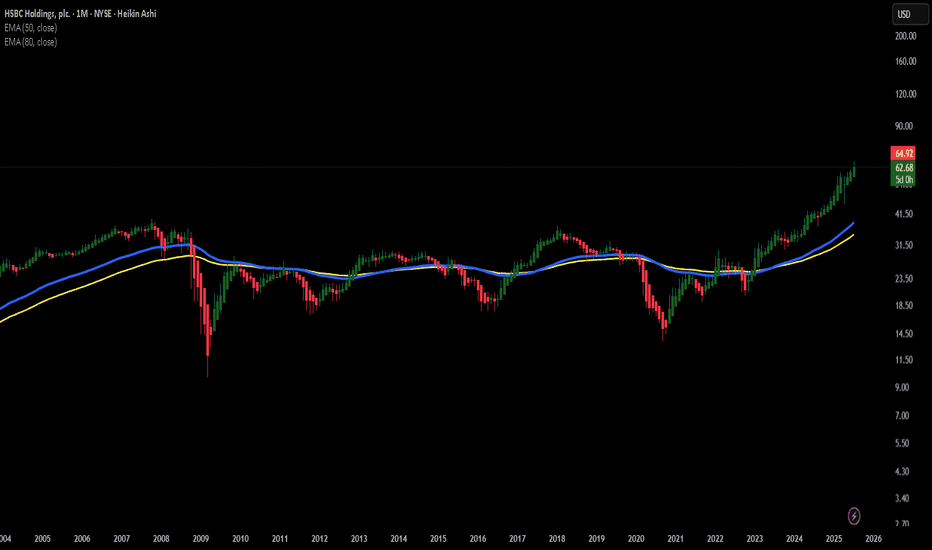

HSBC eyes on $53.xx: Key Resistance to recovery of UpTrendHSBC looking quite strong compared to other banks.

Just poked through a key Resistance at $53.01-53.40

Strong break should retest highs above at $58.11-58.65

.

Previous Analysis that caught a long PERFECTLY

=================================================

Key facts today

HSBC will finance six Airbus A350-900 aircraft for Emirates Group, completing five through a Japanese Operating Lease with Call Option, marking Emirates' return to the JOLCO market.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.775 CHF

20.38 B CHF

132.48 B CHF

16.83 B

About HSBC Holdings Plc

Sector

Industry

CEO

Georges Bahjat El-Hedery

Website

Headquarters

London

Founded

1959

ISIN

GB0005405286

FIGI

BBG00LVDKQX4

HSBC Holdings Plc engages in the provision of banking and financial services. It operates through the following business segments: Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, Global Private Banking, and Corporate Centre. The Retail Banking and Wealth Management segment consists of retail banking, wealth management, asset management, and insurance. The Commercial Banking segment offers banking products and services. The Global Banking and Markets segment includes transaction banking, financing, advisory, capital markets, and risk management services. The Global Private Banking offers transaction banking, financing, advisory, capital markets and risk management services to high-net-worth individuals and families. The Corporate Centre segment is involved in central treasury, including balance sheet management, other legacy businesses, interests in associates and joint ventures, central stewardship costs, and the UK bank levy. The company was founded on January 1, 1959 and is headquartered in London, the United Kingdom.

Related stocks

HSBC – Big Bank EnergyHSBC. The name alone sounds like it should be engraved in stone above a massive marble doorway somewhere in London, guarded by two lions in tuxedos. It’s one of those banks that’s been around forever – the kind of institution that probably has an emergency plan for a meteor strike… and a tea protoco

HSBC (HSBC) – $54 Risk Zone if ABC Correction Is Triggered HSBCHSBC is currently trading within a rising wedge, but a potential short-term drop of approximately 5% could trigger a full ABC correction pattern. This scenario is not confirmed yet, as the chart remains structurally bullish.

However, should the price reverse and break below the rising channel, it w

HSBC eyes on $44.xx: Major Support that could launch next legHSBC dropped into a major support.

Enter here for a scalp or long term.

Nearby resistance for scalp target.

$ 44.76 - 44.91 is the exact support zone.

$ 47.91 - 48.15 is first resistance and TP.

