HBARUSDT — Retest of Demand Zone After Breakout?HBAR/USDT is currently in a crucial retest phase after a strong breakout from its key accumulation zone around 0.199–0.217 (yellow box, Fib 0.5–0.618 area). The recent rally toward 0.29–0.30 highlighted strong buying momentum, but price is now consolidating near 0.243, suggesting a healthy pullback before the next potential move.

This structure often signals a bullish retest after breakout — but if key support levels are lost, it could trigger a deeper correction.

---

🔍 Structure & Pattern

Previous phase: HBAR traded sideways for months within a large range.

Recent move: Clean breakout above the accumulation zone.

Current phase: Retesting the demand zone.

Pattern in play: Bullish Retest / Flag Consolidation on the daily timeframe.

Bullish continuation trigger: Daily close above 0.29197 with volume confirmation.

Bearish invalidation: Daily close below 0.19928 (Fib 0.618).

---

📌 Key Technical Levels (1D)

Support (Demand Zone):

0.21707 (Fib 0.5) → first line of defense.

0.19928 (Fib 0.618) → strongest support; bullish invalidation if broken.

Resistance Levels:

0.26511 → minor resistance.

0.29197 → major resistance / breakout trigger.

0.33037 → TP1.

0.37526 → TP2.

0.40139 → local high & ultimate mid-term target.

Downside targets (if breakdown):

0.160–0.140 → prior consolidation zone.

0.093–0.087 → historical low.

---

🚀 Bullish Scenarios

1. Conservative (Breakout Buyer):

Entry: Daily close above 0.29197

Stop: Below 0.26511

Targets: 0.33037 / 0.37526

Potential reward: +35% to +54% from current levels

2. Aggressive (Buy the Dip):

Entry: 0.217–0.199 demand zone

Stop: Below 0.199 (bullish invalidation)

Targets: 0.265 / 0.292 / 0.330

Attractive R:R potential (>1:3) if demand holds

---

⚠️ Bearish Scenarios

1. Breakdown of 0.199:

Daily close below 0.199 → structure invalidated.

Downside targets: 0.16 → 0.14, and possibly 0.087 (historical low).

2. Rejection at Resistance:

Failure to break 0.292 + formation of a lower-high = possible range or distribution phase.

Price could revisit 0.217 demand zone again.

---

📈 Strategy & Risk Management

Aggressive traders: Buy dips at 0.217–0.199 with tight stops.

Conservative traders: Wait for confirmation above 0.292 before entering.

Risk management: Limit exposure to 1–2% per trade.

Extra confirmation: Watch for volume spikes or bullish candlestick reversals (hammer, engulfing) in demand zones.

---

✅ Conclusion

HBAR is in a critical demand retest. As long as 0.217–0.199 holds, the bias remains bullish, with mid-term targets at 0.33–0.37. A daily close below 0.199, however, would shift momentum bearish and open the door to a much deeper correction.

HBAR offers a high R:R opportunity for both aggressive dip buyers and conservative breakout traders — making it one of the setups to watch closely in the coming weeks.

#HBAR #HBARUSDT #Hedera #Crypto #TechnicalAnalysis #PriceAction #SwingTrade #Fibonacci

HBARUSDT.3S trade ideas

HBAR Eyes Bitcoin for Price Recovery Amid Market UncertaintyBINANCE:HBARUSDT is currently consolidating, trading at $0.255 while oscillating between $0.271 and $0.244 . The narrow range reflects investor caution, with traders awaiting external market cues. Without a decisive breakout, the altcoin may continue drifting sideways in the immediate term.

If Bitcoin strengthens and resumes its rally, BINANCE:HBARUSDT could break resistance at $0.271. Such a move may open the door for gains toward $0.291, with potential upside extending further if bullish conditions persist.

Alternatively, a Bitcoin downturn could drag BINANCE:HBARUSDT lower, pushing it beneath $0.244 support. In such a scenario, the altcoin risks falling to $0.230, undermining the bullish thesis and reinforcing caution among investors.

HBAR Bull Flag Is Ready to Explode, But Only If One Level FallsYello, Paradisers! Is #HBAR quietly setting up for its biggest breakout of the year? The chart is heating up fast, and the next move will be decisive.

💎Since forming a double bottom around $0.128, HBAR has bounced sharply, showing clear strength. The price action is now shaping into a potential bullish flag pattern, but the bulls are stuck at a critical barrier.

