CHINA A50 Bullish inside Channel Up aiming at 16650.China A50 index (CN50) has been trading within a 7-month Channel Up and is currently holding the 1D MA50 (blue trend-line), while being on the 3rd Bullish Leg of this pattern.

The previous two both rose by around +16.50%, so given the similarities, we remain bullish on the index, targeting 16650.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trade ideas

China50 to find enough buyers at current support?CHN50 - 24h expiry

The overnight dip has been bought into and there is scope for further bullish pressure going into this morning.

15160 has been pivotal.

Previous resistance at 15200 now becomes support.

Daily signals are mildly bullish.

Our outlook is bullish.

We look to Buy at 15185 (stop at 14995)

Our profit targets will be 15755 and 15855

Resistance: 15382 / 15570 / 15774

Support: 15235 / 15080 / 14827

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHINA A50 – Bullish Wave Setup After Compression Break Zone🎯 CHINA A50 INDEX: SWING TRADE BULLISH SETUP 📈

"Where Technical Analysis Meets Smart Entry Strategy"

🔍 MARKET OPPORTUNITY

The FTSE China A50 Index presents a premium swing trade opportunity. Current price action (≈15,305-15,511) confirms a bullish reversal pattern with validated double-pullback confirmation on the moving average, positioning traders for a meaningful upside move.

📊 TECHNICAL ANALYSIS & SETUP

Pattern Recognition:

✅ Double Pullback Detected — Price successfully retested the moving average (MA) on two separate occasions without breaking support

✅ MA Retest Confirmation — Bullish structure intact; lower lows avoided

✅ Accumulation Phase — Institutional buyers confirmed via volume analysis

Current Technical Status: BULLISH BIAS ACTIVATED

🎪 THE "SMART LAYERING" ENTRY STRATEGY 💎

Rather than going all-in at a single entry point, we use a layered buy limit order approach — this is the professional's way to average down while maintaining risk management:

Multi-Level Entry Orders:

🎯 Layer 1: Buy Limit @ 15,100.0

🎯 Layer 2: Buy Limit @ 15,200.0

🎯 Layer 3: Buy Limit @ 15,300.0

Pro Tip: You can adjust the number of layers and price intervals based on your position size and risk tolerance. This strategy allows you to accumulate during pullbacks without committing all capital at once.

🛑 RISK MANAGEMENT - STOP LOSS

Stop Loss Level: 15,000.0

This level represents the invalidation point. A close below this breaks our bullish thesis and suggests we need to reassess the pattern.

⚠️ Risk Note: Your stop loss placement should align with YOUR trading plan and risk management rules. This is MY suggested level based on technical structure—always set stops YOU'RE COMFORTABLE WITH.

🚀 PROFIT TARGETS - ESCAPE THE TRADE PROFITABLY

Primary Target: 15,750.0

Reasoning for Exit Strategy:

📍 Strong technical resistance identified at this level

📍 Overbought conditions anticipated (RSI/momentum confluence)

📍 Resistance cluster + historical trapped sellers = optimal exit zone

📍 Risk/Reward Ratio: Favorable 1:2+ setup

⚠️ Profit Management Note: This is the price target I've identified based on technical confluence. However, YOUR exit strategy should be based on YOUR profit objectives and risk appetite. Never force a trade to a target if the market gives you signals to close earlier.

📍 CORRELATED PAIRS TO MONITOR 🌐

Keep an eye on these related assets for context & confirmation:

CNY (Chinese Yuan) — USDCNY

Why: A stronger yuan correlates with A50 rallies; look for CNY weakness as a warning signal

Hong Kong Index (HSI/Hang Seng) — HKEX

Why: HSI and A50 often move in sync; confirms mainland sentiment

Shanghai Index (SSE) — Shanghai Composite

Why: Direct underlying correlation; A50 components trade on Shanghai exchange

China's Tech Index (STAR Market - STAR50)

Why: Tech momentum drives A50; watch tech sentiment separately

Global Risk Sentiment — SPX (S&P 500)

Why: Risk-on/risk-off flows impact emerging market indices like A50

Key Correlation Strategy: If HSI breaks above local resistance while A50 confirms our setup, we have MULTI-TIMEFRAME CONFLUENCE ✅

💡 CRITICAL REMINDERS FOR THIS SETUP

✓ Layered entries reduce average cost and remove emotion from single-point entries

