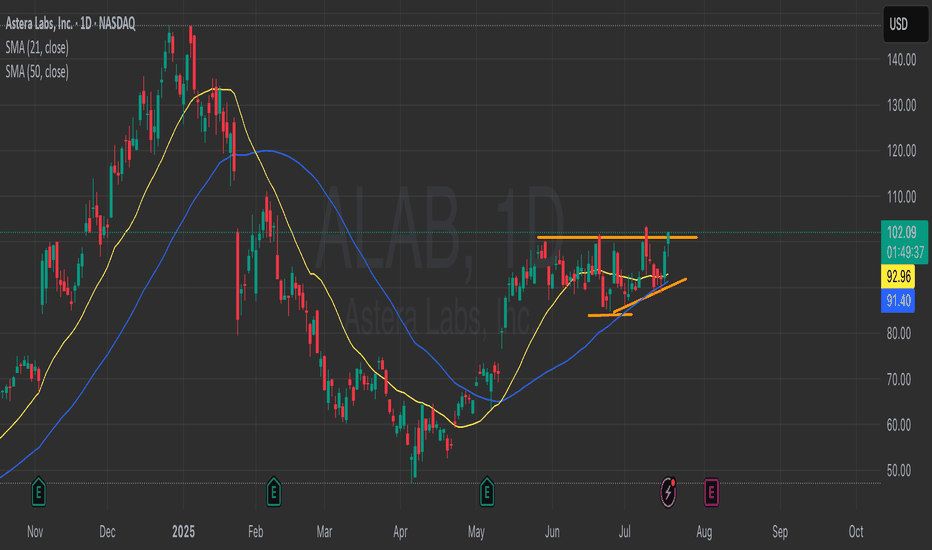

$ALAB – Impulse Complete or Just a Deep Wave-4?After a massive 5-wave run from $47 → $262 , Astera Labs (ALAB) is showing the first real signs of exhaustion.

The key question now: is this a larger ABC correction , or just a Wave-4 pause before a final push higher?

Structure

Price turned lower after rejecting the upper channel resistance

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.483 CHF

−75.76 M CHF

359.91 M CHF

127.25 M

About Astera Labs, Inc.

Sector

Industry

CEO

Jitendra Mohan

Website

Headquarters

San Jose

Founded

2017

ISIN

US04626A1034

FIGI

BBG01TNYQVX2

Astera Labs, Inc. is a global semiconductor company, which engages in the provision of hardware and software solutions for AI and cloud infrastructure applications to solve data, memory, and networking bottlenecks. It operates through the following geographical segments: Taiwan, China, United States, and Other. The company was founded by Jitendra Mohan, Casey Morrison, and Sanjay Gajendra in October 2017 and headquartered in San Jose, CA.

Related stocks

ALAB Cooling Down Before the Next AI Breakout? FVG Entry LoadingAstera Labs (NASDAQ: ALAB) is showing a clean higher-timeframe structure, consistently forming higher highs and higher lows, confirming a bullish long-term trend. However, the recent monthly candle shows potential for a short-term retracement, aligning with ICT principles for a re-entry opportunity.

The best trade is the one where you can’t lose anymore.ALAB is up +122%. 🚀

Most traders would still be asking: Do I hold? Do I sell?

But here’s the beauty of risk management: once a position doubles, you don’t have to play that game anymore.

I pull out my original capital.

What’s left running is pure profit.

Risk = zero.

Upside = unlimited.

From this

ALAB Technical Outlook – Descending Channel in Play📉 ALAB Technical Outlook – Descending Channel in Play

Ticker: ALAB

Timeframe: (30m candles shown)

🔍 Current Setup

ALAB is trading inside a falling channel (downtrend channel) marked by parallel descending resistance and support lines. Price has recently bounced from the lower boundary near 164–16

ALAB $304 After Consolidation Around $180 Resistance/SupportALAB had a big rise today into $180 resistance. This should be an area where a small pullback occurs or a further rise and then pullback into what will be $180 support. (Personally I'm leaning towards pullback above $180 rather than below)

Keep an eye on the major trendline as if ALAB gets too far

ALAB Earnings Play: High-Conviction Call Option Setup!

