Can Regulatory Barriers Create Defense Monopolies?The Geopolitical Catalyst Behind Draganfly's Transformation

Draganfly Inc. (DPRO) is executing a strategic pivot from commercial drone innovation to a defense infrastructure supplier, a transformation driven by geopolitical necessity rather than market competition. The National Defense Authorization Act (NDAA) has created a regulatory moat that mandates the exclusion of foreign-made technology from U.S. critical supply chains, immediately disqualifying dominant players like China's DJI. As one of the few NDAA-compliant North American manufacturers, Draganfly gains exclusive access to billions in government contracts. The company's Commander 3XL platform, featuring a 22-lb payload capacity, patented modular design, and specialized software for GPS-denied environments, is already deployed across Department of Defense branches, validating its technical credibility in high-stakes military applications.

Strategic Positioning and Defense Ecosystem Integration

The company has de-risked its defense market entry through strategic partnerships with Global Ordnance, a Defense Logistics Agency prime contractor that provides crucial logistical expertise and regulatory compliance capabilities. The appointment of former Acting Defense Secretary Christopher Miller to the board further strengthens institutional credibility. Draganfly is rapidly scaling capacity through a new Tampa facility strategically located near major military clients, while maintaining an asset-light model with just 73 employees by leveraging AS9100-certified contract manufacturers. This approach minimizes capital expenditure risk while ensuring responsiveness to large government tenders. The company's intellectual property portfolio, 23 issued patents with a 100% USPTO grant rate, protects foundational innovations in VTOL flight control, modular airframe design, AI-powered tracking systems, and morphing robotics technology.

The Valuation Paradox and Growth Trajectory

Despite Q1 2025 comprehensive losses of $3.43 million on revenue of just $1.55 million, the market assigns Draganfly a premium 16.6x Price-to-Book valuation. This apparent disconnect reflects investor recognition that current losses represent necessary upfront investments in defense readiness facility expansion, manufacturing certification, and partnership development. Analysts forecast explosive growth exceeding 155% in 2026, driven by military contract execution. The military drone market is projected to more than double from $13.42 billion (2023) to $30.5 billion by 2035, with defense ministries worldwide accelerating investments in both offensive and defensive drone technologies. Draganfly's competitive advantage lies not in superior endurance or range AeroVironment's Puma 3 AE offers 2.5 hours flight time versus the Commander 3XL's 55 minutes but in heavy-lift payload capacity essential for deploying specialized equipment like Long Range LiDAR sensors and the M.A.G.I.C. demining system.

The Critical Question of Execution Risk

Draganfly's investment thesis centers on strategic governmental alignment outweighing current operational deficits. The company recently secured a U.S. Army contract for Flex FPV drone systems, including embedded manufacturing capabilities at overseas U.S. Forces facilities, a validation of both technical capability and supply chain flexibility. Integration projects like the M.A.G.I.C. minefield clearance system demonstrate mission-critical utility beyond conventional reconnaissance. However, the path to profitability depends entirely on execution: successfully scaling production capacity, navigating lengthy government procurement cycles, and converting the defense pipeline into realized revenue. The company is positioned to become a major player, specifically in the secure, NDAA-compliant, heavy-lift multirotor segment, not to dominate generalized fixed-wing ISR or mass-market commercial applications. The fundamental question remains whether Draganfly can execute its defense strategy fast enough to justify its premium valuation before competitors develop comparable NDAA-compliant capabilities.

