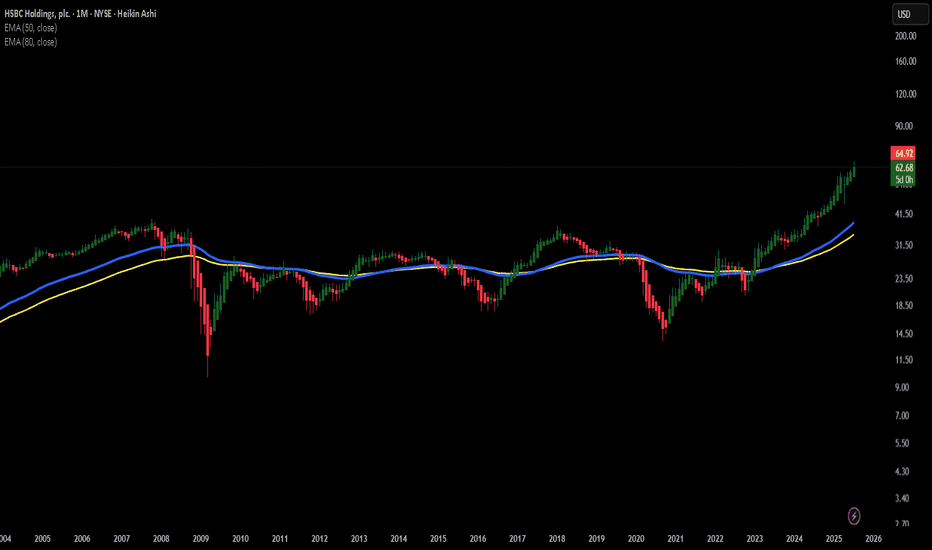

HSBC Holdings Weekly Setup: Buyback Support Sets Up Upside PushCurrent Price: 83.94 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 64%(based on mixed but slightly bullish trader commentary, price holding near support, and supportive buyback-driven news despite thin social confirmation)

Targets

Target 1: 85.20

Target 2: 87.00

St

HSBC Holdings PLC Sponsored ADR

No trades

Key facts today

HSBC has announced that it is maintaining its best lending rate at 5.00 percent in Hong Kong.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.74 USD

22.93 B USD

149.05 B USD

3.44 B

About HSBC Holdings Plc

Sector

Industry

CEO

Georges Bahjat El-Hedery

Website

Headquarters

London

Founded

1959

IPO date

Jun 11, 1992

Identifiers

3

ISIN US4042804066

HSBC Holdings plc (HSBC) is the banking and financial services company. The Company manages its products and services through four businesses: Retail Banking and Wealth Management (RBWM), Commercial Banking (CMB), Global Banking and Markets (GB&M), and Global Private Banking (GPB). It operates across various geographical regions, which include Europe, Asia, Middle East and North Africa, North America and Latin America. RBWM business offers Retail Banking, Wealth Management, Asset Management and Insurance. CMB services include working capital, term loans, payment services and international trade facilitation, among other services, as well as expertise in mergers and acquisitions, and access to financial markets. GB&M supports government, corporate and institutional clients across the world. GPB's products and services include Investment Management, Private Wealth Solutions, and a range of Private Banking services.

Related stocks

HSBC heads up at $80.89: Golden Genesis fib should give us a DIPHSBC grinding upwards along with all financials.

It is about to hit a Golden Genesis fib at $80.89

Look for a Dip-to-Fib or a Break-n-Retest to join.

.

Previous analysis that caught the PERFECT BOTTOM:

And subsequent call for CONTINUATION of uptrend:

.

HSBC to Settle French Criminal Case With $300 Million Payment HSBC Holdings PLC (NYSE: NYSE:HSBC ) is preparing to pay roughly $300 million to settle a French criminal case tied to alleged involvement in the “Cum-Cum” tax scandal. According to Bloomberg, the agreement will be reviewed by a Paris judge in the coming weeks, potentially closing a long-running le

HSBC eyes on $53.xx: Key Resistance to recovery of UpTrendHSBC looking quite strong compared to other banks.

Just poked through a key Resistance at $53.01-53.40

Strong break should retest highs above at $58.11-58.65

.

Previous Analysis that caught a long PERFECTLY

=================================================

HSBC – Big Bank EnergyHSBC. The name alone sounds like it should be engraved in stone above a massive marble doorway somewhere in London, guarded by two lions in tuxedos. It’s one of those banks that’s been around forever – the kind of institution that probably has an emergency plan for a meteor strike… and a tea protoco

HSBC (HSBC) – $54 Risk Zone if ABC Correction Is Triggered HSBCHSBC is currently trading within a rising wedge, but a potential short-term drop of approximately 5% could trigger a full ABC correction pattern. This scenario is not confirmed yet, as the chart remains structurally bullish.

However, should the price reverse and break below the rising channel, it w

HSBC eyes on $44.xx: Major Support that could launch next legHSBC dropped into a major support.

Enter here for a scalp or long term.

Nearby resistance for scalp target.

$ 44.76 - 44.91 is the exact support zone.

$ 47.91 - 48.15 is first resistance and TP.

$ 49.86 - 50.16 will be serious, bigger TP.

=====================================

.

HSBC "Amazing Opportunity"After the UK CPI came hotter than expected, short positions are shining on the horizon. The UK100(FTSE) index looks over-extended to the bullish side, but better than shorting the index itself is finding a highly correlated with the index position, which in our case is HSBC.

As you can see the peri

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

H

HBC3687569

Household Finance Corp. 7.625% 17-MAY-2032Yield to maturity

6.49%

Maturity date

May 17, 2032

R

HBC3745304

Republic New York Corporation 7.2% 15-JUL-2097Yield to maturity

5.97%

Maturity date

Jul 15, 2097

See all HSBC bonds

APIE

Trust for Professional Managers CrossingBridge Ultra-Short Duration ETF Activepassive Intl Equity ETFWeight

0.78%

Market value

7.82 M

USD

Explore more ETFs