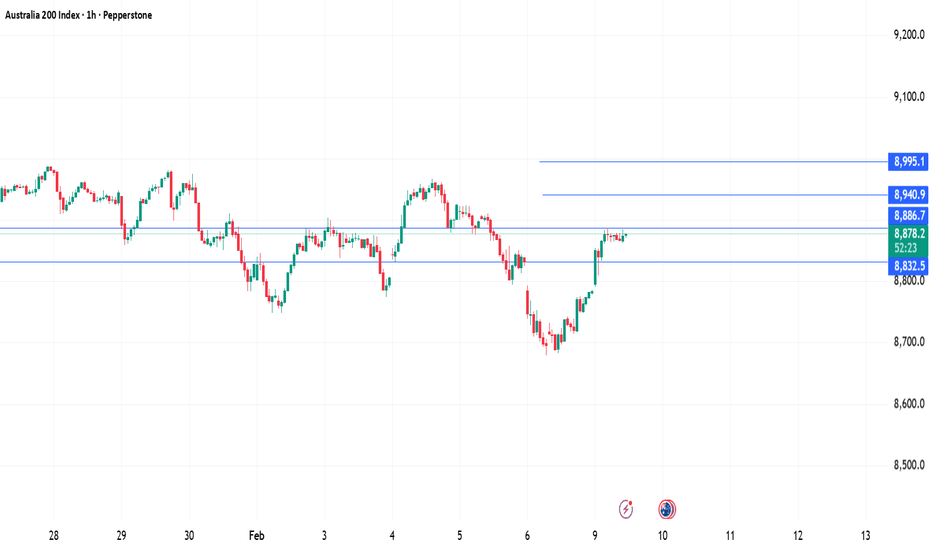

Australia 200: Bulls target October highsOur ASX 200 contract has pushed beyond the highs set in late January, providing a platform to set bullish trades around should price hold above the level.

If we see a pullback and bounce from 8990, longs could be entered with a tight stop below for protection, targeting the October high of 9120.

W

S&P/ASX 200 (XJO) — Bearish Continuation in Play | Smart Money CS&P/ASX 200 (XJO) — Bearish Continuation in Play | Smart Money Concepts

📉 Bias: Bearish | Timeframe: Daily | Style: ICT/SMC

What's Happening

The ASX 200 just printed a -2.03% rejection candle from the premium zone near 9,008, confirming what the structure has been whispering for weeks — the recent

AUS200 Index Wave Analysis – 12 February 2026

- AUS200 Index reversed from resistance zone

- Likely to fall to support level 8800.00

AUS200 index today reversed down from the resistance zone between the resistance level 9085.00 (which has been reversing the price from August), upper daily Bollinger Band and the resistance trendline of the da

AUS200 – Liquidity Sweep Into Demand | Potential Bullish ReversaAUS200 delivered a strong selloff that swept liquidity below recent lows and tapped into a higher-timeframe demand zone. Price reacted sharply from this area, suggesting buyers are stepping in.

Key Levels

• Major demand zone: 8,750 – 8,780

• Liquidity sweep low: below 8,750

• Intraday resistance: 8

AUS200 H4 | Bullish Continuation SetupBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 8,850.90, which is a pullback support.

Our stop loss is set at 8,750.57, which is a pullback support.

Our take profit is set at 9,066.44, which aligns with the 161.8% Fibonacci extension.

High Risk In

AUS200 Short Plan — This Week’s SetupTeam,

Entry Zone: 8965–8972

Stop Loss: 9015

Target 1: 8925–8913

Target 2: 8906–8876

. Tariff Decision – 1st Feb

Markets hate uncertainty, and tariff announcements always inject caution. Even if the outcome is neutral, the lead‑up typically brings risk‑off behaviour, especially in indices tied to g

AUS200 Turning Higher? Key Buy Zones and Profit RoadmapAUS200 (Australia 200) 🚀 BULLISH SWING LAYER Strategy | "The Thief" Entry Method

🥳 Greetings, Traders & "Thief OG's"! 🥳

Get ready for a deep dive into a high-probability BULLISH swing trade setup on the $AUS200. This plan uses a sophisticated entry method to maximize opportunities. Likes & Follows

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

Australia 200 Spot Index reached its highest quote on Oct 22, 2025 — 9,113.70 AUD. See more data on the Australia 200 Spot Index chart.

The lowest ever quote of Australia 200 Spot Index is 3,018.70 AUD. It was reached on Jan 6, 2000. See more data on the Australia 200 Spot Index chart.

Australia 200 Spot Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Australia 200 Spot Index futures or funds or invest in its components.