Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.164 CHF

794.31 M CHF

4.94 B CHF

575.06 M

About Edwards Lifesciences Corporation

Sector

Industry

CEO

Bernard J. Zovighian

Website

Headquarters

Irvine

Founded

1958

ISIN

US28176E1082

FIGI

BBG00C5YWSN1

Edwards Lifesciences Corp. engages in patient-focused medical innovations for heart disease and critical care monitoring. Its products are categorized into four main areas: Transcatheter Aortic Valve Replacement, Transcatheter Mitral and Tricuspid Therapies, Surgical Structural Heart, and Critical Care. It operates through the following geographical segments: United States, Europe, Japan, and Rest of World. The company was founded by Miles Lowell Edwards in 1958 and is headquartered in Irvine, CA.

Related stocks

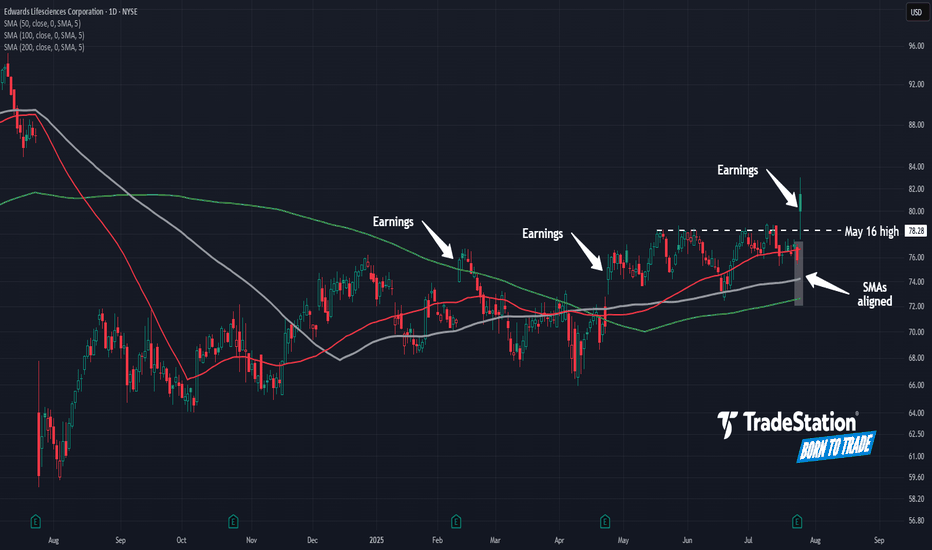

Edwards Lifesciences Enters the GapHealthcare has been the weakest sector in the past year, but some traders may expect a comeback in Edwards Lifesciences.

The first pattern on today’s chart is the breakout on Friday after earnings and revenue beat estimates. That rally brought EW into a bearish gap from one year ago.

Second is th

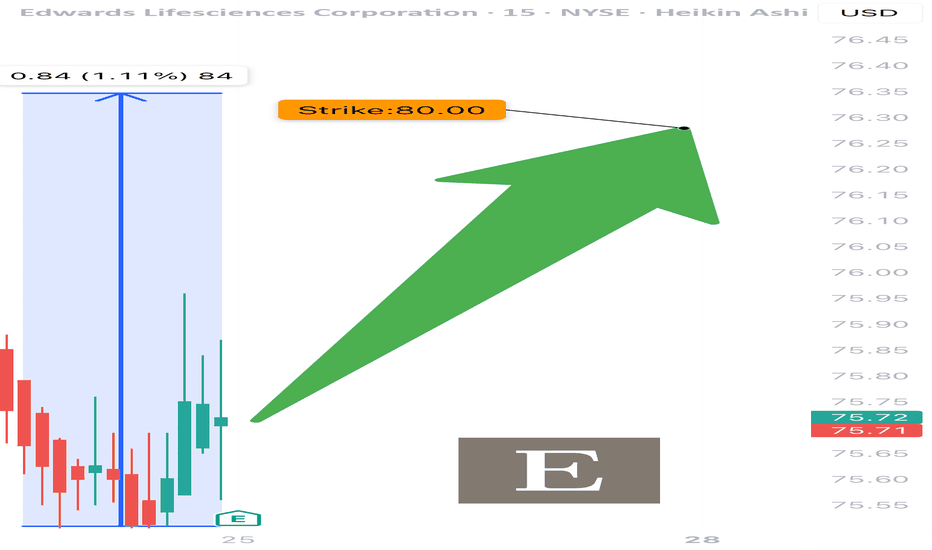

EW EARNINGS TRADE SETUP

📈 EW EARNINGS TRADE SETUP (07/24) 📈

💥 Quiet stock, loud opportunity. Fundamentals strong. Market asleep. We’re not.

