Trade ideas

3-Year Range Breakout in MotionXYZ is shaping up for a potential breakout after nearly three years of range-bound accumulation and it looks like it wants to push through relatively soon. Granted there is a key supply structure just above (marked), which should be respected, but given the duration of the base, a clean push through wouldn’t be surprising.

We’re watching for how price reacts in this zone:

A clean breakout could trigger a swift move toward higher levels.

A rejection would likely lead to a rebuild phase before another attempt.

Either way, the structure remains bullish.

Trade Scenario

Entry: Current price

Stop Loss: Below the LPS, with room for potential wicks

Take Profit:

TP1: Near the equilibrium of the supply zone (first reaction zone)

TP2: Near the all-time high

TP3: Trail stop below each new swing low to capture extended move

Block (XYZ): Weak Earnings, Bitcoin Exposure, and the Next Move📊 Fundamental Overview

I entered Block (XYZ) about a year ago when the company’s cash flow trends were very strong.

However, right now the picture is becoming more concerning.

EPS growth is not stable.

Previously, EPS was growing rapidly (65%, 38%, 155%), but the last two quarters showed only –10% and +13% growth.

Revenue growth stagnated.

Year-over-year revenue used to grow strongly —

2019: $4M → 2020: $9M → 2021: $17M → 2023: $21M → 2024: $24M — but is now roughly flat (~+1% YoY).

Forward P/E: ~22.7 — not particularly attractive considering the company’s decelerating fundamentals.

Share dilution stopped.

Since 2022, Block has halted share issuance, and total shares outstanding remain stable within ±2%, which is a positive signal compared to other fintech peers.

💥 Q3 Earnings Miss

In the latest earnings report:

Expected EPS: $0.63 → Actual: $0.54

Revenue: $6.11 B (below expectations)

The miss triggered a 15–18% drop after earnings, followed by a partial rebound as dip buyers stepped in.

But fundamentally, the company is clearly losing growth momentum.

₿ Bitcoin Exposure Risk

Block currently holds about 8,700 BTC (~$1 billion) on its balance sheet.

While this gives long-term upside potential, it also adds massive volatility risk.

If Bitcoin enters a –70% correction (which I expect in the next 3–4 months), that could hit Block’s balance sheet hard and accelerate the drawdown.

📈 Technical Structure

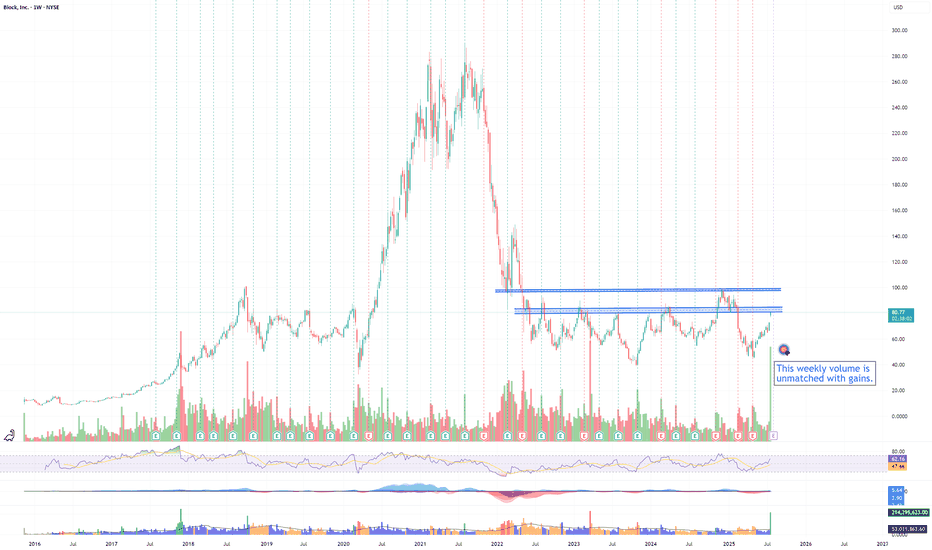

Technically, the stock has already corrected about –86% from its all-time high.

