DX1! (US Dollar Index) — Fundamental Outlook: Bearish BiasThe U.S. dollar remains under sustained pressure as markets move into September. The Federal Reserve has signaled readiness to deliver its first rate cut in September, following confirmation that July PCE inflation remained steady at 2.6% y/y, while consumer spending continued to soften. This combination supports the case for monetary easing to protect the labor market and broader economic momentum.

Positioning data show that the market is already heavily short USD, creating short-term risk of squeezes on stronger-than-expected U.S. data — particularly the September 5 NFP release, which could delay the Fed’s easing trajectory if labor proves resilient. However, the medium-term consensus across major investment banks (JPMorgan, Citi, Goldman Sachs) is that the dollar will weaken further as the Fed embarks on a cutting cycle while the ECB, BoE, and SNB remain relatively more cautious.

➡️ Bias: Sell rallies in DX1! with tactical awareness of NFP risk. Medium-term bearish trend intact, Fed easing the dominant driver.

SDXU2025 trade ideas

The Dollar's Descent: Understanding Historic WeaknessThe U.S. dollar, long considered the world's premier reserve currency and a symbol of American economic might, finds itself in unprecedented territory as it continues to hover near all-time lows against a basket of major currencies. This sustained weakness represents more than just a numerical decline on foreign exchange charts; it signals a fundamental shift in global economic dynamics, monetary policy effectiveness, and international confidence in American fiscal management. The implications of this historic depreciation extend far beyond currency traders and central banks, touching everything from household purchasing power to geopolitical relationships and the future architecture of the global financial system.

The current situation represents a culmination of multiple converging factors that have been building over several years. The dollar's decline hasn't occurred in isolation but rather as part of a complex interplay between domestic fiscal policies, international trade dynamics, shifting reserve currency preferences, and evolving global economic power structures. Understanding this phenomenon requires examining not just the immediate catalysts but also the deeper structural changes that have eroded the dollar's traditional sources of strength.

The Anatomy of the Dollar's Decline

The measurement of the dollar's value against other currencies typically relies on the U.S. Dollar Index (DXY), which tracks the greenback against a weighted basket of six major currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. When analysts refer to the dollar approaching all-time lows, they're observing a sustained depreciation that has pushed this index to levels not seen in decades, with some bilateral exchange rates reaching historic extremes.

The technical aspects of this decline reveal a currency under persistent selling pressure. Foreign exchange markets, which trade over six trillion dollars daily, have witnessed consistent dollar weakness across multiple timeframes and against virtually all major and emerging market currencies. This broad-based depreciation suggests that the issue isn't merely tactical positioning by traders but reflects fundamental concerns about the dollar's intrinsic value and future trajectory.

Several immediate factors have contributed to this weakness. The Federal Reserve's monetary policy stance, particularly its approach to interest rates and quantitative easing, has played a crucial role. While other central banks have moved more aggressively to combat inflation or support their currencies, the Fed's policies have often prioritized domestic economic stability over currency strength. This divergence in monetary policy has created interest rate differentials that make holding dollars less attractive relative to other currencies offering higher yields.

The massive fiscal stimulus measures implemented in recent years have also weighed heavily on the dollar. The expansion of the federal deficit and the dramatic increase in the national debt have raised questions about the long-term sustainability of American fiscal policy. International investors, who must consider currency risk when purchasing U.S. assets, have grown increasingly concerned about the potential for future dollar depreciation as a means of reducing the real burden of this debt.

Trade dynamics have further complicated the dollar's position. The persistent U.S. trade deficit means that more dollars flow out of the country to purchase foreign goods than flow in from exports. This structural imbalance creates constant selling pressure on the dollar as these funds are converted into other currencies. Additionally, the weaponization of the dollar through sanctions and financial restrictions has prompted some nations to seek alternatives for international trade settlement, reducing demand for dollars in global commerce.

