BBRI - Bullish ScenarioNote : If you have any questions, feel free to send me message

Please give your comment/idea. Thanks

Greetings

Humbled, we would like to thanks for your support who has already liked, commented and followed us. Your support, strengthens us, to help in analyzing the market. If you have any questions, feel free to send us message (inbox).

Pra Trading :

- Please care for Money Management

- Have a good psychology

- Do not be hurry to open position and do not do nothing if u see opportunity

- Evaluate and upgrade your trading plan

Execution Strategy :

- Know what you want to buy, see the Fundamental

- Decide that you are on investing or speculating

- Consider what your strategy based on Investing/Speculating

- Make Road Map Of Your Trading Plan

- Decide

a. Entry strategy

b. Cut loss

c. Target of Profit

Post Trading :

a. Do not be sad if you loss or do not be very happy if you win

b. Just become a normal without emotion, Do not put emotion into your trading

c. Evaluate your trading

d. Keep on Learning

e. Be Humble

Idea :

BBRI - Bullish Scenario

Trade ideas

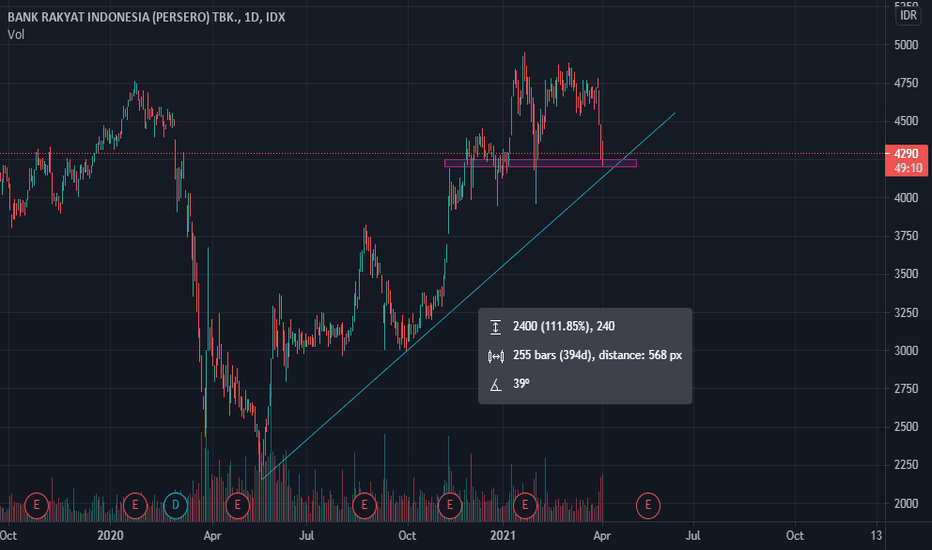

BBRI RoadmapBBRI on Weekly Chart is forming Head and Shoulder Pattern.