We’re currently sitting inside a major accumulation cluster between $50–80 — a very strong volume node.

If this cluster breaks down, the next major support zone is $8–15, which would imply a potential –90%+ drawdown, typically a “pre-bankruptcy” level of decline.

After the latest earnings report, XYZ dropped by nearly 18%, forming a noticeable gap down. However, the volume on this sell-off was relatively low compared to the massive volume spikes seen in July 2025.

Typically, such sharp post-earnings drops come with high capitulation volume, signaling panic selling and potential bottom formation, but this time, that confirmation is missing.

This raises the risk that the current decline might not yet be over, and that smart money may still be waiting lower, around the next demand zone.

From a wave-structure perspective, it looks like wave 1 is complete, followed by a sharp corrective move that has already exceeded the typical 38–62% retracement range, falling by about 86%, an unusually deep correction, but not impossible within a prolonged cycle.

The ongoing consolidation phase has lasted significantly longer than previous ones, which increases the probability of a final downward push, forming a classic zigzag pattern (A–B–C), a drop, consolidation, and one more leg down to complete seller capitulation.

Volume patterns in such structures usually peak in the middle of the formation, aligning with current price behavior.

Technically, both outcomes remain open,

we could see a short-term bounce from this zone or a double zigzag (dZ) structure unfolding lower before the true bottom forms.

Upside momentum currently lacks fuel, fundamentals don’t support a strong rally yet.

If price breaks above $100, the next upside target sits around $280, offering roughly 4× potential from current levels.

So the setup remains binary, either accumulation continues before reversal, or we break down further in sync with BTC weakness.

⚠️ Risk View

Fundamental growth has stalled.

Earnings miss raises red flags.

Bitcoin exposure magnifies downside risk.

If price breaks below $32–30, that would confirm a breakdown, potential free-fall to $8–15.

On the positive side, the company stopped share dilution, maintains good liquidity, and still has strong brand power in fintech.

🧩 My Position

I currently hold a protected position (protective puts) till march 2026, limited downside, but I’m considering a full exit.

There’s no visible fuel for strong upside, and with BTC risk rising, the short-term picture remains shaky.

If we see capitulation into the $30–40 range with BTC bottoming, that could be a smart-money accumulation zone again.

🔑 Key Levels

$100 → breakout confirmation, opens path to $280

$50–80 → main accumulation cluster

$32–30 → invalidation / stop-loss zone

$8–15 → next major demand zone if breakdown continues

🧭 Summary

Block’s fundamentals are slowing, its Bitcoin exposure is a double-edged sword, and technically we’re at a critical level.

If BTC corrects sharply, Block could retest the $30–40 area or even lower, but if it holds and reverses above $100, the next bull wave could be massive.

At this stage, risk management and patience are key.