✓ Respect your SL — losses are part of trading; manage them professionally

✓ Trail profits as price moves in your favor to lock in gains

✓ Volume confirmation adds extra credibility to this move

✓ This is a SWING trade — expect 3-7 day holds, not scalps

📈 TRADE SUMMARY CARD

Asset: FTSE China A50 (CN50)

Setup Type: Bullish Swing Trade

Entry Method: Layered Buy Limits (15100/15200/15300)

Stop Loss: 15,000.0 (risk management)

Take Profit: 15,750.0 (primary)

Risk/Reward: ~1:2.5

Holding Period: 3-7 days typical

Current Price: ~15,305-15,511

🎬 MARKET CONTEXT SNAPSHOT

The A50 Index has demonstrated resilience despite macro headwinds, with technical recovery patterns suggesting institutional accumulation. The confluence of:

Double MA pullback confirmation

Volume support

Resistance zone placement

...creates a HIGH-PROBABILITY trade setup for disciplined traders.

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#ChinaA50 #SwingTrade #TechnicalAnalysis #IndexTrading #Trading #LayeredEntry #TradingSetup #FXTrading #SmartMoney #TradingStrategy #RiskManagement #FTSE #ChinaMarkets #BullishSetup #TradersOfTradingView

Buying the Strong: China CN50 Outperforming & Breaking out 1) Last week we saw China mainland/HK equity outperforming other major equity bourses, with the CN50 +4% w/w

2) Technically, we've seen the CN50 index breaking out to new cycle highs... the daily chart is a thing of beauty... much of this can be attributed to a 22% weekly gain for Cambricon Tech, a favoured AI play in China and the 7th biggest weighting (3.2%) on the CN50 index...

3) Headlines coming out now suggest some sort of trade deal with the US has been reached... whilst this wont necessarily surprise, it should still be taken well by both China and US equity markets... that said, the contra view is if China are to loosen its rare earth controls it could make the Chinese AI plays relatively less attractive in the short-term...

4) Last week's China 4th Plenum detailed that policymakers will continue going hard on making China the dominant AI centre globally, and enhancing technological self reliance over the coming 5 years.

The US vs China battle to be the dominant AI player by 2030 ramps up - and remains one of the most interesting and important developments in global markets and macro....

China50 to continue in the upward move?CHN50 - 24h expiry

Daily signals are bullish.

20 1day EMA is at 15033.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

Dips continue to attract buyers.

We look for a temporary move lower.

Risk/Reward would be poor to call a buy from current levels.

We look to Buy at 15055 (stop at 14898)

Our profit targets will be 15505 and 15585

Resistance: 15339 / 15400 / 15500

Support: 15150 / 15000 / 14827

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

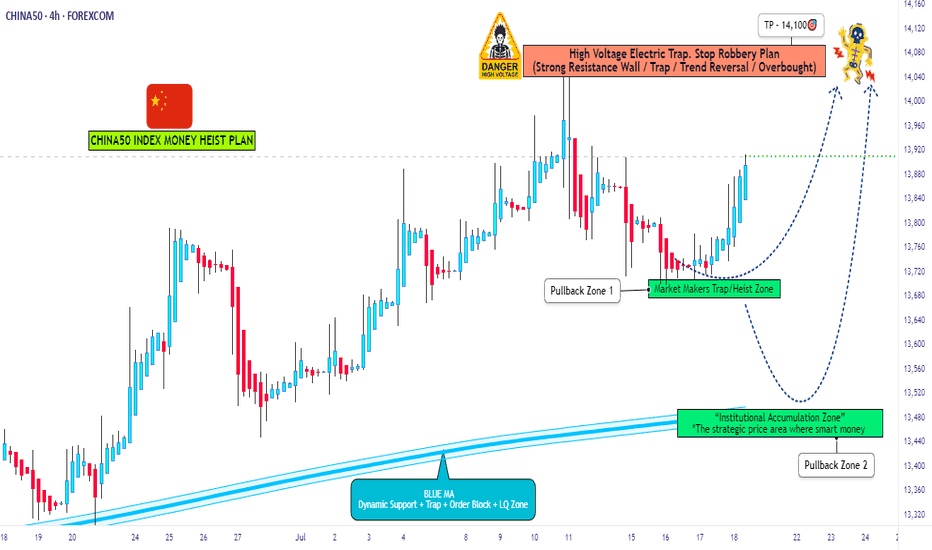

CHINA50 Bull Run: Time to Steal Some Pips?🔐 OPERATION BULL DRAGON: CHINA50 HEIST 🔐