Historical Context and Precedents

To fully appreciate the significance of the dollar's current weakness, it's essential to examine historical precedents and the evolution of the dollar's role in the global economy. The Bretton Woods system, established in 1944, positioned the dollar as the world's primary reserve currency, backed by gold and serving as the anchor for international monetary stability. When this system collapsed in 1971, the dollar transitioned to a fiat currency, deriving its value from the strength of the U.S. economy and the confidence of global markets rather than gold reserves.

Throughout its modern history, the dollar has experienced several significant periods of weakness. The stagflation of the 1970s saw the dollar lose considerable value as inflation soared and economic growth stagnated. The Plaza Accord of 1985 deliberately weakened the dollar to address trade imbalances, demonstrating that currency depreciation could be a policy tool rather than merely a market outcome. The financial crisis of 2008 triggered another period of dollar weakness as the Federal Reserve implemented unprecedented monetary easing.

However, the current situation differs from these historical episodes in several important ways. Previous periods of dollar weakness often occurred within a framework where the dollar's fundamental role as the global reserve currency remained unchallenged. Today, that supremacy faces genuine competition from alternative currencies and payment systems. The rise of the euro, the internationalization of the Chinese yuan, and the emergence of digital currencies all represent potential challenges to dollar hegemony that didn't exist during previous cycles of weakness.

The geopolitical context has also shifted dramatically. During past periods of dollar weakness, the United States maintained relatively stable relationships with its major trading partners and allies. Current tensions, trade disputes, and the fragmentation of the global economy into competing blocs have created an environment where dollar alternatives are not just economically viable but politically desirable for some nations. This represents a structural change that could make the current period of weakness more persistent and potentially irreversible in some respects.

Global Economic Implications

The ramifications of the dollar's sustained weakness extend throughout the global economy, creating both opportunities and challenges for different stakeholders. For American consumers, a weaker dollar translates directly into reduced purchasing power for imported goods. Everything from electronics to clothing to automobiles becomes more expensive as the dollar's depreciation increases the cost of foreign-produced items. This imported inflation adds to domestic price pressures, potentially eroding living standards and complicating monetary policy decisions.

American businesses face a mixed picture. Exporters benefit from a competitive advantage as their goods become relatively cheaper in foreign markets, potentially boosting sales and market share. Multinational corporations with significant overseas earnings see those profits translate into more dollars when repatriated, improving their financial results. However, companies reliant on imported inputs face higher costs, and those with international supply chains must navigate increased complexity and currency risk.

The impact on financial markets has been profound and multifaceted. Equity markets have shown remarkable resilience, with some sectors benefiting from the currency tailwind to earnings. However, bond markets face challenges as foreign investors demand higher yields to compensate for currency risk, potentially increasing borrowing costs for the U.S. government and corporate issuers. Commodity markets, traditionally priced in dollars, have seen significant price increases as the weakening currency makes raw materials more expensive in dollar terms.

For emerging markets, the dollar's weakness presents both opportunities and risks. Countries with dollar-denominated debt benefit from the reduced real burden of their obligations, providing fiscal relief and potentially enabling increased domestic investment. However, those nations that have traditionally relied on dollar stability for their own monetary frameworks face uncertainty and potential instability. The shift away from dollar dependence requires careful management and potentially painful adjustments to monetary and fiscal policies.

Developed economies have responded to the dollar's weakness in various ways. The European Union has seen the euro strengthen significantly, creating challenges for European exporters but providing relief from imported inflation. Japan faces particular difficulties as yen strength threatens its export-dependent economy, prompting potential intervention in currency markets. These dynamics have strained international cooperation and raised the specter of competitive devaluations reminiscent of the 1930s.

The Reserve Currency Question

Perhaps the most significant long-term implication of the dollar's sustained weakness concerns its status as the world's primary reserve currency. This privileged position has provided the United States with what former French Finance Minister Valéry Giscard d'Estaing called an "exorbitant privilege" – the ability to borrow in its own currency, maintain persistent trade deficits, and exercise significant influence over global financial conditions.

