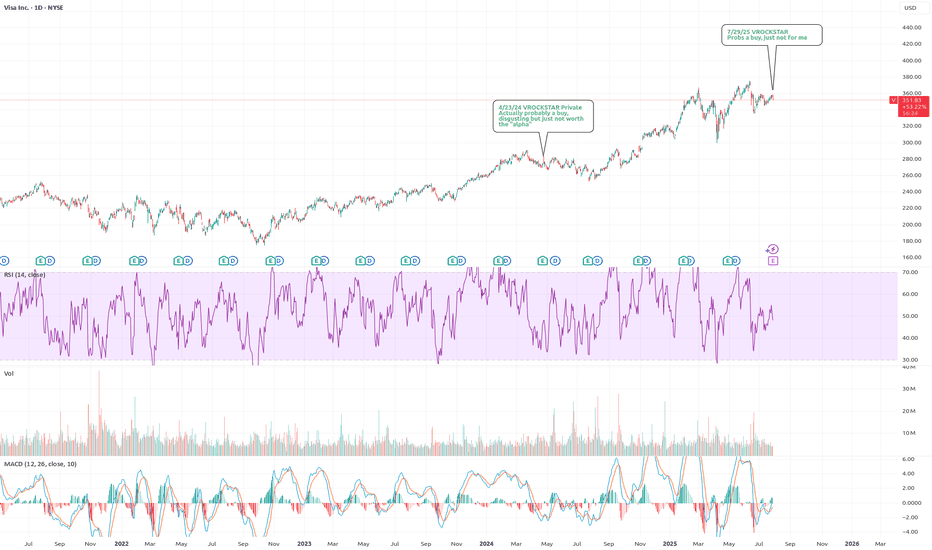

7/29/25 - $v - Probs a buy, just not for me7/29/25 :: VROCKSTAR :: $V

Probs a buy, just not for me

- over 3% fcf yields, growing, consumer spending well

- over time (probably long duration) I think the biz model probably gets eroded, but also mgmt has done a nice job evolving, perhaps they keep up with the times etc.

- don't think anything is broken here

- all else equal a nice barometer for the consumer names in my portfolio (deck, lulu)

- i'd guess stock is higher on this print

- just have too many other things going on to play this $666 bn EV

V

V will be joining crypto soon... BULLISH UPSIDETechnical Analysis: Visa Inc. (V) – Thesis: V will integrate cryptocurrency in the near future.

The chart shows a symmetrical triangle pattern forming on Visa Inc. (V), which is a consolidation pattern often leading to a breakout in the direction of the prevailing trend — which in this case, has been bullish since the April lows.

Bullish Case

Breakout Confirmation: Price has now broken out above the descending resistance of the triangle (~$350) and is trading at $353.27. This breakout is being accompanied by moderately increasing volume, which is a positive signal for confirmation.

Rising Trendline Support: The ascending trendline from the April lows continues to hold, supporting the broader uptrend.

Next Key Resistance Levels:

$360 – Local consolidation and horizontal resistance level

$375 – Previous swing high from mid-June

$390–395 – All-time high resistance zone

Stop Loss Levels

Aggressive Stop: Below the breakout candle low (~$348)

Conservative Stop: Below ascending trendline and prior swing low support (~$342)

Hard Stop: Break below $338 would invalidate the triangle pattern and signal trend weakness.

Risks

Slower global consumer spending or recessionary pressures

Regulatory risk (especially around interchange fees)

Competition from fintech disruptors (though Visa is often a partner to them)

Summary: Bullish Thesis on Visa (V)

Technical: Breakout from symmetrical triangle backed by volume and strong trendline support

Target: $375 → $390 → $405+

Stop-Loss: Tight at $348, looser at $342 or $338

Fundamental: Strong earnings power, dominant market share, resilient cash flow, and secular tailwinds from digital payments

If price holds above the breakout level and the volume stays supportive, Visa may be setting up for a sustained run toward all-time highs into Q3 earnings.

VISA on a strong Bullish Leg targeting $440.Visa Inc. (V) has been trading within a Channel Up pattern since the October 10 2022 market bottom. After December 2022, every test of the 1W MA50 (blue trend-line) has been the most optimal long-term buy opportunity, being also a Higher Low (bottom) of the pattern.