Now, BBRI is on Critical Point at Neckline

Scenario 1:If by next week or next 2 weeks BBRI is closed below <3,700,

it will confirm the Head and Shoulder Pattern with Target Price 2,900-3,100

Scenario 2: False Break at Neckline and retrace max to 4,000-4,200

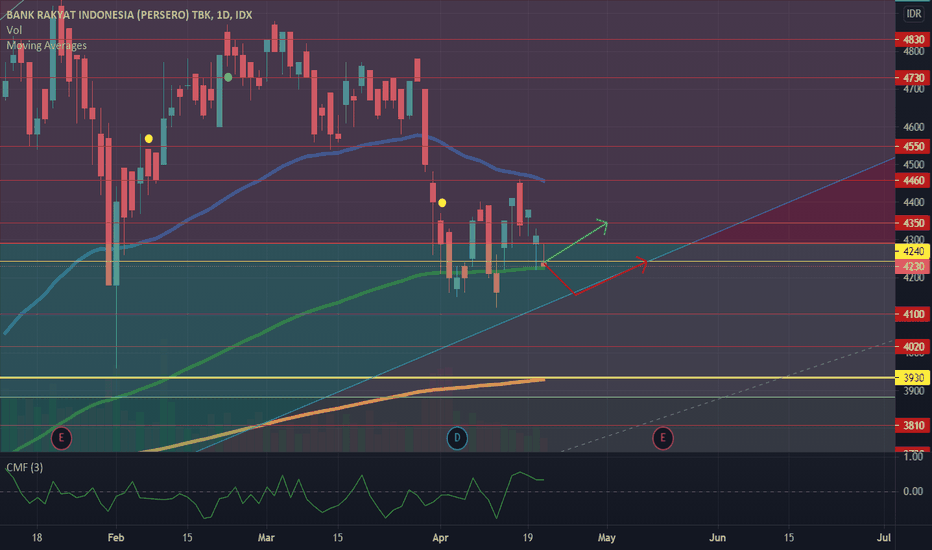

IDX: BBRI , PREDICTION FOR NEXT WEEKweak resistance at 4300 4350 4450

mediumsupport at 4240

Market close at 4280, it'll testing his medium support, possibly rebound to his medium support and go to 4350. set at 4250

Orange trading plan is my recommend,

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

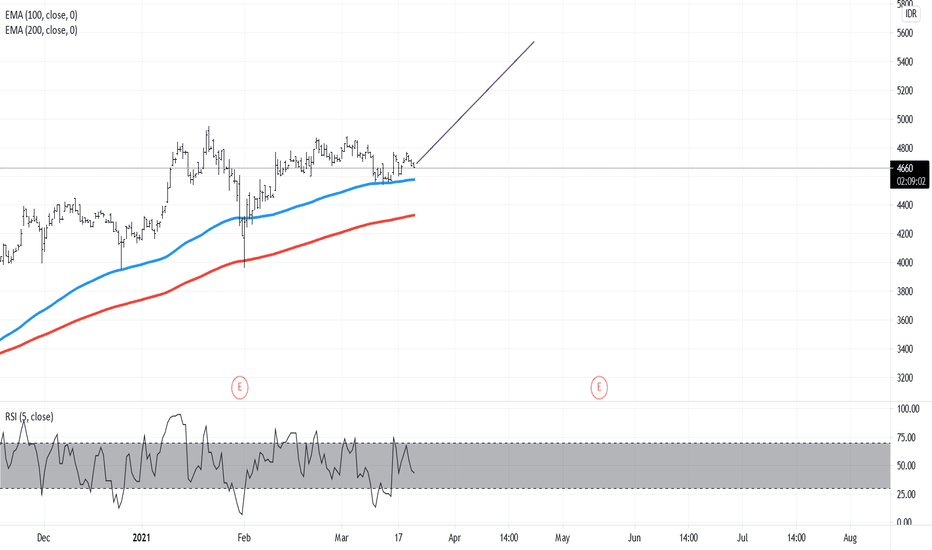

IDX: BBRI REBOUND AT EMA 144weak resistance at 4300 4350 4450

medium resistance at 2440

Market close at 2430, it'll testing his EMA 144, and it so strong , possibly rebound to his weak resistance.

Green trading plan is my recommend,

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

BBRIRESIS AT 4570

SUPP AT 4380

.

Disclaimer:

This information is for educational purposes and is not an investment recommendation nor to be representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

BBRI- Dividend RallyBBRI stochastic showing golden cross, with accumulation by the big broker in the past 7 days. With an annual general shareholder meeting scheduled on March 29th with agenda of profit usage, dividend rally might push the price point to 4850-4970 at its max. But, today there is a bearish maruboze candlestick appears, meaning the price might go down to 4600 or even worst to 4460 before bounceback. Resist is at 4890, with maximum price point (IF) dividend rally happens at 4970.

Rejected by all-time high or new high BBRI? IDX:BBRI

It will be interesting to see whether or not $BBRI will create its new high or be rejected by its all-time high. Well, the upside potential is still a good opportunity to take profit.

Happy trading, and be safe.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.