Goldman Sachs Raises Recession Odds to 35% Amid Tariff Fears Goldman Sachs (NYSE: GS) has lowered its S&P 500 year-end target again. The firm now sees the index ending at 5,700 points, down from its earlier forecast of 6,200. This revision comes just days before President Trump’s new round of tariffs is set to begin. The updated target implies only a 2% gain from Friday’s close of approximately 5,597.

Chief U.S. Equity Strategist David Kostin pointed to rising tariffs and slowing economic growth as key concerns. The revised forecast reflects a cautious outlook in light of economic risks. This is the second time Goldman has slashed its target this month.

At the same time, Goldman Sachs has raised its 12-month recession probability to 35%, up from a previous 20%. Chief Economist Jan Hatzius explained that higher tariffs and softening economic data contributed to the decision. Goldman now estimates the average U.S. tariff rate will rise to 15% in 2025, compared to an earlier projection of 10%.

Alongside these changes, the bank has cut its Q4 2025 U.S. GDP growth forecast to 1.0% from 1.5%. The adjustment follows weakening household and business confidence. Recent White House comments also suggest officials may accept short-term economic strain to pursue long-term trade objectives.

These developments reflect growing concern across Wall Street. Goldman’s 5,700 target ranks among the lowest of major forecasts. With markets already on edge, the new projection underscores broader fears over trade tensions and economic resilience.

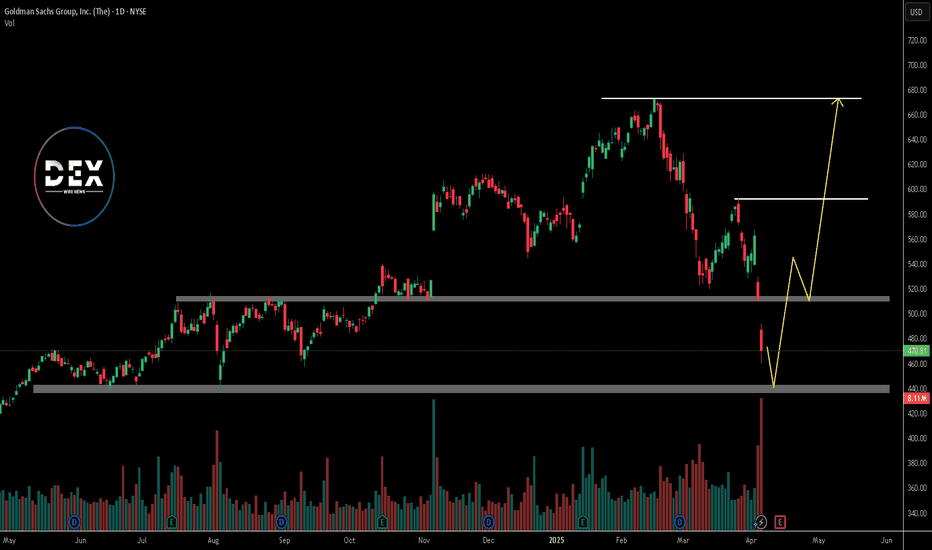

Technical Analysis: Bearish Momentum Below $500

The S&P 500 has turned bearish after falling below a key support at $510. This level had held firm previously but now acts as resistance. The break and close below the key level signals strong bearish pressure and there is a possibility of more bearish momentum.

Price is currently trending lower towards the next potential support at $440. If it breaks below it, further drop could follow. The bearish pressure may continue unless the bulls defend the key support level.

However, if the bulls can finally defend the $440 level, it could potentially recover and target $510. In that case, the first resistance to overcome is $510. If it is also broken above, the next target would be the $592 resistance zone. A break above $592 could revive bullish momentum.

As of April 4th 2025, Goldman Sachs stock closed at $21.74, down 1.50% on the day. Investors await further updates ahead of the earnings report due April 14th 2025.

Trade ideas

Goldman Sachs Earnings Tomorrow – Ready for a Bullish Breakout?Goldman Sachs (NYSE: GS) is shaping up for a potential bullish move ahead of its earnings report tomorrow (January 15) before the market opens. With the stock bouncing off key support levels and positive momentum indicators, a strong earnings surprise could trigger further upside toward my targets.

Let’s break down the setup:

💼 Trade Setup for Swing Trade:

🔹 Entry Price: $569 (current price)

🎯 Take Profit 1: $600

🎯 Take Profit 2: $625

🎯 Take Profit 3: $650

🛡️ Stop Loss: $540 (below key support)

📈 Why Am I Bullish on Goldman Sachs?

