Exxon Mobil Stock Outlook: Fundamentals + Technicals Aligned📌 Exxon Mobil Corporation (XOM) — Bullish Master Plan (Swing / Scalping Trade)

🛠️ Plan Setup (Thief Strategy)

Bias: Bullish — Triangular Moving Average Pullback 📈

Entry: Multiple layered limit orders at 🔹 $110.00 🔹 $111.00 🔹 $112.00 (You can adjust layers based on your own strategy).

Stop Loss (Pro

Key facts today

Exxon Mobil anticipates strong growth in China's LNG demand, particularly in transport and marine sectors, while seeking expansion in new markets across Asia Pacific, Africa, and Latin America.

ExxonMobil engaged in the trading of 21,000 tons of E10 barges, selling to Varo, BP, and MB Energy, as gasoline profit margins increased in Northwest Europe.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.01 EUR

32.53 B EUR

328.34 B EUR

4.26 B

About Exxon Mobil Corporation

Sector

Industry

CEO

Darren W. Woods

Website

Headquarters

Spring

Founded

1882

ISIN

US30231G1022

FIGI

BBG000QFTTK0

Exxon Mobil Corp. engages in the exploration, development, and distribution of oil, gas, and petroleum products. It operates through the following segments: Upstream, Energy Products, Chemical Products, and Specialty Products. The Upstream segment organizes the exploration of crude oil and natural gas. The Energy Products segment includes fuels, aromatics, and catalyst and licensing. The Chemical Products segment offers petrochemicals. The Specialty Products segment provides finished lubricants, basestocks and waxes, synthetics, and elastomers and resins. The company was founded by John D. Rockefeller in 1882 and is headquartered in Spring, TX.

Related stocks

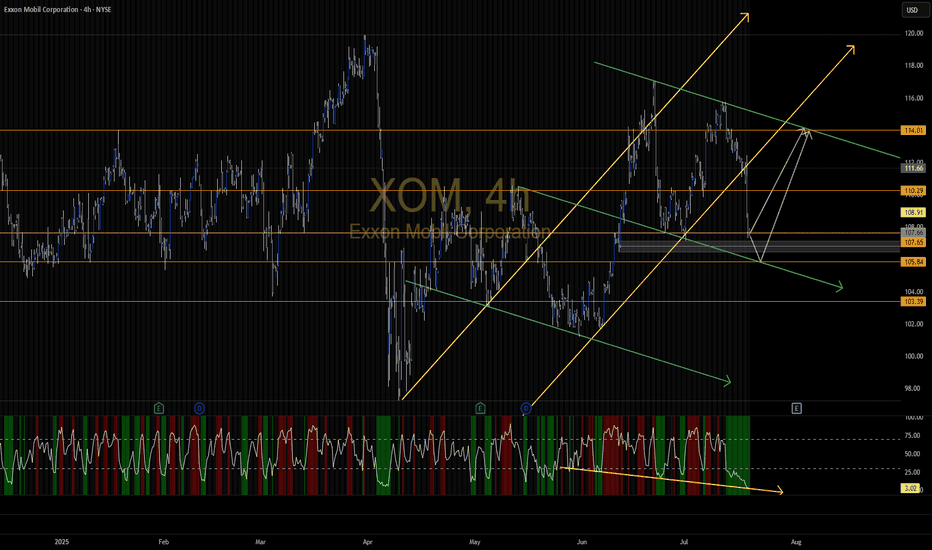

Exxon Stock Chart Fibonacci Analysis 082125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 108/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

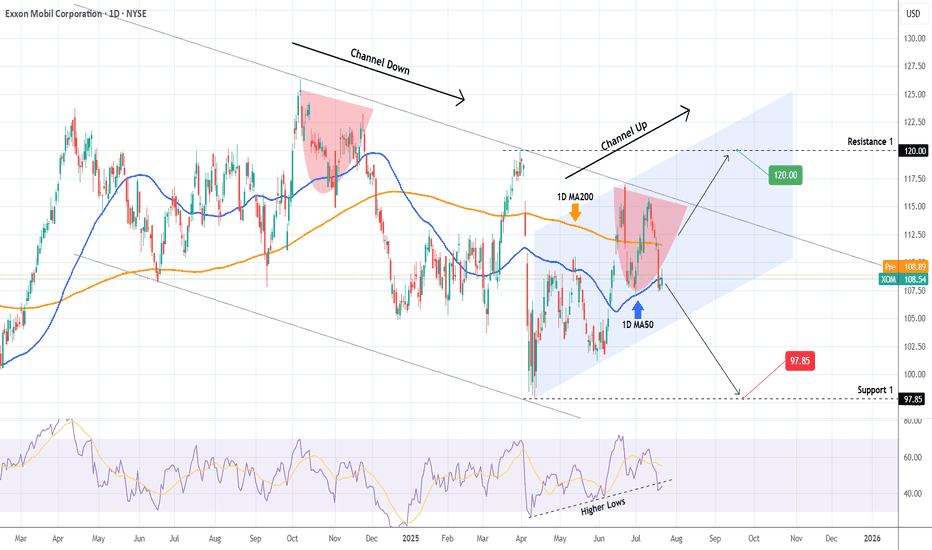

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and te

Top-Down Analysis in Action – Live Trade: Where I Enter and WhyIn this video, I walk you through my full trading process – starting with a clean top-down analysis.

