Trade ideas

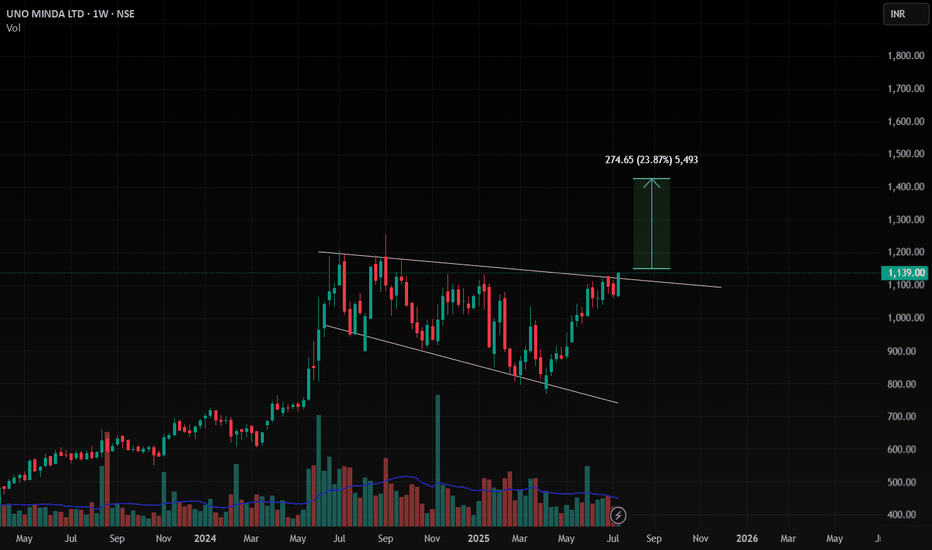

Amazing breakout on WEEKLY Timeframe - UNOMINDACheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Uno Minda Ltd (UNOMINDA) Technical & Price Action Insights

Bullish MACD on OBV:

The convergence of the MACD (Moving Average Convergence Divergence) on On-Balance Volume (OBV) suggests strong accumulation and increasing buying pressure — a positive technical signal for upward movement.

Ascending Triangle Pattern:

Uno Minda's stock chart is forming a classic ascending triangle, a continuation pattern typically indicating bullish momentum with potential for a breakout above resistance.

Breakout Zone Near ₹1,140–₹1,155:

Price is hovering just below its resistance level. If a breakout occurs on high volume, it could trigger a sharp upward move toward ₹1,250 and beyond.

Strong Volume Confirmation:

Volume has been increasing during consolidation near the triangle’s upper boundary, a sign that institutional players may be positioning ahead of a breakout.

Above 50 DMA & 200 DMA:

The stock is comfortably trading above both its 50-day and 200-day moving averages, confirming a bullish trend across short and long-term timeframes.

Fundamental Strengths

Robust Revenue & Profit Growth:

Revenue CAGR (5Y): ~22%

Profit CAGR (5Y): ~41%

Uno Minda has consistently posted strong top and bottom-line growth, supported by increasing demand from OEMs and expansion into EV components.

Solid Operating Margins & ROE:

OPM stable at ~11–12%

ROE: 17.5%

These margins are consistent with premium auto component manufacturers and reflect operational efficiency and pricing power.

Diversified Product Portfolio:

Uno Minda offers 25+ auto component systems catering to ICE and EV platforms — mitigating industry-specific risks and positioning the firm for long-term secular growth.

Capex-Driven Expansion:

Recent AGM approvals include a ₹2,500 crore fund raise, indicating aggressive investment plans, possibly in R&D, automation, or EV capacity expansion.

Institutional Support & Strong Promoter Holding:

Promoter Holding: ~68.7%

Increasing FII interest over recent quarters

A steady promoter stake and growing institutional interest highlight market confidence in the company’s long-term outlook.

Conclusion:

With a bullish technical setup, strong fundamental tailwinds, and growing demand from both traditional and EV auto segments, Uno Minda looks poised for an upside breakout. A sustained close above the triangle resistance could unlock a new leg of rally — making it a stock to watch closely in the short to medium term.

Technical Analysis – UNO MINDA LTD (June 27, 2025)UNO MINDA is showing strong bullish momentum after forming a base and reclaiming the 200 EMA. The breakout from the falling channel and consolidation near resistance suggest strength. As long as it sustains above ₹1020, accumulation in the 1100–1110 range is favorable for a move toward ₹1300+

Weekly Chart:-

Daily Chart:-

The stock has:

Formed a strong base around ₹850–₹900.

Broken above the 200-day EMA with strength.

Recently made higher highs and higher lows, which is a bullish price structure.

Consolidated near a resistance zone (around ₹1100–₹1120) and is now trying to break above it.

Chart Pattern Insight:

The stock was earlier trading within a downward-sloping channel (black trendlines).

It has recently broken out of the upper boundary of this channel.

A horizontal resistance zone (highlighted in red) around ₹1110 is currently being tested.

If the price closes convincingly above ₹1120, it would confirm a bullish breakout.

Uno Minda Ltd – Coiled for a Breakout🚗 Uno Minda Ltd – Coiled for a Breakout After 38% Correction!

📉 Stock Background & Current Structure:

Uno Minda Ltd, a key player in the automobile components sector, has corrected nearly 38% from its all-time high of ₹1,255. The recent low was recorded around ₹867, which is close to a key swing level.