💎The $0.285–$0.30 zone is proving to be a major challenge, as it combines both horizontal resistance and the 61.8% Fibonacci retracement. Since mid-July, not a single daily candle has been able to close convincingly above this level, a clear sign of just how important this wall is.

💎For #HBARUSDT, a strong breakout and close above $0.30 with real volume would open the doors to a major bullish move, targeting the $0.380–$0.410 zone. This range not only marks the next strong resistance but also aligns with HBAR’s 52-week high.

💎On the downside, solid support lies between $0.235–$0.22, a zone that has held firm since mid-July within a converging triangle formation. As long as HBAR stays above this range, the bullish setup remains valid, and the breakout pressure continues to build.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

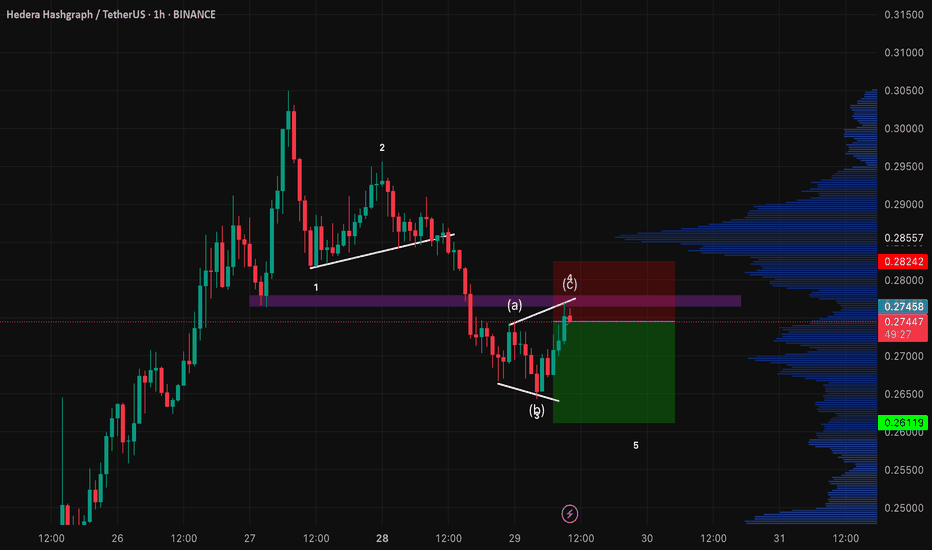

HBAR’s ABC Setup — Short-Term Pain, Long-Term Gain?HBAR has been consolidating sideways for the past 30 days, with $0.27 acting as a clear resistance — aligning with the golden pocket (GP). Price failed to sustain above the yearly open (yOpen) at $0.26901, despite multiple attempts. Each breakout attempt lacked follow-through → weakness.

Structurally, HBAR appears to be in a corrective phase after completing five Elliott waves, and is now potentially forming an ABC corrective pattern. Price has also lost the monthly open (mOpen) at $0.25099, which should now act as resistance.

🔴 Short Opportunity

Previous ideal entry: $0.27463 (Golden Pocket) — offered an R:R of ~1:7

Next short zone: Between mOpen ($0.25099) and yOpen ($0.26901)

Target: Around $0.21/$0.2 as take-profit (TP)

🟢 Long Opportunity Zone

➡️ Primary zone: $0.21 – $0.19675

🧩 Confluence factors:

FVG (Fair Value Gap) / imbalance fill

SSL (Support/Stop-Loss liquidity) positioned in the zone

Weekly level: $0.20685

0.55 Fib retracement: $0.20657 (aligned with the weekly level)

0.75 Fib speed resistance fan: Supports this zone if price reaches it between 19 – 25 Aug

1.0 trend-based Fib extension: $0.19675 (projected Wave C target of ABC)

Pitchfork lower support line intersecting with the zone

nPOC & key level: $0.2

With all these aligning, this is the most favourable long setup.

Long Trade Setup Example

Entry: $0.21– $0.19675

Stop Loss: Below $0.19

TP1: ~$0.223

Final target: $0.3+ (swing trade potential)

R:R: 1:6+

🔍 Indicators used:

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find them on my profile under “Scripts” and apply them directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

HBAR Price Stalls as Outflows Hit 2-Month High—What’s Next?BINANCE:HBARUSDT price is currently at $0.243 , trapped within the range of $0.244 to $0.271. The mixed market cues, including the bearish CMF and the relatively neutral RSI, suggest that HBAR could continue consolidating.

This sideways movement is expected to persist unless there is a major shift in investor sentiment or a market catalyst that could push the altcoin in either direction.

If outflows intensify and BINANCE:HBARUSDT falls below its $0.244 support level , the bearish case could become more likely. In such a scenario, the price may drop further to $0.230, invalidating the current bullish-neutral outlook and signaling a deeper correction for HBAR.

HL Ladder + Sweep = Long Setup LoadedHolding higher lows, sweeping local liquidity, and prepping for a 0.305–0.322 extension. The HBAR ladder keeps climbing.

📊 BYBIT:HBARUSDT.P — Liquidity-Grab Pullback

🎯 Direction: Long (only after downside sweep confirmed)

📍 Entry Zone: 0.263 – 0.271 (refined bullish OB / 0.50–0.618 retrace of BOS leg)

🛑 Stop Loss: 0.255 (below sweep/OB edge; ATR buffer)

💰 Targets:

• TP1 — 0.286

• TP2 — 0.305

• TP3 — 0.322

📐 RR Ratio: ~3.1 : 1 (to TP2)

🧠 Trust Meter: ████████▒▒ — 88%

⸻

🔍 Why We Like It

• HTF Bias (12H/4H): Uptrend intact; HL ladder pressing into prior supply.

• Sweep Trigger: Prefer wick into 0.258–0.262 → close back inside range to take sell-side liquidity.

• LTF Confirmation: After sweep → 15m BOS up (close above last LH) → pullback entry into 0.263–0.271 OB/FVG in fib pocket.

• Participation Filter: Sweep candle vol ≥1.5× 20-bar avg or delta absorption on footprint.

• Macro Context: OI rising, funding tame; BTC.D drifting down supports alt longs.

⸻

📏 Management

• SL → BE+fees at TP1, trail under 5m HL ladder.

• Time-stop: no new HH in 50m → cut 50% or exit.

• Invalidate on 12H close < 0.255 or BTC.D spike intraday.

• Entry must trigger within 6×15m bars after BOS.

⸻

🚀 Candle Craft | Signal. Structure. Execution.

HBAR Showing Increasing Selling Pressure - Eyes BreakdownHBAR is currently facing notable selling pressure, as indicated by its Chaikin Money Flow (CMF) reading on the daily chart. The CMF is sitting at -0.07 and trending downward, signaling that more money is flowing out of the asset than into it.

For those unfamiliar, the CMF measures buying and selling pressure by combining price and volume data over a given period. A positive CMF reading suggests strong buying interest, while a negative value points to dominant selling activity.

In HBAR’s case, the negative CMF confirms traders are exiting positions, which adds to the bearish momentum. This persistent outflow of capital could push the price below the lower boundary of its current trading range, potentially signaling further downside ahead.

$HBAR Is Loading… $0.30 Next?CRYPTOCAP:HBAR has turned its key resistance into support, showing a strong shift in market structure. After reclaiming this level, price has been holding steady above it, supported by the 100 EMA.

As long as bulls defend this zone, the next upside target could be the $0.30 area and beyond.

A clean breakout above that level could open the door for further gains.

DYOR, NFA

Hedera (HBAR): Looks Good For Another 15% Upside MoveAnother BOS that caught our attention happened on HBAR coin, where recently after the local breakout we are seeing a smaller struggle, which might send the price back for a quick retest, where we will be sitting in one of our entry zones. forlong position.

The second one is the other green line, which would mean. we form another BOS (on top of the current BOS). Seems good so as long as we are above the 4 hr 200 EMA, we are bullish!

Swallow Academy

HBAR Elder-Ray Index Signals Sustained Selling PressureHBAR’s Elder-Ray Index has remained in negative territory for the past six consecutive daily sessions, reflecting a persistent accumulation weakness. This momentum indicator compares price action to a moving average to gauge the balance between buying and selling pressure. Positive values typically indicate buyer control, while negative readings point to seller dominance.

The current sequence of red histogram bars underscores sustained selling pressure and fading bullish momentum, suggesting that sellers have maintained the upper hand in HBAR’s market over the past week.

