Bulls Cornered at Historic Oversold Zone - Spring Loads📊 To see my confluences and/or linework, step 1: grab chart, step 2: unhide Group 1 in object tree, step 3: hide and unhide specific confluences. 🎨

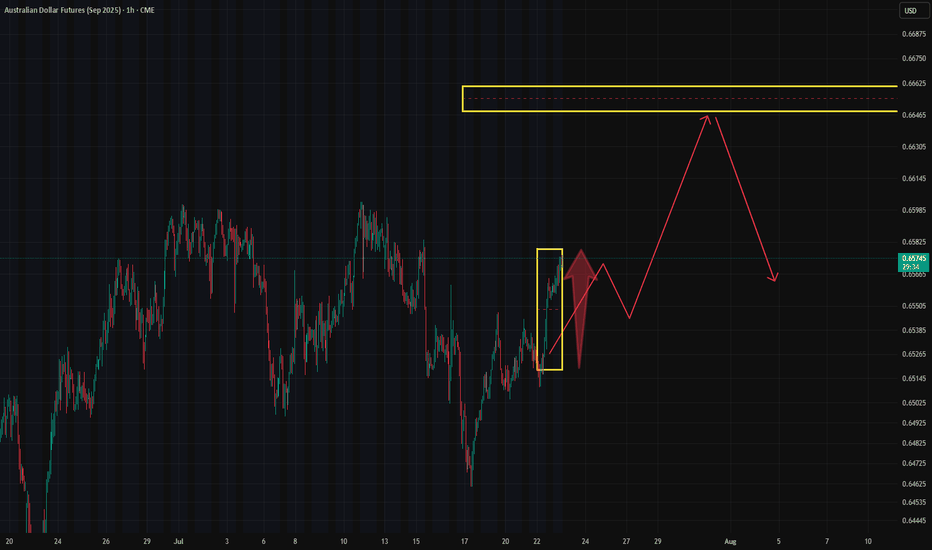

🎯 6A1!: Bulls Cornered at Historic Oversold Zone - Spring Loads

The Market Participant Battle:

Bears have systematically trapped bulls into a prov

Related futures

AUD: Revisit Key Supply Zone, Potential Short Setup.The AUD Futures 6A1! has revisited a key supply zone established earlier this month, presenting a potential opportunity for another short trade setup. According to the latest COT report, non-commercial traders have increased their short positions, indicating a bearish sentiment. However, it's crucia

a return to dominant sellers origin presents a =BUYers world1->3 : number 3 closes below ( alibet slightly) number 1 ,

this makes number 2 a solid major high, as it has proven itself

to have more selling power then the players from number 1

3->4 : we return to number 2 and assess the strength of the sellers

from number 2 , versus buyers from number 3

* w

percise double bottom alongside mfi+rsi oversold points upside1 & 2 . the percision of the double bottom

makes me think a return to #3 makes sense ,

perhaps there are alot of buy orders that sellers are not

able to fill, and therefore theygot exhausted there.

2. we saw at #2 that increasing volitility still was not able to

lower it by even a tick....

3. i

Aussie Shorts Looks Promising This is a pullback trend trade anticipating trend continuation. Entry is based on LVN (low volume node) for entry. Also looking on the footprint chart there is a high volume node with -ve delta that was traded at 0.64715.

If the sellers return to defend that price then this pullback should give som

Australian dollar rose 0.8% but there is a "Wall" of naked callsAustralian dollar is up 0.8% in 24h — and almost eyeing the 0.66–0.665 zone .

That’s exactly where we’ve been seeing a systematic build-up of naked calls on the futures.

More “bricks” added to the wall yesterday.

Early, looking at the CME data , there’s been a meaningful inflow in deep-out-of-the-

Mid-Session Market InsightsMid-Session Market Insights

In today's session, I'm closely monitoring eight different futures markets: S&P 500, NASDAQ 100, Russell 2000, Gold, Crude Oil, Euro Dollar, Yen Dollar, and Aussie Dollar.

S&P 500: We're seeing a rotational pattern within the prior day's value area and the CVA. I'm eyei

Quiet Before the Move — What AUD Options Are Telling UsThe AUD is stuck inside its recent range — trading has gone sideways, and trying to predict a breakout direction ahead of key moves would be premature (for more on the “Suffering Trader” concept, click here ).

Price is consolidating just below a cluster of previously opened retail longs. This "fa

(6A1!) – Bullish Continuation SetupDescription:

6A1! (AUD/USD Futures) is currently coiling inside a symmetrical triangle structure, developing a textbook compression pattern after reclaiming a key low-volume demand zone. The price action shows signs of bullish continuation, supported by structural higher lows and the recent mitiga

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.