## 🚀 ALAB Earnings Play: High-Conviction Call Option Setup!

**Astera Labs (ALAB)** reports **Friday BMO (Aug 8)** – eyes on breakout potential.

---

### ⚡️ Bullish Thesis:

* 📈 **TTM Revenue Growth:** +144.3%

* 💰 **Gross Margin:** 75.8%

* 🧠 **AI + Cloud Tailwinds** fueling semiconductor strength

ALAB WEEKLY TRADE IDEA (2025-07-31)

### 🚨 ALAB WEEKLY TRADE IDEA (2025-07-31)

🧠 **Smart Money Snapshot**

→ RSI: **76+** = Strong Momentum

→ Call/Put Ratio: **2.19** = Bullish Bias

→ Volume: 📉 **0.6x last week** = Momentum may fade

→ Gamma Risk: ⚠️ High = Expect **fireworks**

---

📈 **TRADE SETUP**

💥 Ticker: **\ NASDAQ:ALAB **

🟢 Str

ALAB: High-Quality Breakout With Strong Structure and 3.2 R/RAstera Labs ( NASDAQ:ALAB ) just delivered a clean technical breakout above multi-week resistance, paired with bullish confirmation from momentum and Ichimoku structure. This isn’t a hype trade — this is what a textbook continuation breakout looks like.

📊 Key Technical Breakdown

Base Breakout

Afte

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

The current price of ALAB is 128.149 CHF — it has decreased by −26.04% in the past 24 hours. Watch Astera Labs, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Astera Labs, Inc. stocks are traded under the ticker ALAB.

ALAB stock has fallen by −26.04% compared to the previous week, the month change is a −29.31% fall, over the last year Astera Labs, Inc. has showed a 80.46% increase.

We've gathered analysts' opinions on Astera Labs, Inc. future price: according to them, ALAB price has a max estimate of 218.10 CHF and a min estimate of 99.14 CHF. Watch ALAB chart and read a more detailed Astera Labs, Inc. stock forecast: see what analysts think of Astera Labs, Inc. and suggest that you do with its stocks.

ALAB reached its all-time high on Sep 19, 2025 with the price of 199.756 CHF, and its all-time low was 70.961 CHF and was reached on Jul 4, 2025. View more price dynamics on ALAB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ALAB stock is 35.20% volatile and has beta coefficient of 2.57. Track Astera Labs, Inc. stock price on the chart and check out the list of the most volatile stocks — is Astera Labs, Inc. there?

Today Astera Labs, Inc. has the market capitalization of 21.07 B, it has decreased by −29.20% over the last week.

Yes, you can track Astera Labs, Inc. financials in yearly and quarterly reports right on TradingView.

Astera Labs, Inc. is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

ALAB earnings for the last quarter are 0.35 CHF per share, whereas the estimation was 0.26 CHF resulting in a 35.76% surprise. The estimated earnings for the next quarter are 0.31 CHF per share. See more details about Astera Labs, Inc. earnings.

Astera Labs, Inc. revenue for the last quarter amounts to 152.27 M CHF, despite the estimated figure of 136.85 M CHF. In the next quarter, revenue is expected to reach 164.44 M CHF.

ALAB net income for the last quarter is 40.64 M CHF, while the quarter before that showed 28.17 M CHF of net income which accounts for 44.27% change. Track more Astera Labs, Inc. financial stats to get the full picture.

No, ALAB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Oct 18, 2025, the company has 440 employees. See our rating of the largest employees — is Astera Labs, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Astera Labs, Inc. EBITDA is 36.98 M CHF, and current EBITDA margin is −28.49%. See more stats in Astera Labs, Inc. financial statements.

Like other stocks, ALAB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Astera Labs, Inc. stock right from TradingView charts — choose your broker and connect to your account.