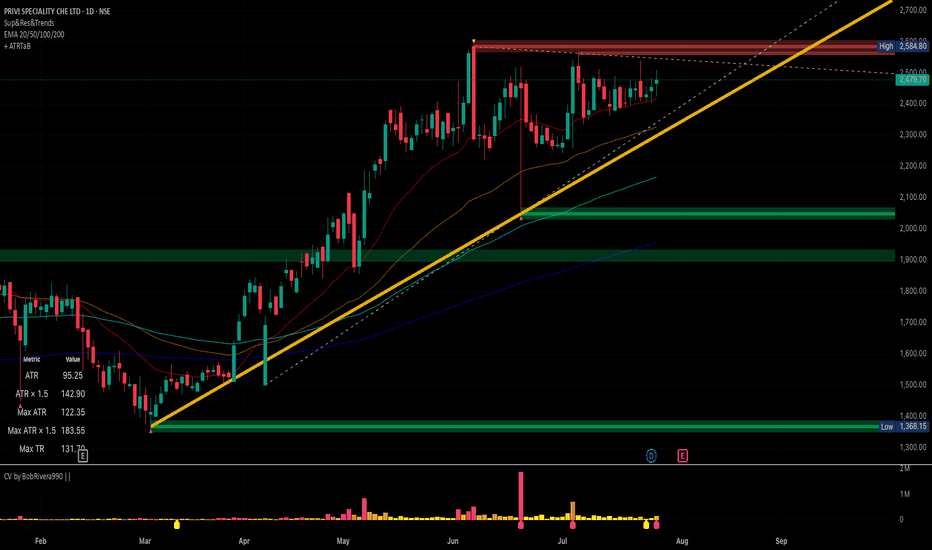

Privi Specialty Chemicals – Trendline Breakout in ActionPrivi Specialty Chemicals – Trendline Breakout in Action

NSE:PRIVISCL

📈Pattern & Setup:

Privi Specialty Chemicals is displaying a **descending trendline breakout** on the daily chart. After weeks of consolidation near the 2300–2500 range, the stock has now broken above its trendline resistance with strong bullish momentum and healthy volume — a solid technical confirmation of breakout strength.

This breakout follows a **rounding base formation**, where the stock first paused, built strength, and is now resuming its prior uptrend. The price structure indicates that supply is getting absorbed and fresh demand is pushing prices higher.

Once the stock sustains above 2520, it can extend its move toward 3000+ levels — marking a potential 20% upside.

📝 Trade Plan:

Entry: Above 2520 with strong volume confirmation.

🚩Stop-Loss: 2400 (below recent swing low).

🎯Targets:

Target 1 → 2750 (short-term move).

Target 2 → 3010 (measured move target, ~20.7% potential).

💡Pyramiding Strategy:

1. Enter 50% position on breakout above 2520.

2. Add remaining position above 2600 after retest confirmation.

3. Trail stop-loss to 2470 once price sustains above 2650.

🧠Logic Behind Selecting this Trade:

The breakout setup is clean — long consolidation, higher lows, volume support, and a decisive trendline breach. This kind of breakout generally attracts momentum traders and institutional flows, making it ideal for a swing trade setup.

Keep Learning. Keep Earning.

Let’s grow together 📚🎯

🔴Disclaimer:

This analysis is purely for educational purposes and not a buy/sell recommendation. Always consult your financial advisor or do your own research before investing.

Trade ideas

Privi Speciality propending so special moves. Privi Specialty Chemicals Ltd. is the leading supplier and exporter of aroma and fragrance chemicals. The company expanded to manufacturing capacity of 50+ products to 40,000 tons per annum with a power of two manufacturing facilities situated in Mahad, Maharashtra and Jhagadia, Gujarat.

Privi Specialty Chemicals CMP is 1109.50. Negative aspects of the company are high valuation (P.E. = 194), declining annual net profits, declining cash from operations annual and MFs are decreasing stake. Positive aspects of the company are FIIs are increasing stake and zero promoter pledge.

Entry can be taken after closing above 1150. Targets in the stock will be 1198 and 1232. Long term target in the stock will be 1289 and 1357. Stop loss in the stock should be maintained at closing below 955.

Privi - TurnaroundWith Oil prices (cooking oil) prices cooling down..used oil prices should come down as well. With this company expanding and its key raw material price cooling down this stock could be due a turnaround.

Technically there is a nice positive divergence in the RSI

Watch to go long above 1150. and keep a 5-7% stoploss.