The erosion of confidence in the dollar threatens this special status. Central banks worldwide have been gradually diversifying their reserves away from dollars, increasing holdings of gold, euros, yuan, and other assets. While the dollar still accounts for the majority of global reserves, its share has been declining steadily. This trend, if it continues, could fundamentally alter the global financial architecture and reduce American influence over international economic affairs.

The search for alternatives has accelerated in recent years. The Chinese yuan's inclusion in the International Monetary Fund's Special Drawing Rights basket marked a significant milestone in its internationalization. Digital currencies, both central bank digital currencies and cryptocurrencies, offer potential alternatives for international trade settlement and value storage. Regional payment systems and bilateral currency swap agreements have proliferated, creating pathways for trade that bypass the dollar entirely.

However, the transition away from dollar dominance faces significant obstacles. The depth and liquidity of U.S. financial markets remain unmatched, providing essential infrastructure for global finance. The rule of law, property rights protection, and regulatory framework in the United States continue to attract international investment despite currency concerns. No single alternative currency currently possesses all the attributes necessary to fully replace the dollar's multifaceted role in the global economy.

Policy Responses and Future Scenarios

Policymakers face difficult choices in responding to the dollar's weakness. Traditional approaches to currency support, such as raising interest rates or intervening in foreign exchange markets, carry significant economic costs and may prove ineffective against structural pressures. The Federal Reserve must balance its domestic mandate for price stability and full employment with the international implications of its policies, a task made more complex by the dollar's global role.

Fiscal policy presents another set of challenges and opportunities. Addressing the structural factors undermining dollar confidence would require difficult decisions about spending, taxation, and debt management. Political polarization and competing economic priorities make comprehensive fiscal reform challenging, yet the consequences of inaction could be severe. The possibility of a dollar crisis, while still remote, has moved from the realm of theoretical speculation to a risk requiring serious contingency planning.

International cooperation could play a crucial role in managing the transition to a new monetary order. Multilateral agreements on exchange rate management, similar to but more flexible than the Bretton Woods system, might provide stability during a period of adjustment. However, the current geopolitical climate makes such cooperation difficult to achieve. The fragmentation of the global economy into competing blocs may accelerate the development of alternative currency systems, further undermining the dollar's position.

Looking ahead, several scenarios could unfold. A gradual, managed decline in the dollar's dominance might allow for smooth adjustment to a multipolar currency system, with several major currencies sharing reserve status. This outcome would require careful coordination and policy discipline from major economies. Alternatively, a more chaotic transition could occur if confidence in the dollar erodes rapidly, potentially triggering financial instability and economic disruption.

The technological revolution in finance adds another dimension of uncertainty. Central bank digital currencies could reshape international monetary relations in ways that are difficult to predict. The adoption of blockchain technology and smart contracts might enable new forms of international trade settlement that don't require traditional reserve currencies. These innovations could either accelerate the dollar's decline or, if led by the United States, potentially reinforce its position through digital dominance.

Conclusion: Navigating Uncharted Waters

The dollar's hover near all-time lows represents more than a cyclical fluctuation in currency markets; it signals a potential inflection point in the global economic order. The convergence of fiscal pressures, monetary policy challenges, geopolitical tensions, and technological disruption has created conditions unlike any previously experienced in the modern era of fiat currencies. The implications extend beyond exchange rates to encompass fundamental questions about economic governance, international cooperation, and the distribution of global economic power.

For investors, businesses, and policymakers, navigating this environment requires careful consideration of both immediate risks and long-term structural changes. Hedging strategies, diversification approaches, and policy frameworks developed during periods of dollar strength may prove inadequate in a world where the greenback's supremacy can no longer be assumed. The ability to adapt to multiple possible futures, rather than betting on a single outcome, becomes essential for managing risk and capturing opportunities.

The social and political implications of the dollar's decline deserve equal attention to the economic aspects. Currency strength has long been intertwined with national prestige and political power. A sustained period of dollar weakness could reshape domestic politics, alter international alliances, and influence the trajectory of globalization itself. The psychological impact of losing reserve currency status, should it occur, would reverberate through American society in ways that extend far beyond financial markets.