Trade ideas

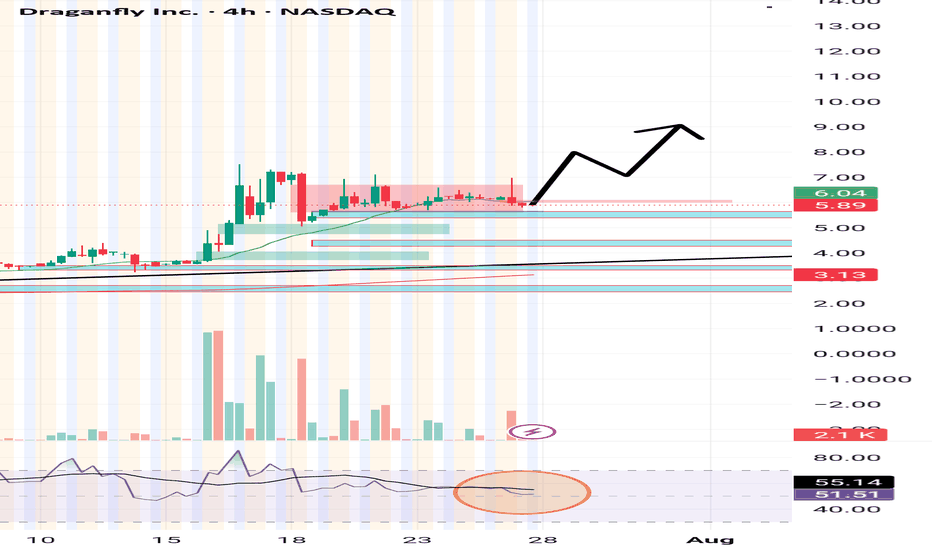

DPRO Stock: Bearish Momentum Fades, Reversal Setup Taking ShapeIt looks like DPRO has finished its bearish phase and is showing signs of a potential reversal to the upside.

✅ Momentum indicators (MACD, RSI) are turning positive

✅ Selling pressure is easing and support is forming

✅ Growing interest in the drone/defense sector is boosting sentiment

DPRO may be ready to bounce — keep an eye on volume and breakout levels for confirmation.

Draganfly Inc. (DPRO) — Swing Trade🏢 Company Snapshot

Draganfly Inc. (Ticker: DPRO on TSX/CSE) develops and supplies unmanned aerial vehicles (drones) and associated data-analysis systems, catering to public safety, agriculture, industrial inspection and defense sectors. The thematic driver: escalating demand for Western-compliant drone platforms and recent contract news in the defense segment.

📊 Fundamentals

P/E: N/A (company is unprofitable).

P/B: ~14.7× (from one data source) versus industry norms far lower.

Debt/Equity: 0 (virtually no debt, per recent balance sheet).

ROE: negative (loss-making).

Dividend Yield: 0% (no dividend).

Summary: High valuation with minimal profitability but strong balance sheet (low debt) and speculative growth stance.

📈 Trends & Catalysts

Revenue growth: Forecast for ~ +70–80% YoY in some reports, albeit off a small base.

EPS trend: Still in the red and not yet profitable; margin pressure remains.

Balance sheet: Cash rich, debt light — gives operational flexibility.

Fintel

Catalysts: Defense-contract wins (NDAA-compliant drone supply), drone market growth, potential sector rotation into aerospace/defense.

Risks: Very high valuation, execution risk in growth, dilution potential (past funding rounds), speculative nature.

🪙 Industry Overview

Weekly: Up (recent bounce from low base) — e.g., one-month ≈ +41% per one chart.

Monthly: Up strongly (short-term momentum).

12-month: Up significantly (100%+ in one year) but from low base, highly volatile.

Sentiment: Bullish, given thematic tailwinds in drones/UAS and recent momentum, yet tempered by speculative fundamentals.

📐 Technicals

Price ≈ C$11.98

50-SMA ≈ C$9.09 (above trendline) → price well above 50-SMA, indicating strong uptrend but non-trivial pullback risk.

RSI(2): 5.88

Pattern: Strong run-up from the ~$5–6 range into ~$14, now consolidating/pulling back. Support coming into play.

Support: C$11.18 – C$10.38

Resistance: C$13.58 – C$15.18 major zone.

🎯 Trade Plan

Entry Zone: C$12.10-$12.50 (ideally on pullback into support zone)

Stop Loss: C$9.50 (below support)

Target: C$17.85

Risk/Reward: ~ 1:2

Alternate setup: If price breaks above C$15.20 with volume, consider continuation entry targeting C$18+.