🔥 YOUR INVITATION TO THE ULTIMATE MONEY HEIST 🔥

🌏 ASSET: CHINA50 INDEX (A50)

📅 TRADE TYPE: SWING + DAY TRADE

✅ BIAS: BULLISH — TIME TO STEAL SMART! 💰✨

📋 MISSION BRIAMER (PLAN):

We’re entering LONG 🚀 using a LAYERED LIMIT ORDER strategy — because real thieves don’t FOMO in!

🎯 ENTRY ZONES (MULTI-LEVEL LAYERS):

➖ LAYER 1: 14900.0 🟢

➖ LAYER 2: 14800.0 📍

➖ LAYER 3: 14600.0 🔁

🧠 Feel free to ADD MORE LAYERS based on your risk appetite!

⛔ STOP LOSS (DIP EXIT):

🔻 THIEF SL: 14200.0

⚠️ Adjust based on your strategy & risk tolerance! Protect your capital!

🎯 TAKE PROFIT (ESCAPE WITH THE BAG):

🚀 TP: 15600.0

⚡ Resistance & Overbought zone around 15700.0 — Don’t get caught! Exit like a ghost! 👻💰

👁️ SCALPER NOTES:

Only take LONG scalps! Use TRAILING SL to lock in profits! 🧨

📊 WHY THIS HEIST?

Strong bullish structure + fundamental tailwinds! 🌊🐂

Always confirm with your own analysis! 📈

🔔 ALERT — NEWS RISK:

Avoid entering during high-impact news! Volatility = Police traps! 🚨🚓

💎 GENERAL DISCLAIMER:

This is NOT financial advice. Do your own research. Trade at your own risk.

We are not your financial advisor. We’re just fellow thieves sharing a plan. 😉

✨ SUPPORT THE SQUAD:

👉 If you like this plan, SMASH that 👍 BOOST button!

👉 It helps us bring more high-quality heists to you!

👉 Follow for daily trading ideas & market insights!

💬 Let’s conquer the markets together — one heist at a time! 🎯🤑

#CHINA50 #A50 #Trading #SwingTrade #DayTrade #Investing #Crypto #Stocks #Forex #MoneyHeist #TradingStrategy #Profit #RiskManagement #TradingCommunity #FinancialFreedom #TraderLife #Bullish #MarketAlert #TechnicalAnalysis #LimitOrders #LayeredEntry #ThiefTrading

China50 to form a higher low?CHN50 - 24h expiry

Daily signals are bullish.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

Trading has been mixed and volatile.

Dip buying offers good risk/reward.

Trend line support is located at 15030.

We look to Buy at 15075 (stop at 14945)

Our profit targets will be 15465 and 15525

Resistance: 15339 / 15400 / 15500

Support: 15109 / 14948 / 14855

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

**Analysis of the A50 Index** The recent trend of the FTSE Ch**Analysis of the A50 Index**

The recent trend of the FTSE China A50 Index is closely tied to China's macroeconomic policies. As a benchmark representing the 50 largest companies in the A-share market, its performance directly reflects market expectations for China’s core assets and economic outlook.

Currently, policy measures have become the core driver of the A50's movement. A series of stimulus policies introduced by the central government to stabilize the economy, particularly favorable measures in the real estate and capital markets, have effectively boosted investor confidence and provided solid bottom support for the index. However, sustained upward movement still faces challenges. Although domestic economic data has shown some improvement, issues such as insufficient demand persist, and the recovery of corporate profitability needs time to verify, limiting the index’s rebound potential.

From an external perspective, persistently high U.S. dollar interest rates continue to create capital outflow pressures, weighing on the financial and technology sectors, which have significant weight in the index.

Technically, the A50 Index faces a key resistance level near 12,000 points, with major support at around 11,500 points. In the short term, it is expected to consolidate within this range, awaiting further validation from substantive economic data and additional policy catalysts. The future direction of a breakout will depend on the visible effects of policies and marginal changes in global liquidity. Investors should closely monitor the effectiveness of economic recovery following policy implementation.

CN50 price action forming a top?CHN50 - 24h expiry

Intraday rallies continue to attract sellers and there is no clear indication that this sequence for trading is coming to an end.