As the world watches the dollar's trajectory with a mixture of concern and opportunism, the need for thoughtful analysis and measured response becomes paramount. The current situation demands neither panic nor complacency but rather a clear-eyed assessment of changing realities and proactive adaptation to new circumstances. The dollar's decline may mark the end of one era and the beginning of another, but the nature of that new era remains to be written by the collective actions of governments, markets, and societies worldwide.

The path forward will likely be characterized by increased volatility, structural adjustments, and the gradual emergence of new monetary arrangements. Whether this transition enhances global economic stability or triggers periodic crises will depend largely on the wisdom and cooperation of global leaders. The dollar's current weakness serves as both a warning and an opportunity – a signal that the old order is passing and a chance to build something better in its place. The challenge lies in managing this transition while maintaining the stability and prosperity that the dollar-based system, despite its flaws, has helped facilitate for decades.

In this context, the dollar's hover near all-time lows should be understood not as an isolated phenomenon but as part of a broader transformation of the global economy. The outcomes of this transformation remain uncertain, but its importance cannot be overstated. The decisions made in response to the dollar's weakness will shape international economic relations for generations to come, making this one of the most consequential periods in modern monetary history.

DXY - Dollar Index - Potenzial New Long phase

As we see in the chart .. in 2022 december we had a big volume accumulation before the october 2022 top to 112

After that we had a rebound and a laterality from sep. 22 to july 25.

In this moment we touche this volume and from my point of view we completed an ABC pattern.

Probably we have completed the pattern with a final Impulsive wave C and in this moment we start the final LONG wave 5

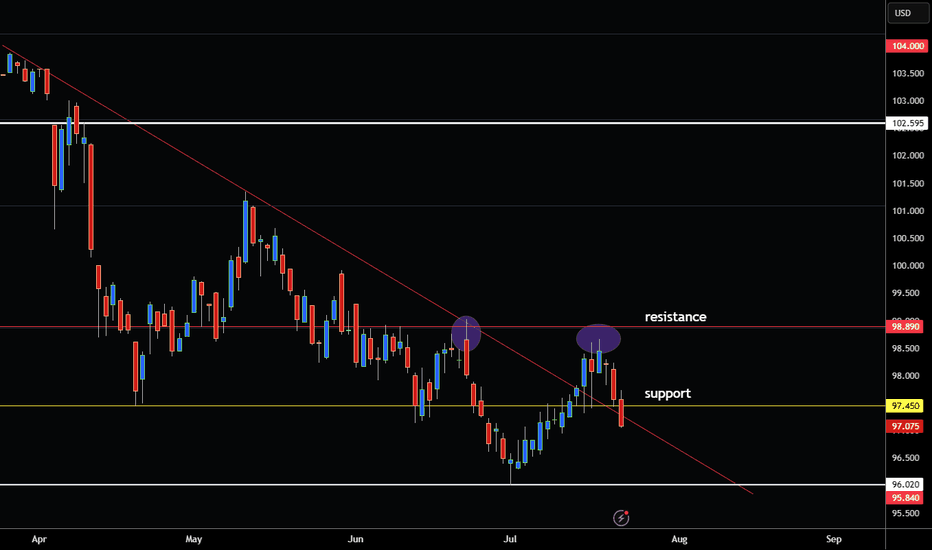

US DOLLAR BREAKS ABOVE RESISTANCE 98.99 BOTTOM CONFIRMED! Hey Traders so today looking at the US Dollar and as of today there is now a 123 bottom on the charts that has been confirmed by breaking above the 2 point.

Sees like fundamentally the US Dollar has now become bullish so with this breakout now confirmed does this mean we are in the beginning of Bull Market for the USD?

Well no one knows for sure but without any interest rate cuts and lots of tarriffs coming through it seems to be that way. Only time will tell of course if this becomes a new uptrend in USD so now we have a breakout whats next?

The way you trade the 123 bottom is wait for the market to break above the 2 point. Then alot of times there will be a retest of that zone at 98.89

Watch for the retest then consider selling Euro, Pound, Cad, Australian, Gold, Commodities etc...

