AUDJPY Trade Recap + Coffee Sell Position Explanation 25.09.25Two positions covered in this recap.

AUD / JPY - 1%

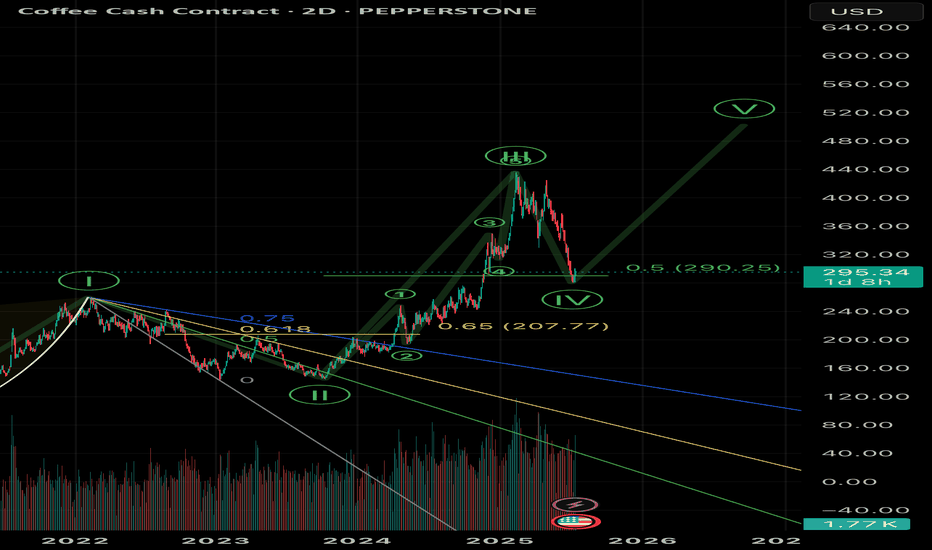

COFFEE Short Structure Explanation

Full explanation as to why I executed on this position, using the 4H to my advantage but also understanding price was due a deeper pullback, but these pullbacks do not always happen.

Any questions you have just drop them below 👇

COFFEE trade ideas

COFFEE At Crossroads: Up or down?COFFEE has seen a strong impulse to the upside. But guess what? Now price is being coiling into a tight triangle. In this case, there are two scenarios possible, and taking into account that the market conditions are bullish, I am more inclined to say that the price will break to the upside of the triangle formation.

Do you agree? Drop a comment below. Engaging with the TradingView community is always helpful to improve and grow as traders.

Not financial advice, just sharing my thoughts on the charts. Trade safely 😊

Coffee Heist: Are You Ready for the Bullish Layup?🚨☕ "COFFEE" Heist Plan – Swing/Day Robbery 🚨

🌟 Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Robbers & Money Makers 🤑💰💸✈️

Based on 🔥 Thief Trading Style Analysis 🔥 here’s our master heist plan to rob the "COFFEE" Commodities CFD Market.

🎯 Plan: Bullish Robbery

Entry 📥: Any price level – Thief always sneaks in at any vault door.

👉 But remember: Thief Strategy = LAYERED ENTRY ⚡

Multiple Buy-Limit Layers:

(390.00) 🏦

(380.00) 💎

(370.00) 🎭

(360.00) 🔑

(Add more layers based on your own robbery plan)

Stop Loss 🛑:

This is Thief SL @ 340.00 ⚔️

Dear Ladies & Gentlemen (Thief OG’s) – Adjust your SL based on your personal robbery strategy & risk appetite.

Target 🎯:

⚠️ Police barricade spotted @ 440.00 🚔

So escape early with the loot @ 430.00 💸 before getting caught!

🏴☠️ Thief Notes:

Our heist is in the bullish zone 🚀

Layer in carefully, don’t rush 💎

Always manage risk – the cops (market makers) are watching 👮♂️

Use alerts, trailing SL & risk management to protect your stolen bags 💰

💥 If you’re riding with the Thief crew – Hit Boost 🚀 & Share Love ❤️ – that fuels our robbery strength!