What's interesting is that the stock recently:

Swiped the latest swing low, potentially triggering stop hunts and liquidity grabs.

Has been consolidating in a tight range (₹915–₹880) for the last 9 trading sessions.

This behavior typically signals absorption of selling pressure and potential preparation for an explosive move.

🧠 Why This Trade Setup?

A strong support base is being formed in the consolidation range.

Despite a lower-low formation on the higher timeframe, price failed to break down aggressively.

This indicates that smart money might be accumulating.

If the price breaks out of this consolidation range, it offers a great swing trade setup with a well-defined risk-to-reward profile.

🎯 Trade Plan:

Element Levels

Entry On breakout above ₹915

Stop-Loss ₹870 (just below swing low)

Target 1 ₹993

Target 2 (optional) ₹1,070

Target 3 (longer term) ₹1,150

We are currently focused on Target 1, and will assess further upside if momentum sustains.

🔍 Technical Perspective:

Consolidation zones often lead to strong directional moves.

Recent swing low swipe signals liquidity grab — a common sign before reversals.

A breakout will confirm short-term trend reversal on lower timeframes.

This is a classic "base + breakout" setup loved by both swing and positional traders.

🔔 What Led Me to Update This Analysis?

Significant price correction offering value

Repeated tests of support without breakdown

Range-bound movement suggests seller exhaustion

Structure aligns with high-probability breakout pattern

📌 Summary:

Stock: Uno Minda Ltd

Sector: Auto Parts / Manufacturing

Strategy: Breakout Swing Trade

Risk Level: Moderate (tight SL, defined setup)

📢 Don’t Miss Out!

✅ Follow me so you don’t miss the next breakout opportunity!

👍 If this helped you, drop a like and leave a comment with your view!

💬 Let’s chat in the comments. See you there! 🚀📊

🙏 Thanks for your continued support. Let’s grow together as traders!

"UnoMinda" at the cusp of breakout! "UnoMinda" is a great counter to go Long on with high probability and great risk - reward ratio! The stock is about to breakout from a Cup Pattern. The price is at the cusp of breakout which is giving more confidence to enter the trade on Long Side.

#SniperTrade #Momentum #Options #CapitalMarkets #harshal95 #StockMarket

UNO MINDA LTD S/RSupport and Resistance Levels: In technical analysis, support and resistance levels are significant price levels where buying or selling interest tends to be strong. They are identified based on previous price levels where the price has shown a tendency to reverse or find support.

Support levels are represented by the green line and green shade, indicating areas where buying interest may emerge to prevent further price decline.

Resistance levels are represented by the red line and red shade, indicating areas where selling pressure may arise to prevent further price increases. Traders often consider these levels as potential buying or selling opportunities.

Breakouts: Breakouts occur when the price convincingly moves above a resistance level (red shade) or below a support level (green shade). A bullish breakout above resistance suggests the potential for further price increases, while a bearish breakout below support suggests the potential for further price declines. Traders pay attention to these breakout signals as they may indicate the start of a new trend or significant price movement.

20 EMA: The yellow line denotes 20 EMA, to interpret the 20 EMA, you need to compare it with the prevailing stock price. If the stock price is below the 20 EMA, it signals a possible downtrend. But if the stock price is above the 20 EMA, it signals a possible uptrend.

Disclosure: I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It is important to consult with a qualified financial advisor before making any investment decisions. Tweets neither advice nor endorsement.

Uno Minda LtdTargets given in chart - SL is closure below Trend line on DCB

Market Cap

₹ 36,469 Cr.

Current Price

₹ 636

High / Low

₹ 658 / 433

Stock P/E

53.2

Book Value

₹ 72.5

DividendYield

0.08 %

ROCE

19.4 %

ROE

17.2 %

Face Value

₹ 2.00

Promoter holding

70.0 %

EPS last year

₹ 11.4

EPS latest quarter

₹ 3.01

Debt

₹ 1,395 Cr.

Pledged percentage

0.00 %

Net CF

₹ -86.5 Cr.

Price to Cash Flow

45.7

Free Cash Flow

₹ -146 Cr.

Debt to equity

0.34

OPM last year

11.0 %

OPM 5Year

11.2 %

Reserves

₹ 4,041 Cr.

Price to book value

8.72

Int Coverage

13.0

PEG Ratio

2.92

Price to Sales

3.10

Market Cap to Sales

3.10

Qtr Profit Var

24.5 %

SWING IDEA - UNO MINDAUno Minda , a leading automotive components manufacturer, stands out as a compelling candidate for investors.

Reasons are listed below :

Multiple tests on the 600-630 levels followed by a breakout, now undergoing retesting, indicating a significant market shift.

Identification of a bullish "morning star" on the daily timeframe and a bullish "hammer" on the weekly timeframe, signaling potential upward momentum.

Strong support from the 50 EMA on the weekly and the 200 EMA on the daily timeframe, bolstering Uno Minda's price action.

Support from the golden Fibonacci zone reinforces the importance of current price levels, adding confidence to potential trades.

Consistent establishment of higher highs reflects a sustained bullish trend, aligning with swing trading strategies seeking upward movement.

A notable increase in trading volumes underscores growing investor interest and suggests the potential for sustained momentum.

Target - 720 // 765

StopLoss - weekly close below 604

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights