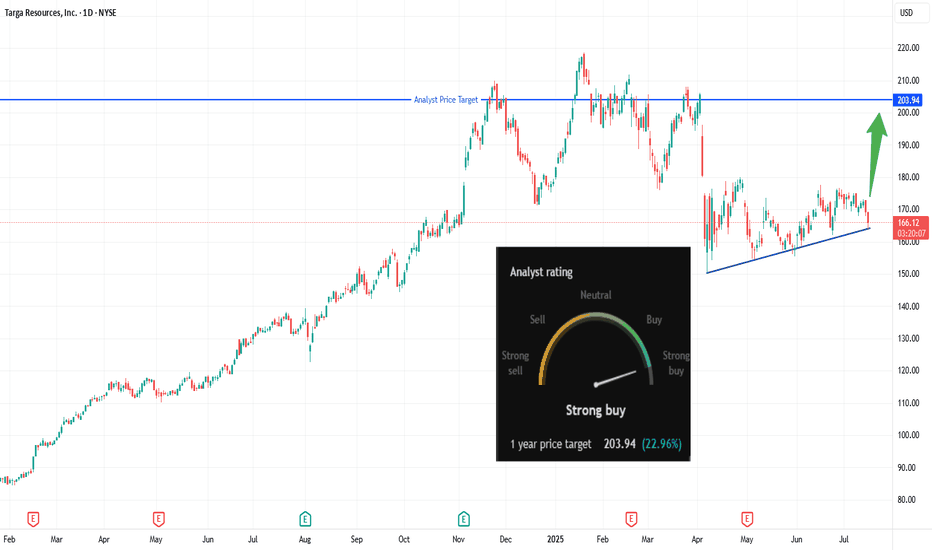

Breakout Brewing: Is TRGP About to Explode?🔹 Trade Summary

Setup:

Ascending triangle forming over several months

Price consolidating near major resistance

Strong analyst buy rating with 1-year target at $203.94

Entry:

Buy on daily close above $169.42 (breakout trigger)

Stop-loss:

Below $159 (invalidate the setup)

Tar

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.95 EUR

1.23 B EUR

16.06 B EUR

211.95 M

About Targa Resources, Inc.

Sector

Industry

CEO

Matthew J. Meloy

Website

Headquarters

Houston

Founded

2005

ISIN

US87612G1013

FIGI

BBG001B57J13

Targa Resources Corp. engages in the business of gathering, compressing, treating, processing, transporting, and purchasing and selling natural gas. It operates through the following segments: Gathering and Processing, and Logistics and Transportation, and Other. The Gathering and Processing segment includes assets used in the gathering, and purchase and sale of natural gas produced from oil and gas wells. The Logistics and Transportation segment refers to the activities and assets necessary to convert mixed natural gas liquids (NGLs) into NGL products. The Other contains the results of commodity derivative activity mark-to-market gains and losses related to derivative contracts. The company was founded on October 27, 2005 and is headquartered in Houston, TX.

Related stocks

Another Nat Gas Play Breaking Out! The US is going big into the LNG exporting business in the next few years, and any company that can move that along is going to make money.

The technicals still look strong to go higher, but right now the future fundamentals look even more compelling.

Targa Resources Corp. provides midstream natu

filing the gap at 77 before see reversal indicators curling upThe stochastics are at a low, and then you got MACD still forcing its way down some more; it should restore bullish with a reversal pattern, but do not see this at this level until it drops a few points; we can see there is a sentiment of a reversal, but we are waiting until we see an indicator, or

Targa Resources Corp. WCA - Ascending TriangleCompany: Targa Resources Corp.

Ticker: TRGP

Exchange: NYSE

Sector: Energy

Introduction:

In today's examination, we focus on Targa Resources Corp. (TRGP) listed on the NYSE, a key player in the energy sector. The weekly chart exhibits a bullish breakout from an Ascending Triangle pattern, which h

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

T

TRGP5246086

Targa Resources Partners LP 4.875% 01-FEB-2031Yield to maturity

—

Maturity date

Feb 1, 2031

See all TAR bonds

Curated watchlists where TAR is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

See all sparks

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Targa Resources Corp. stocks are traded under the ticker TAR.

We've gathered analysts' opinions on Targa Resources Corp. future price: according to them, TAR price has a max estimate of 206.24 EUR and a min estimate of 159.84 EUR. Watch TAR chart and read a more detailed Targa Resources Corp. stock forecast: see what analysts think of Targa Resources Corp. and suggest that you do with its stocks.

Yes, you can track Targa Resources Corp. financials in yearly and quarterly reports right on TradingView.

Targa Resources Corp. is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

TAR earnings for the last quarter are 2.46 EUR per share, whereas the estimation was 1.58 EUR resulting in a 55.64% surprise. The estimated earnings for the next quarter are 1.76 EUR per share. See more details about Targa Resources Corp. earnings.

Targa Resources Corp. revenue for the last quarter amounts to 3.62 B EUR, despite the estimated figure of 4.15 B EUR. In the next quarter, revenue is expected to reach 3.97 B EUR.

TAR net income for the last quarter is 530.65 M EUR, while the quarter before that showed 183.76 M EUR of net income which accounts for 188.77% change. Track more Targa Resources Corp. financial stats to get the full picture.

Yes, TAR dividends are paid quarterly. The last dividend per share was 0.88 EUR. As of today, Dividend Yield (TTM)% is 2.14%. Tracking Targa Resources Corp. dividends might help you take more informed decisions.

Targa Resources Corp. dividend yield was 1.54% in 2024, and payout ratio reached 47.94%. The year before the numbers were 2.13% and 50.48% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 4, 2025, the company has 3.37 K employees. See our rating of the largest employees — is Targa Resources Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Targa Resources Corp. EBITDA is 4.00 B EUR, and current EBITDA margin is 26.33%. See more stats in Targa Resources Corp. financial statements.

Like other stocks, TAR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Targa Resources Corp. stock right from TradingView charts — choose your broker and connect to your account.