We rob, we trade, we escape – That’s the Thief Way! 🏆🐱👤

#ThiefTrader #CoffeeHeist #CommoditiesCFD #SwingTrade #DayTrade #LayerStrategy #BuyTheDip #TradingPlan #ForexRobbers #MarketHeist

1000 USD: Coffee Bull Market Overview: Prices set to DOUBLE ☕ Coffee (Arabica, ICE “KC”) — Outlook to 2026

Where we are: Nearby Arabica trades ~405–410 US¢/lb after a parabolic 2025 on weather stress, thin deliverable stocks, and policy shocks. The Dec ’25 contract is ~400 ¢/lb.

Big picture 2025/26: Official global production is pegged at a record ~178.7 M bags (robusta-led) versus ~169.4 M bags consumption; ending stocks remain tight near ~22.8 M. Inside that headline, arabica is the pinch point: Brazil’s arabica is down year over year on heat/drought, and multiple private houses flag an arabica deficit on the order of ~–8.5 M bags for 2025/26.

________________________________________

🤖 1) Brazil 2025 flowering & 2026 crop execution (↑ to 9.5/10)

Why it matters: Brazil is the swing producer for arabica; 2026 outcomes hinge on Sep–Oct 2025 flowering and the trees’ carryover stress from 2024–25 dryness/frost. Local co-ops in Cerrado report frost-related damage with six-figure bag impacts to 2026 potential.

What we’re seeing: The latest national estimate cuts 2025 output to ~55.2 M bags total (arabica ~35.2 M), confirming a weaker arabica “off” year. Talk of a “super 2026” has faded unless rains arrive and stick through flowering and early fruit set.

Why 9.5/10? A missed flowering or poor fruit set is the cleanest path to a 2026 arabica shortfall big enough to rip futures.

________________________________________

🌍 2) U.S. 50% tariff on Brazilian coffee (new 9.0/10)

Why it matters: The U.S. typically imports ~8 M bags from Brazil. A 50% tariff (effective Aug 6, 2025) distorts flows, inflates U.S. landed costs, and channels more hedging into NY “KC,” structurally supporting futures. Brazil trade groups directly linked August’s vertical move to the tariff shock.

Why 9.0/10? If the tariff persists into 2026, basis stays elevated and retail prices remain sticky even if global aggregates look “adequate.”

________________________________________

🧭 3) EU Deforestation Regulation (EUDR) go-live (↑ 8.8/10)

Why it matters: Traceability/geolocation rules begin Dec 30, 2025 for large/medium operators (SMEs Jun 30, 2026). Compliance temporarily shrinks “eligible” supply and reprices differentials.

Why 8.8/10? Early-2026 could see EU-grade shortages, wider diffs, and higher KC via arbitrage.

________________________________________

📉 4) Exchange (ICE) certified stock drawdown (↑ 8.5/10)

Why it matters: Deliverable supply amplifies squeezes. Arabica certified stocks ~0.67–0.78 M bags in early September—thin for the season.

Why 8.5/10? With low float, any weather or logistics hiccup can air-pocket futures into blow-off spikes.

________________________________________

🌡️ 5) ENSO/La Niña watch & Brazil rainfall tail-risk (holds 8.0/10)

Why it matters: La Niña-skewed patterns risk ill-timed rain (flower knock-off) or too-little rain (poor fruit set) in Minas Gerais during Sep–Oct. Early September dryness was flagged; late-September storms are pivotal.

Why 8.0/10? The timing of rain matters as much as totals; a mis-timed pattern is enough to dent 2026 yields.

________________________________________

🇻🇳 6) Vietnam robusta recovery vs. water stress (↑ 7.8/10)

Why it matters: Robusta tightness forced blend shifts. A rebound toward ~31 M bags in 2025/26 would cap KC via spread relief; persistent water stress/tree fatigue would keep robusta tight, forcing arabica to carry the world.

Why 7.8/10? Binary swing factor: a real rebound cools spreads; a miss extends the squeeze into 2026.

________________________________________

🏛️ 7) Policy & trade fragmentation beyond U.S. tariffs (↑ 7.5/10)

Why it matters: Frictions and exemptions remain fluid. Retaliation or parallel measures could redirect flows to EU/Asia, move basis, and distort origin diffs.

Why 7.5/10? The tariff is already biting; add-ons would compound tightness.