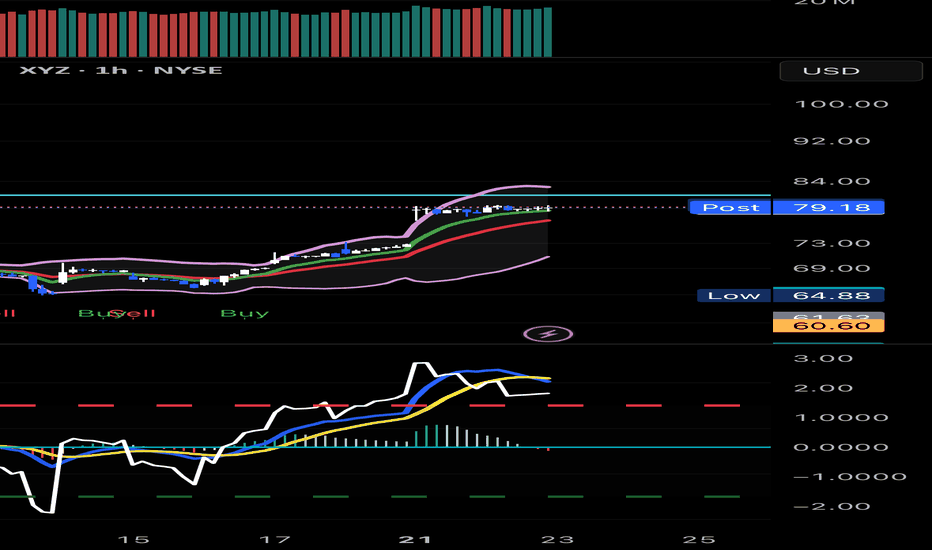

XYZ is looking likely to form a Bullish Flag Patternafter a surge of price and then a long consolidation phase, XYZ may burst through the 82.44 resistance and go on a rally. the recent 50\200 MA semi-golden cross and the likely upcoming 150\200 MA golden cross are making the bullish speculative more likely.

XYZ - Blocks stacking up=======

Volume

=======

- slight decrease

==========

Price Action

==========

- Broken out downtrend line of 3 years, rebounded and supported above trendline

- Bullish flag forming

- Double bottom noticed

=========

Oscillators

=========

- Ichimoku

>>> price closed above cloud

>>> red kumo thinning

>>> Tenken + Chiku - piercing clouds and sloping upwards

>>> Kijun - remains neutral

- MACD bullish

- DMI turning bullish

- StochRSI, bullish and reversed within band

=========

Conclusion

=========

- short to long term swing

- price may reverse at current level, to enter spot or wait for pullback at entry 2.

Block - a potential break out of a bullish flagFollowing a significant downtrend, the stock NYSE:XYZ has been consolidating since May 2022, trading within a range of $45–$50 and $90.

Within this broad consolidation, the price has repeatedly reacted to the $81–$82 level. Recently, after a sharp rally from $45, the stock is now consolidating right below this levela, forming a bullish flag pattern.

A breakout to the upside could propel the price toward the $98–$99 level, as suggested by the volume profile. With a dynamic breakout and a tight stop-loss set around $78, the risk-reward ratio could exceed 5:1.

Bearish potential detected for XYZEntry conditions:

(i) lower share price for ASX:XYZ along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $111.02 (open of 24th February).

Depending on risk tolerance, the stop loss for the trade would be:

(i) above the previous swing high of $117.25 from the open of 4th September, or

(ii) above the potential prior resistance of $118.99 from the open of 19th August, or

(iii) above the previous swing high of $124.00 from 29th August.

Bullish trendline keeps beeing rock solid 📈 We can clearly see a bullish trendline confirming the trend since mid-May.

✅ The trendline has been tested and confirmed on multiple occasions, especially over the last two weeks.

🔥 The candles that broke through ended up attracting a huge amount of buyers, turning them into extremely bullish candles. The wicks at times indicate traders clearly respecting the trendline, while the closely following 50-day SMA has so far acted as a reliable safety net.

🎯 I’ve used the trendline and SMAs to trade short term multiple times, and it has worked wonderfully so far.

🟢 Once we reach the trendline or the SMA, I go long. If we break through the 50 and 200 SMAs and close beneath them (important!), I’m out.

💰 So far, this has brought me some nice gains. If the trend breaks: so be it. It has already given me great opportunities. Winning five times and losing once should always be considered a huge win in trading, as long as you manage your risk.

⚠️ This is not financial advice! I just wanted to share how it has played out for me so far. At the very least it might help others see similar patterns in the future. For now, as long as the trendline holds, my personal outlook remains bullish. If we break it, we might see bearish momentum.

XYZ Bullish Setup: Pending Entry & Target Strategy!📌 Asset & Plan

XYZ (Block, Inc.) NYSE | Swing/Day Trade

Plan: Bullish 💹 (Pending Order Setup)

Breakout Entry: Near $83.00 ⚡ (Set alerts to catch the breakout!)

