ibit Bitcoin ETF LONG now is a good time to invest. If you go on Google and type in far side Bitcoin and click the link that goes to the farside uk Bitcoin site. You'll see the daily money flows into or out of all of the different Bitcoin ETFs. If you do the same thing but type ethereum instead you'll see all of the different inflows and outflows of

Related funds

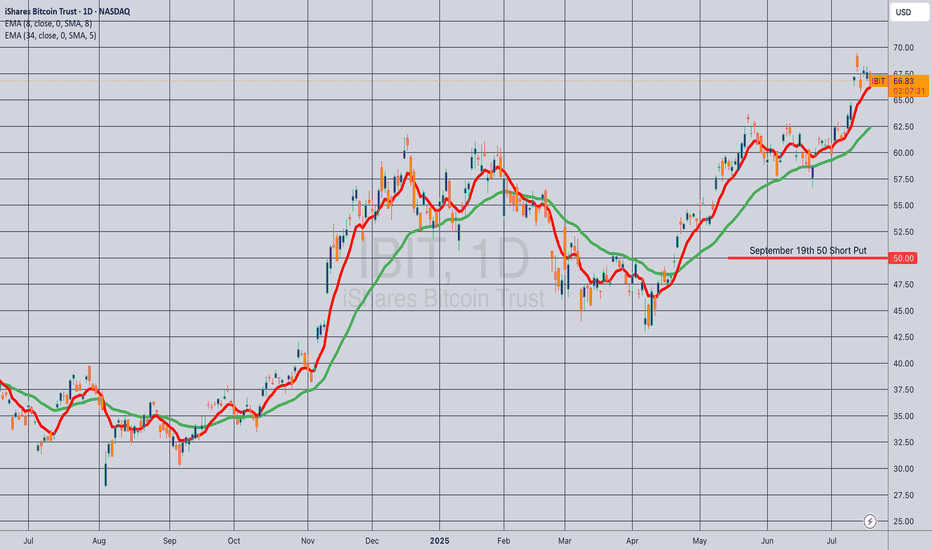

Opening (IRA): IBIT October 19th 56 Covered Call... for a 54.20 debit.

Comments: Selling the -75 call against shares to emulate the delta metrics of a +25 delta short put, but with the built-in defense of the short call and to take advantage of higher IV on the call side than on the put.

Metrics:

Buying Power Effect/Break Even: 54.20/share

Ma

IBIT – Bitcoin Trust Tracking the Channel with PrecisionTicker: NASDAQ:IBIT – iShares Bitcoin Trust

Timeframe: 1D (Daily)

Current Price: $66.83

Bias: Bullish within ascending channel

Outlook: Continuation possible after Stoch RSI reset and trendline bounce

🧠 Idea Summary

IBIT has been trading within a strong ascending channel (marked in red) since lat

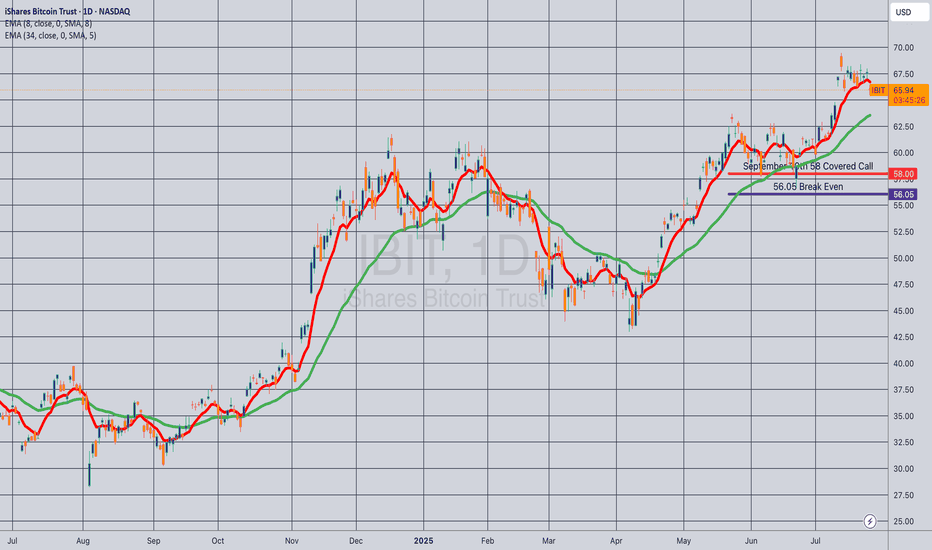

Opening (IRA): IBIT Sept 19th 58 Covered Call... for a 56.05 debit.

Comments: Selling the -75 delta call against shares to emulate the delta metrics of a +25 delta short put to take advantage of higher IV on the call side and the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 56.05

Max Profit: 1.95

ROC at Max:

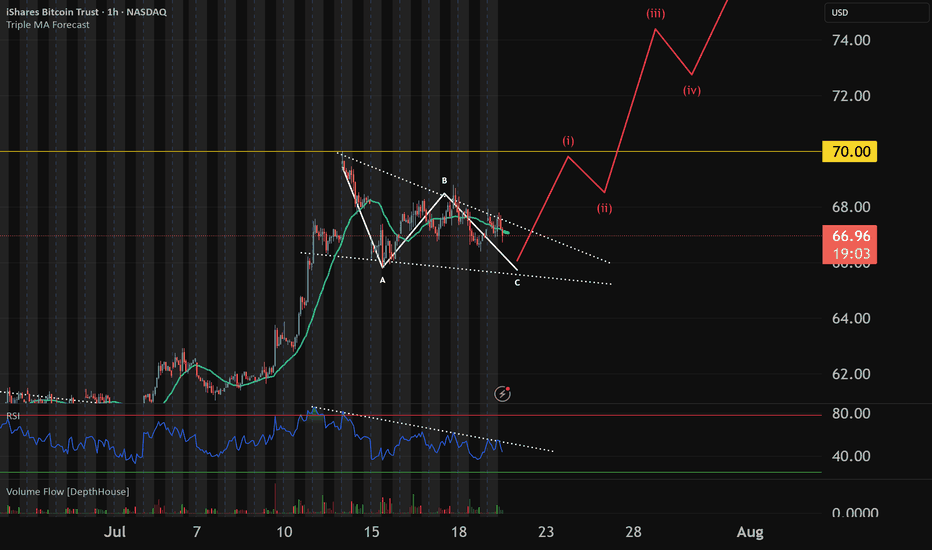

IBIT finishing C wave before next leg upIBIT is following an ABC correction after creating a new ATH. Crypto market has been hitting ATH in market value and ETH/alts have been expanding upwards as BTC has stalled which shows a rotation from large caps to rest of the market. This indicates a bull market cycle and we will be looking for a E

See all ideas

Curated watchlists where IBIT is featured.

Bitcoin ETFs: Spot trading hits Wall Street

11 No. of Symbols

See all sparks

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

No, IBIT doesn't pay dividends to its holders.