________________________________________

💵 8) FX (BRL) & producer selling (↑ 7.0/10)

Why it matters: A stronger BRL curbs farmer selling; a weak BRL unleashes hedges and pressures KC. Policy/inflation noise keeps BRL volatile.

Why 7.0/10? Not first-order, but magnifies weather/policy shocks.

________________________________________

🏭 9) Demand elasticity & substitution (holds 6.8/10)

Why it matters: 2025 sticker shock clipped demand by roughly –0.5%. 2026 could stabilize if prices plateau; if retail rises further (tariffs/EUDR), more down-trading or substitution (robusta/other beverages) caps upside.

Why 6.8/10? A genuine headwind to the $10/lb path unless supply breaks further.

________________________________________

🚢 10) Logistics, certifications & differentials (new 6.5/10)

Why it matters: Tight washed/tenderable pools, evolving ICE rules/diffs, and shipping bottlenecks can widen basis and squeeze deliverables.

Why 6.5/10? Secondary, but adds fuel to any fundamental spark.

________________________________________

📈 11) Spec positioning & financial flows (↑ 6.5/10)

Why it matters: 2025’s run featured panic buying in a low-float market. Another weather scare + thin stocks invites CTA/momentum flows through round-numbers.

Why 6.5/10? Not fundamental—but can yank KC vertically.

________________________________________

🧪 12) “Record global production” optics vs. arabica reality (new 6.0/10)

Why it matters: The record headline is robusta-led. Inside, Brazil arabica declines and exporters stay cautious. The market trades the arabica bottleneck, not the aggregate.

Why 6.0/10? This optics gap sustains volatility—bulls can still win if arabica under-delivers.

________________________________________

Updated Catalyst Scorecard

Rank Catalyst Score

1 Brazil 2025 flowering → 2026 crop 9.5

2 U.S. 50% tariff on Brazil 9.0

3 EU EUDR (Dec 30, 2025 start) 8.8

4 Low ICE certified stocks 8.5

5 ENSO/La Niña rainfall risk 8.0

6 Vietnam robusta recovery risk 7.8

7 Wider trade policy fragmentation 7.5

8 FX (BRL) & selling behavior 7.0

9 Demand elasticity/substitution 6.8

10 Logistics, diffs & certification frictions 6.5

11 Spec/CTA flows 6.5

12 “Record crop” optics vs arabica bottleneck 6.0

________________________________________

📊 Supply–Demand Snapshot — Why Arabica Is the Pinch Point

• World 2025/26: Production ~178.7 M; consumption ~169.4 M; ending stocks ~22.8 M (still lean).

• Brazil arabica: ~40.9 M (down ~2.8 M YoY); robusta records elsewhere (Brazil/Indonesia); Vietnam recovery penciled near 31 M.

• Private balance: Arabica deficit ~–8.5 M for 2025/26 (vs ~–5.5 M in 2024/25).

• ICE plumbing: Certified arabica ~0.67–0.78 M bags and trending lower → thin deliverables, higher tail-risk premia.

________________________________________

🔍 Recent Headlines You Should Know

• KC spiked toward/above $4/lb in early 2025 on panic buying, weather, and policy shocks.

• “Record global crop” headlines coexist with lower Brazil arabica and tight ending stocks.

• U.S. 50% Brazil tariff (Aug 6, 2025) credited with a ~30% surge in August.

• EUDR deferred to Dec 30, 2025 for large/medium operators; compliance scramble into 1H26.

• Early-Sep 2025 Minas dryness kept flowering risk live; markets watching late-Sep showers.

________________________________________

🎯 Street & Agency Views (as of Sep 2025)

• Early-2025 consensus had end-2025 ~$2.95/lb, expecting mean reversion. The market disagreed post-tariffs.

• One multilateral outlook saw >50% y/y up in 2025, then –15% in 2026, assuming supply normalization and Colombia recovery.

• Several trade houses continue to highlight a widening arabica deficit into 2025/26.

Takeaway: Consensus expects some 2026 cooling, but policy + compliance + arabica weather can overwhelm “aggregate surplus” narratives.