🧩 Thief-Style Layer Strategy

Multiple limit layer entries after breakout: $82.00 / $80.00 / $78.00

Scale your positions according to your risk appetite and strategy 📈

Stop Loss: $74.00 (adjust as per your risk) ⚠️

Target: $92.00 🏁

📊 Real-Time Market Snapshot (Sep 1, 2025)

Current Price: $79.64

52-Week Range: $46.53 - $98.92

🧠 Investor Sentiment

Retail: Moderately Bullish (60% Greed) 🟢

Institutional: Cautiously Optimistic (55% Greed) 🟡

Fear & Greed Index: Neutral → Greed (58/100) 📊

💹 Fundamental & Macro Highlights

Fundamentals (6.5/10) ✅

Undervalued by ~29% (Intrinsic Value: $111.64)

EPS Growth (2026 Est.): +39.49% YoY

Revenue Growth (2025 Est.): +2.92% YoY

Strong solvency & healthy gross margins

Macro Environment (6/10) 🌍

Market Volatility: Low

Safe Haven Demand: Moderate

Interest Rates: Stable (Fed rate cuts expected late 2025)

🐂 Overall Market Outlook

Bullish Score: 65% 🟢 (S&P 500 inclusion & strong analyst targets)

Bearish Risks: 35% 🔴 (slowing revenue growth & competition pressures)

💡 Bottom Line

XYZ is undervalued with moderate bullish sentiment. Use layered entries to optimize risk/reward, set alerts for breakout, and monitor macro factors. 🚀

#NYSE #StockTrading #SwingTrade #DayTrade #BullishSetup #BreakoutAlert #LayerStrategy #XYZStock #TechnicalAnalysis #MarketInsights #TradingIdeas

Block Inc XYZ is a buy for meThe stock decline appears to stem from a combination of recent earnings results, slightly softened guidance, and general fintech sector caution.

Investor sentiment toward fintech remains cautious. Other POS and payments firms, even when posting decent earnings, have seen significant stock swings due to heightened sensitivity over consumer behaviour and growth trajectories.

My take:

Not spending a lot on physical properties like the Brick-and-mortar business model is an advantage for XYZ.

I am buying this stock for mid to long-term holding

Stock Of The Day / 08.08.25 / XYZ08.08.2025 / NYSE:XYZ

Fundamentals. The earnings report did not meet expectations.

Technical analysis.

Daily chart: Uptrend. Local maximum 82.18 ahead.

After-hours/Premarket: Gap Up on increased volume. At the same time, the price was unable to update the after-hours high. We mark the after-hours low of 74.55.

Core session: The primary impulse from the opening was stopped at 78.0. The next attempt to rebound from the level around 10:00 p.m. was unsuccessful and the price breakdown the level and stood in the trading range below the level. We are considering a short trade in case exit down from the trading range.

Trading scenario: breakdown of level 78.0

Entry: 77.54 when exit downw from the trading range below the level.

Stop: 78.26 we hide it above the high of the trading range.

Exit : Cover part of the position before the level of 74.55 (RR 1/4). Cover the rest of the position at a price of 74.89 when the structure of the downward trend is broken (RR 1/3.7)

Risk Rewards: 1/3.8 (1/4 max)

P.S. In order to understand the idea of the Stock Of The Day analysis, please read the following information .

XYZ momentum is buildingXYZ positive weekly volume this week is a first in its history! Even though it has never had this much 'green' volume in its weekly history, there is plenty of resistance to be overcome for this stock

$81-85 will be challenging as sellers all the way from 2022 will begin dumping shares, especially when uncertain market conditions will be pushing them to sell. If it consolidates at 85, plan for a move to 98, where there will be another wave of sellers from Dec 2024 and 2022.

XYZ moves will parallel the BTC market with a lag. When BTC breathes, XYZ will breathe. With a BTC bull, expect XYZ to run.

Rating is neutral as this needs to break through resistance prior to accumulation, not the other way around.

Block | XYZ | Long at $64.84Block's NYSE:XYZ revenue is anticipated to grow from $24 billion in FY2024 to $32 billion in FY2027. With a current price-to-earnings ratio of 13.8x, debt-to-equity ratio of 0.36x, and rising cash flow in the billions, it's a decent value stock at its current price. Understandably, there is some hesitation among investors due to competitive fintech market and economic headwinds. But, like PayPal NASDAQ:PYPL , growth is building.

From a technical analysis perspective, the price dropped to within my historical simple moving average bands. Often, but not always, this signals a momentum change and the historical simple moving average lines indicate an upward change may be ahead. While the open price gaps on the daily chart in the $40s and GETTEX:50S may be closed before a true move up occurs, NYSE:XYZ is in a personal buy zone at $64.84.