$ 49.86 - 50.16 will be serious, bigger TP.

=====================================

.

HSBC "Amazing Opportunity"After the UK CPI came hotter than expected, short positions are shining on the horizon. The UK100(FTSE) index looks over-extended to the bullish side, but better than shorting the index itself is finding a highly correlated with the index position, which in our case is HSBC.

As you can see the peri

M&S & HSBC UK Collaborate to Elevate Digital Banking ExperienceIn a dynamic move to cater to evolving consumer demands, UK retailer Marks and Spencer (M&S) has cemented a new seven-year partnership with NYSE:HSBC UK, aimed at revolutionizing the credit and digital payment landscape through its banking arm, M&S Bank.

The collaboration signifies a strategic sh

Potential Symmetrical triangle?I find the chart on HSBC interesting. Last year, we witnessed the market break a significant downtrend that had been in place since 2007. Currently, it appears we are on the verge of completing a symmetrical triangle pattern. Considering the market's support from its 200-week moving average and the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

R

HBC3745304

Republic New York Corporation 7.2% 15-JUL-2097Yield to maturity

5.82%

Maturity date

Jul 15, 2097

H

HBC3687569

Household Finance Corp. 7.625% 17-MAY-2032Yield to maturity

5.59%

Maturity date

May 17, 2032

See all HBC1 bonds

ISFD

iShares PLC - iShares Core FTSE 100 UCITS ETF Accum Hedged USDWeight

7.77%

Market value

1.40 B

USD

Explore more ETFs

Frequently Asked Questions

The current price of HBC1 is 11.093 CHF — it has increased by 0.23% in the past 24 hours. Watch HSBC Holdings Plc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange HSBC Holdings Plc stocks are traded under the ticker HBC1.

HBC1 stock has risen by 4.43% compared to the previous week, the month change is a −3.08% fall, over the last year HSBC Holdings Plc has showed a 36.36% increase.

We've gathered analysts' opinions on HSBC Holdings Plc future price: according to them, HBC1 price has a max estimate of 13.21 CHF and a min estimate of 9.48 CHF. Watch HBC1 chart and read a more detailed HSBC Holdings Plc stock forecast: see what analysts think of HSBC Holdings Plc and suggest that you do with its stocks.

HBC1 reached its all-time high on Oct 2, 2025 with the price of 11.629 CHF, and its all-time low was 4.896 CHF and was reached on Sep 6, 2021. View more price dynamics on HBC1 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HBC1 stock is 3.64% volatile and has beta coefficient of 1.62. Track HSBC Holdings Plc stock price on the chart and check out the list of the most volatile stocks — is HSBC Holdings Plc there?

Today HSBC Holdings Plc has the market capitalization of 192.99 B, it has decreased by −0.74% over the last week.

Yes, you can track HSBC Holdings Plc financials in yearly and quarterly reports right on TradingView.

HSBC Holdings Plc is going to release the next earnings report on Feb 25, 2026. Keep track of upcoming events with our Earnings Calendar.

HBC1 earnings for the last quarter are 0.29 CHF per share, whereas the estimation was 0.27 CHF resulting in a 5.88% surprise. The estimated earnings for the next quarter are 0.24 CHF per share. See more details about HSBC Holdings Plc earnings.

HSBC Holdings Plc revenue for the last quarter amounts to 14.26 B CHF, despite the estimated figure of 13.69 B CHF. In the next quarter, revenue is expected to reach 13.37 B CHF.

HBC1 net income for the last quarter is 3.87 B CHF, while the quarter before that showed 3.73 B CHF of net income which accounts for 3.66% change. Track more HSBC Holdings Plc financial stats to get the full picture.

HSBC Holdings Plc dividend yield was 6.56% in 2024, and payout ratio reached 52.74%. The year before the numbers were 7.68% and 52.68% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 3, 2025, the company has 211 K employees. See our rating of the largest employees — is HSBC Holdings Plc on this list?

Like other stocks, HBC1 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HSBC Holdings Plc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HSBC Holdings Plc technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HSBC Holdings Plc stock shows the buy signal. See more of HSBC Holdings Plc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.