________________________________________

🧭 Pathways to 1,000 ¢/lb in 2026 (Aggressive Target)

We’re already near 400 ¢. To reach $10/lb, the market needs a stack of arabica-specific shocks that persist into 2026:

1. Brazil under-delivers in 2026: Patchy/failed flowering (Sep–Oct ’25) and/or heat during fruit set reduce yields; 2026 arabica ≤ ~38–40 M.

2. Tariffs persist through 2026: U.S. 50% duty remains in force, lifting U.S. basis and rerouting flows; fewer tenderable lots into ICE.

3. EUDR friction bites in 1H26: Non-compliant lots stranded; compliant premiums surge; differentials widen and pull KC higher.

4. Certified stocks < ~500k bags: Roaster drawdown + limited grading/tendering triggers backwardation and squeeze mechanics.

5. Vietnam misses rebound: Water stress or tree fatigue keeps robusta tight; arabica must carry blends globally.

6. Pro-cyclical flows: Thin deliverables + headlines = momentum/CTA accelerants through round numbers (500 → 700 → 900 → 1,000).

Probability assessment: Not the base case, but plausible if two or more of (1–4) coincide while financial flows amplify. Call it ~20–25% conditional on Q4’25 weather and policy staying restrictive.

________________________________________

🧮 Scenario Framework (NY Arabica, nearby; end-2026)

• Bull (30%) — Squeeze: Brazil 2026 < 40 M; tariff persists; EUDR tight; certifieds < 0.5 M; Vietnam under-shoots.

Price: 800–1,000 ¢/lb (blow-off spikes possible above 1,000 on transient squeezes).

• Base (50%) — Elevated & volatile: Brazil 2026 ~41–44 M; tariff partially eased or offset; EUDR frictions fade by 2H26; Vietnam rebounds.

Price: 450–650 ¢/lb with episodic spikes on weather or logistics.

• Bear (20%) — Normalization: Strong Brazil flowering → 2026 ≥ 45 M; tariff rolled back; EUDR compliance smoother; certifieds rebuild > 1.2 M; demand softens.

Price: 280–420 ¢/lb (vol still above pre-2024 norms).

________________________________________

🗓️ Watchlist & Timeline (what to track)

• Sep–Oct 2025: Brazil flowering windows (Minas/Cerrado/N. São Paulo). Look for rain onset, follow-up, and heat bursts.

• Nov–Dec 2025: Fruit set confirmation; disease incidence; updated 2026 potential.

• Dec 30, 2025: EUDR go-live (large/medium operators).

• Q1–Q2 2026: Compliance bottlenecks, EU diffs, tenderable quality flows into ICE.

• All 2025/26: Tariff status, BRL swings, certified stock trajectory, Vietnam water/harvest updates.

________________________________________

⚠️ Risk Matrix (what flips the call bearish)

• Timely rains in Sep–Oct 2025 and mild temps → robust fruit set; Brazil 2026 ≥ 45 M.

• Tariff rollback or broad exemptions reduce U.S. basis support.

• Vietnam outperform (> 31 M) relieves spreads; Indonesia robusta stays strong.

• Certified stocks rebuild > 1.2 M bags by mid-2026.

• Demand destruction accelerates (retail fatigue, substitution), capping upside.

________________________________________

📌 Positioning Lens (informational, not advice)

• Drivers of upside convexity: Brazil weather into October, policy stickiness (tariff/EUDR), and certified stock path.

• Tell-tales of a squeeze: Steepening backwardation, diffs blowing out for compliant washeds, and rapid certified draw alongside rising exchange open interest.

• Tell-tales of normalization: Strong flowering reports, improved grading pass-rates, certified rebuilds, and easing EU compliance premia.

________________________________________

Bottom Line

• The base case remains elevated and volatile into 2026, not automatic mean reversion.

• A credible path to 1,000 ¢/lb exists if Brazil’s 2026 arabica disappoints, policy frictions persist, EUDR pins EU-grade supply, and certifieds fall sub-0.5 M, with CTA flows doing the rest.

• Conversely, timely Brazil rains, tariff relief, and a clean EUDR transition cap the rally and pull prices toward the high-$3s/low-$4s.

COFFEE Price Rising – Is a Correction Ahead?Hello everyone, what do you think about PEPPERSTONE:COFFEE ?

