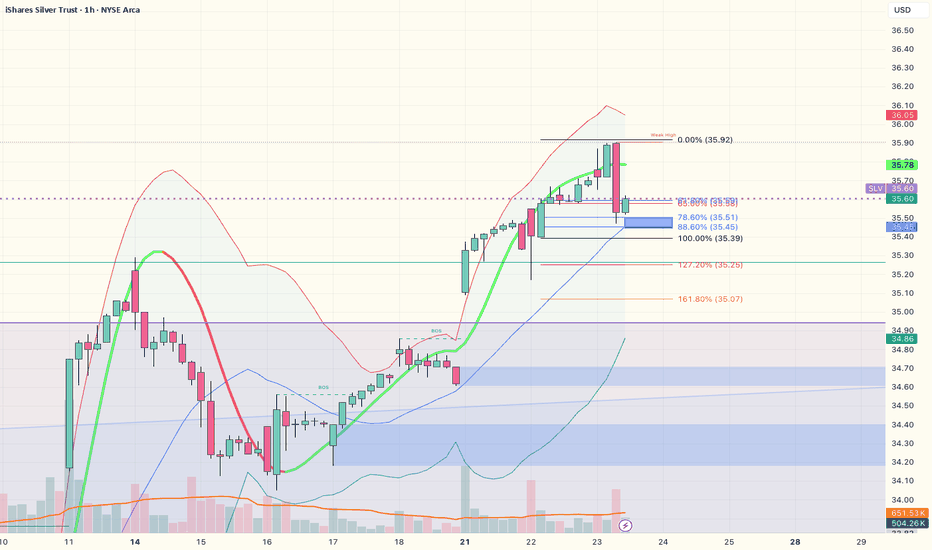

SLV | Next Leg Higher Is Here | LONGiShares Silver Trust seeks to reflect generally the performance of the price of silver. The Trust seeks to reflect such performance before payment of the Trust's expenses and liabilities. It is not actively managed. The Trust does not engage in any activities designed to obtain a profit from, or to

Key stats

About iShares Silver Trust

Home page

Inception date

Apr 21, 2006

Structure

Grantor Trust

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Return of capital

Income tax type

Collectibles

Max ST capital gains rate

39.60%

Max LT capital gains rate

28.00%

Primary advisor

iShares Delaware Trust Sponsor LLC

Distributor

BlackRock Investments LLC

ISIN

US46428Q1094

SLV gives investors direct exposure to silver by physically holding the metal in vaults in London. As such, investors get exposure to spot silver (determined by the London Silver Fix), less fund expenses. As this fund is considered a collectible for tax purposes, taxes on long-term gains are quite steep. Still, SLV provides stability for buy-and-hold strategies.

Related funds

Classification

What's in the fund

Exposure type

Miscellaneous

Bonds, Cash & Other100.00%

Miscellaneous100.00%

Top 10 holdings

Double Top on the Weekly Silver ChartSilver ( AMEX:SLV ) has had a great run this year, however after a volatile week we've now printed a double top on the weekly chart. Is that the end of this great bull run? It would not surprise me to see some profit taking as we head towards the end of year. Perhaps a drift lower rathe rather than

Silver (SLV): Multi-Year Cup & Handle SetupSilver appears to be repeating the same large-scale institutional “Cup and Handle” structure that played out almost perfectly on Gold.

The difference is that in SLV (iShares Silver Trust), the chart history is shorter, so the full formation is not as clearly visible — but if we reference the histori

$SLV Silver Accumulation ARCLikely to see a partial decline come in here eventually, but it should remain fairly high and tight.

an alternative would be a break upward, and retest of previous highs. a successful checkback would be the signal for continuation, as would the confirmation of a partial decline.

Likely to see a

SLV Maintains Strong Uptrend AMEX:SLV continues to trade within a strong uptrend, supported by a weakening US Dollar, rising US deficit spending, and growing market uncertainty. Similar to trends observed in precious metals and Bitcoin, the move away from US Treasury Bonds has been a significant bullish catalyst for these asse

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

A0JMD6 assets under management is 22.12 B EUR. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

A0JMD6 expense ratio is 0.50%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, A0JMD6 isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

No, A0JMD6 doesn't pay dividends to its holders.

A0JMD6 shares are issued by BlackRock, Inc.

A0JMD6 follows the LBMA Silver Price ($/ozt). ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Apr 21, 2006.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.