Targets:

$80.00

$90.00

$100.00

[*) $134.00 (very long-term)

A BNPL Bubble Is Actually Why I'm Bullish, For NowBNPL is growing and inflating at an increasing rate. From concert tickets to burritos, everyone is using buy now pay later. The global market is projected to hit 560 billion dollars in 2025, up from around 492 billion in 2024, and climb to 912 billion by 2030 at a compounding growth rate of 10.2%. Just in the U.S. alone, demand is expected to reach 122 billion next year and scale to 184 billion by the end of the decade. The trajectory is steep, with the structural weaknesses already showing.

Block is positioned at the center of BNPL. In Q1 2025 they reported:

2.29 billion in gross profit, up 9 percent YoY

466 million in adjusted operating income, up 28%

10.3 billion in GMV through Afterpay, with 298 million in BNPL gross profit, up 23% YoY

The stock took a hit. It dropped 9 percent in February and another 21 percent after missing Q1 earnings, but this is seen as typical early bubble behavior. There is short term fear but continuing growth and acceleration. Klarna’s credit losses, IPO delays, and regulatory friction are not problems, they are actually signals that the sector is growing faster than the market, or quite frankly, anyone can control.

BNPL is becoming the default credit system for younger consumers. It is overused and expanding too fast. That is the formula for both upside and implosion. However with that, timing will be everything here, and knowing when to close will be crucial if BNPL can't stabilize.

Baseline expectation: SQ trades in the 80 to 90 range in the short term

Midterm upside: 120 by 2027

Long-term target: 180 to 220 if BNPL stabilizes and Block captures its runway

Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout🧠 Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout 📈

WaverVanir VolanX Protocol | Long-Term Thesis | Smart Money Structure

🗓️ Chart as of July 19, 2025 | 1D Timeframe | DSS Score: High Conviction Long

📍 Technical Analysis – VolanX SMC Layer

Block Inc (SQ) is forming a macro reversal base after years of distribution and downside compression:

✅ Break of Structure (BOS) off deep discount zone

✅ CHoCH and BOS cluster near $48–$55 suggests institutional accumulation

✅ Price reclaimed Equilibrium (~$72.80) with clean volume breakout

🟥 Red zone = supply / inefficiency from 2022

🟨 Target zone = $147.62, the 2021 fair value gap top

🌐 Macro + Fundamental Catalysts

🧾 S&P 500 Inclusion Confirmed

Block (SQ) has officially been added to the S&P 500 index (as of June 2025), unlocking large inflows from passive index funds and boosting institutional exposure.

💰 Fundamental Growth Narrative:

Gross profit set to exceed $8.65B in 2025

Cash App expanding with lending, rewards, and direct deposit capture

Bitkey wallet + Proto mining chip reinforce dual revenue from crypto hardware and Bitcoin transactions

Analyst median target: $75–90; VolanX scenario-adjusted upper target: $120–147

🧭 Trade Setup – WaverVanir Playbook

📌 Accumulation confirmed. Sentiment reset. Now preparing for revaluation.

Metric Value

Entry Zone $71–75

Stop Loss Below $66

TP1 $98

TP2 $122

TP3 (macro fill) $147.62

🔐 Narrative Bias:

“S&P inclusion acts as a flow catalyst. The macro regime now favors quality fintechs with crypto rails. Block is no longer speculative—it’s foundational.”

🔺 #WaverVanir #VolanXProtocol #SmartMoneyConcepts #SQ #SMP500 #MacroBreakout #OptionsFlow #BitcoinEquity #CashApp #CryptoRails #SMC #DSS #ChartAnalysis #InstitutionalFlow

Overweight $XYZ ; Raising Price Target to $140+- BOATS:XYZ has been included to S&P 500 . It's a big news for BOATS:XYZ , this was one of the undervalued stock, treated like a dog but this company is always innovating and has strong talented employees.

- On top of that now BOATS:XYZ will get passive funds which is massive and bullish for the company.