Against the USD.

If you however you are bearish USD I would wait until market has daily close under 3 point that way you know for sure market has turned.

I will now start to include COT Report in my Analysis so we can see institutional positioning.

Currently Large Specs are Short the USD.

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

Dollar Index - Expecting Bullish Continuation In The Short TermH4 - Strong bullish momentum followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

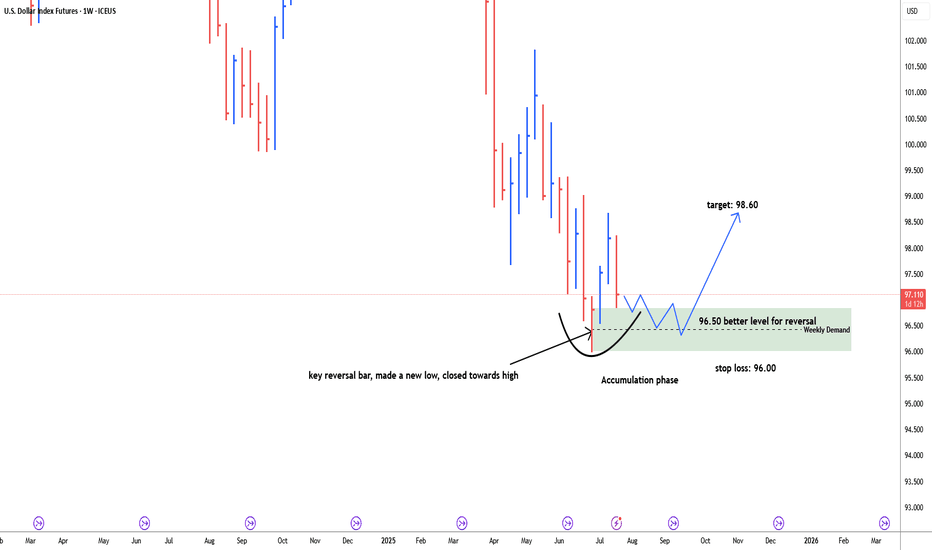

USD Dollar index possbile bullish reversal#usddollarindex, last weekly bar of the month of June is key reversal bar, made a new low and closed towards high. price retracing back down to test weekly demand zone. discount zone of demand is 96.50. possible bullish reversal target: 98.60. Stop loss below 96.00. price need time to build energy for bullish momentum. 96.50-96.00 is more secure level for long.

US DOLLAR INDEX BREAKING BELOW SUPPORT LEVEL RE-ENTER DOWNTREND! Hey Traders so today looking at the US Dollar Index or DX Market we can see that it has been in a solid downtrend since March. This is why alot of commodities and currencies have been getting stronger against it.

This is why I feel you don't need indicators to trade because price action shows you almost everything you need to be successful. A simple trendline and support and resistance is all you need to imo to see the story the market is trying to tell.

I'm not saying it's the holy grail of trading no one has a crystal ball we are all taking educated bets or guesses on where the market will go.

But most of the time it works! Key word there (most of the time)😁

Ok enough humor for today so getting down to it.

Now we see it is breaking below which is 97.45 from back in April. Also notice that 98.89 that got rejected twice once in June again last week. If market can get a daily close today below 97.45 this shows me that US Dollar Trend is still down. Now that it has re-entered under the downtrend line I would looks to sell rallies or buy markets against USD. Euro,Pound,Aussie,Gold, Commodities etc...

However if bullish USD I would wait for market to close above 98.89. That way you have true confirmation that the market wants to break higher because it will have formed a bottom formation!

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

Dollar Outlook – Bearish Trend with Key Support Levels AheadThe market is clearly bearish, and I do not recommend buying the dollar at the moment.

If the price breaks through the important zone between 98.525 and 96.725, we could see a move down toward the next zone between 95.935 and 94.790.

This lower zone is a key support level if it gets broken, the dollar could face a very difficult situation.

