Weekly Bearish Key Reversal on XLFXLF has provided a great trend (and moral support) to the bullish trend we've seen recently. However a Weekly Bearish Key Reversal on XLF might be a moment for a pause before data later this week and FOMC the week after. Take a look at some of the US Banks weekly charts as well.

Key stats

About Financial Select Sector SPDR Fund

Home page

Inception date

Dec 16, 1998

Structure

Open-Ended Fund

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

SSgA Funds Management, Inc.

Distributor

ALPS Distributors, Inc.

ISIN

US81369Y6059

XLF offers efficient exposure to the heavyweights in the US financials segment. Its cap-weighted, S&P 500-only portfolio means that its concentrated in large banks and avoids small-caps. For many investors and traders, XLF has been the go-to ETF for financials exposure, although there are more comprehensive funds out there for long-term exposure. Note: XLF spun off its real estate exposure in September 2016, consistent with the GICS reclassification that elevated real estate to sector-level status. The change was material: Real estate comprised about 20% of the fund at the time. For each share held, XLF shareholders as of 9/16/16 received 0.139146 shares of XLRE, State Street Global Advisors' real estate ETF. (Immediately prior to the distribution, XLF had swapped its REITs for shares of XLRE.)

Related funds

Classification

What's in the fund

Exposure type

Finance

Stock breakdown by region

Top 10 holdings

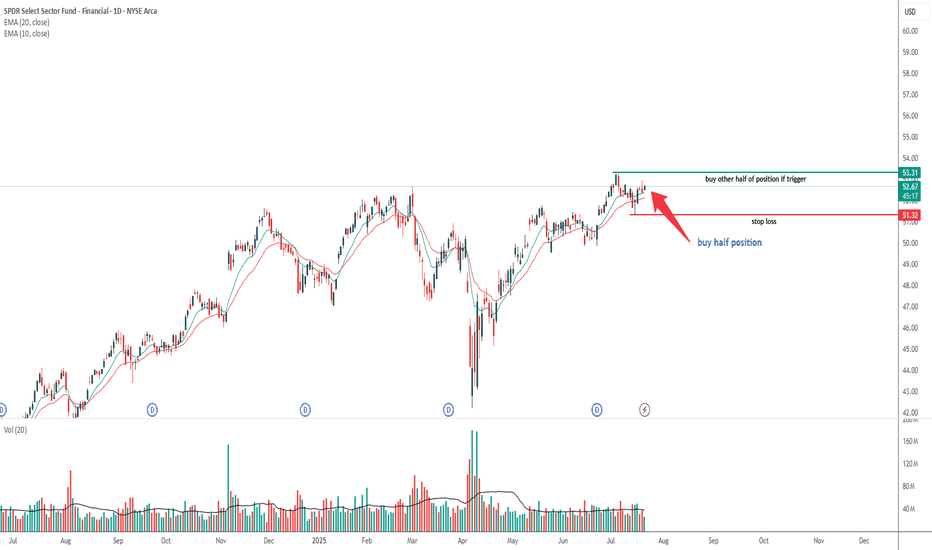

Pre-Earnings Breakout in Financials?Financials could be attempting a breakout, two weeks before the sector kicks off earnings season.

The first pattern on today’s chart of the SPDR Select Sector Financial ETF is the price level around $52. XLF stalled at that zone in February after peaking about 1 percent below it in November. Februa

The Big Banks are in BIG TROUBLEAs you can see on this weekly chart, the XLF has been in this steady up trend since October 2023. It bounced off this upward slopping trendline 3 different times and then finally broke through it on the 4th hit, then came back up to test the underside of the trendline as resistance. It did get back

Rhythm of the Great BearUndead Bear Captain's Log

April 27, 2025

Will make one final attempt to chart and navigate the murky waters of the Great Bear.

XLF may be a good candidate with still distinct waves, like XRT, XLRE and XHB.

All other sectors, especially SPY are skewed by tech, same-day options and basically uncharta

XLF Trade LevelsThe financial sector interests me, especially with an upcoming interest rate meeting, earnings report, and declining consumer sentiment.

Ultimately, I like to swing the Sector ETF's but they also make for affordable day trades!

With XLF being in a tight range on the Weekly+ timeframes, it makes i

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

XLF assets under management is 54.96 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

XLF invests in stocks. See more details in our Analysis section.

XLF expense ratio is 0.08%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, XLF isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

Yes, XLF pays dividends to its holders with the dividend yield of 1.34%.

XLF shares are issued by State Street Corp.

XLF follows the S&P Financial Select Sector. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Dec 16, 1998.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.