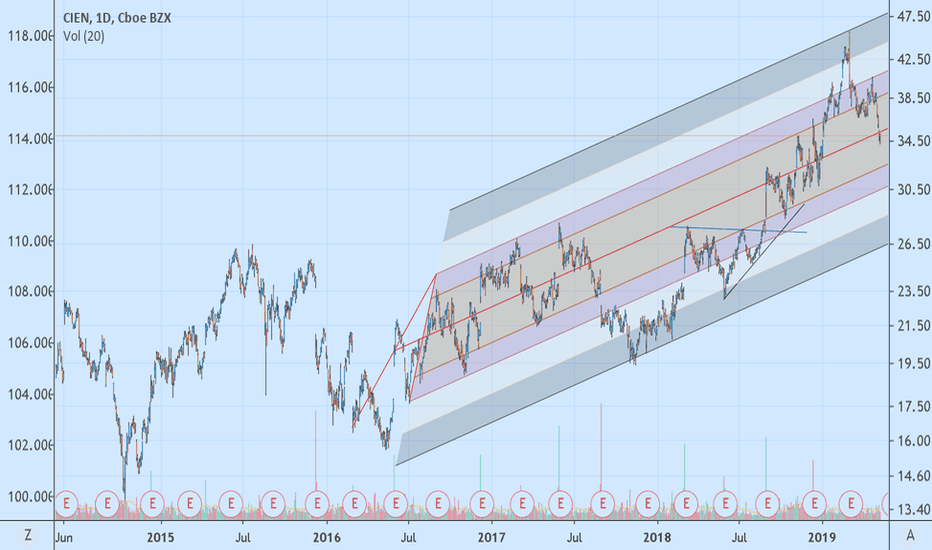

CIEN Trend Analysis with Modified Pitch ForkAlthough the short term signal is SHORT, look for a reversal to LONG around $31.

When using Modified Pitchforks, it's important that the projected lines provide multi-sigma coverage of the linear regression slope. In the case of CIEN, a Modified Pitchfork from the 2017 lows provides almost perfect symmetry and gives the trader several levels to trade Ciena. It's important to note CIEN had been in a flat range since 2002, however, it's a very wide range from $10 to $40, with two outliers that extend the range to $50 (1/03-1/04) on the high-end of the range and $5 on the low-end of the range (11/08-02/09).

Once a leader in networking hardware, Ciena lost tremendous market share to Motorola Solutions (MSI) , Arista ANET and Cisco CSCO by not recognizing the importance of 4G early enough. That mistake led them to invest heavily in 5G and the company is benefiting from this as it emerges as a potential leader in the crucial migration to 5G. With US sanctions pressuring their lead international competitor, Huwei, Ciena is poised for a massive repricing of its market cap, which at $5.5B ranks it amongst the smallest amongst its peer group: MSI: $25B, ANET: $20B, CSCO: $232B. CIEN's market cap is roughly equal to Lumentum LITE ($4.9B) but the latter trades at a PE of 130 compared to CIEN's PE of 23. If CIEN was priced at the same earnings multiple as LITE, the stock would be trading around $200/sh.

For a long position, look for a convergence of technical zones. Looking at a monthly chart, you'll see that the high end of 2010-2018 range is $30. The 50p EMA is crossing above the 100p EMA and the 24p EMA crossed above both slower EMA's last October.

On the weekly scale, the 100p EMA is at $30 with the 200p EMA just below around $27.

On the daily scale, a Fibonacci fan of the May 2018 to March 2019 move projects the 3rd fan line around $32, with prices presently hugging the 2nd fan line at $35, which also coincides with the 200p EMA. RSI is close to penetrating the lower band, confirming the stock is getting oversold, but there is still downside left before CIEN finds a floor. When it does, load the boat.

I also use a proprietary short term price predictor overlaid against a linear regression slope. When the predicted price forecast moves above the linear regression slope, it's generally a good time to step in. To create a similar 'indicator', you can use a Time Series Forecast (similar to a MA) with a periodicity of 9 overlaid against a Linear Regression Indicator with a periodicity of 18. When the TSF crosses above or below the LRI, it's a powerful buy/sell signal, but use the slope itself as a filter to avoid chop in sideways markets and this technique will help you capture very large moves. As of this writing, this method is in a sell signal with the linear regression slope pointing down. Look for when the slope levels off, and the TSF crosses above/below the LRI, as happened in early February just before the move from $38 to $46 for a buy signal, and in late February for a sell signal as the slope leveled off and the crossover occurred near $45 for a short trade that remains open. Using the linear regression slope as a filter for the TSF/LRI crossover would have avoided the chop from March to late April, and then the current short trade would have been validated at the end of April at $40.

CIE1 trade ideas

CIEN H&SI suppose you could probably sort anything in this market right now since I think the China talks will fail. This looks like it's headed down on a H&S and bear flag pattern. I expect this to create a smaller bear flag right here for a couple of days.

Not actively shorting it since I like this stock, will buy if it hits $31 this month.

Possible reversal for $CIENCIEN is getting closer the the uptrending support, it has bounced on this support multiple times and has followed this pattern the whole entire time.

I'll be keeping an eye on this one, I will be looking to take a position if the stock reacts nicely to the support, hopefully in the 36,5 ish area

CIEN enter at second test and bustedWrite sometning about your psyhology thinking before trade? I am back again it is very psyhologicaly difficult when you loose

Describe the trade. What you see? from the upper support price will decline. I have very conservative tarket at a littel bit more than 33

What have I done well for this trade? enter point but at second test

What can I take away to help with later trades? try to not enter the trade at the second test in a few days