DOLLAR HIT LARGE DEMANDWe may hit the end of the bend. On the larger time frame, we see price retest the double bottom neckline. Last month price developed a doji a huge sign that price might be heading in the opposite direction soon. Fundamentally we see Smart money adding to their contracts and the candles are shortening. Its safe to say that most pairs on the correlated side of the dollar that we can hold our sells until we see price action give us the sign to get out.

DX - USD Index Longterm Outlook Indicates Further DeclineThis long-term chart shows how the USD Index is trading within the boundaries of the Median Line set.

We see the lower extreme, solid support around the Center Line, and the upper extreme acting as resistance.

What’s next?

Well—if it’s not heading higher, it’s likely heading lower—and the rejection at the Upper Median Line (U-MLH) supports that view.

If we revisit the Center Line, my experience tells me it won’t hold—we’ll break through and head even lower.

Buckle up. It’s going to be a rough ride.

A Contrarian View On the US DollarI don't recall the last bullish headline I saw for the US dollar, bearish sentiment may be stretched, and I'm seeing plenty of clues across the US dollar index and all FX majors that we could at least be looking at a minor bounce. Whether it can turn into a larger short-covering rally is likely down to Trump's trade deals. Either way, I'm, on guard for an inflection point for the dollar.

Matt Simpson, Market Analyst at City Index and Forex.com

Is the US Dollar about to Rally?Hey traders just saw 3 bar trend line confirmed on US Dollar Index but is it actually entering a new uptrend?

Not sure no one knows of course fundamentally speaking I'm not sure. Seasonally it normally tops in the summer. But of course anything is possible in this new Tariff driven market we are in. But as you can see this is how you can get in when a trend changes early just find 3 bars and draw a straight line to connect them and you will be close to being on the right side of the market.

So if your bullish be careful and use risk management.

But if you bearish don't short until it goes back under the downtrend line imo.

Enjoy!

Clifford

Look To Sell USD and Buy EUR, GBP, NZD and AUD!This is the FOREX outlook for the week of May 5 - 9th.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

USD Index has tapped the W -FVG. I expect it to sweep the last week's high before heading down. Short term strength for longer term weakness.

Look to buy xxxUSD pairs. Sell USDxxx pairs.

Wait for valid setups. FOMC is Wednesday! Don't just jump into trades without confirming the bias first!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

DXY Struggles at Mid-Cycle: Capital Flow Rotation Underway

The US Dollar Index (DXY) is sitting at a generational pivot zone around the 100 level, a midpoint in its 10-year price cycle. It has failed to reclaim this level decisively, and macro headwinds continue to build:

The re-escalation of tariff wars by the US administration, alienating global partners

Increasing capital outflows to the Yen, Gold, and emerging crypto ETFs

The risk of a flattening or inverted yield curve dragging confidence in USD-denominated debt

A break below 98.52 could accelerate the move toward 96.20, 94.76, and 92.44, historically associated with market stress and recessionary periods.

As the dollar's reputation as the world's safe haven erodes, Bitcoin—particularly in its regulated, ETF-wrapped form—is gaining favour as a neutral store of value.

DXY The Fake Dance- One of the most important barometers for global currencies and markets in the world.

- Most of the time DXY is a well used machine to supress markets (forex, stocks, cryptos, etc..)

- When they don't start the printing machine, DXY keeps is strength.

- When they start to print DXY starts to dip and markets boom up.

- it's really basic and based on "BRRR Machine".

- i had a hard time to decrypt this fake peace of resilience.

- actually there's none visible divergences on the 1M or 3M Timeframes.

- So i decided to push my analysis to 6M Timeframe and noticed few things :

- You can notice that from 2008 ( Post crises ), DXY was in a perma bullish trend.

- So now check MACD and will notice this fake move on January 2021 ( in graph the red ? )

- MACD was about to cross down, columns smaller and smaller, then a Pump from nowhere lol.

- i rarely saw that in my trading life on a 6M Timeframe.

- So to understand more this trend, i used ADX (Average Directional Index)

- ADX is used to determine when the price is trending strongly.