HBAR Set for 22% Rally if Key Support Holds Strong 0.30 targetHello✌

Let’s analyze Hydra Hashgraph’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

If HBAR’s real use grows, burning fees could rise and boost investor trust. But with 42.4 billion coins out (85% of max), steady demand is needed to handle new unlocks 📊.

📊Technical analysis:

BINANCE:HBARUSDT is currently trading near a confluence of key daily support levels 📉. If this zone holds, the setup suggests a potential upside of around 22 percent toward the 0.30 target 🎯.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

Hedera (HBAR) – Pullback Opportunity After 100% RallyHBAR has surged 100% recently. With the broader market entering contraction, we’re now watching for a healthy retracement into key support, aligning with the 50% Fibonacci level and a fair value gap (FVG). This could be the formation of a higher low before continuation.

🔍 Setup Overview:

Entry Zone: $0.22 – $0.19

Take Profits: $0.26 / $0.32 / $0.37

Stop Loss: Daily close below $0.18

Bias: Bullish continuation from support

🧠 Trade Idea:

Price is approaching a confluence zone of Fib support and unfilled imbalance. As long as daily structure holds above $0.18, the bullish case remains intact. This zone offers an attractive long setup for the next move higher, targeting previous resistance levels.

⚠️ Invalidation:

A daily close under $0.18 would break structure and invalidate the setup. Monitor price action and volume confirmation around this support zone for entry timing.

HBAR - it's time to run away from it Today we dug up a real crypto zombie! HBAR — is it worth touching or better to avoid? Let me explain:

The token was dead for many years after 2021. But suddenly it grew by hundreds of percent after the ETF application was filed.

I will not discuss how useful this project is or not, let's just look at the chart:

➡️ During the last growth impulse, a GAP was formed from below, which has already begun to partially close. At levels of $0.243 - 0.171. In 99% of cases, gaps close sooner or later, continuing to attract price until that moment.

➡️ Volume - divergence in purchase volumes. The price is falling, and sales volumes are also falling. Fewer and fewer people want to sell. But it's too early to rejoice; look at the purchase volumes, they are simply non-existent.

➡️ Money Flow - surprisingly, the picture here is not so bad. Harmony with the price. Liquidity is slowly coming in, but the indicator is already in the neutral zone, even though we are in the midst of a bull market.

➡️ Support/Resistance - the price was unable to overcome even such a weak resistance level as $0.289. This only confirms the complete lack of desire to buy among people.

Yes, of course, no one is selling either, because what is the point of selling in the midst of growth?

➡️ The price is now approaching the support level of $0.235, a level with fairly low interest, and if it cannot hold the price, the next support level will be at the very bottom of the GAP at $0.175.

📌 Conclusion:

It is extremely convenient to trade now, as HBAR is simply flying in both directions like a weather vane. And now, when the correction begins, it will fall sharply.

But don't even think about buying it on the spot. Spare your deposit 😁

HBAR Triangle Tightens: Can Bulls Break $0.27?BINANCE:HBARUSDT continues to form a classic ascending triangle on the daily chart; an overall bullish continuation pattern. While the rising trendline from June shows steady higher lows, the key resistance at $0.27 has capped multiple breakout attempts.

A clean breakout above $0.27 would confirm the pattern, but the real battleground lies at $0.29, which aligns with the Fibonacci extension resistance drawn from BINANCE:HBARUSDT 's prior rally and retracement. If bulls clear this level, the path toward $0.31 and above opens up quickly.

On the downside, the rising support sits near $0.23. A breakdown below that level would invalidate the pattern and weaken the near-term outlook.

Zooming into lower timeframes, the 4-hour RSI shows a clear hidden bullish divergence, where the price made slightly lower highs but RSI climbed from 42 to 52. This often suggests momentum is building beneath the surface, supporting a continuation of the existing uptrend rather than a reversal.

While the BINANCE:HBARUSDT chart setup itself is strong, broader sentiment also supports this bullish lean. On-chain data shows sustained exchange outflows, reflecting investor confidence, and a majority of traders on Binance continue to hold long positions, pointing to a bullish bias in positioning.

Combined, the triangle structure, RSI divergence, and Fib level confluence suggest HBAR could be gearing up for a breakout; if outflows (rising bullish volume) confirm the move.

HBARUSDT 12H#HBAR has formed a Double Top pattern on the 12H timeframe and has now broken below the neckline.

