Bulls Cornered at Historic Oversold Zone - Spring Loads📊 To see my confluences and/or linework, step 1: grab chart, step 2: unhide Group 1 in object tree, step 3: hide and unhide specific confluences. 🎨

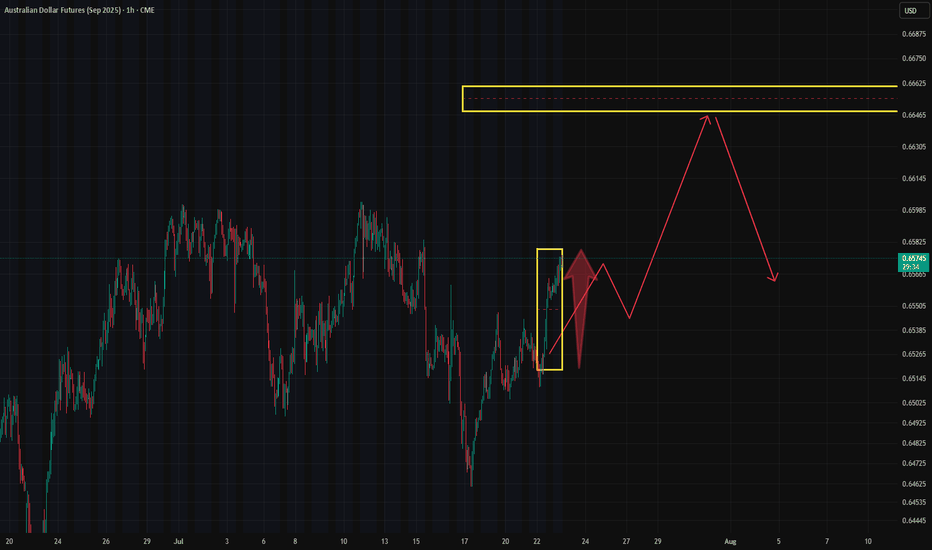

🎯 6A1!: Bulls Cornered at Historic Oversold Zone - Spring Loads

The Market Participant Battle:

Bears have systematically trapped bulls into a prov

Related futures

AUD: Revisit Key Supply Zone, Potential Short Setup.The AUD Futures 6A1! has revisited a key supply zone established earlier this month, presenting a potential opportunity for another short trade setup. According to the latest COT report, non-commercial traders have increased their short positions, indicating a bearish sentiment. However, it's crucia

a return to dominant sellers origin presents a =BUYers world1->3 : number 3 closes below ( alibet slightly) number 1 ,

this makes number 2 a solid major high, as it has proven itself

to have more selling power then the players from number 1

3->4 : we return to number 2 and assess the strength of the sellers

from number 2 , versus buyers from number 3

* w

percise double bottom alongside mfi+rsi oversold points upside1 & 2 . the percision of the double bottom

makes me think a return to #3 makes sense ,

perhaps there are alot of buy orders that sellers are not

able to fill, and therefore theygot exhausted there.

2. we saw at #2 that increasing volitility still was not able to

lower it by even a tick....

3. i

Aussie Shorts Looks Promising This is a pullback trend trade anticipating trend continuation. Entry is based on LVN (low volume node) for entry. Also looking on the footprint chart there is a high volume node with -ve delta that was traded at 0.64715.

If the sellers return to defend that price then this pullback should give som

Australian dollar rose 0.8% but there is a "Wall" of naked callsAustralian dollar is up 0.8% in 24h — and almost eyeing the 0.66–0.665 zone .

That’s exactly where we’ve been seeing a systematic build-up of naked calls on the futures.

More “bricks” added to the wall yesterday.

Early, looking at the CME data , there’s been a meaningful inflow in deep-out-of-the-

Mid-Session Market InsightsMid-Session Market Insights

In today's session, I'm closely monitoring eight different futures markets: S&P 500, NASDAQ 100, Russell 2000, Gold, Crude Oil, Euro Dollar, Yen Dollar, and Aussie Dollar.

S&P 500: We're seeing a rotational pattern within the prior day's value area and the CVA. I'm eyei

Quiet Before the Move — What AUD Options Are Telling UsThe AUD is stuck inside its recent range — trading has gone sideways, and trying to predict a breakout direction ahead of key moves would be premature (for more on the “Suffering Trader” concept, click here ).

Price is consolidating just below a cluster of previously opened retail longs. This "fa

(6A1!) – Bullish Continuation SetupDescription:

6A1! (AUD/USD Futures) is currently coiling inside a symmetrical triangle structure, developing a textbook compression pattern after reclaiming a key low-volume demand zone. The price action shows signs of bullish continuation, supported by structural higher lows and the recent mitiga

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of Australian Dollar Futures (Nov 2025) is 0.64870 USD — it has fallen −0.30% in the past 24 hours. Watch Australian Dollar Futures (Nov 2025) price in more detail on the chart.

The volume of Australian Dollar Futures (Nov 2025) is 28.00. Track more important stats on the Australian Dollar Futures (Nov 2025) chart.

The nearest expiration date for Australian Dollar Futures (Nov 2025) is Nov 17, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Australian Dollar Futures (Nov 2025) before Nov 17, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Australian Dollar Futures (Nov 2025) this number is 590.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Australian Dollar Futures (Nov 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Australian Dollar Futures (Nov 2025). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Australian Dollar Futures (Nov 2025) technicals for a more comprehensive analysis.