Every Bullish Leg has been +5% stronger than the previous, which leads us to believe that the current Bullish Leg will peak at around +49.50% (+5% from +44.60%). This translates to $440 Target towards the end of the year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

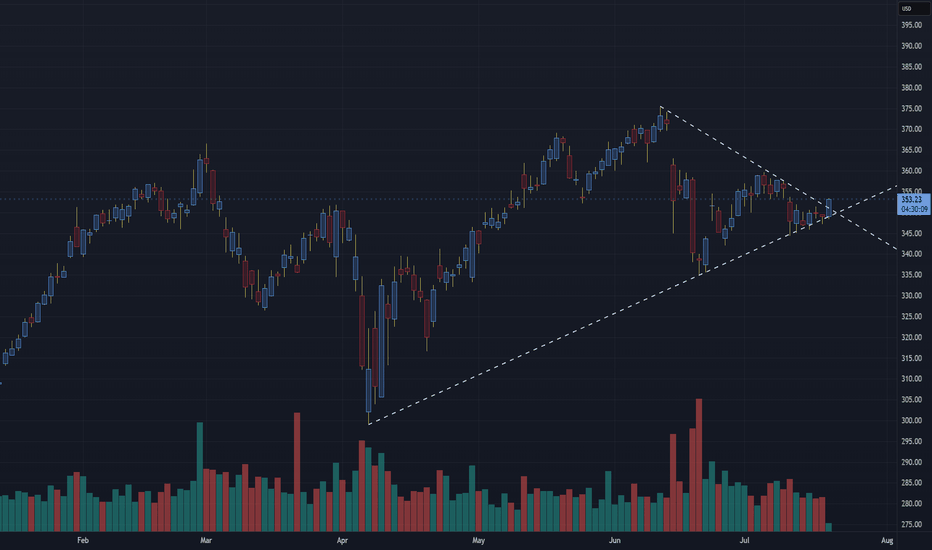

Visa Wave Analysis – 19 June 2025

- Visa broke daily up channel

- Likely to fall to support level at 332.90

Visa recently broke the support zone located between the support level 345,00 (which reversed the price earlier this month) and the 38.2% Fibonacci correction of the upward impulse from the start of April.

The breakout of this support zone coincided with the breakout of the daily up channel from April – which accelerated the active wave 4.

Visa can be expected to fall to the next support level at 332.90 (former minor support from April and the target for the completion of the active wave 4).

Visa: Resistance ApproachingThe next key step for Visa should be overcoming resistance at $394.49 during magenta wave . However, if support at $339.61 fails to hold, our alternative scenario (33% probability) will be activated—suggesting the recent high already marked the end of the corrective wave alt. in magenta. In that case, a renewed decline below the $299 mark would be likely, aiming to complete the alternative turquoise wave alt.4 on a larger scale.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

VISA - A Pump & Dump? Help me understand please.To places where no stock price has ever gone before..

What makes VISA so special?

The credit industry is currently staring into the abyss due to massively rising payment defaults.

Why is VISA skyrocketing in price, breaking through every barrier as if they were made of butter?

I don't know, and I'm very puzzled.

What will happen if economic conditions become even more difficult and the madness we're currently experiencing fully hits, and hardly anyone can service their consumer debt anymore?

I think at that point, VISA will look like a

Pump & Dump too like many others.

I'd appreciate any info on why VISA is rising so much.

Strategic Entry in Visa (V): Stability, Growth, and Opportunity📈 Strategic CALL Entry on VISA (V) – All 20 Criteria Met

Today I’m entering a CALL option on Visa (V) based on a comprehensive analysis that aligns with all of our 20-entry criteria, combining technical indicators, fundamental strength, and disciplined risk management.

But beyond that, we are also factoring in key macroeconomic catalysts and upcoming earnings, which strengthen the setup and give us a clear path for growth.

🔍 Why Visa – and why now?

✅ Meets all 20 internal criteria, including:

Price above both the 50- and 200-day moving averages (clear uptrend)

RSI in a healthy range (not overbought)

Volume confirms price action

Consistent earnings performance

Strong sector momentum (payments & fintech)

Sound risk-to-reward structure (<6% of portfolio risk)

Positive analyst sentiment

Solid balance sheet, low debt, global dominance, etc.

📊 Earnings expected in June

Visa is set to report earnings in June. Forecasts suggest strong performance backed by increasing digital transactions and resilient global spending. A positive surprise could trigger a sharp upward move.

🌍 Macroeconomic backdrop: US GDP data out today at 8:30 AM (EST)

GDP expectations stand at +2.2%. If confirmed, it signals continued economic strength — a bullish sign for consumer-facing companies like Visa that benefit directly from transaction volume growth.

💡 Why Visa stands out:

Stability

Steady growth

Low volatility

Strong technical and fundamental alignment

📌 Bottom line:

Visa not only checks all our boxes internally, but also benefits from a favorable macroeconomic context and key catalysts ahead. This is a high-conviction, low-emotion trade backed by structure, not hype.

Visa Challenge Resistance at $362Visa is one of the greatest companies, with a solid business model and a profit margin of 50%.

The stock has hit resistance at $362 and is currently testing that level. If the share price breaks above it, we could see a continued uptrend to new highs. However, if it fails to break out, a pullback might be expected.