1️⃣ Earnings Catalyst (January 15, Pre-Market)

Goldman Sachs will release its Q4 2024 earnings tomorrow before the market opens. Historically, the bank has outperformed expectations, particularly in trading revenues and fixed income.

Given the recent recovery in capital markets, there’s a good chance Goldman will report higher-than-expected revenues, which could trigger a sharp rally.

2️⃣ Technical Reversal in Play

GS is bouncing off a key support zone near $550, which has acted as demand multiple times in the past. The RSI is rising from oversold levels, and Stochastic has turned bullish, suggesting momentum is building.

A break above $575 would confirm the reversal and open the door to higher targets at $600, $625, and $650.

3️⃣ Valuation and Undervaluation

Goldman Sachs is trading at a P/E ratio of 16.8, which is cheaper than peers like JPMorgan and Morgan Stanley. This leaves room for valuation expansion, especially if the bank delivers positive earnings surprises.

With recovering trading volumes, M&A activity, and IPO deals, GS could see a significant boost to revenue and profitability.

💡 Final Thoughts:

Goldman Sachs is setting up for a potential bullish move, with a solid technical and fundamental backdrop. The upcoming earnings report is a key catalyst that could trigger strong upside if results beat expectations.

I’m targeting $600, $625, and $650, while managing risk with a stop loss at $540. Let's see how it plays out!

💬 What do you think? Are you bullish on Goldman Sachs too? Drop your thoughts in the comments! 👇

Goldman Sachs Wave Analysis – 25 March 2025

- Goldman Sachs continues daily uptrend

- Likely to rise to resistance level 600.00

Goldman Sachs continues to rise inside the B-wave of the medium-term ABC correction (4) from the end of February.

The active wave B started earlier from the support zone between the support levels 520.00 (former monthly low from December) and 540.00.

Given the clear daily uptrend, Goldman Sachs can be expected to rise to the next round resistance level 600.00.

Goldman Pulls BackGoldman Sachs hit a new high two weeks ago, and some traders may see opportunities in its latest pullback.

The first pattern on today’s chart is the November high around $613. The Wall Street giant is apparently stabilizing at that level. Has old resistance become new support?

Second, stochastics have dipped to an oversold condition.

Third, GS gapped higher after its last earnings report on January 15. That may reflect strong fundamentals.

Finally, GS is trying to hold its 50-day simple moving average (SMA). The 100-day is also rising from below. Both of those patterns may be consistent with a bullish uptrend.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

The Best 3 Shocking Chart Patterns The Best 3 Shocking Chart Patterns Using The Rocket Booster Strategy..

-

Again am trying to get understand how to trade the options markets

and let me tell you i have not

had a good night's rest for the past 5 days!

Trying to combine the rocket booster strategy

with candle-sick patterns

Honestly, i didn't think

i would master options trading

Because basically am a commodity

trading expert

Specializing in buying bitcoin

As you venture into mastering options

trading to increase your income

you will find these top 3

candlestick patterns

you should know about:

-The 3 Outside Up

-Bullish Engulfing

-The Rising 3 Soldiers NYSE:GS

Will more of them appear?

not so

But watch this space for another

week

Let me also share with you

the rocket booster strategy

which has 3 steps

-The price has to be above the 50 Day moving average

-The price has to be above the 200 Day moving average

-The price has to gap up in a trend

That last step is important because that's the step

That will show you the candle stick

pattern you may be looking for.

To learn more Rocket Boost this content

Disclaimer: Trading is risky please learn

risk management and profit-taking

strategies

Also feel free to

use a simulation trading

account before you trade with

real money

Decent long on GS for about 12%The chart I published shows that from the covid lows until Sept 2021 GS went on a MONSTER RUN. Then the 2022 correction ( JUST DIDNT FEEL LIKE A BEAR MARKET) allowed for some profit taking and accumulation from the smart money AKA institutions. We are late on the break-out since Goldman broke out in April/May of 2024 but thats ok bc there is still alot of upside left.

By my calculations there is close to 12% until we run into any real trouble. I will be taking this trade if I can get the entry I am looking for. I am not telling you to and I never will. I am not your daddy and I never will be.

If you like my ideals you can always copy them as your own but understand they will then be your own ideals.

I am here to share my experience and help people become better investors and traders. The first step in that direction is to understand that losses are nothing more than Market tuition and in trading/investing it will always be your fault and no one elses.

You reap all the glory and you are responsible for all the pain.

GoodLuck My fellow Traders!