🧠 Quick Read:

• Beat rate: 88% over 8 quarters

• Margins elite (OP Margin: 29%, Net: 75.7%)

• RSI 43 → Neutral setup with room to run

• Big OI at $80 calls (6.7k+) 💪

• IV not bloated

Edwars lifesciences: ready for a bull runAfter a sharpe decline the NYSE:EW stock rebounded and now it seems to be ready for a new bull run.

Actually the P&F chart reversed bullish in august, and after one month of trading range it gave another strong buy signal in october, with the quadruple-top at 73.

At the current price of 74 t

Buy at 86,19 after the rejectionTHIS IS NOT SHORT IDEA!!! Expecting a fall to 86,19 and rejection back to the final target. Enter just after clear rejection on 4H chart. Then set conditional SL, if any two 4H candles closes below the SL zone, cutloss your trade. No rejection at 86,19 = no trade. Don´t fall to the trap by buying lo

Edwards Lifesciences - A Fine Enterprise

How to summarize this business ?

Rising earnings with high profit margins and low debt over long period of time.

***

EPS has grown from 0.3 in 2010 to 2.48 in 2022, with average profit margin of 22% for the past 7 years. Equity has been growing from 1.9 in 2010 to 9.5 in 2022 (book value per sha

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US28176EAD0

Edwards Lifesciences Corporation 4.3% 15-JUN-2028Yield to maturity

—

Maturity date

Jun 15, 2028

See all EWL bonds

Frequently Asked Questions

The current price of EWL is 65.396 CHF — it has increased by 6.88% in the past 24 hours. Watch Edwards Lifesciences Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Edwards Lifesciences Corporation stocks are traded under the ticker EWL.

We've gathered analysts' opinions on Edwards Lifesciences Corporation future price: according to them, EWL price has a max estimate of 81.62 CHF and a min estimate of 58.19 CHF. Watch EWL chart and read a more detailed Edwards Lifesciences Corporation stock forecast: see what analysts think of Edwards Lifesciences Corporation and suggest that you do with its stocks.

EWL stock is 6.43% volatile and has beta coefficient of 0.45. Track Edwards Lifesciences Corporation stock price on the chart and check out the list of the most volatile stocks — is Edwards Lifesciences Corporation there?

Today Edwards Lifesciences Corporation has the market capitalization of 37.94 B, it has increased by 3.82% over the last week.

Yes, you can track Edwards Lifesciences Corporation financials in yearly and quarterly reports right on TradingView.

Edwards Lifesciences Corporation is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

EWL earnings for the last quarter are 0.53 CHF per share, whereas the estimation was 0.49 CHF resulting in a 7.42% surprise. The estimated earnings for the next quarter are 0.47 CHF per share. See more details about Edwards Lifesciences Corporation earnings.

Edwards Lifesciences Corporation revenue for the last quarter amounts to 1.22 B CHF, despite the estimated figure of 1.18 B CHF. In the next quarter, revenue is expected to reach 1.19 B CHF.

EWL net income for the last quarter is 267.85 M CHF, while the quarter before that showed 323.29 M CHF of net income which accounts for −17.15% change. Track more Edwards Lifesciences Corporation financial stats to get the full picture.

No, EWL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 9, 2025, the company has 15.8 K employees. See our rating of the largest employees — is Edwards Lifesciences Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Edwards Lifesciences Corporation EBITDA is 1.35 B CHF, and current EBITDA margin is 29.41%. See more stats in Edwards Lifesciences Corporation financial statements.

Like other stocks, EWL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Edwards Lifesciences Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Edwards Lifesciences Corporation technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Edwards Lifesciences Corporation stock shows the neutral signal. See more of Edwards Lifesciences Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.