I begin on the daily chart to spot key market structure and levels, then zoom in to the 1-hour chart for confirmation, and finally execute my trade on the 5-minute chart.

You’ll see:

✔️ How I define

Exxon Mobil Corporation (XOM) – BUY IDEA📌 We’re watching a strong bullish structure in XOM. After a sharp open, price retraces to fill the GAP and respects the key Low zone 🟧, signaling institutional interest.

🟢 Entry aligns with downside liquidity sweep followed by bullish momentum. This trade has confluence between previous liquidity,

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

P

PXD5112422

Pioneer Natural Resources Company 1.125% 15-JAN-2026Yield to maturity

—

Maturity date

Jan 15, 2026

P

PXD5026932

Pioneer Natural Resources Company 1.9% 15-AUG-2030Yield to maturity

—

Maturity date

Aug 15, 2030

P

PXD5112423

Pioneer Natural Resources Company 2.15% 15-JAN-2031Yield to maturity

—

Maturity date

Jan 15, 2031

P

PXD.GB

Pioneer Natural Resources Company 7.2% 15-JAN-2028Yield to maturity

—

Maturity date

Jan 15, 2028

See all 4XOM bonds

Curated watchlists where 4XOM is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 4XOM is 95.65 EUR — it has increased by 0.59% in the past 24 hours. Watch Exxon Mobil Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange Exxon Mobil Corporation stocks are traded under the ticker 4XOM.

4XOM stock has fallen by −0.92% compared to the previous week, the month change is a 4.54% rise, over the last year Exxon Mobil Corporation has showed a −5.07% decrease.

We've gathered analysts' opinions on Exxon Mobil Corporation future price: according to them, 4XOM price has a max estimate of 123.83 EUR and a min estimate of 81.13 EUR. Watch 4XOM chart and read a more detailed Exxon Mobil Corporation stock forecast: see what analysts think of Exxon Mobil Corporation and suggest that you do with its stocks.

4XOM reached its all-time high on Nov 22, 2024 with the price of 117.80 EUR, and its all-time low was 26.86 EUR and was reached on Oct 29, 2020. View more price dynamics on 4XOM chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4XOM stock is 0.59% volatile and has beta coefficient of 0.44. Track Exxon Mobil Corporation stock price on the chart and check out the list of the most volatile stocks — is Exxon Mobil Corporation there?

Today Exxon Mobil Corporation has the market capitalization of 408.74 B, it has increased by 1.72% over the last week.

Yes, you can track Exxon Mobil Corporation financials in yearly and quarterly reports right on TradingView.

Exxon Mobil Corporation is going to release the next earnings report on Oct 24, 2025. Keep track of upcoming events with our Earnings Calendar.

4XOM earnings for the last quarter are 1.39 EUR per share, whereas the estimation was 1.33 EUR resulting in a 4.60% surprise. The estimated earnings for the next quarter are 1.50 EUR per share. See more details about Exxon Mobil Corporation earnings.

Exxon Mobil Corporation revenue for the last quarter amounts to 69.19 B EUR, despite the estimated figure of 68.50 B EUR. In the next quarter, revenue is expected to reach 72.95 B EUR.

4XOM net income for the last quarter is 6.01 B EUR, while the quarter before that showed 7.13 B EUR of net income which accounts for −15.67% change. Track more Exxon Mobil Corporation financial stats to get the full picture.

Yes, 4XOM dividends are paid quarterly. The last dividend per share was 0.85 EUR. As of today, Dividend Yield (TTM)% is 3.52%. Tracking Exxon Mobil Corporation dividends might help you take more informed decisions.

Exxon Mobil Corporation dividend yield was 3.57% in 2024, and payout ratio reached 49.00%. The year before the numbers were 3.68% and 41.41% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 12, 2025, the company has 61 K employees. See our rating of the largest employees — is Exxon Mobil Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Exxon Mobil Corporation EBITDA is 52.16 B EUR, and current EBITDA margin is 18.76%. See more stats in Exxon Mobil Corporation financial statements.

Like other stocks, 4XOM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Exxon Mobil Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Exxon Mobil Corporation technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Exxon Mobil Corporation stock shows the sell signal. See more of Exxon Mobil Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.