If this candle and the next one close below the neckline, the pattern will be confirmed and we could see further downside toward the following support levels:

🎯 $0.21906

🎯 $0.19877

🎯 $0.18721

🎯 $0.16989

🎯 $0.15514

⚠️ As always, use a tight stop-loss and apply proper risk management.

HBARUSDT – Planning Ahead, Not Reacting Late In the event of a potential Q3 correction, I believe HBARUSDT could revisit the green box zones below.

These areas aren’t guaranteed bounce points — but they represent fair value in a market pullback scenario.

🧭 How I’m Preparing

📌 No blind orders

📌 Set alerts at the green zones

📌 When price hits, switch to 1-hour

📌 Wait for upward breakout + rising CDV

If it aligns, I take the trade — one bullet only.

"The smart investor doesn’t fear the correction — they prepare for it."

No rush. No panic. Just discipline.

Let’s stay ready.

— UmutTrades 💙

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

HBAR: Capitulation - A Major Bottom and High-Reward LongToday we're looking at Hedera (HBAR), which has just experienced a waterfall decline, breaking key structural levels in a classic capitulation event. While the immediate trend is aggressively bearish, these are the exact conditions that often precede major market bottoms and powerful V-shaped recoveries.

This analysis will break down the overwhelming evidence of seller exhaustion and why the current level presents a rare, high-reward opportunity for a counter-trend long position, targeting a significant rally.

The Analysis: The Case for a Generational Bottom

Trading against a strong trend is inherently risky, but the data becomes compelling when a market reaches a state of extreme, multi-timeframe exhaustion. Here is the confluence of signals pointing to a major bottom on HBAR:

1. CRITICAL - The Capitulation Signal (Widespread Oversold Conditions):

This is the single most important factor. Our momentum dashboard is showing a profound alignment of exhaustion: the 30M, 1H, 4H, and—most importantly—the Daily timeframes are all simultaneously deep in "Oversold" territory. When the daily chart signals this level of exhaustion, it's often a sign of a macro trend pivot, not just a minor bounce. This is a textbook signal of seller capitulation.

2. The Time-Based Pivot (Fibonacci Time Cycle):

Adding a powerful, non-price-based confluence is the appearance of a Fibonacci Time Cycle (the purple lightning bolt) precisely at the recent low. These cycles often mark temporal points where a trend exhausts itself. The alignment of extreme oversold price conditions with a time-based pivot point is a very strong indication that a turn is imminent.

3. Test of Major Dynamic Support (EMA 400):

The price found its footing and is starting to bounce from the vicinity of the EMA 400. This long-term moving average is a significant level that often acts as a major floor for price during larger corrective moves within a macro uptrend.

4. Highly Asymmetric Risk-to-Reward Profile:

This is a classic high-reward setup. By entering near the absolute lows, a trader can define their risk with a very tight stop loss. The potential upside, however, is substantial. A recovery would first target the Daily Open and then potentially the previous highs, creating a scenario where the potential reward vastly outweighs the defined risk.

The Potential Trade Plan

This is an aggressive but calculated trade plan designed to capture the beginning of a potential new bullish impulse from a point of maximum fear.

Entry Zone: The current price area represents the point of maximum opportunity. Look for signs of a base forming as buyers begin to step in.

Stop Loss: A very tight stop loss can be placed just below the absolute low at $0.25800. A break of this level would invalidate the immediate reversal thesis.

Potential Targets:

Target 1: A reclaim of the Daily Open / Psy-Lo level around $0.2715 - $0.2750.

Target 2: The major swing high and Psy-Hi level at $0.30500, which would represent a full V-shaped recovery.

Conclusion

While the recent price action has been extremely bearish, the confluence of signals—a rare multi-timeframe oversold condition, a time-based pivot point, and a test of major long-term support—points towards a potential major market bottom. For traders willing to take on calculated risk, the current levels on HBAR offer a compelling, high-reward opportunity to catch what could be the start of the next major rally.

Disclaimer:

This analysis is for educational purposes only and is not financial advice. Trading involves a high level of risk, especially when attempting to trade against a strong trend. Always conduct your own thorough research and consult with a licensed financial advisor before making any trading decisions.

Hedera (HBAR): Buyers Pushing For Breakout | Good Buy EntryHedera is loading up for a breakout here, which might give us a good R:R trade if executed properly.

What we are looking for is a proper breakout where buyers maintain the dominance in that region, after which our target is going to be the resistance zone and 200EMA line.

Swallow Academy