US2000 H4 | Bullish Continuation SetupBased on the H4 chart analysis, we could see the price fall to our buy entry level at 2,660.36, which is an overlap support.

Our stop loss is set at 2,632.04, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our take profit is set at 2,728.88, which is a swing high resis

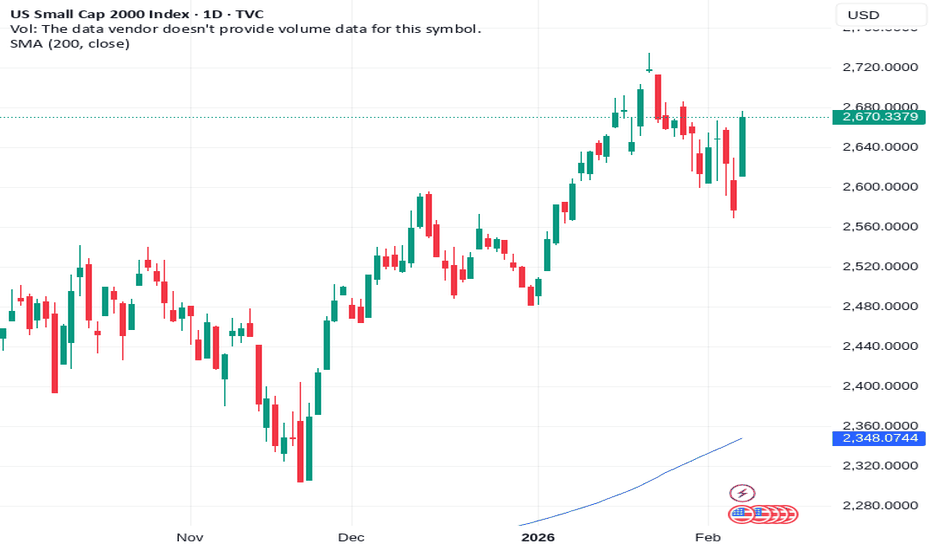

RUSSELL 17-year Channel Up starting a correction.Two weeks ago (January 23, see chart below) we gave a Sell Signal on Russell 2000 (RUT) that turned out to be very timely and is about to hit our 2550 short-term Target:

Today we move back to the macro setting on the 1M time-frame as the market seems overheated on the long-term following a flaw

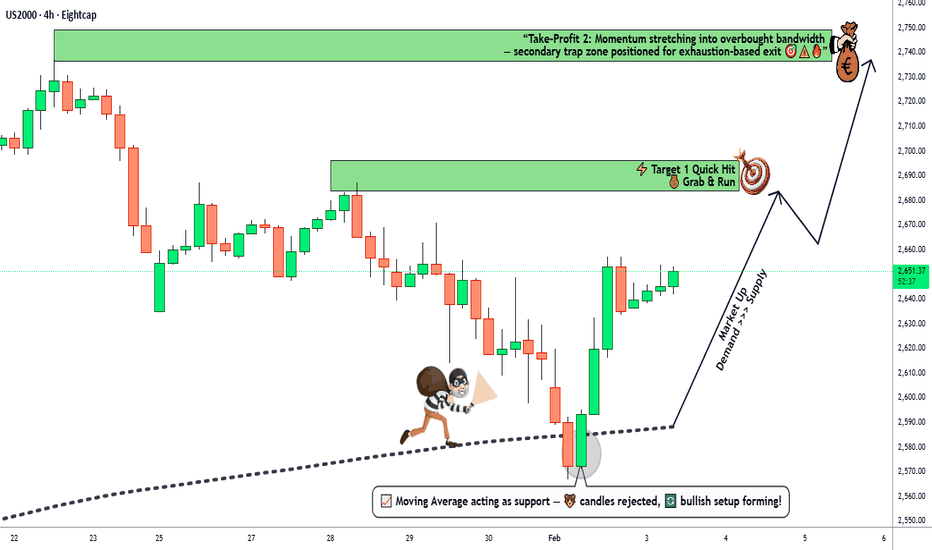

IWM Set Up for a Short-Term Continuation Move:Current Price: 2670.34

Direction: LONG

Confidence level: 85%(Trader consensus remains unified across group metrics.)

Targets

Target 1: 2715.00

Target 2: 2760.00

Stop Levels

Stop 1: 2640.00

Stop 2: 2600.00

Wisdom of Professional Traders:

Here’s my take after combining what I’m seeing from prof

US2000 Index | Trend-Aligned Long Opportunity🎯 Russell 2000 (US2000) CFD – Bullish Breakout Setup | Day/Swing Trade Strategy 📈

🔥 MARKET OVERVIEW & OPPORTUNITY

The Russell 2000 Index (US2000) is flashing a strong bullish continuation setup! 💪 Clean pullback to the Simple Moving Average (SMA) has been confirmed, giving us a high-probability ent

SHORT RUSSELLProbable corrective move towards a key liquidity zone on the 15-minute timeframe.

Analysis based on market structure and short-term liquidity levels.

Invalidations: above the recent 15M swing highs.

Target: identified liquidity zone.

⚠️ Informational analysis only – not financial advice.

US2000 H1 | Bullish Bounce OffThe price has bounced off our buy entry level at 2,641.87, which is a pullback support.

Our stop loss is set at 2,600.84, which is a pullback support that aligns with the 78.6% Fibonacci retracement.

Our take profit is set at 2,708.35, which is a pullback resistance.

High Risk Investment Warning

US2000 H1 | Bearish Reversal SetupBased on the H1 chart analysis, we could see the price rise towards our sell entry level at 2,692.02, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 2,738.46, which is a swing high resistance.

Our take profit is set at 2,626.00, which is a mu

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

Russel 2000 Index Cash reached its highest quote on Jan 22, 2026 — 2,738.44 USD. See more data on the Russel 2000 Index Cash chart.

The lowest ever quote of Russel 2000 Index Cash is 948.50 USD. It was reached on Mar 19, 2020. See more data on the Russel 2000 Index Cash chart.

Russel 2000 Index Cash is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Russel 2000 Index Cash futures or funds or invest in its components.