SLV ShortBroader Market Structure

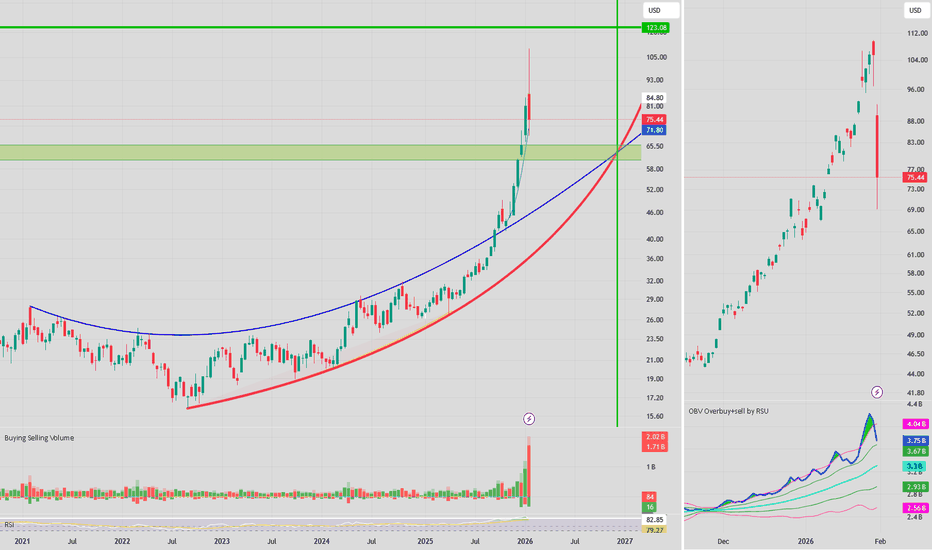

On the higher timeframe structure visible here, SLV previously printed a lower low (LL) near the mid-$60s, followed by a strong impulsive rally that broke above prior internal highs. That move created a Change of Character (CHoCH) around the 82.8 area, signaling a shift fro

Key stats

About iShares Silver Trust

Home page

Inception date

Apr 21, 2006

Structure

Grantor Trust

Replication method

Physical

Dividend treatment

Capitalizes

Distribution tax treatment

Return of capital

Income tax type

Collectibles

Max ST capital gains rate

39.60%

Max LT capital gains rate

28.00%

Primary advisor

iShares Delaware Trust Sponsor LLC

Distributor

BlackRock Investments LLC

Identifiers

3

ISIN US46428Q1094

SLV gives investors direct exposure to silver by physically holding the metal in vaults in London. As such, investors get exposure to spot silver (determined by the London Silver Fix), less fund expenses. As this fund is considered a collectible for tax purposes, taxes on long-term gains are quite steep. Still, SLV provides stability for buy-and-hold strategies.

Related funds

Classification

What's in the fund

Exposure type

Miscellaneous

Bonds, Cash & Other100.00%

Miscellaneous100.00%

Top 10 holdings

Macro Tailwinds Align — SLV Upside BrewingSLV Trading Intelligence (Swing Setup)

Core Idea:

Selling pressure looks exhausted → capital may rotate into hard assets → bounce probability rising.

Structural line in the sand

Losing this level invalidates the setup

🎯 Upside Targets

$83 area → primary liquidity target

$100 zone → stretch ta

SLV Gamma Squeeze Setup — AI Targets Explosive UpsideSLV QuantSignals V4 Weekly 2026-02-06

Instrument: $70 CALL

Expiry: Feb 6, 2026

Entry Zone: $4.25 – $4.45

Stop Loss: $3.30 (-25%)

🎯 Targets

Target 1: $5.50 (+25%)

Target 2: $7.00 (+60%+)

🧠 Quant Thesis

SLV is trading below its 50-Day MA and Weekly VWAP, creating a stretched condition ripe fo

Mean Reversion Setup: SLV1. RSI in oversold region

2. Price likely to rebound back to the mean

Trade Rules:

Entry Trigger - RSI has cross below oversold region, enter limit buy at close price

Exit Trigger - Close at market when close price cross above exit trigger (Red Line)

Notes: Maximum of 3 open positions

$SLV Weekly — The $80 Billion Question: $161 or $29?AMEX:SLV Weekly — The $80 Billion Question: $161 or $29?

Silver just printed one of the most violent weekly candles in ETF history.

The numbers:

→ High: $109.83

→ Close: $75.44

→ Range: -18.8% from peak

→ Volume: 2.06B (massive)

That's a textbook distribution candle — parabolic blowoff followed by

# S L V, A Silver V-Shape Recovery ^^.^What a Big Drop from Sell of Greedy investors.

Silve is precious Metal that AI loves.

We can not let it go!

Indicator:

S. L. V hits 60 MA and rebounces.

although MACD is below 0.

It's being supported around $68

We have to be Greedy.

AI demand on Silver is high.

I try to catch the deep....

Target N

Curve line analysisI draw lines according to the stocks historical price action.

Curved lines are good to include on a chart. Many times they give a better fit and possible resistance line at where the price may come back to and test.

On this chart I show two curves on a two week chart.

Upper line moves along the s

SLV - Parabolic Exhaustion Play - $100 Puts Feb 13📉 Pattern Recognition Setup

AMEX:SLV just completed a 68% run from $65 to $110 in under 3 months. This isn’t normal commodity ETF behavior - this is meme-stock price action.

Key Observation:

The current parabolic structure mirrors the prior $30→$48 spike that collapsed violently after hitting exha

QuantSignals SLV Weekly Setup: Bullish Mean-Reversion TowardSLV QuantSignals V4 Weekly 2026-02-06

Trend: Neutral / Mean Reversion

Conviction: Moderate

Time Horizon: Weekly

SLV shows a significant VWAP gap ($91.49 vs $101.03) and bullish MACD divergence. Despite media bearishness (“Cramer Effect”), the institutional squeeze is expected to push the price to

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

SLV trades at 70.15 USD today, its price has risen 3.16% in the past 24 hours. Track more dynamics on SLV price chart.

SLV net asset value is 70.08 today — it's fallen 8.04% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

SLV assets under management is 43.07 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

SLV price has fallen by −15.26% over the last month, and its yearly performance shows a 146.14% increase. See more dynamics on SLV price chart.

NAV returns, another gauge of an ETF dynamics, have risen by −8.04% over the last month, have fallen by −8.04% over the last month, showed a 49.90% increase in three-month performance and has increased by 138.53% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by −8.04% over the last month, have fallen by −8.04% over the last month, showed a 49.90% increase in three-month performance and has increased by 138.53% in a year.

SLV fund flows account for 10.67 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

SLV expense ratio is 0.50%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, SLV isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, SLV technical analysis shows the sell rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SLV shows the buy signal. See more of SLV technicals for a more comprehensive analysis.

Today, SLV technical analysis shows the sell rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SLV shows the buy signal. See more of SLV technicals for a more comprehensive analysis.

No, SLV doesn't pay dividends to its holders.

SLV trades at a premium (0.10%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

SLV shares are issued by BlackRock, Inc.

SLV follows the LBMA Silver Price ($/ozt). ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Apr 21, 2006.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.