Price action looks to be forming a top.

Rallies should be capped by yesterday's high.

We look for a temporary move higher.

Risk/Reward would be poor to call a sell from current levels.

We look to Sell at 15235 (stop at 15369)

Our profit targets will be 14835 and 14765

Resistance: 15288 / 15400 / 15500

Support: 15063 / 15000 / 14900

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

China A50: Bulls eye 16,000 as triangle breaksThe China A50 contract has broken out of the ascending triangle it’s been trading in over the past month, putting traders on alert for a potential resumption of the prior bullish trend. However, having recently traded through 15000 on multiple occasions only to reverse back lower, the precondition to act upon today’s break would be to see the price close above the level.

If that plays out, longs could be established above 15000 with a stop beneath for protection. One look at the recent price action tells you that once a sustained bullish breakout occurs, the contract tends to gravitate towards big figures, suggesting 16000 may be an appropriate initial target rather than nominating a specific extension level. If achieved, traders could assess based on the price action at the time whether to square or hold looking for a push towards the October swing high of 16322 set last year.

RSI (14) has broken its downtrend and has now set a higher low above 50, pointing to building bullish momentum while not yet being overbought. The signal has been confirmed by MACD which has staged a bullish crossover in positive territory. The broader picture is one that favours longs over shorts.

If the price cannot close above 15000, there may be better setups elsewhere.

Good luck!

DS

China50 intraday rallies continue to attract sellers.CHN50 - 24h expiry

Bespoke resistance is located at 15000.

15068 has been pivotal.

15045 has been pivotal.

Preferred trade is to sell into rallies.

Expect trading to remain mixed and volatile.

We look to Sell at 14975 (stop at 15095)

Our profit targets will be 14615 and 14545

Resistance: 14921 / 15068 / 15200

Support: 14756 / 14600 / 14447

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

China A50 breakout test looms at December highsChina’s A50 index appears to be on a collision course with the swing high set in December last year, motoring higher like so many other Chinese indices. If we see a clean break of the level, there’s very little technically standing in the way of a potential move back towards the blow-off highs set in October 2024.

14,409 is the level in question, with the current trajectory putting it on track to be tested as soon as Tuesday. Should we see a break and close above it, or at least a definitive bullish move, longs could be established with a stop beneath for protection.

15,000 screens as an initial target simply because it’s a round number, along with 15,079—the 23.6% fib of the September–October surge last year. Beyond that, 15,200 looks to be the last level of any significance before the October 2024 swing high of 16,322.

Of course, if the price cannot meaningfully clear 14,409, the setup could be flipped, with shorts set beneath the level with a stop above for protection. 14,185 and 13,700 screen as potential targets.

MACD and RSI (14) are both generating bullish momentum signals, favouring a bias to buy dips and topside breaks rather than selling rallies.

Good luck!

DS

China A50 breakout test looms at December highsChina’s A50 index appears to be on a collision course with the swing high set in December last year, motoring higher like so many other Chinese indices. If we see a clean break of the level, there’s very little technically standing in the way of a potential move back towards the blow-off highs set in October 2024.

14,409 is the level in question, with the current trajectory putting it on track to be tested as soon as Tuesday. Should we see a break and close above it, or at least a definitive bullish move, longs could be established with a stop beneath for protection.

15,000 screens as an initial target simply because it’s a round number, along with 15,079—the 23.6% fib of the September–October surge last year. Beyond that, 15,200 looks to be the last level of any significance before the October 2024 swing high of 16,322.

Of course, if the price cannot meaningfully clear 14,409, the setup could be flipped, with shorts set beneath the level with a stop above for protection. 14,185 and 13,700 screen as potential targets.

MACD and RSI (14) are both generating bullish momentum signals, favouring a bias to buy dips and topside breaks rather than selling rallies.

Good luck!

DS

Can CHINA50 Deliver Big Gains | Before the Vault Closes?💰🕶 CHINA50 Bullish Heist Blueprint 🚀🏴☠️

📌 Asset: "CHINA50" Index CFD

📌 Plan: Bullish — Thief using multiple limit layers (13860 | 13830 | 13800) OR enter at any price level to join the heist.

📌 Stop Loss: Thief SL @ 13800 (adjust to your risk)

📌 Target: 14400 — Cash Out & Vanish!