GS Testing Channel Resistance! Key Trade Setups for TomorrowAnalysis:

Goldman Sachs (GS) is approaching the upper boundary of its rising channel near $628, suggesting a potential for either a breakout or a rejection. The stock has shown strong upward momentum, rallying from the $556 support level. The MACD remains bullish, although the histogram is flattening, indicating slowing momentum. Meanwhile, the Stochastic RSI is nearing overbought levels, hinting at a possible pullback or consolidation.

Volume remains consistent, supporting the uptrend, but traders should watch closely as the stock approaches a critical resistance zone.

Key Levels to Watch:

* Resistance Levels:

* $628: Immediate resistance at the current price level, aligning with the upper channel boundary.

* $630-$635: Extended resistance zone if momentum continues.

* Support Levels:

* $620: Near-term support level within the rising channel.

* $600: Key psychological and technical support.

* $556-$560: Strong downside support, aligning with previous lows.

GEX Insights:

* Gamma Exposure (GEX):

* Positive GEX peaks at $630, signaling strong resistance.

* Support zones are solid at $600 due to substantial negative GEX positioning.

* Options Activity:

* IVR: Moderate, reflecting steady implied volatility.

* Call/Put Ratio: Leaning bullish, but resistance overhead may limit gains.

Trade Scenarios:

Bullish Scenario:

* Entry: Break above $628 with increasing volume.

* Target: $635 (first target), $640 (extended target).

* Stop-Loss: Below $620.

Bearish Scenario:

* Entry: Rejection near $628 with bearish price action.

* Target: $620 (first target), $600 (extended target).

* Stop-Loss: Above $630.

Directional Bias:

The bias is cautiously bullish as GS continues to trend higher within its rising channel. However, the $628-$630 zone poses significant resistance, and a failure to break above this level may result in a pullback toward $620 or lower.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

Goldman Sachs... GS looks like a top unless they pump moreLike the prior Idea of mine...most things have given back the Trump-bump election push and are on the way down or skating on thin ice and ready to begin a hard fall.

This has shown similar patterns from previous times.

The lines are hull moving averages or averages that are envelope or 3x exponential. mix them together and you get predictors that are pretty good in general.

Goldman Sachs ... simple levels, earnings and future tradeUsing simple lines that are from key pivot points and using a "Bow string method"- taking a fib channel and connecting to highs or lows and putting the third point of the channel tool on the lowest or highest point between the first two highs or lows respectively.

You can see a top may of been in along the top line...granted it was due to the election crack up boom attempt number 1...probably 4 more coming to try and prop things up.

Anywho...here are all the touches to show congruence back to 2009...the last time a crap load free-falled into the bowl that is the economic market.

Check out the Minds on here about GS I'll put up for more analysis showing why i say that top line is quite significant...

GS The Goldman Sachs Group Options Ahead of EarningsIf you haven`t bought the dip on GS:

Now analyzing the options chain and the chart patterns of GS The Goldman Sachs Group prior to the earnings report this week,

I would consider purchasing the 555usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $4.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Goldman Sachs ($GS): Trend Channel in FocusGoldman Sachs has been trending higher since our analysis two months ago, prompting us to reevaluate our stance. We’ve concluded that it makes more sense to remain bullish for now and not anticipate a bearish scenario at this stage. We are particularly encouraged by how consistently NYSE:GS has respected its trend channel, which strengthens our belief that it will continue to hold. However, there is a significant concern: we don’t want to see NYSE:GS losing this trend channel or creating a false breakdown, only to trap bears and continue higher.

Goldman Sachs has its earnings call scheduled for the same day as BlackRock and JP Morgan this Wednesday. This adds pressure, and with additional uncertainty from the upcoming political shifts, such as the inauguration of Trump, the potential impact on NYSE:GS , NYSE:BLK , and NYSE:JPM remains unclear.

Setting a limit at the 23.6%-38.2% Fibonacci levels feels too risky given the current environment and the uncertainty in the near future. While we favor this updated bullish scenario over the previous one, the bearish scenario isn’t entirely off the table. It could quickly come back into play if NYSE:GS loses key support levels.

For now, NYSE:GS needs to touch the $536–$489 zone and reclaim the trend channel promptly to validate our bullish scenario. If it fails to do so, we’ll need to approach with extreme caution, and as a result, we are not rushing into a trade at the moment.

