Jammu & Kashmir Bank Ltd.

No trades

19.46 INR

20.82 B INR

137.36 B INR

417.24 M

About Jammu & Kashmir Bank Ltd.

Sector

Industry

CEO

Amitava Chatterjee

Website

Headquarters

Srinagar

Founded

1938

IPO date

Aug 3, 1998

Identifiers

2

ISIN INE168A01041

Jammu & Kashmir Bank Ltd. engages in the provision of banking and financial services. The firm's products and services include personal loans, personal accounts, term bank deposits, mutual fund, life insurances, business loans, business accounts, and business insurance. It operates through the following segments: Treasury Operations, Corporate and Wholesale Banking, Retail Banking, and Other Banking Business. The company was founded on October 01, 1938 and is headquartered in Srinagar, India.

Related stocks

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

105JKBLPER

Jammu and Kashmir Bank Limited 10.5% PERPYield to maturity

—

Maturity date

—

950JKBL32

Jammu and Kashmir Bank Limited 9.5% 30-MAR-2032Yield to maturity

—

Maturity date

Mar 30, 2032

975JKBL32

Jammu and Kashmir Bank Limited 9.75% 30-DEC-2032Yield to maturity

—

Maturity date

Dec 30, 2032

See all J&KBANK bonds

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

0.46%

Market value

380.88 K

USD

TLTE

FlexShares Morningstar Emerging Markets Factor Tilt Index FundWeight

0.05%

Market value

157.02 K

USD

Explore more ETFs

Frequently Asked Questions

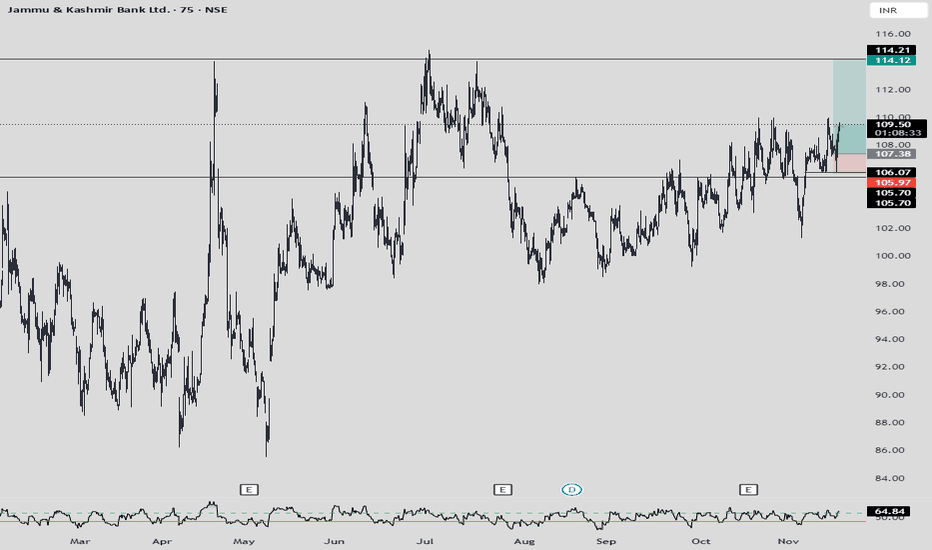

The current price of J&KBANK is 104.42 INR — it has decreased by −0.90% in the past 24 hours. Watch Jammu & Kashmir Bank Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Jammu & Kashmir Bank Ltd. stocks are traded under the ticker J&KBANK.

J&KBANK stock has fallen by −1.86% compared to the previous week, the month change is a 0.65% rise, over the last year Jammu & Kashmir Bank Ltd. has showed a 0.65% increase.

J&KBANK stock is 1.98% volatile and has beta coefficient of 1.60. Track Jammu & Kashmir Bank Ltd. stock price on the chart and check out the list of the most volatile stocks — is Jammu & Kashmir Bank Ltd. there?

Today Jammu & Kashmir Bank Ltd. has the market capitalization of 113.53 B, it has decreased by −1.68% over the last week.

Yes, you can track Jammu & Kashmir Bank Ltd. financials in yearly and quarterly reports right on TradingView.

J&KBANK net income for the last quarter is 5.81 B INR, while the quarter before that showed 4.95 B INR of net income which accounts for 17.49% change. Track more Jammu & Kashmir Bank Ltd. financial stats to get the full picture.

Yes, J&KBANK dividends are paid annually. The last dividend per share was 2.15 INR. As of today, Dividend Yield (TTM)% is 2.09%. Tracking Jammu & Kashmir Bank Ltd. dividends might help you take more informed decisions.

Jammu & Kashmir Bank Ltd. dividend yield was 2.33% in 2024, and payout ratio reached 11.37%. The year before the numbers were 1.60% and 12.77% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 5, 2026, the company has 12.51 K employees. See our rating of the largest employees — is Jammu & Kashmir Bank Ltd. on this list?

Like other stocks, J&KBANK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Jammu & Kashmir Bank Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Jammu & Kashmir Bank Ltd. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Jammu & Kashmir Bank Ltd. stock shows the buy signal. See more of Jammu & Kashmir Bank Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.