- In many cases, it is the ultimate trend indicator.

- So if you look well ADX columns, you will notice that a strong divergence is on the way.

- First check the Yellow Doted Line in July 2022 when DXY reached 115ish and look the size of the green columns.

- Now check today (red doted Line), and look again the ADX green columns is higher, but DXY diped to 105ish.

- So like always, i can be wrong, but i bet on a fast DXY dip soon or later.

- it's possible to fake pumps, but it's harder to fake traders.

Happy Tr4Ding !

US Dollar at Breaking Point: China Tariff Clash Risks Collapse Farmers, Boeing, and tech sectors brace for severe damage as USD threatens to break critical 10-year support amid escalating trade tensions.

Technical Breakdown: Crucial USD Zone Under Threat

The US Dollar Index (DXY) currently sits precariously within a critical 10-year support and resistance zone between 100 and 98. Historically, this key price area has repeatedly served as a midpoint equilibrium, dictating significant directional shifts. A decisive breach below this support could unleash substantial downward momentum, targeting deeper psychological and technical levels at 95 or potentially 92.

Examining a 10-year price cycle reveals a consistent pattern: whenever the USD has broken below this midpoint zone, it has lingered and struggled to regain upward traction. Currently, the short-term reprieve provided by the temporary 90-day tariff halt may offer brief support—but the underlying macroeconomic stress signals growing vulnerability.

Fundamental Factors: Tariff War's Long-Term Damage

While the US administration's aggressive tariff strategy against China was intended to protect American industries, its effects are increasingly backfiring—posing significant long-term risks to the US dollar and economy.

Agriculture:

US farmers are already suffering substantial losses. China, a critical export destination for American meat, grain, and soybeans, has drastically reduced purchases in retaliation. The direct result is declining farm revenues, increased inventory buildup, and weakening regional economies dependent on agricultural exports.

Aviation (Boeing):

One of America's largest manufacturing exporters, Boeing has become a recent casualty. Tariff escalations and strained diplomatic relations have severely affected aircraft sales to China—its biggest overseas market. With Boeing's market dominance already challenged by competitors like Airbus, prolonged tariffs could have dire financial implications, further pressuring USD sentiment.

Technology and Semiconductor Industries:

The US tech sector, including semiconductor giants such as Intel, Nvidia, Qualcomm, and Apple, heavily relies on Chinese manufacturing and consumption markets. Tariffs imposed on Chinese components and retaliatory measures have led to significant supply chain disruptions, increased production costs, and lower profit margins. Extended trade tensions risk permanently damaging these companies' competitiveness and earnings potential.

Retail and Consumer Goods:

American retailers, from Walmart to Amazon, are also exposed to China's tariff retaliation. Rising import costs translate directly into higher consumer prices, diminished purchasing power, and potential slowdowns in consumer spending—key pillars underpinning US economic growth and, by extension, dollar strength.

Why the Dollar Could Sink Further

As these vital sectors face prolonged pressure, broader economic fundamentals weaken. Reduced export revenues, rising domestic costs, and declining consumer confidence collectively undermine investor sentiment toward the US dollar. Moreover, sustained trade tensions might force the Federal Reserve into more accommodative monetary policies, potentially leading to rate cuts—a scenario traditionally bearish for the USD.

If the current trajectory persists, the US dollar could face intensified selling pressure, propelling it towards critical psychological and historical support levels at 95, with an even deeper potential retreat toward 92.

Bottom Line

The dollar now stands at a pivotal crossroads. With crucial sectors like agriculture, aviation, technology, and retail deeply vulnerable to prolonged US-China trade conflict, a fall below the critical 10-year support at 98 would signal a significant bearish shift. Investors and policymakers alike must brace for volatility as the implications of this trade war continue to unfold.

How low Can the Dollar Go? And What It Could Mean for EUR/USDThe US dollar index has handed back all of its Q4 gains with traders betting that Trump's trade war will do more damage than good to the US economy. I update my levels on the US dollar index and EUR/USD charts then wrap up market exposure to USD index futures.