Anticipating a Drop on Goldman. GSIt is looking like a start of Wave 3 or C, as per Elliott. We are inclined to believe that the drop will be impulsive, secondary to a short time in the correction post Wave 1 (or A), suggesting Wave 2 completion, rather than B. Technically, stochastics and volatility zones are about to flip, momentum down going. Also, there is a cross of both the Smoother by Ehlers and MIDAS curve. This is a highly suggestive bearish picture from and eagle's eye view. Aiming to reverse position in the event of contralateral MIDAS curve cross.

GS (Goldman sachs)Banking sector is Correcting and the big banks will correct with it.

Monthly Money flow lit up on GS for only the 3rd time in 10years.. last 2 the mes this has happen GS crashed 30% or more..

Using weekly chart log scale

You can see GS has hit the top of a 14 year bull resistance

Daily chart you can see GS has gapped outside channel on trump election and now I believe we head back to channel support this quarter

My target is 507-512

The 200sma is at 497 so I doubt they break below that

Goldman Sachs - The desired growth,earnings will help capitalizeHi guys, continuing with our Banking trend, we are going to take a look at Goldman Sachs -

Fundamentals

Goldman Sachs is set for a strong 2025, driven by robust U.S. GDP growth forecasts of 2.5%, fueled by AI-driven investments and federal incentives. The firm expects the S&P 500 to rise to 6,500, supported by steady earnings growth and favorable monetary policy, with Fed rate cuts stimulating economic activity. Strategic initiatives in asset management, emphasizing portfolio recalibration amidst shifting economic conditions, position Goldman Sachs to capitalize on market dynamics. These factors align to create a favorable financial outlook for the year.

Technicals :

Similiar to the previous banking groups, they had a fantastic 2024, with great growth after the beggining of the year. Their stock formulated a very strong Ascending channel after it crushed the previous storng Resistance level at 390 around april last year.

Entry: 577

Target: 678

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my community so you can follow up with me in private!

Goldman Sachs | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Goldman Sachs

- Double Formation

* 012345 | Wave 1&2 | Subdivision 1

* Flag Structure | Uptrend Bias

- Triple Formation

* Top Bottom Structure(Neckline At 573.00 USD) | Subdivision 2

* 345 Template | Trend Developing Entry | Subdivision 3

* Trend, Behaviour & Entry

Active Sessions On Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

GS GlitchI had this developed when the price was near the blue rectangle on the left. When I saw it at 510 I though it is a dud project. Now after the rebound from the green I decided to share it just in case we get to see some more relevant price action near the elements.

Not sure if the projection in time of the linear pathway is relevant. Could be dilated for months for something that could happen in weeks. Nevertheless, I have an interest for the last yellow arrow which could provide a setup for a broader bearish move. Don't know where/when such a setup might occur yet.

Goldman Sachs (GS): Ready for a Big Correction?As we projected four months ago, Goldman Sachs ( NYSE:GS ) has reached our anticipated upside range between $516 and $575, touching $540 specifically. We've reinforced our analysis with a trend line dating back to 2016, which has been tested and validated three times. Combining this trend line, the Elliott wave count, and key Fibonacci levels, our outlook now points towards a significant pullback from current levels. Given that we're likely dealing with a larger Elliott wave cycle, we anticipate a substantial correction of around 28%.

While a 28% decline sounds extreme, it's not unprecedented for $GS. The drop from the top of wave 3 to the bottom of wave 4 was 35%, and the decline from wave (1) to (2) was almost 50%. Even smaller corrections within these larger waves illustrate that major pullbacks are essential for long-term growth, especially as institutional investors take profits. With Goldman Sachs having gained 87% year-to-date—a remarkable rise in this sector—a correction is likely as big players start locking in their gains.

We aren't sure yet how this correction will unfold, but we anticipate a sharper, quicker drop compared to the more prolonged wave (2) correction. A potential support level for wave A could be around $420. Meanwhile, wave C and the overarching wave (4) are expected to land between $366 and $264.

We are not setting a limit order at the moment but have alerts in place for both scenarios: whether we call the exact top here or see NYSE:GS push higher before pulling back. Either way, we'll be ready and will update you as the situation evolves.

Goldman Pulls Back After RallyingGoldman Sachs broke out to record highs earlier this month, and some traders may think the investment bank will keep running.

The first pattern on today’s chart is the large candle on October 15 after quarterly results beat estimates.

Next, you have that session’s low at $515.51. Also notice the price zone around $510-515 where GS peaked in August and September. Consider how the stock pulled back to hold those levels on Tuesday and Wednesday. Has new support been established above previous highs?

Third, MACD is rising.

Finally, the higher monthly lows in August, September and October are potentially consistent with a long-term uptrend. (Some traders may even view them as part of an ascending triangle.)

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.