🔥 Mission Briefing (Thief OG Style) 🔥

Ladies & Gentlemen of the Thief Crew — the vault is open, the guards are sleeping, and the CHINA50 is ripe for a high-class heist. We’re stacking layered buy limits like lockpicks, slipping in unnoticed at each price level. Your loot? A fat bullish run to our target.

💎 Entry Plan

🎯 Any price level within the buy limit layers. The more layers you stack, the bigger your bag — just don’t get greedy, thieves.

🛡 Stop Loss Strategy

Set your SL where it keeps you safe but still in the game. Default: @13800. If you’re a risk-hungry OG, adjust to taste.

🏆 Target & Exit

TP at or pull the escape lever earlier if the market shows too many alarms going off. Always leave with profit, not regrets.

⚠️ Thief Crew Reminder ⚠️

📰 Watch for China market news drops — they can flip the scene fast.

🔔 Set alerts, trail your SL once you’re in the green, and protect the loot.

💥 Boost this plan if you’re running with us — more visibility, more crew members, more wins. Let’s rob this market clean, one candle at a time.

— Thief Trader™ 🐱👤💸

China A50 bullish setupChina A50 remains in an uptrend, marked by higher lows since April and repeated bounces from the 50-day moving average. With both 50 and 200-day averages pointing higher, the bias favours playing from the long side.

A break and hold above 13812 would generate a bullish setup, opening the door for longs with stop beneath for protection. 13900 is the first hurdle, followed by 14000, with 14185 as a potential target. A clean break there would put 14409 in play. If the index can’t hold 13812, the focus flips back to the 50-day moving average as near-term support.

Good luck!

DS

China50 Target Locked | Long Setup via Thief Strategy🏴☠️ CHINA50 Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the CHINA50 Index CFD like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 0.63700 after MA pullback

📍 Zone-2 Buy: Near 0.62800 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 13540 (4H swing low)

⛔ SL for Pullback-2: 13350

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 14100

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

CHINA50 shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

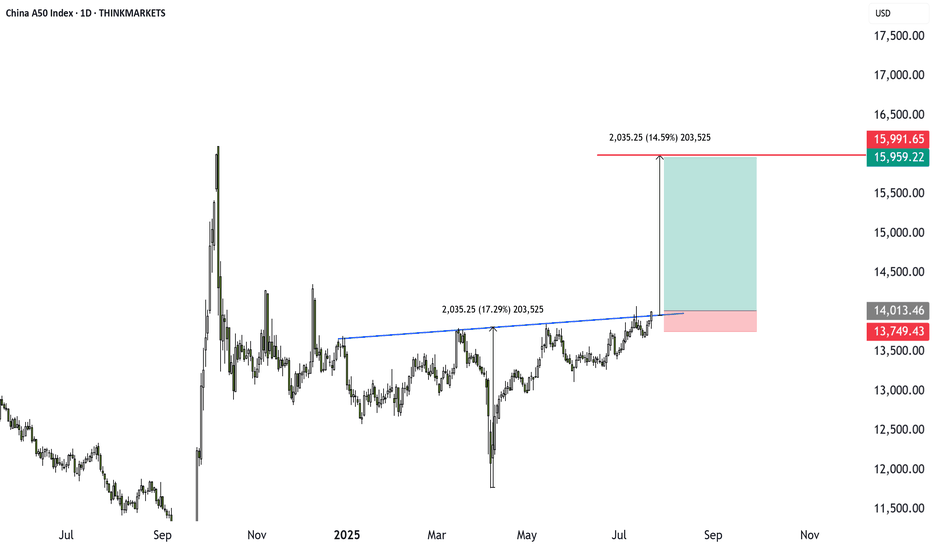

China A50 Breakout: 14% Opportunity Amid Summer Lull?Markets are quiet, but the China A50 is heating up. A bullish inverse head and shoulders pattern has formed, backed by stimulus hopes. Target upside is 14% with a strong risk-reward setup. Are you ready to trade it, or still on holiday?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

China50 to find sellers at current market price?CHN50 - 24h expiry

Selling posted close to the previous high of 13800.

13868 has been pivotal.

Bespoke resistance is located at 13800.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

We look for a temporary move higher.

We look to Sell at 13795 (stop at 13890)

Our profit targets will be 13515 and 13435

Resistance: 13821 / 13905 / 14000

Support: 13764 / 13676 / 13638

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.