🧠 My Take

DPRO offers a high-risk/high-reward swing setup: it carries a speculative valuation and remains unprofitable, but the drone/defense theme is active and price action shows momentum. The most actionable way in is via a pullback into the C$12 support zone, which affords a favorable risk/reward before the next leg higher. A break below support would invalidate the bias.

DPRO: in mid-term support NASDAQ:DPRO is pulling back toward the mid-term support zone. As long as price holds above 9–7.85, the trend structure outlined in the October update remains intact.

Chart:

Previously:

On support and trend structure (Oct 7):

DPRO shows good trend linearity, with price structure suggesting further upside potential as long as it holds above the 8.15–7.20 support zone.

See the weekly review:

$DPRO - Dragonfly, Inc - $8.60 Retest - $9.25 PTNASDAQ:DPRO broke out this morning, retesting the $8.60s before consolidating throughout the premarket. Based on current projections, we're targeting a $9.25 Price Target on the trade, look for a re-entry on that lower-level support trend.

This comes after NASDAQ:DPRO announced landing a US Army Deal for Flex FPV Drone Systems. With the increase used of drone's in today's moderinzed warfare, DPRO looks set to win for the time being.

DPRO - DRAGONLY High Risk High RewardDragonfly is a very risky investment that has an amazing amount of upside potential.

A low price equity stock that is gaining market share in Canada as a major ecommerce delivery business.

As a resident of Canada its amazing to see how many of these vehicles have now appeared on our roads and delivering packages.

If you expect continued growth from NASDAQ:AMZN and online ordering this company should drastically benefit.

DPRO could easily steal market share from FDX UPS and other areas of the transport delivery market.

Keep in mind this is very speculative.

DPRO falling wedge breakoutDPRO has broken out of a falling wedge on the weekly. Ticker will respond well to Trump's "Big Beautiful Bill" which includes over $30 billion for defense/military spending. The drone company is already making progress with US military projects and is setting up for a strong rally.

7/9/25 - $dpro - PSA... rotate7/9/25 :: VROCKSTAR :: NASDAQ:DPRO

PSA... rotate

- saw some d00d shilling this

- couldn't help myself

- this isn't a company with a future outside M&A or restructuring

- the meme move is simply what we've gotten in chitco's since the liquidity bottom in april

- you do you

- but friends don't let friends drive drones or PnL drunk

V

Draganfly Inc. (DPRO) Stock Performance and Financial HighlightsDraganfly Inc. (DPRO) has experienced significant stock price fluctuations from October 2024 to December 2024. Here’s a summary of its recent performance:

October 2024: The stock opened at $0.88 on October 2, 2024, and traded mostly below $1 throughout the month. The price began to climb towards the end of October due to increased interest and speculation.

November 2024: DPRO's price showed substantial volatility and rapid gains. By November 29, it had surged to close at $4.19, marking a significant percentage increase in a short time. This surge was attributed to market reactions to operational and strategic updates.

December 2024 (up to today): The stock has continued its volatile trading, closing at $3.53 on December 6, after reaching highs near $4. However, the price has seen intra-day swings, reflecting a speculative trading environment

DPRO's performance has been driven by both its operational announcements and general speculative trading in the market.

Bullish on DronesThe USA has banned the use of all Russian and Chinese drowns. This is the wait that we have all endured now. With stocks like Dragonfly and drone Delivery Canada... its a perfect opportunity to generate revenue and have a stronger position in the markets in North America. I expect this stock will reach and brake $1 by mid March beginning of April. This is just my feeling and prediction.

DPRO - Strong BreakoutDPRO has broken out of a down channel very strongly

This is a good sign for the bulls

I expect price to break down to the horizontal green line and then continue upwards, allowing the breakdown of the broadening ascending wedge structure

This breakdown will be short lived and price should continue upwards as the trend has reversed

DRAGANFLY (DFLY, DFLYF, 3U8) BOUNCE UPDRAGANFLY has been going down for the last months, more than 50% downghll. The growth was over-extended. In my opinion, it is now looking for a confort zone that will take the stock to de 200MA. This will also be supported by previous support levels and perfect fundamentals. This will happen, in my opinion, around the 29th of April. Have a nice day!