The price of COFFEE is quite interesting at the moment. It has been steadily rising and seems to be forming a familiar triangle pattern. If this pattern continues to develop, there’s a strong chance the price will continue to move upwards. However, I will wait for a strong candle to confirm the signal before making a decision.

My target is 427 , but if the price drops below the triangle, we might see a short-term correction, and we’ll need to reassess.

👉 Do you think the price will continue to rise or is a correction ahead? Share your thoughts in the comments!

Note: This is not financial advice, just a personal view on the chart. Wishing everyone safe and successful trading! 😊

Coffee smells goodAnother day, another breakout trade. I went long at the 0.5 retracement, we’ve had a nice reaction so far. Stop loss under the 0.5 Fibonacci. I expect coffee to reach a new high. There’s plenty of commodities that look strong vs the dollar, coffee has lagged for weeks now but if you zoom out there’s signs we can put in a new high.

Not financial advice. Do what’s best for you.

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

COFFEE - My Commodity of ChoiceI've laid out a plan I'm looking at on one of my favorite commodities - COFFEE ☕😍

What makes it so hard is the predictability of the weather - nearly impossible for the future. However, it is odd to see that the price still bonces at key support and resistance zones, almost like any "stock". Which tells me regular market trading still applies despite the odd weather event.

The reason Coffee has fallen so hard over the past few months is supply - due to extremely favorable weather conditions, coffee supply is more than demand. Resulting, as market dynamics goes, in a drop of price.

It's unfortunate though that my favorite pack of beans at the supermarket has not gone down - weird how that works 🙄 I like a medium roast, Columbia single origin.

It's dropped -33% already, but I can clearly see the market structure entering bearish phase after the bullish phase, peak (the new high) and now likely a multi-month bearish season. The question is just where the price can bottom for such a well loved commodity.

I looked at past cycles, not too long ago we dropped roughly 44% during the bearish cycle, taking 2-3 years to move into accumulation before another impulse wave up. That places a target for entry exactly in the highlighted zone around $250ish.

But I wouldn't get too greedy on my favorite commodity, buying orders can't be too low either. This would likely have to be a multiyear hold. Pepperstone sells coffee on cash contract but I usually do futures. Pity that I didn't get in sooner, bullish cycles is also at least a 2 year journey. I'll sell when the weather is bad 😅

Next up? Chocolate for sure...

Coffee smells nice especially with profitsBe honest, what do you do when your trade gets into profits almost immediately when you placed the trade ? Is your decision to close the trade affected by past trades, especially if you had several losses ? In your mind , are you thinking if I take profits off the table now, I would be square off or make a small profit for today. The pressure is intense............

I used to do that in the past, not anymore. I am entering into a new mental phase of keeping my cool (maybe enough losses, haha) or embark on this new strategy.........

If profit target is at 3 and you took it when it reaches 1, then you need to buy it back at 2 later to reach 3 and more often than not, the retracement in the 2nd trade will wipe out your tight SL.

So, my strategy is to do nothing and let it run and keep staring at the profits and telling myself, stay calm and not do anything rash and stupid like taking profits. Of course, some of you may disagree with my idea and think I am an idiot or unrealistic or gone berserk.

Study my SL and you will slowly come to appreciate my rationale for doing so. Of course, I hope it turns out the way I want it to be. Let's see later.......

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bull Flag break out Coffee future**Coffee Bull Flag Breakout Plan:**

1. **Entry:**

- Buy on candle close above flag resistance

- Analyse shorter time frame like 1 or 4 h to get better price

2. **Stop Loss:**

- Below flag low

- Use 2% account risk max

3. **Take Profit:**

- Target 1: Height of flagpole added to breakout point

- Target 2: Next major resistance level

4. **Key Confirmations:**

- Increasing volume on breakout

- Higher timeframe uptrend intact

- Strong momentum indicators

5. **Management:**

- Move stop to breakeven at +50% to first target

- Take partial profits at first target

Second try on coffeeA mini double bottom on this weekly trendline confluence. It should have a good chance to workout as we are not yet back into the channel, check my previous call trade on coffee. We might gone in a little early as the original trade was spotted on the 1 hour chart but if it pays off the reward will be better.