Trade ideas

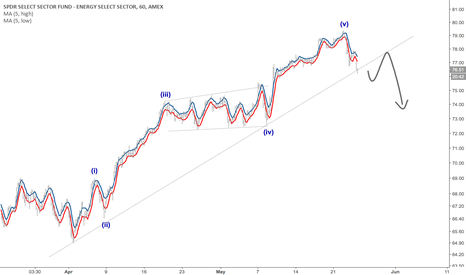

Short XLE (After next week's potential bounce)XLE has broken triangle formation. Expect it to retest the bottom trendline before further down. Short it if the retest fails to go above TL.

My OB/OS indicator has reached to the previous low level. Trade the bounce intraday or 2-3 days short term. Then resume the downside, expect it to break the previous low in my indicator.

LT TP: 41

XLE Ascending Triangle breakout.A close above 79 would lead to a breakout. Supporting this theory is rising inflation and a more dovish Fed. Recently Fed Governor James Bullard stated “If it was just me I’d stand pat where we are and I’d try to react to data as it comes in,”. More thank likely we will see more members of the Fed turn into doves as the year nears end. Which should create a bull run in the energy sector and commodities.

XLE - Energy Sector About to Poop Itself or No?The energy sector has been performing badly over recent months, but not as bad as basic materials sector. Specifically leading the problem in the energy sector are oil & gas drilling, oil & gas exploration and production, oil & gas refining and marketing, oil-related service and equipment, renewable energy equipment & services, and uranium industries. These industries are making new lows over the past month and over the past quarter.

It is quite early, but this should be on the radar for a potential shorting opportunity. If truly the beginning of a downward move, a further break of the support level around $72 would be a confirmation, and this should be expected within the next 2-4 months (pretty much from October - December, or even January) . Also, the idea of the downtrend could potentially be a recovery for a possible uptrend if the resistance levels around $76 and $78 are tested and broken.

The financial sector was also showing some milder weakness but more time is needed to tell how the sector is behaving. Watch the energy sector; what do you guys think?

I am watching the XLEs for a potential short...I am watching the XLEs for a potential short. If the $74 level breaks and they get to $73 I will short them.

My stop-out will be $74. This is a logical level to have it at because it has been support since May. If it does break to the downside, it will most likely become a resistance level. A break back above this could mean it is going to rally back up to the $78 level, which was where the top was in January and May.

My target to cover will be $69. I think that there will be support around $68.75 because it was the top of the range from February through April.

Here are my 7 Trading Rules as applied to this trade:

1) IT IS MORE IMPORTANT TO KNOW HOW TO SELL THAN TO KNOW WHAT TO BUY. YOU SHOULD NOT ENTER A POSITION WITHOUT HAVING YOUR TWO SELL STRATEGIES DEFINED. THE OPPOSITE IS TRUE FOR SHORTING.

My buy to cover target is $69. My buy-stop is $74.

2) ALWAYS THINK ABOUT RISK

If I short it at $73 and cover at $74 it is a one point loss. If I short it at $73 an cover at $69, it is a four point gain. A 4 to 1 Potential Profit / Loss Ratio is appealing.

3) UNDERSTAND AND CONSIDER THE POSITION-SIZING DYNAMICS

I am not oversizing this position...I am using no more than 5% of my capital for this trade. This is my maximum amount to put in any trade.

4) LEARN HOW TO DEVELOP YOUR OWN IDEAS

I came up with this idea by analyzing the SPDRs

5) HAVE A VALID REASON TO TRADE

Break of a support level

6) DON'T BE MARRIED TO AN IDEA

I have a clear stop out strategy

7) DON'T OVERTHINK

I have clearly defined all aspects of the trade

Look for XLE breakout of cup and handle; bullish continuationIn previous research on bullish WTI I overlaid XLE and observed that there is a cup and handle. Cup and handle or ascending triangle or whatever pattern price zigzag combined with rising WTI says XLE is a bullish continuation.

Keep a close eye as that continuation pattern is now pushing against resistance.