"King of Cards" How Does Visa Make Money?NYSE:V

To be honest, VISA stock is the kind of investment that really feels solid and reliable. I bought a bit of VISA a few years ago, and before I knew it, the price had climbed past $300 and I started getting those occasional dividend notifications. The dividends aren’t huge, but it’s nice to see that money coming in automatically. I can see why so many dividend investors like VISA.

VISA is, of course, the same “VISA” you see on your credit cards. Globally, they dominate the credit card market, with nearly half of the market share, and they’re among the top 10 biggest companies in the US by market cap.

These days, cashless payments have become the norm, and that trend really works in VISA’s favor. Most analysts expect VISA to keep growing steadily, with annual revenue and profit increases of around 10%. VISA has also raised its dividend every year for over 16 years, making it a classic “dividend growth” stock. The yield itself is under 1%, but the key is that the dividend keeps getting bigger.

Recently, VISA’s been expanding into new businesses too-like Visa Direct for money transfers-so they’re evolving from just a credit card company into a global payments platform. Maybe that’s why even Warren Buffett has invested in VISA.

Of course, there are risks. There’s always talk of antitrust regulation, and new fintech companies like PayPal are trying to take market share. In fact, VISA’s stock has underperformed the market a bit in the last few years. But VISA’s economic moat (the barriers that keep competitors out) is still very strong.

Looking at the current price, VISA’s P/E ratio is actually a bit lower than its five-year average, so some people think it’s undervalued right now. That’s why I think VISA is a stock you can hold in your portfolio for the long term and feel pretty comfortable about.

- VISA is the clear leader in global payments, and as we move toward a cashless society, its growth prospects look strong.

- The dividend is small but growing every year, and the stock price has trended upward over the long term.

- There are risks like regulation and fintech competition, but most still see VISA as a solid investment.

Maybe you like this Video deal with VISA

below comment!

V | Waiting for Dip | Extended Price | (May 2025)V | Waiting for Dip | Extended Price | (May 2025)

1️⃣ Insight Summary

Visa has been on a strong long-term uptrend and continues to deliver solid financials. However, current price levels seem a bit stretched, and I'm looking for a better risk-reward entry zone.

2️⃣ Trade Parameters

Bias: Long (on pullback)

Entry Zone (Watchlist): $300 – $275

Stop Loss (if entered): Below $251

TP1: $295 (first bounce zone)

TP2: $322

Final Target: $346

Partial Exits: TP1 for early profits, TP2 and beyond for longer-term hold.

3️⃣ Key Notes

💰 Visa posted strong earnings ($2.80 EPS) and impressive revenue ($35B), with a solid net income margin.

🏦 The company benefits from its tight integration with the banking system and steady cash flow (~ SEED_TVCODER77_ETHBTCDATA:4B ).

📉 Debt is manageable at FWB:20B , and Beta at 0.72 shows less volatility than the market—ideal for steady investors.

⚠️ Despite these positives, price looks extended, and I’d prefer a pullback toward $300 or $275 before considering an entry.

📊 Technically, there are signs of a possible bearish divergence forming—this supports the idea of waiting for a better level.

4️⃣ Follow-up Note

Visa remains on my radar, but no trade until we see a clearer technical pullback or structure reset near my ideal buy zone.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

VISA:Respecting the 61.8% Fibonacci Level and Going for New HighWho doesn't know VISA? Almost everyone has or has had a VISA card. VISA stock has an unbeatable bullish outlook, which, like all stocks on the stock market, has retraced its rise.

---> What is its current situation?

If we look at the chart, its appearance is CLEARLY BULLISH (Bull), having gone through a retracement phase. The retracement it has made is EXACTLY THE 61.8% Fibonacci, AND IT HAS RESPECTED IT. Since reaching that retracement on March 14, the price has not stopped rising. It is currently BREAKING KEY ZONES to initiate an attack on NEW HIGHS IN VALUE. If it surpasses the 352 zone, it will go directly to the highs, and will most likely break them to explore new prices for the stock.

--------------------------------------

Strategy to follow:

ENTRY: We will open two long positions if the H4 candle closes above 352.

POSITION 1 (TP1): We close the first position in the 366 zone (+4%) (highs zone).

--> Stop Loss at 336 (-4.2%).

POSITION 2 (TP2): We open a Trailing Stop position.

--> Initial trailing stop loss at (-4.2%) (coinciding with the 336 level of position 1).

--> We modify the trailing stop loss to (-1%) when the price reaches TP1 (366).

-------------------------------------------

SET UP EXPLANATIONS

*** How do I know which two long positions to open? Let's take an example: If we want to invest €2,000 in the stock, we divide that amount by 2, and instead of opening one position of €2,000, we'll open two positions of €1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but it automatically closes the trade if the market price suddenly moves in an unfavorable direction by a specified distance. This specified distance is the trailing Stop Loss.

--> Example: If the trailing Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% during increases. Therefore, the risk decreases until the position enters a profit. This way, you can take advantage of very strong and stable price trends, maximizing profits.